Are you wondering if you can include home renovations in your mortgage? Many homeowners dream of upgrading their living spaces but worry about the financial burden.

At Home Owners Association, we understand the challenges of financing home improvements. This blog post will explore renovation mortgages, their benefits, and how to incorporate renovation costs into your home loan.

What Are Renovation Mortgages?

Definition and Purpose

Renovation mortgages are specialized home loans that combine the purchase of a property and its renovation costs into a single mortgage. These loans help buyers transform fixer-uppers into dream homes or allow current homeowners to upgrade their existing properties without separate financing.

Types of Renovation Mortgages

Several renovation mortgage options exist in the Australian market:

-

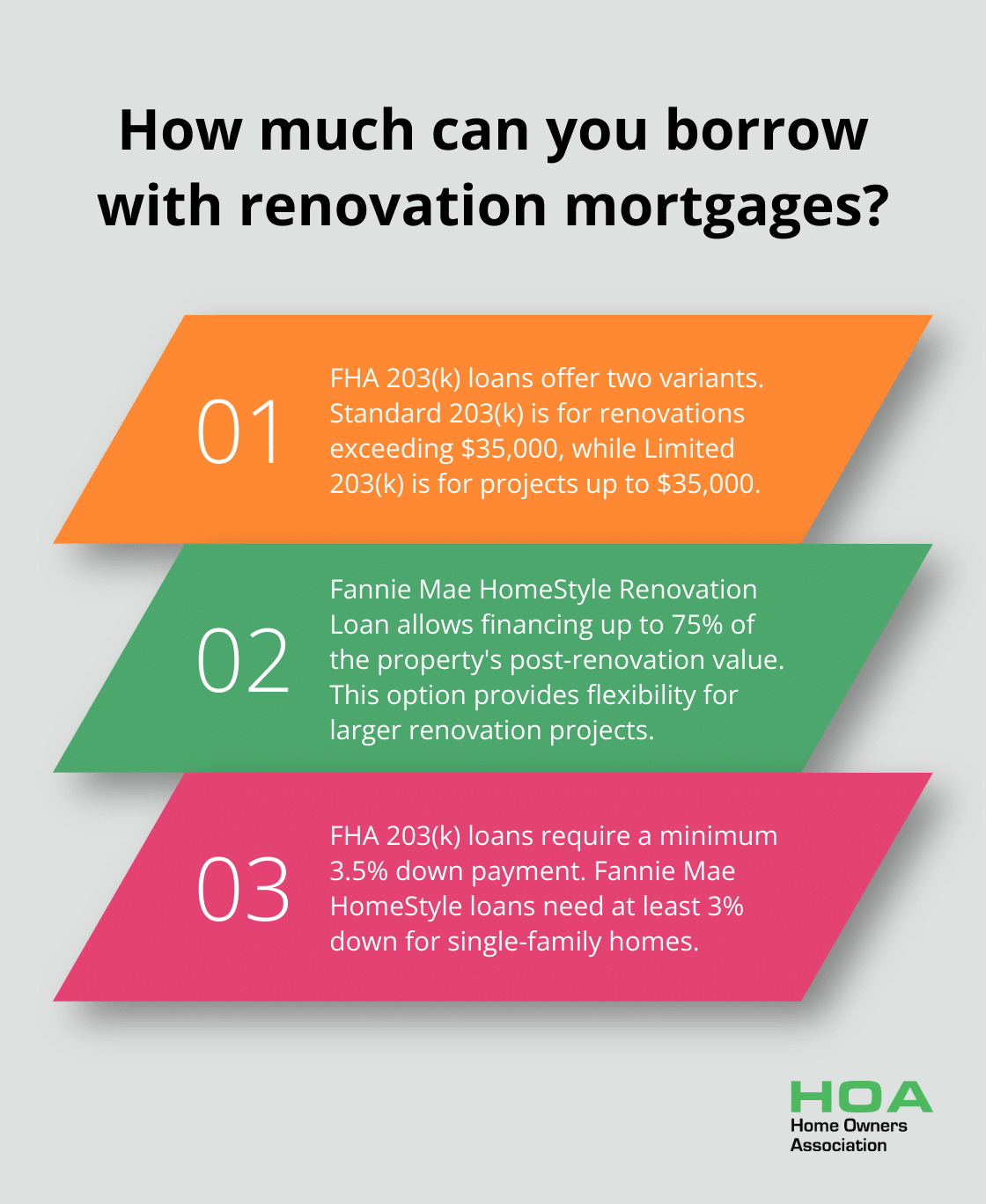

FHA 203(k) Loan: This popular choice offers two variants:

-

Standard 203(k): For major renovations exceeding $35,000

-

Limited 203(k): For smaller projects up to $35,000

-

Fannie Mae HomeStyle Renovation Loan: This option allows borrowers to finance up to 75% of the property’s post-renovation value.

-

Freddie Mac’s CHOICERenovation Mortgage: This alternative provides flexibility for both single-family and multi-unit properties. It typically requires a lower down payment compared to traditional loans, making it accessible to a wider range of borrowers.

Eligibility and Requirements

Lenders assess various factors when determining eligibility for renovation mortgages:

-

Credit Score: For FHA 203(k) loans, borrowers typically need a minimum credit score of 500, though some lenders may have higher requirements.

-

Down Payment: FHA 203(k) loans require at least 3.5%, while Fannie Mae HomeStyle loans need a minimum 3% down payment for single-family homes.

-

Debt-to-Income Ratio: Lenders evaluate this to ensure borrowers can manage the loan payments.

Renovation mortgages often involve stricter approval processes. Lenders usually require detailed renovation plans, including cost estimates and timelines from licensed contractors. Additionally, the property must meet certain standards after renovations are complete.

Application Process

The application process for renovation mortgages involves several steps:

- Property Selection: Choose a property that qualifies for the specific renovation loan program.

- Contractor Selection: Find licensed contractors to provide detailed renovation plans and cost estimates.

- Loan Application: Submit the loan application along with the renovation plans and estimates.

- Appraisal: The lender will order an appraisal to determine the property’s post-renovation value.

- Loan Approval: Once approved, the lender will set up a schedule for disbursing funds as renovations progress.

Many Melbourne homeowners have successfully navigated the renovation mortgage process (with expert guidance and access to trusted lenders who specialize in these types of loans). This support can prove invaluable when dealing with the complexities of renovation financing.

As we move forward, let’s explore the numerous benefits that come with including renovations in your mortgage.

Why Include Renovations in Your Mortgage?

Financial Advantages

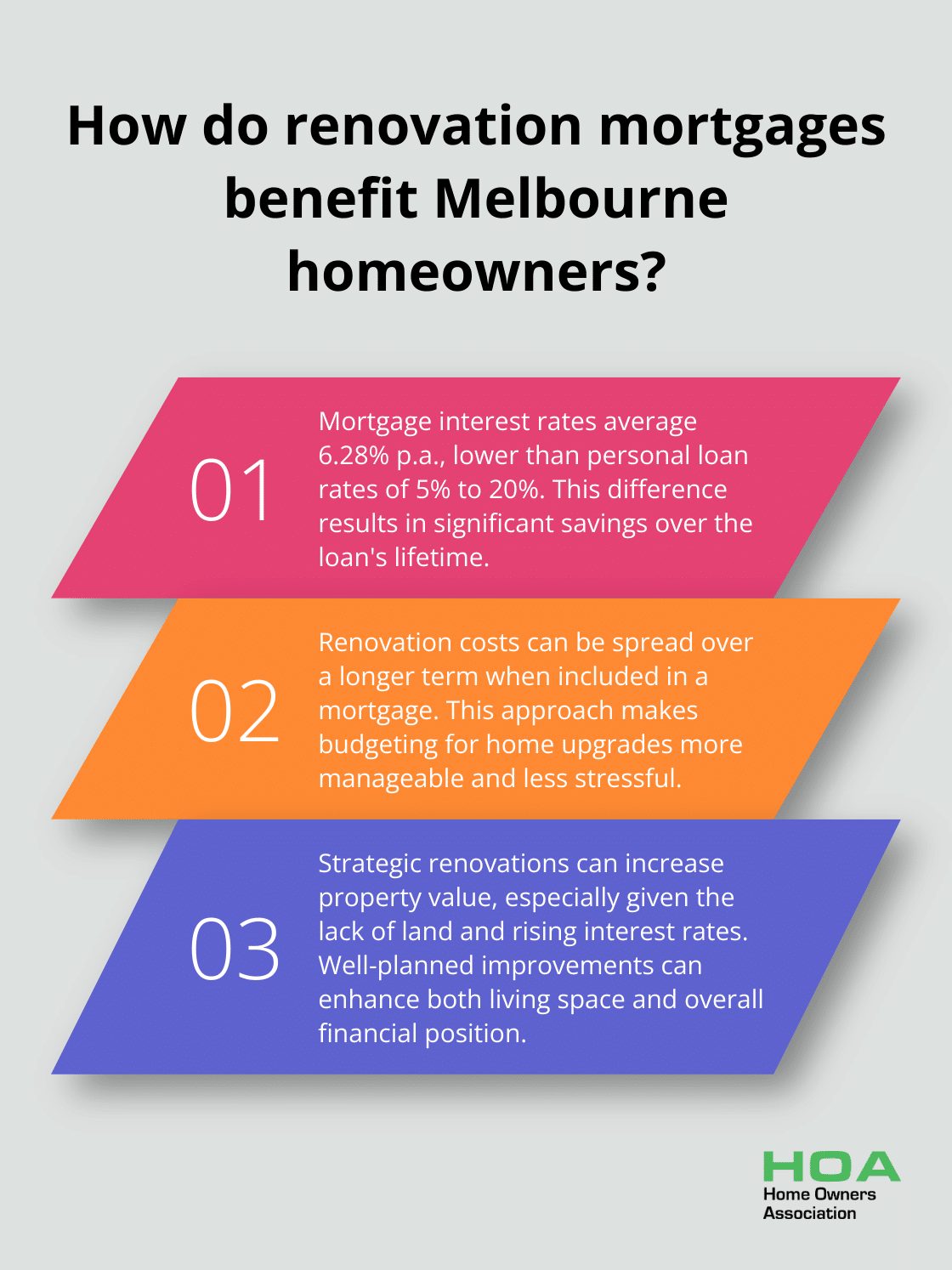

Including renovations in your mortgage offers significant financial benefits for Melbourne homeowners. Interest rates for mortgages typically average around 6.28% p.a., which is substantially lower than personal loan rates (5% to 20%). This difference translates to considerable savings over the loan’s lifetime.

Incorporating renovation costs into your mortgage allows you to spread the expense over a longer term. Instead of facing a large upfront cost or short-term high-interest debt, you can manage improvements as part of your regular mortgage payment. This approach makes budgeting for home upgrades more feasible and less stressful.

Property Value Enhancement

Strategic renovations can significantly increase your property’s value. Renovating is an alluring option for homeowners, especially given the lack of land, soaring interest rates, and construction costs. Well-planned renovations can potentially increase your home’s value, improving both your living space and overall financial position.

However, it’s important to note that not all improvements boost your home’s value. Some renovations can actually be counterproductive, costing more than they return in resale value.

Simplified Financing Process

Combining renovation costs with your mortgage streamlines the financing process. You’ll have a single point of contact and one monthly payment, rather than juggling multiple loans or credit lines. This simplified approach saves time and reduces stress during your renovation project, allowing you to focus on the improvements themselves.

Access to Larger Funds

Renovation mortgages often provide access to larger funds compared to standard mortgages. This increased borrowing capacity is essential for tackling larger projects or addressing unexpected costs that may arise during renovations.

Expert Guidance

When you include renovations in your mortgage, you often gain access to expert advice and resources. Professional guidance can help you navigate the complexities of renovation financing, ensuring you make informed decisions throughout the process. This support proves invaluable when dealing with the intricacies of renovation mortgages.

As you consider the benefits of including renovations in your mortgage, it’s important to understand the steps involved in this process. Let’s explore how you can successfully incorporate renovation costs into your home loan.

How to Include Renovations in Your Mortgage

Assess Your Renovation Needs

Start with a thorough evaluation of your property to identify necessary improvements. Create a detailed list of renovations and prioritize essential repairs and upgrades that add value. Consider using a formula to determine potential value: take the average house price for your suburb and size, then compare it to your house’s valuation plus the cost of the renovation.

Obtain quotes from at least three reputable contractors for each major renovation. This step provides a realistic cost estimate and helps prevent budget overruns. Factor in a contingency fund of 10-20% for unexpected expenses (a common practice among savvy homeowners).

Explore Lender Options

With your renovation plan and cost estimates ready, contact at least five lenders to compare their offerings. When discussing options, ask about:

- Interest rates and comparison rates

- Loan terms and repayment schedules

- Fees and charges, including valuation and application fees

- Flexibility in fund disbursement for renovations

Complete the Property Appraisal Process

Most lenders require a professional appraisal to determine your property’s current value and projected post-renovation value. This step influences the loan amount you can secure.

Provide the appraiser with detailed renovation plans, including materials to be used and expected completion timelines. This information helps the appraiser consider your renovation plans and their potential impact on the property’s value.

Prepare Required Documentation

Submit the necessary documentation to secure your renovation mortgage. Typical requirements include:

- Proof of income (pay slips, tax returns)

- Bank statements

- Existing mortgage details (if refinancing)

- Detailed renovation plans and cost estimates

- Contractor licenses and insurance certificates

- Council approvals or permits for planned renovations

Organize these documents meticulously to streamline the application process.

Finalize Your Renovation Mortgage

After your application receives approval, review the loan agreement carefully. Pay close attention to the draw schedule, which outlines how and when renovation funds will be released. Typically, lenders release funds in stages as renovation milestones are completed.

Ensure you understand all terms and conditions, including any restrictions on the types of renovations allowed or requirements for licensed contractors. If any aspect is unclear, seek clarification from your lender or consult with a professional for expert advice.

Before undertaking any major renovations, consult with local real estate experts to understand what truly adds value in Melbourne’s market (and what doesn’t).

Final Thoughts

You can include home renovations in your mortgage, which offers financial advantages and simplifies the improvement process. This approach allows you to access lower interest rates and spread costs over a longer term, potentially increasing your property’s value. Home Owners Association supports Melbourne homeowners throughout the renovation financing journey, providing valuable insights into local market trends.

We offer expert guidance and resources to ensure your renovation project meets high-quality standards while staying within budget. Our team can help you identify renovations that add the most value to your property. We also provide access to exclusive trade pricing and discounts, maximizing the value of your renovation investment.

As you consider including renovations in your mortgage, weigh the benefits against your long-term financial goals and current circumstances. Home Owners Association is here to assist you in making informed decisions about your renovation project and financing options. With proper planning and expert advice, you can transform your property while managing costs effectively.