At Home Owners Association, we understand the importance of energy-efficient home improvements for both your wallet and the environment. Many homeowners are unaware of the tax benefits available for such upgrades, especially in Australia through the ATO.

This guide will explore various energy-efficient home improvements that qualify for tax incentives, helping you save money while reducing your carbon footprint. We’ll also provide insights on how to maximize these benefits and navigate the process of claiming them.

Energy-Efficient Home Upgrades That Qualify for Tax Benefits

At Home Owners Association, we strive to help Australian homeowners make smart choices for their properties. Energy-efficient upgrades not only reduce your carbon footprint but can also lead to significant tax benefits. Let’s explore the top home improvements that qualify for these incentives.

Solar Panel Installation: A Bright Idea for Your Wallet

Solar panels revolutionize energy savings and tax benefits. In Australia, the Small-scale Renewable Energy Scheme (SRES) offers small-scale technology certificates (STCs) for eligible solar panel installations. Installing an eligible system allows the creation of STCs with a value that can be redeemed by selling or assigning them, effectively reducing the upfront cost of your solar system. Some states offer their own solar rebates, further increasing your savings.

Victoria’s Solar Homes Program provides rebates of up to $1,400 for solar panel systems, plus an interest-free loan for the same amount. This can significantly offset the initial investment, making solar an attractive option for many homeowners.

Windows and Doors: Your Gateway to Energy Efficiency

Upgrading to energy-efficient windows and doors can dramatically improve your home’s insulation. While Australia doesn’t have a federal tax credit specifically for these upgrades, some state and territory governments offer rebates or incentives.

The New South Wales Government’s Energy Savings Scheme provides financial incentives for installing energy-efficient windows and glazing. These improvements can lead to substantial energy savings.

HVAC Systems: Cool Savings, Hot Benefits

High-efficiency heating, ventilation, and air conditioning (HVAC) systems are another area where you can find tax benefits and rebates. The Australian Government’s Energy Rating System helps consumers identify energy-efficient appliances, including air conditioners and heaters. The label provides an energy rating for three climate zones (hot, average and cold), helping you select an appliance that performs best in your location.

Some states offer specific rebates for HVAC upgrades. In South Australia, the Retailer Energy Efficiency Scheme (REES) provides discounts on energy-efficient reverse cycle air conditioners. These rebates can amount to hundreds of dollars in savings, making the switch to a more efficient system much more affordable.

Insulation Improvements: Wrap Your Home in Savings

Proper insulation is key to maintaining a comfortable home temperature and reducing energy costs. While federal tax credits for insulation are not currently available in Australia, many state and local governments offer rebates or incentives for insulation upgrades.

For example, the Victorian Energy Upgrades program provides discounts on insulation installations. This can include ceiling, wall, and underfloor insulation.

Energy-Efficient Appliances: Small Changes, Big Impact

Upgrading to energy-efficient appliances can yield substantial savings on your energy bills and may qualify for rebates or incentives. The Energy Rating Label system in Australia helps consumers identify the most efficient appliances.

Some states offer specific programs for appliance upgrades. The NSW Energy Savings Scheme, for instance, provides incentives for replacing old, inefficient appliances with newer, energy-efficient models.

To make the most of these energy-efficient improvements for your home, it’s important to stay informed about the latest tax benefits and rebates available in your area. The next section will provide a deeper look into understanding tax credits and rebates across different levels of government and how to claim them effectively.

Navigating Tax Credits and Rebates for Energy Upgrades

At Home Owners Association, we help Australian homeowners maximize available tax credits and rebates for energy-efficient upgrades. Understanding these incentives can significantly reduce the costs of your home improvements.

Federal Incentives: The Small-scale Renewable Energy Scheme

The Australian Government’s Small-scale Renewable Energy Scheme (SRES) offers homeowners incentives for investing in renewable energy. Installing an eligible system allows the creation of small-scale technology certificates (STCs) with a value that can be redeemed by selling or assigning them. The number of STCs you receive correlates with the expected electricity production or displacement over your system’s lifetime.

Electricity retailers must purchase a certain number of STCs each year, which effectively reduces the upfront cost of your installation. For instance, a 6.6kW solar system in Sydney could qualify for about 99 STCs (potentially saving you thousands of dollars on your initial investment).

State-Specific Programs: A Patchwork of Opportunities

Each Australian state and territory offers unique incentives for energy-efficient home improvements. These programs vary widely, so check what’s available in your area.

Victoria’s Solar Homes Program offers an interest-free loan of up to $1,400 for solar panel systems. Queensland’s Affordable Energy Plan provides interest-free loans for solar and storage systems. South Australia’s Home Battery Scheme offers subsidies and low-interest loans for battery storage systems.

New South Wales runs the Energy Savings Scheme, which provides financial incentives for various energy-efficient upgrades (including lighting, HVAC systems, and building envelope improvements). The exact savings depend on the type and scale of your upgrades.

Local Utility Rebates: Hidden Gems of Savings

Many local utility companies offer their own incentives for energy-efficient upgrades. You can often combine these with state and federal programs for maximum savings.

Energy Australia offers discounts on energy-efficient appliances and free home energy assessments in some areas. AGL provides rebates for installing solar hot water systems in certain states. These local programs change frequently, so check with your utility provider regularly.

Claiming Your Benefits: A Step-by-Step Approach

To claim your tax benefits and rebates, follow these steps:

-

Research: Before starting any project, thoroughly research the available incentives in your area. The Australian Government’s energy.gov.au website serves as a great starting point.

-

Verify Eligibility: Ensure your planned upgrades meet the specific requirements for each incentive program (this often includes using certified installers and products).

-

Keep Detailed Records: Maintain all receipts, contracts, and certification documents related to your energy-efficient upgrades.

-

Apply Promptly: Many rebate programs have limited funding or specific claim periods. Submit your applications as soon as possible after completing your upgrades.

-

Seek Professional Advice: Consider consulting with a tax professional or energy efficiency expert to ensure you maximize your benefits.

The landscape of energy efficiency incentives constantly evolves. We stay up-to-date with the latest changes to help our members make informed decisions. Taking advantage of these programs not only saves you money but also contributes to a more sustainable future for Australia.

To further enhance your energy savings and tax benefits, the next section will explore strategies for maximizing these advantages through careful planning and execution of your home improvement projects.

How to Maximize Energy Savings and Tax Benefits

The Power of Home Energy Audits

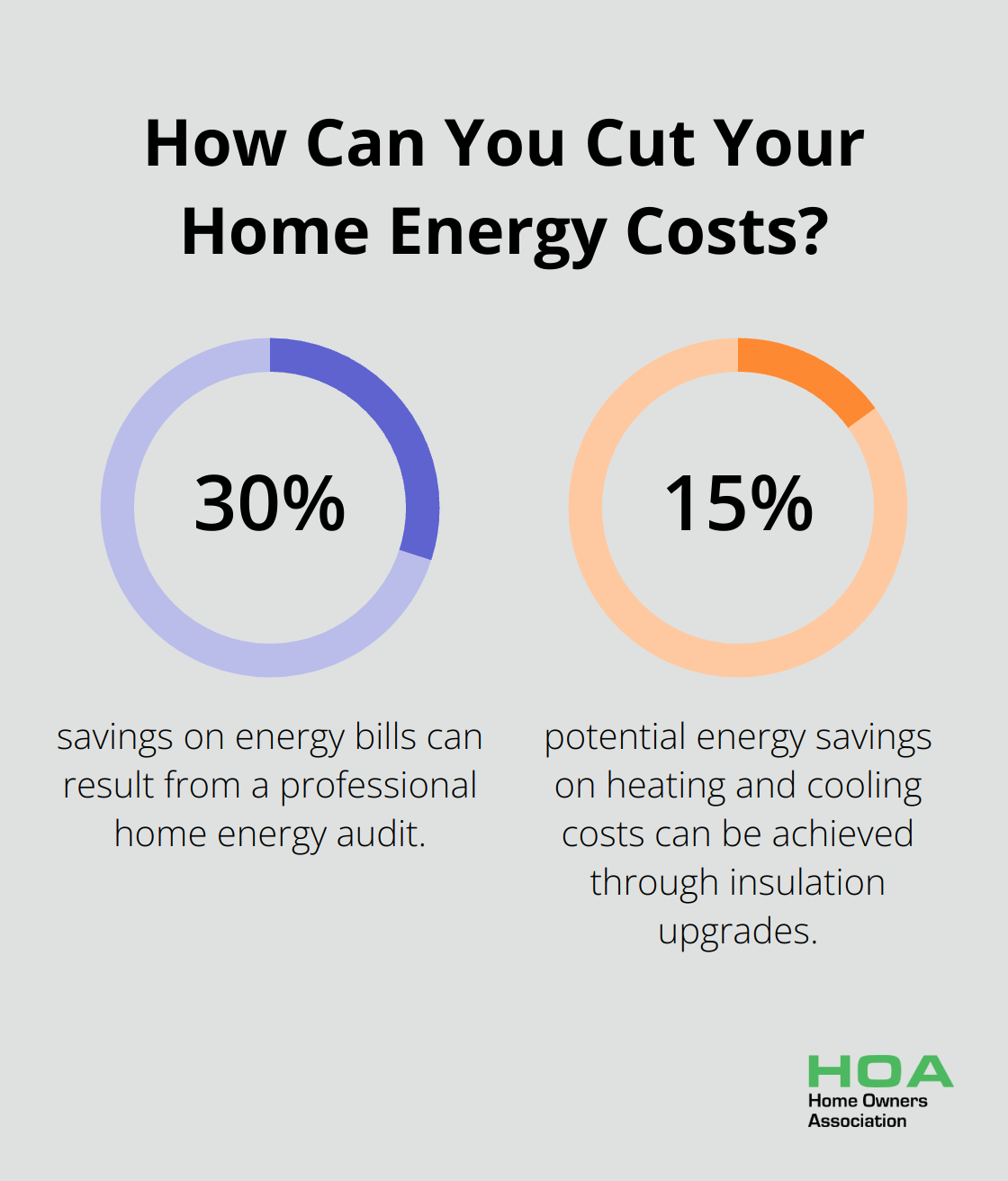

A professional home energy audit forms the foundation of an effective energy-saving strategy. These audits typically cost between $200 and $600 but can result in savings of up to 30% on energy bills. In New South Wales, the Energy Savings Scheme offers discounts on comprehensive home assessments, which potentially reduces your out-of-pocket expenses.

During an audit, experts use tools like blower door tests and infrared cameras to identify air leaks, insulation gaps, and inefficient appliances. They provide a detailed report that outlines potential improvements and their estimated energy savings. This information proves invaluable for prioritizing your upgrades and maximizing your return on investment.

Strategic Upgrade Prioritization

After receiving your audit results, prioritize your improvements. Focus on upgrades with the highest return on investment (ROI) and those that qualify for the most substantial tax benefits or rebates.

Insulation upgrades often top the list, with potential energy savings of up to 15% on heating and cooling costs. In Victoria, the Energy Efficient Home Bundle offers rebates of up to $1,000 for ceiling insulation upgrades, which makes this an attractive starting point.

Solar panel installations, while requiring a larger upfront investment, can lead to significant long-term savings. With the federal Small-scale Renewable Energy Scheme (SRES) offering rebates of around $3,000 for a 6.6kW system in Sydney, the payback period can be as short as 3-5 years.

Bundling Upgrades for Maximum Impact

Combining multiple upgrades can lead to compounded energy savings and often qualifies you for additional rebates. For example, pairing a solar panel installation with a home battery system can increase your energy independence and potentially qualify you for additional state-specific incentives.

In South Australia, the Home Battery Scheme initially offered subsidies of up to $6,000 per battery when launched in October 2018, with a flat $500 per kWh of battery storage. This scheme can be combined with the federal SRES rebates for solar panels. This combination not only maximizes your tax benefits but also dramatically reduces your reliance on grid electricity.

Meticulous Documentation: Your Key to Claiming Benefits

Proper documentation is essential for successfully claiming tax benefits and rebates. Keep detailed records of all energy-efficient home improvements, including:

- Receipts and invoices for all purchases and installations

- Manufacturer certifications for products (especially important for claiming SRES benefits)

- Energy audit reports and recommendations

- Before and after photos of installations

- Energy bills showing consumption changes after upgrades

Create a dedicated file for each upgrade project, including digital backups of all documents. This organized approach will streamline the process when it’s time to claim your benefits, ensuring you don’t miss out on any potential savings.

Tax laws and rebate programs can change. Stay informed about the latest updates by regularly checking government websites or consulting with energy efficiency experts (this can save you time and money in the long run).

Final Thoughts

Energy-efficient home improvements offer financial benefits and environmental impact for Australian homeowners. The Australian Taxation Office (ATO) recognizes these upgrades, providing various deductions and credits that reduce tax burdens. Homeowners who implement solar panels, insulation, and other energy-saving measures can take advantage of the Small-scale Renewable Energy Scheme, state programs, and local utility rebates to offset costs.

These improvements yield long-term financial impacts beyond immediate tax benefits. Reduced energy bills, increased property value, and potential income from excess energy production contribute to substantial savings over time. The environmental impact of these upgrades is significant, as they reduce carbon emissions and promote sustainable living practices.

Home Owners Association helps Melbourne homeowners navigate energy-efficient upgrades and their associated tax benefits. Our members receive exclusive access to trade pricing, discounts on materials, and expert advice to ensure their home improvement projects meet high standards while maximizing available incentives. Investing in energy-efficient home improvements is a smart financial decision and a step towards a more sustainable future.