At Home Owners Association, we understand the importance of maximizing your home renovation investments. Home renovation tax deductions can significantly reduce your tax burden, but navigating the complex rules can be challenging.

This guide will help you understand which renovations qualify for tax deductions and how to claim them effectively. Whether you’re a rental property owner or living in your own home, we’ll show you how to make the most of your renovation expenses come tax time.

What Renovations Qualify for Tax Deductions?

Repairs vs. Improvements

The Australian Taxation Office (ATO) distinguishes between repairs and improvements. Repairs are tax-deductible in the year you make them, while improvements depreciate over time. For instance, fixing a leaky roof qualifies as a repair, but replacing the entire roof with better quality material counts as an improvement.

Capital Works Deductions

Capital works deductions apply to structural improvements and are written off over a longer period than other depreciating assets. This includes extensions, alterations, and structural improvements (such as adding a carport or building a retaining wall).

Depreciating Assets

Renovations that involve installing new fixtures or appliances fall under depreciating assets. These items have a limited effective life and you can claim them over several years. For example, if you install a new air conditioning unit, you can claim its depreciation based on its effective life as determined by the ATO.

Record-Keeping Essentials

You must maintain meticulous records when claiming renovation tax deductions. Keep every receipt, invoice, and contract related to your renovations for at least five years after you lodge your tax return. This documentation proves invaluable if the ATO audits your claims.

Energy-Efficient Upgrades

Eco-friendly renovations reduce your carbon footprint and can lead to tax benefits. While Australia doesn’t offer specific tax deductions for energy-efficient upgrades, these improvements can increase your property’s value and potentially reduce your taxable capital gain when you sell.

Home Office Renovations

The rise of remote work has made home office renovations increasingly common. If you use part of your home exclusively for work, you may claim deductions for renovations to that space. This could include installing built-in desks, improving lighting, or adding soundproofing.

Understanding these categories of tax-deductible renovations sets the foundation for maximizing your claims. In the next section, we’ll explore how to apply these principles specifically to rental properties, where the opportunities for deductions are often more extensive.

How Rental Property Owners Can Maximize Tax Deductions

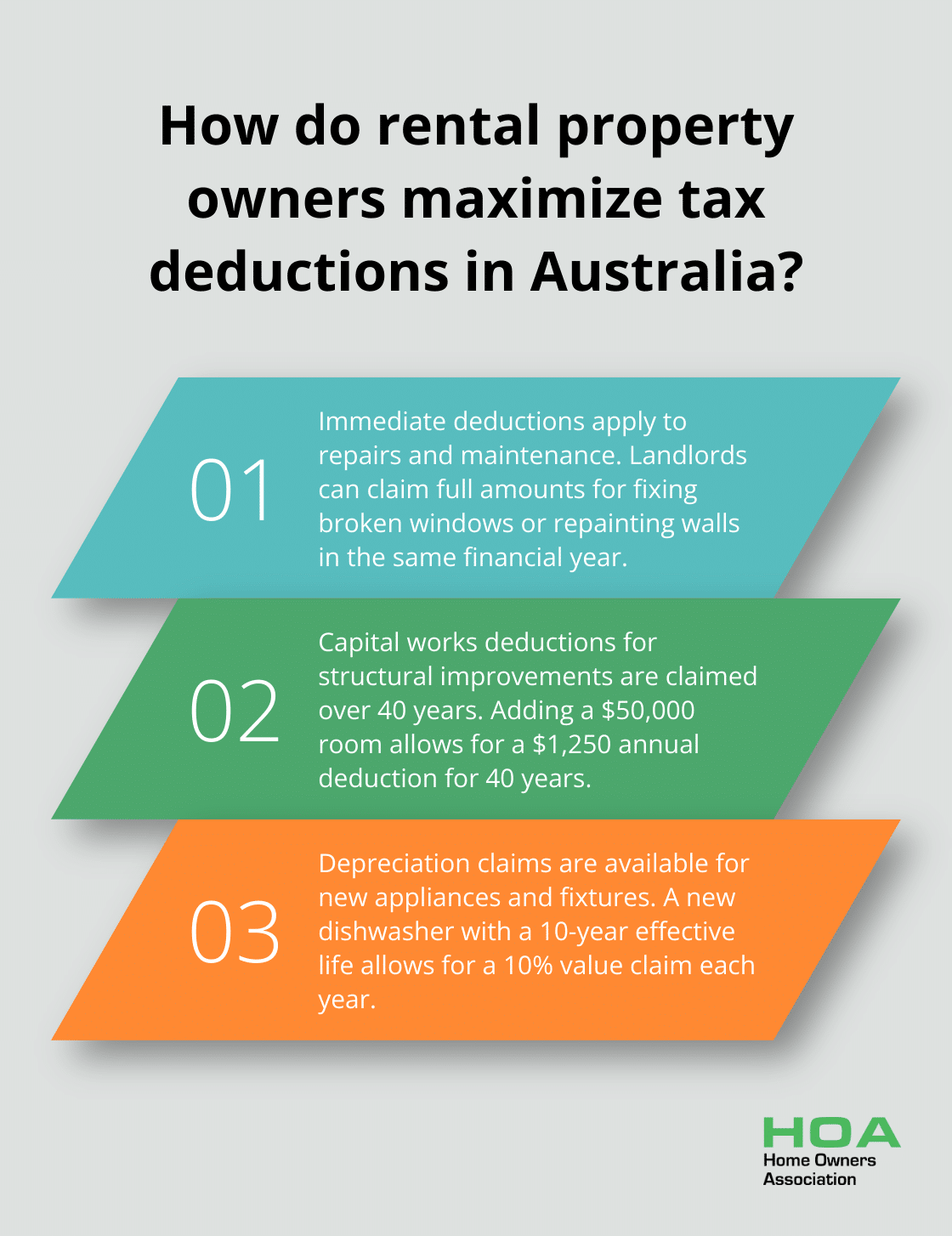

Immediate Deductions for Repairs and Maintenance

The Australian Taxation Office (ATO) allows landlords to claim immediate deductions for repairs and maintenance. This includes fixing broken windows, repairing leaky taps, or repainting walls. If you spend $2,000 on repainting your rental property, you can deduct the full amount in the same financial year.

It’s important to distinguish between repairs and improvements. Replacing a broken hot water system with a similar model is a repair, while upgrading to a more efficient system is an improvement. The former is immediately deductible, while the latter falls under capital works or depreciation.

Capital Works Deductions for Improvements

Capital works deductions apply to structural improvements and are claimed over 40 years from the date the construction was completed. This includes extensions, alterations, and renovations that change the property’s structure. For instance, if you add a new room to your rental property for $50,000, you can claim $1,250 per year for the next 40 years.

The ATO reports that many property investors underutilize capital works deductions. Proper tracking and claiming of these expenses could significantly reduce your taxable income over time.

Depreciation Claims for New Appliances and Fixtures

When you install new appliances or fixtures in your rental property, you can claim depreciation based on their effective life. The ATO provides a comprehensive list of effective lives for various assets. For example, a new dishwasher typically has an effective life of 10 years, allowing you to claim 10% of its value each year.

To maximize these deductions, consider engaging a quantity surveyor to prepare a depreciation schedule. This professional assessment can uncover deductions you might otherwise miss.

Strategic Timing of Renovations

The timing of major renovations or improvements to your rental property is important. Completing work before the end of the financial year can allow you to start claiming deductions sooner. However, you should not rush renovations at the expense of quality – poor workmanship can lead to costly repairs down the line.

Strategic planning of your renovations and meticulous tracking of your expenses can significantly reduce your tax liability as a rental property owner. Always consult with a tax professional to ensure you’re maximizing your deductions while staying compliant with ATO regulations.

Now that we’ve covered how rental property owners can optimize their tax deductions, let’s explore the opportunities available for owner-occupied homes. While the rules differ, there are still several ways homeowners can benefit from renovation-related tax deductions.

Tax Deductions for Owner-Occupied Homes

Home Office Renovations

The Australian Taxation Office (ATO) allows deductions for expenses related to your home workspace if you run a business or work from home. This includes renovations specifically for your home office area.

You can claim tax deductions for installing built-in shelving, improving lighting, or adding soundproofing to your dedicated work area. However, you must maintain accurate records and only claim the portion of the renovation that relates directly to your work activities.

Energy-Efficient Upgrades

Australia doesn’t offer direct tax deductions for energy-efficient home improvements. However, these upgrades can provide financial benefits. Installing solar panels, improving insulation, or upgrading to energy-efficient appliances can reduce your energy bills and potentially increase your property’s value.

Some states and territories offer rebates or incentives for energy-efficient upgrades. For example, the New South Wales government provides rebates for households, including low income households, families, and seniors, as well as gas rebates and medical and life support energy rebates. These incentives can significantly offset the cost of eco-friendly renovations (although they are not tax deductions).

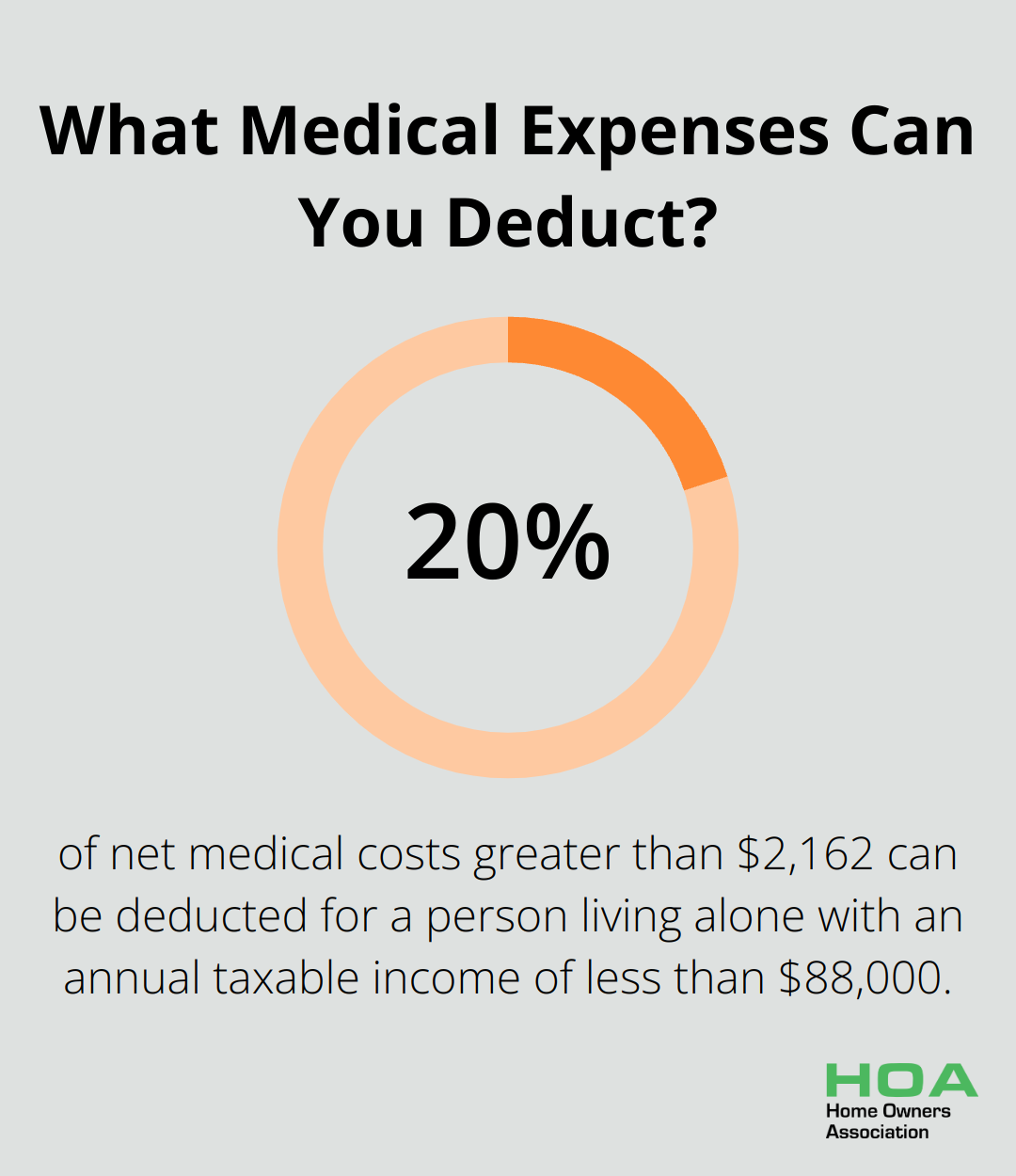

Medical Necessity Renovations

Renovations made for medical reasons can be tax-deductible under certain circumstances. If you or a dependent living with you require home modifications due to a disability or medical condition, these expenses may qualify as medical expenses on your tax return.

Examples include:

- Installing wheelchair ramps

- Widening doorways

- Modifying bathrooms for accessibility

To claim these deductions, you’ll need a doctor’s recommendation and detailed documentation of the expenses. These deductions are subject to the ATO’s net medical expenses tax offset, which allows a person living alone with an annual taxable income of less than $88,000 to deduct 20% of their net medical costs that are greater than $2,162.

Record-Keeping for Homeowners

Maintaining meticulous records of all renovation expenses is essential for homeowners. This includes:

- Receipts for materials and labor

- Contracts with contractors

- Before and after photos of renovated areas (especially for home office claims)

- Medical documentation for accessibility modifications

Consulting with Tax Professionals

The tax implications of home renovations can be complex. Home Owners Association recommends consulting with a tax expert to identify all possible deductions for your specific situation. A professional can help you navigate the intricacies of the tax code and maximize your benefits while ensuring compliance with ATO regulations.

Final Thoughts

Home renovation tax deductions offer significant savings for property owners. Rental property investors benefit from immediate deductions for repairs, capital works deductions, and depreciation claims. Owner-occupiers can claim deductions for home office renovations, energy-efficient upgrades, and medically necessary modifications.

Meticulous record-keeping and strategic planning maximize home renovation tax deductions. We recommend consulting a tax professional to navigate complex regulations and identify all possible deductions for your situation. A qualified expert ensures compliance with Australian Taxation Office guidelines while maximizing your benefits.

Home renovations become smart financial investments with careful planning and expert guidance. The landscape of tax regulations changes, so staying informed and seeking professional advice is essential. Home Owners Association can help you turn your renovations into long-term financial gains.