At Home Owners Association, we understand the importance of maximizing your tax benefits. Home improvements can offer significant tax deductions, but navigating the process can be challenging.

This guide will walk you through how to claim home improvement tax deductions effectively. We’ll cover eligible improvements, necessary documentation, and key steps to ensure you don’t miss out on potential savings.

What Are Home Improvement Tax Deductions?

Definition and Eligibility

Home improvement tax deductions are financial incentives the government provides to homeowners who make qualifying upgrades to their properties. These deductions reduce your taxable income, which can lower your overall tax bill. Not all home improvements qualify for tax deductions, so it’s essential to understand the criteria.

Types of Eligible Home Improvements

The Australian Taxation Office (ATO) recognizes several types of home improvements that may be eligible for tax deductions:

- Energy-efficient upgrades: The Energy Efficient Home Improvement Credit offers a deduction of up to $600 for qualifying windows and skylights, and there are also deductions available for exterior doors.

- Home office improvements: If you’re running a business from your home, renovations to this space may be deductible. However, employees cannot claim deductions for renovation costs as home office expenses.

- Rental property improvements: Landlords can often deduct the cost of repairs and improvements made to rental properties.

- Accessibility modifications: Improvements that make your home more accessible for individuals with disabilities may qualify for deductions.

The Critical Distinction: Repairs vs. Improvements

The ATO distinguishes between repairs and improvements, which significantly impacts your ability to claim deductions. Repairs are generally considered maintenance and are immediately deductible. For example, fixing a leaky roof or replacing a broken window falls under this category.

Improvements, on the other hand, are alterations that add value to your property or extend its useful life. These are typically not immediately deductible but may be claimed over time through depreciation. Examples include adding a new room or completely renovating a kitchen.

Many homeowners struggle with this distinction. According to industry data, approximately 30% of homeowners initially misclassify improvements as repairs. This confusion can lead to incorrect tax filings and potential issues with the ATO.

Record-Keeping Best Practices

To avoid complications, you should keep detailed records of all work done on your property. Include descriptions of the work, costs, and dates. This documentation will prove invaluable when it’s time to file your taxes or if you face an audit.

Tax laws can be complex and change frequently. While this guide provides a general overview, it’s always best to consult with a tax professional or the ATO directly for the most up-to-date and personalized advice. They can help you navigate the nuances of home improvement tax deductions and ensure you’re maximizing your benefits while staying compliant with Australian tax laws.

As we move forward, let’s explore the specific types of home improvements that are eligible for tax deductions in more detail.

Which Home Improvements Qualify for Tax Deductions?

Energy-Efficient Upgrades

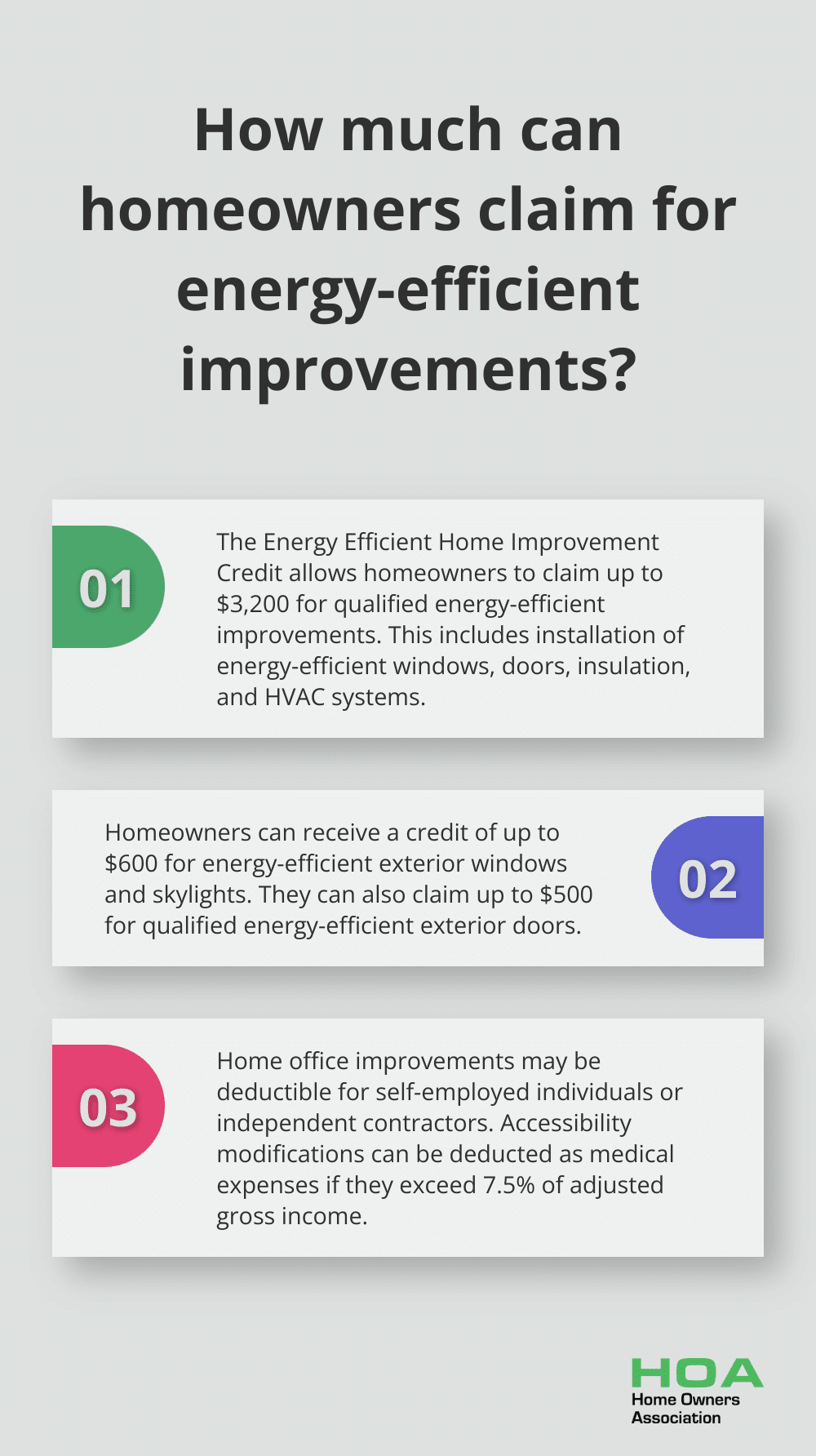

The Energy Efficient Home Improvement Credit allows homeowners to claim up to $3,200 for qualified energy-efficient improvements. This includes the installation of energy-efficient windows, doors, insulation, and HVAC systems.

Homeowners can receive a credit of up to $600 for energy-efficient exterior windows and skylights. Additionally, they can claim up to $500 for qualified energy-efficient exterior doors. These upgrades not only provide tax benefits but also lead to long-term savings on energy bills.

Home Office Improvements

The rise of remote work has increased the relevance of home office improvements. If you use a portion of your home exclusively for business purposes, you may deduct expenses related to that space. This can include renovations, repairs, and even a portion of your utility bills.

It’s important to note that these deductions typically apply only to self-employed individuals or independent contractors. Employees working from home generally cannot claim these deductions. A tax professional can provide guidance on your specific situation.

Accessibility Modifications

Homeowners who modify their homes to accommodate individuals with disabilities may qualify for tax deductions. These modifications can include: Installing ramps, Widening doorways, Modifying bathrooms for accessibility.

The IRS allows these deductions as medical expenses if they don’t add to the overall value of your home. To claim these deductions, your total medical expenses must exceed 7.5% of your adjusted gross income. This threshold can be challenging to meet, so careful planning and documentation are essential.

Major Renovations and Additions

While most home improvements don’t qualify for immediate tax deductions, they can affect your tax situation when you sell your home. Major renovations and additions (such as adding a new room or completely renovating a kitchen) can increase your home’s cost basis, potentially reducing your capital gains tax when you sell.

The IRS considers these improvements as capital expenses. You should keep detailed records of these improvements, as they can help lower your tax bill in the future.

As we move to the next section, we’ll explore the specific steps you need to take to claim these home improvement tax deductions effectively. Proper documentation and understanding of the process are key to maximizing your tax benefits.

How to Claim Home Improvement Tax Deductions

Keep Detailed Records

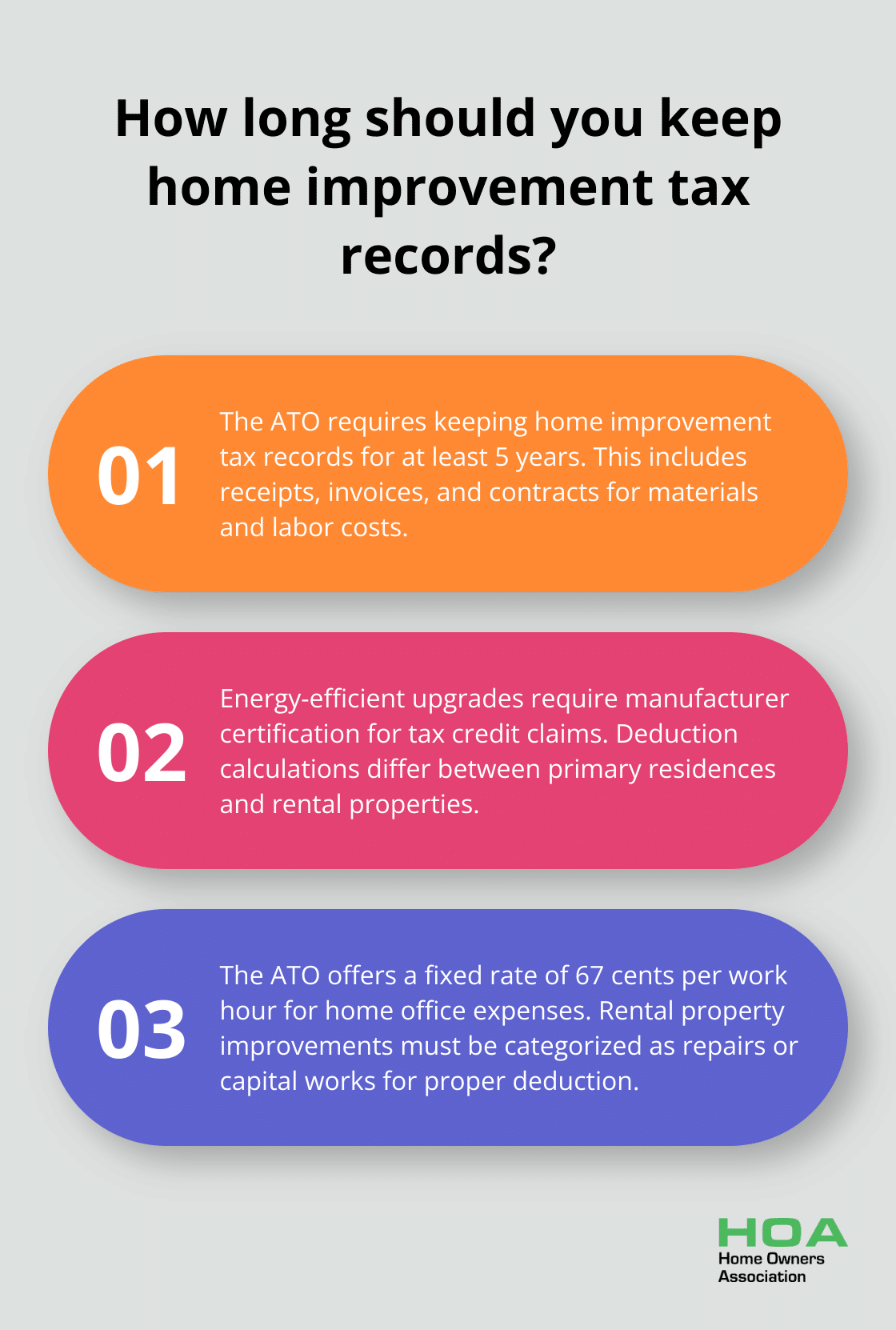

The foundation of a successful tax deduction claim is thorough documentation. You must keep all receipts, invoices, and contracts related to your home improvements. This includes materials, labor costs, and any professional fees. The Australian Taxation Office (ATO) requires you to retain these records for at least five years from the date you lodge your tax return.

For energy-efficient upgrades, you need certification from the manufacturer that the product meets the required standards. This is essential for claiming the Energy Efficient Home Improvement Credit. The eligibility criteria for these tax credits differ between primary residences and rental properties.

Calculate Deductions Accurately

Determining the correct deduction amount can be complex. For home office improvements, you need to calculate the percentage of your home used exclusively for business. The ATO provides a fixed rate method of 67 cents per work hour for home office expenses, which can simplify this process.

For rental property improvements, you must distinguish between repairs (immediately deductible) and capital works (deductible over several years). The ATO’s Rental Properties Guide offers detailed explanations on how to categorize these expenses.

Use the Correct Tax Forms

The specific forms you need depend on the type of deduction you’re claiming. For most home improvements, you’ll use the Rental Schedule (NAT 2668) if it’s a rental property, or the Business and Professional Items Schedule (NAT 2816) for home office deductions.

You typically claim energy-efficient upgrades on your individual tax return. The ATO updates these forms annually, so always use the current version when lodging your return.

Consult a Tax Professional

Tax laws are complex and frequently change. Consulting with a registered tax agent or accountant is invaluable. They can offer personalized advice based on your specific situation and ensure you maximize your deductions while remaining compliant with ATO regulations.

A professional can also help you navigate grey areas, such as determining whether an expense is a repair or an improvement (this distinction can significantly impact your tax outcome).

Stay Informed About Changes

Tax laws and regulations evolve. You need to stay informed about any changes that might affect your ability to claim home improvement tax deductions. The ATO website is a reliable source of up-to-date information. You can also consider joining organizations like Home Owners Association, which provide members with regular updates on tax-related matters affecting homeowners.

Final Thoughts

Home improvement tax deductions offer significant benefits for homeowners. You can reduce your tax burden and enhance your property’s value by understanding which improvements qualify and how to claim them. Proper documentation stands as the key to successful tax deductions, so keep meticulous records of all home improvements.

The advantages of claiming home improvement tax deductions extend beyond immediate financial gains. Energy-efficient upgrades lead to long-term savings on utility bills, while accessibility modifications improve quality of life for those with disabilities. Even improvements that don’t qualify for immediate deductions can increase your home’s cost basis, potentially reducing capital gains tax when you sell.

We at Home Owners Association encourage you to explore all potential deductions available to you. Our team supports homeowners in Melbourne, Australia, to make the most of their property investments. You can learn more about how to claim home improvement tax deductions and access our resources at Home Owners Association.