At Home Owners Association, we know that budgeting for home repairs and maintenance is a cornerstone of responsible homeownership. Many homeowners wonder how much to save for home repairs and maintenance, and the answer can vary based on several factors.

Proper budgeting not only prevents costly emergency repairs but also preserves and increases your home’s value. In this post, we’ll guide you through creating a realistic maintenance budget and highlight essential tasks to keep your home in top shape.

Why Budget for Home Maintenance?

Financial Preparedness Prevents Surprises

Home maintenance isn’t optional-it’s essential. A 2023 Hippo survey revealed that 78% of homeowners encountered unexpected repairs. This statistic highlights the need for financial readiness. Regular fund allocation creates a buffer against these surprises, which can otherwise result in debt or subpar living conditions.

Protect Your Most Valuable Asset

Your home likely represents your largest investment. Regular upkeep doesn’t just maintain functionality; it preserves and often increases value. A lack of preventative maintenance could easily lead to a 10% loss in a property’s appraised value. For example, gutter cleaning (costing $119 to $234) can avert water damage that might otherwise cost thousands to repair.

Safety First, Comfort Second

A well-maintained home is a safer home. Consider smoke detectors: the National Fire Protection Association reports that three out of five home fire deaths occur in properties with non-functioning smoke alarms. Regular checks of such critical systems don’t just enhance comfort-they save lives.

Proactive maintenance allows you to address issues before they disrupt your daily life. A properly functioning HVAC system (with regular cleaning costing $269 to $506) isn’t just about comfort; it maintains a healthy living environment and prevents system failures during extreme weather.

Long-Term Savings and Peace of Mind

Budgeting for home maintenance saves money in the long run and provides peace of mind. Experts recommend setting aside up to 5% of your income for home maintenance, as well as $10,000 to cover emergency repairs and system replacements. This investment in your property ensures that small issues don’t escalate into costly emergencies.

The Role of Professional Guidance

Organizations like Home Owners Association offer valuable resources and expert advice to help homeowners navigate the complexities of home maintenance. Their guidance can prove invaluable in creating effective maintenance schedules and budgets tailored to specific property needs.

As we move forward, we’ll explore specific maintenance tasks and effective budgeting strategies to keep your home in top condition year-round.

Essential Home Maintenance Tasks and Their Costs

Regular Inspections: The Foundation of Home Care

Regular inspections form the first line of defense against costly repairs. In Arizona, electrical inspections typically cost between $125 to $200, with an average of $160. A roof inspection (typically costing $200-$600) can prevent water damage that might otherwise cost thousands. HVAC inspections ($300-$500 annually) ensure your system runs efficiently, potentially saving you 15% on energy bills according to the U.S. Department of Energy.

Plumbing inspections, often overlooked, prove crucial. A professional inspection costs $200-$400 but can catch leaks early. A small leak wastes up to 10,000 gallons of water per year, significantly impacting your water bill and potentially causing structural damage.

Seasonal Maintenance: Protecting Your Home Year-Round

Seasonal maintenance tasks preserve your home’s integrity. Gutter cleaning ($119-$234) should occur at least twice a year. Neglect of this task can lead to water damage, which costs an average of $2,582 to repair (HomeAdvisor).

Weatherproofing is another seasonal must-do. According to the EPA, homeowners can save an average of 15% on heating and cooling costs (or an average of 11% on total energy costs) by air sealing their homes. Professional weatherstripping services might cost $300-$600 but can result in even greater energy savings.

Long-Term Projects: Investing in Your Home’s Future

Long-term projects like painting and flooring replacement are significant investments that pay off over time. Exterior painting (costing $2,500-$4,000 for a 2,400-square-foot home) not only enhances curb appeal but also protects your home from the elements. This investment can last up to 10 years with proper maintenance.

Flooring replacement is another substantial project. While costs vary widely based on material choice, expect to pay $3-$22 per square foot for installation. However, new flooring can increase your home’s value by up to 5%, according to the National Association of Realtors.

Understanding and budgeting for these essential tasks protects your investment and ensures a comfortable living environment for years to come. Proactive maintenance always proves more cost-effective than reactive repairs. As we move forward, we’ll explore how to create a realistic budget for these necessary home maintenance tasks.

How Much Should You Budget for Home Maintenance?

The 1-4% Rule

A common guideline in the industry suggests setting aside a portion of your home’s value annually for maintenance and repairs. According to Bankrate, ongoing yearly expenses for the average single-family homeowner have increased 26 percent since 2020. This range varies based on factors such as your home’s age, location, and overall condition.

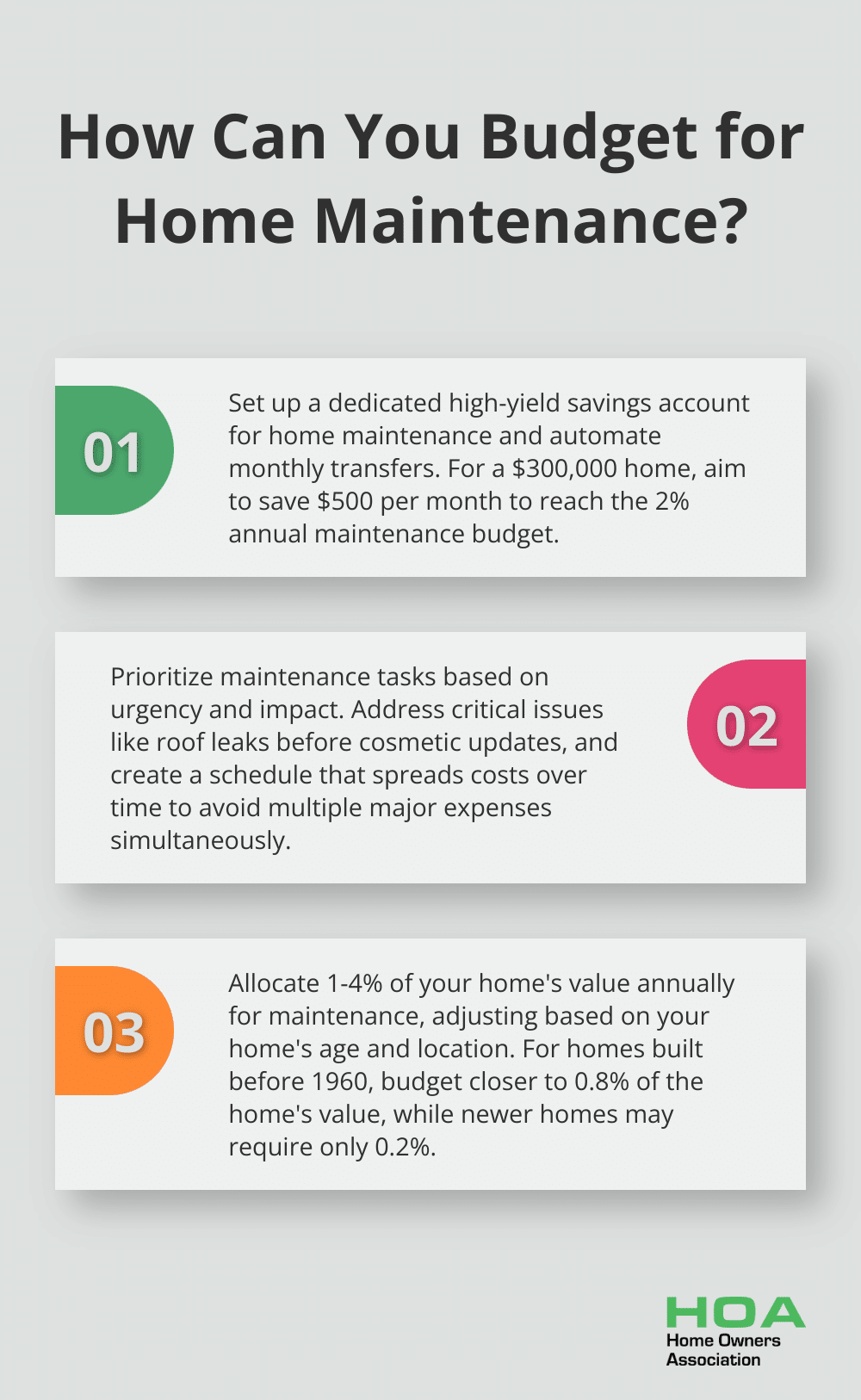

Older homes typically require more maintenance. The American Housing Survey found that homes built before 1960 spent about 0.8% of their value on maintenance, compared to only 0.2% for homes built in the 2010s. Climate also affects maintenance needs; homes in harsh weather conditions may need more frequent repairs.

Establishing a Dedicated Savings Account

To ensure fund availability when needed, set up a separate high-yield savings account specifically for home maintenance. This approach helps resist the temptation to use these funds for other purposes and potentially earn interest on your savings.

Consider automating monthly transfers to this account. If you target 2% of your home’s value annually and your home is worth $300,000, you’d need to save $500 per month (adjust this amount based on your home’s specific needs and your financial situation).

Prioritizing Projects

Not all home maintenance tasks hold equal importance. Prioritize projects based on their urgency and potential impact on your home’s value and safety. For example, addressing a leaky roof should take precedence over updating kitchen appliances.

Create a maintenance schedule that includes both routine tasks and long-term projects. This approach helps spread costs over time and prevents multiple major expenses from occurring simultaneously.

According to Thumbtack, the annual cost of home maintenance for a single-family home hit $10,147 in Q2 2024, a 4.69% increase year over year. Planning ahead and prioritizing effectively can help you manage these costs without compromising your home’s condition or your financial stability.

Professional vs. DIY Maintenance

While DIY can save money on some tasks, it’s important to know when to call in professionals. For instance, HVAC maintenance by a professional can cost between $75 and $150 per hour (but can prevent system failures and extend equipment lifespan, potentially saving thousands in the long run).

These guidelines, tailored to your specific situation, can help you create a robust home maintenance budget that protects both your property and your finances.

Final Thoughts

Budgeting for home repairs and maintenance protects your investment and ensures a comfortable living space. The amount you save depends on factors like your home’s age, location, and condition, but the 1-4% rule of your home’s value provides a solid annual savings target. This approach allows you to address routine upkeep and larger projects without financial strain.

A proactive maintenance strategy preserves and potentially increases your home’s value over time. Regular inspections and timely repairs prevent small issues from escalating into costly emergencies (which can save you thousands in the long run). This forward-thinking approach to home care pays dividends both in terms of your property’s condition and your financial well-being.

We at Home Owners Association understand the challenges of maintaining a home in Melbourne, Australia. Our organization offers benefits, expert advice, and resources to help you navigate your home maintenance journey with confidence. Start your home maintenance budget today and invest in a worry-free homeownership experience.