At Home Owners Association, we’re excited to share the latest information on 2024 federal tax credits for energy-efficient home improvements. These incentives can significantly reduce your tax burden while helping you create a more sustainable living space.

Upgrading your home with energy-efficient features not only lowers your utility bills but also increases your property value. In this post, we’ll explore the available tax credits, eligibility requirements, and how to claim these benefits on your 2024 tax return.

What Are Energy-Efficient Home Improvements?

Definition and Scope

Energy-efficient home improvements refer to upgrades that reduce energy consumption and lower utility bills. These modifications transform homes and range from simple changes (like installing LED lighting) to more complex projects (such as upgrading HVAC systems or adding solar panels).

Impact on Residential Properties

Energy efficiency in homes is not just a trend; it’s a smart investment. Homeowners who implement energy-efficient upgrades can significantly reduce their carbon footprint and save money on utility bills.

Consider these impactful examples:

- Proper insulation prevents up to 40% of a home’s heating energy from escaping (as highlighted by the Australian Government’s YourHome initiative).

- Upgrading to a 5-star energy-rated refrigerator saves up to $1,000 over its lifetime compared to a 2-star model (Energy Rating website).

- Double-glazed windows reduce heat loss and outside noise, improving home comfort levels.

Moreover, energy-efficient homes typically command higher resale values. Buyers often pay premiums for properties with energy-saving features, making these improvements a wise long-term investment.

Evolution of Tax Incentives

Tax incentives for energy-efficient home improvements have a rich history in Australia. These incentives have evolved to meet changing environmental goals and economic needs. The Small-scale Renewable Energy Scheme (SRES) stands as a cornerstone of these efforts, providing financial incentives for installing eligible renewable energy systems.

Under the SRES, homeowners receive small-scale technology certificates (STCs) for installing systems like solar panels. Each STC represents 1 megawatt hour (MWh) of renewable electricity generated or displaced, effectively lowering the installation costs of these systems.

State-level programs also play a crucial role:

- Victoria’s Solar Homes Program offers rebates of up to $1,400 for solar panel systems and up to $1,000 for solar hot water systems.

- New South Wales’ Empowering Homes program provides interest-free loans for solar battery systems.

- Queensland’s Affordable Energy Plan includes rebates for energy-efficient appliances.

- Western Australia’s Household Energy Efficiency Scheme offers free home energy assessments and up to $1,000 for energy-saving upgrades.

These incentives have driven significant adoption of energy-efficient technologies. In the first half of 2024 alone, Australians installed approximately 1.3 GW of rooftop solar photovoltaics (PV) as homeowners sought to alleviate rising energy costs.

As we move forward, the landscape of energy-efficient home improvements continues to evolve. The next section will explore the specific tax credits available for 2024, helping you navigate the opportunities to upgrade your home while maximizing your financial benefits.

What Tax Credits Can You Claim in 2024?

The 2024 tax year presents significant opportunities for Australian homeowners who plan to make energy-efficient improvements. Home Owners Association wants to ensure you understand the substantial tax credits available, enabling you to maximize your savings while upgrading your home.

Windows and Doors: A Clear Path to Savings

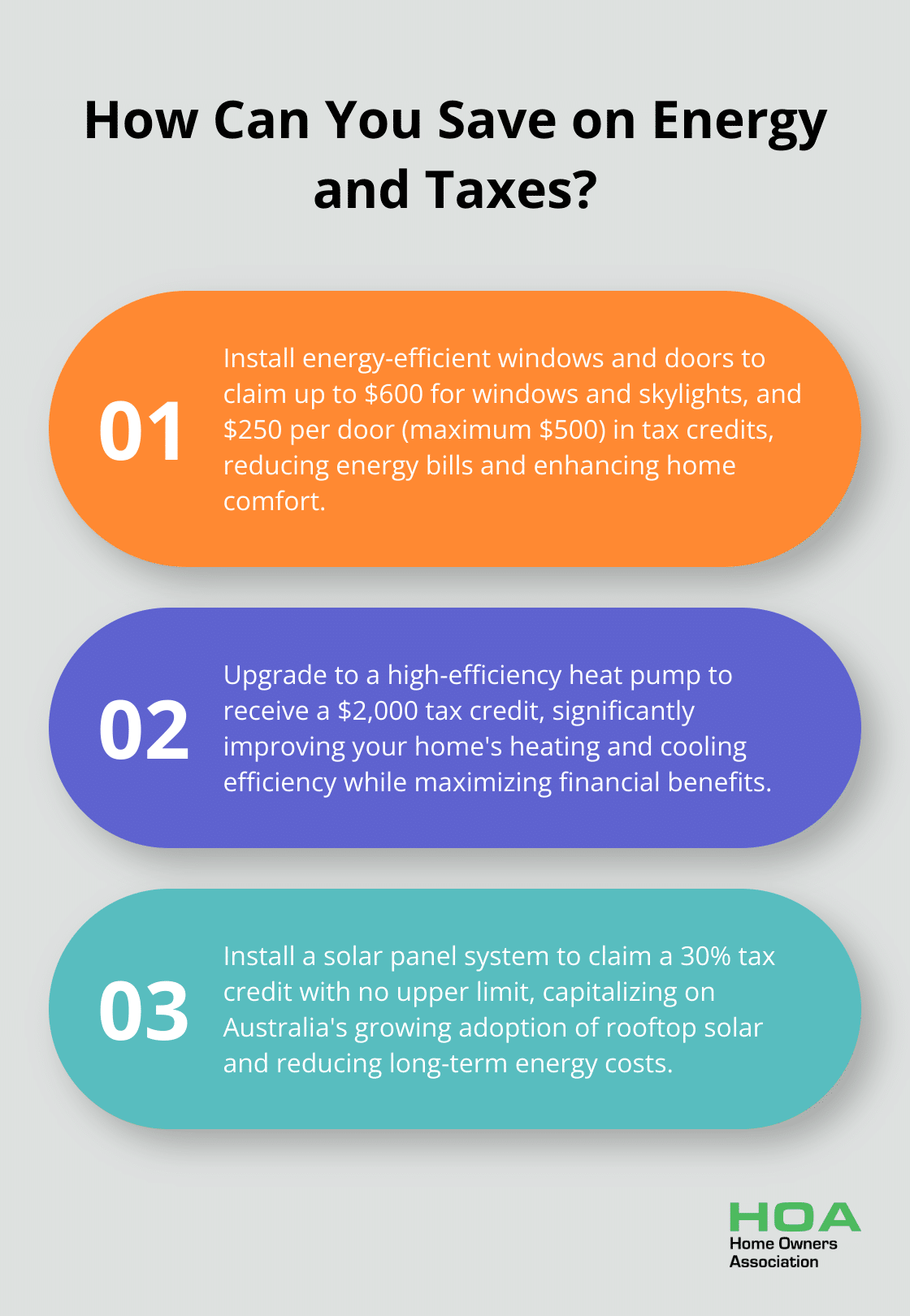

Energy-efficient windows and doors offer more than aesthetic appeal; they represent a smart financial decision. In 2024, homeowners can claim a tax credit of up to $600 for qualifying exterior windows and skylights. For exterior doors, the credit caps at $250 per door, with a total limit of $500. These improvements reduce energy bills and enhance home comfort and value.

HVAC Systems: Efficiency in Heating and Cooling

Upgrading your heating, ventilation, and air conditioning (HVAC) system can lead to substantial energy savings. The 2024 tax credit offers up to $600 for central air conditioners and $600 for electric and natural gas heat pumps. The standout option is the $2,000 credit available for certain high-efficiency heat pumps. This generous credit makes it an optimal time to consider switching to a more efficient heating and cooling solution.

Insulation and Air Sealing: Wrap Your Home in Savings

Proper insulation and air sealing form the foundation of an energy-efficient home. The tax credit for these improvements equals 30% of the cost, up to $1,200. It’s worth noting that while this credit covers materials, it excludes labor costs for insulation projects. Despite this limitation, upgrading insulation can prevent up to 40% of a home’s heating energy from escaping (as reported by the Energy Rating website), making it a valuable investment.

Solar Power: Harness the Sun’s Potential

Solar panel installations continue to attract energy-conscious homeowners. The Residential Clean Energy Credit offers a 30% tax credit on the cost of solar panel systems, with no upper limit. This credit proves particularly attractive given that Australians installed 141,364 new rooftop solar systems during the first half of 2024 alone.

Water Heaters: Efficiency That Flows

Energy-efficient water heaters provide another avenue for homeowners to benefit from tax credits in 2024. The credit for these appliances varies based on the system type. Traditional energy-efficient water heaters qualify for a credit of up to $600. However, heat pump water heaters, which boast significantly higher efficiency, are eligible for the higher $2,000 credit, making them an attractive option for long-term energy savings.

To fully leverage these credits, you must keep detailed records of your purchases and installations. The Australian Taxation Office may request documentation to verify your claims. Additionally, consulting with a tax professional can help ensure you maximize your benefits while complying with all regulations.

These tax credits aim to make energy-efficient upgrades more accessible. By taking advantage of these incentives, you not only reduce your tax burden but also contribute to a more sustainable future. The next section will guide you through the eligibility requirements and application process, ensuring you can confidently claim these valuable tax credits on your 2024 tax return.

How to Claim Your Energy-Efficient Tax Credits

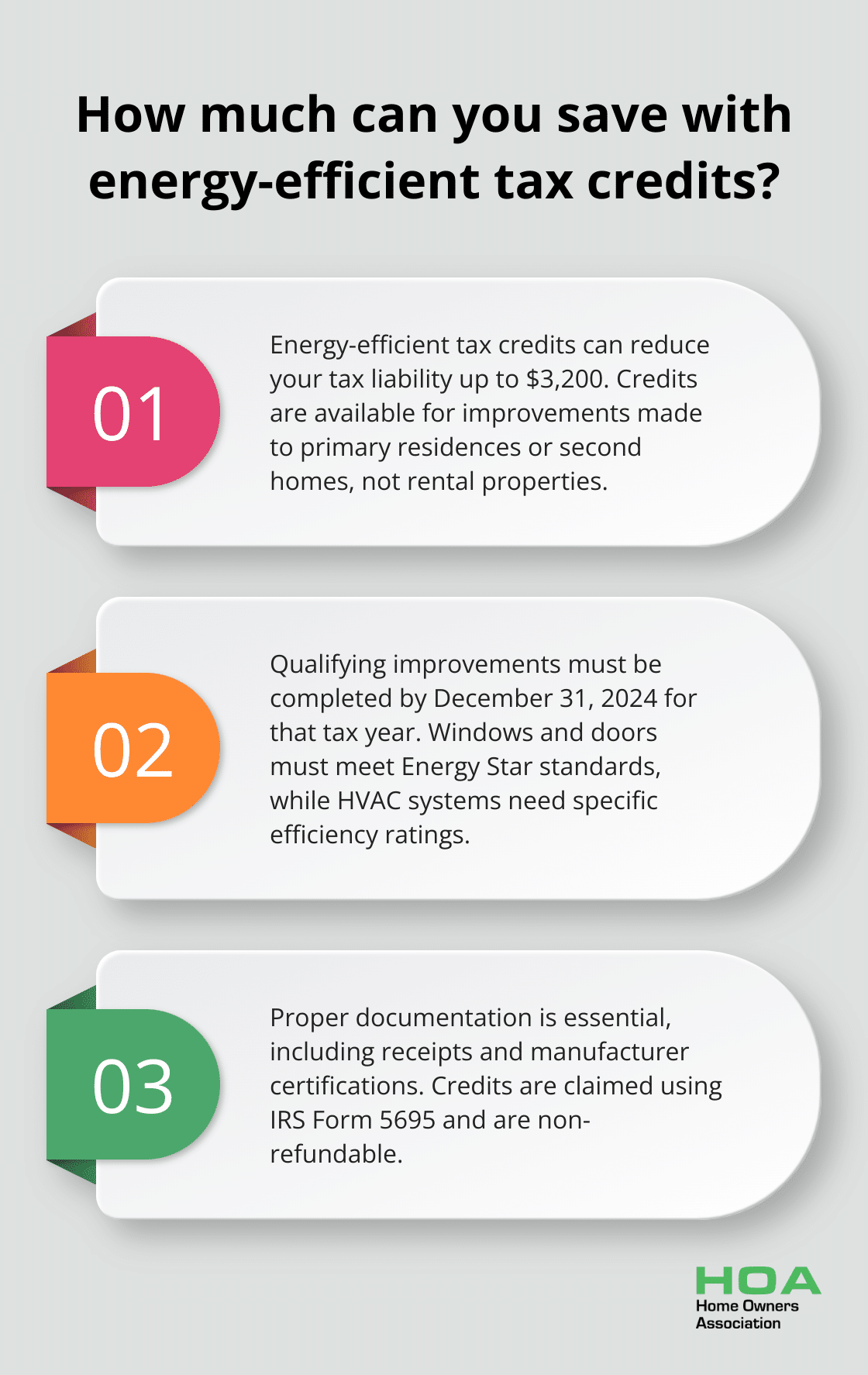

Qualifying for Tax Credits

To claim energy-efficient tax credits in 2024, you must own the home where you make the improvements. The property must be your primary residence or a second home, not a rental property. You must complete improvements by December 31, 2024, to qualify for that tax year’s credits.

Product requirements vary. Windows and doors must meet Energy Star standards, while HVAC systems need specific efficiency ratings. The Department of Energy provides detailed guidelines for each improvement type.

Necessary Documentation

Proper documentation is essential for claiming tax credits. Keep all receipts and manufacturer certifications for your energy-efficient purchases. These should clearly show the cost of materials and installation, as well as the purchase and installation date.

For solar panel installations, you need a copy of your contract and proof of payment. HVAC upgrades require certification from the manufacturer stating that the system meets the required efficiency standards.

Filing Your Tax Return

When you file your 2024 tax return, you must complete IRS Form 5695, Residential Energy Credits. To qualify for the credit, qualified energy efficiency improvements must meet certain energy efficiency requirements. This form calculates your total credit amount, which you then transfer to your 1040 form.

Enter the costs of your energy-efficient improvements in the appropriate sections of Form 5695. The form will guide you through calculating your credit based on the type and cost of each improvement.

These credits are non-refundable, which means they can reduce your tax liability to zero, but you won’t receive a refund for any excess credit amount. If you make qualified energy-efficient improvements to your home after Jan. 1, 2023, you may qualify for a tax credit up to $3,200.

Common Mistakes to Avoid

One frequent error is claiming credits for ineligible expenses. Labor costs for insulation and air sealing don’t qualify for the credit. Only include the cost of materials for these improvements.

Another mistake is exceeding the maximum credit limits. While the overall limit is $3,200, individual improvements have their own caps (e.g., you can claim up to $600 for windows, but not more, even if your actual costs were higher).

Don’t forget to factor in any utility rebates or state incentives you received. These may reduce the amount you can claim on your federal taxes.

Maximizing Your Benefits

To maximize your tax credits, plan your improvements strategically. Consider spreading major upgrades across multiple tax years to take full advantage of annual credit limits.

Stay informed about changes in tax laws and energy efficiency standards. The Department of Energy and the IRS regularly update their guidelines, which can affect your eligibility for certain credits.

If you’re unsure about any aspect of claiming these credits, consult with a tax professional. They can help you navigate the complexities of tax law and ensure you claim all eligible credits (while avoiding potential audits or penalties).

Final Thoughts

The 2024 federal tax credits for energy-efficient home improvements offer homeowners a unique chance to upgrade their properties while enjoying significant financial benefits. These incentives reduce immediate tax burdens and contribute to long-term savings on energy bills. Implementing these upgrades will invest in a more comfortable living space, increase property value, and play a part in creating a more sustainable future.

Energy-efficient homes provide more than financial advantages; they offer improved comfort, better air quality, and increased resilience to extreme weather conditions. They also help reduce our collective carbon footprint, which is an important step in addressing climate change. The potential to save up to $3,200 through various credits makes 2024 an ideal time to consider these home improvements.

We at Home Owners Association encourage Melbourne homeowners to take full advantage of these incentives. Our team will help you navigate the complexities of these tax credits and guide you through your home improvement journey. You will improve your home and make a smart financial decision that pays dividends for years to come.