Home renovations can be exciting but costly endeavors. At Home Owners Association, we understand the financial challenges homeowners face when upgrading their living spaces.

Credit cards can be valuable tools for funding these projects, offering benefits like rewards, cashback, and flexible payment options. In this post, we’ll guide you through selecting the best credit cards for home renovation to maximize your benefits and minimize costs.

Credit Cards for Home Renovation Explained

Rewards-Focused Cards for Renovation Spending

Credit cards can serve as powerful tools for financing home renovations when used strategically. One popular option for homeowners are cards that offer rewards on home improvement purchases. These cards typically provide cashback or points for spending at hardware stores, furniture retailers, and other renovation-related merchants.

0% APR Introductory Offers

Another excellent choice for homeowners are cards with 0% APR introductory periods. These offers allow you to finance your renovation interest-free if you pay off the balance within the promotional period. This option proves particularly beneficial for larger projects where you need more time to repay without incurring interest charges.

Store-Specific Credit Cards

Many major home improvement retailers offer their own credit cards with special financing options and discounts. While these can benefit those loyal to a particular store, exercise caution with deferred interest plans. Unlike true 0% APR offers, these plans can charge retroactive interest if you don’t pay off the full balance by the end of the promotional period.

Benefits of Using Credit Cards for Renovations

Credit cards for renovations can offer significant advantages. The rewards earned can offset some of your project costs, and the ability to spread payments over time can help manage cash flow. Additionally, many credit cards offer purchase protection and extended warranties (which can prove valuable for big-ticket renovation items).

Potential Risks and Considerations

It’s important to understand the risks associated with using credit cards for renovations. Credit card interest rates typically exceed other forms of financing, so carrying a balance beyond any promotional period can quickly become expensive. According to the Reserve Bank of Australia, the average ‘standard’ credit card rate is 19.87% in 2023 (a substantial cost if not managed carefully).

Moreover, using a large portion of your credit limit for renovations can impact your credit utilization ratio, potentially affecting your credit score. Financial experts generally recommend keeping your credit utilization below 30% to maintain a healthy credit profile.

To make the most of credit cards for your renovation project, create a solid repayment plan before using them. Calculate the monthly payments needed to clear the balance within the promotional period, if applicable, and ensure it fits within your budget. The goal is to improve your home without compromising your financial health.

You might also consider combining credit card use with other financing options. For instance, you could use a rewards card for smaller purchases to earn points, while utilizing a home equity loan or line of credit for the bulk of the project. This strategy can help you maximize benefits while minimizing interest costs.

Now that we’ve explored the types of credit cards suitable for renovations and their potential benefits and risks, let’s examine the key features you should look for when choosing a credit card for your home improvement project.

What Features Matter in a Renovation Credit Card?

When you select a credit card for your home renovation project, you should focus on features that align with your specific needs and financial goals. The right credit card can make a significant difference in managing renovation costs effectively.

Introductory APR Offers

A card with a no-interest intro period can help you extend out your renovation payments and possibly avoid interest charges. These offers typically last between 12 to 21 months, giving you time to pay off your renovation expenses without accruing interest.

You should have a solid repayment plan in place. A NerdWallet study found that 34% of homeowners planning improvements intend to use credit cards for at least part of the financing. If you’re among this group, calculate your monthly payments to ensure you can clear the balance before the promotional period ends.

Rewards Tailored to Home Improvement

You should look for cards that offer enhanced rewards on home improvement purchases. The Bank of America® Customized Cash Rewards credit card allows cardholders to choose “home improvement/furnishings” as their 3% cash back category. This can lead to substantial savings over time, especially for ongoing or multiple renovation projects.

Some cards offer rotating bonus categories that may include home improvement stores. The Discover it® Cash Back card is known for this feature, potentially offering 5% cash back on these purchases during certain quarters.

Cash Back on Renovation-Related Expenses

Beyond specific home improvement rewards, consider cards that offer high cash back rates on general purchases. Cashback credit cards can offer up to $600 back, which can be advantageous for expenses that don’t fall neatly into home improvement categories.

Credit Limits and Flexibility

For larger renovation projects, a higher credit limit can be important. The Chase Sapphire Preferred® Card often comes with higher credit limits for qualified applicants, which can be beneficial for financing more extensive home improvements.

Additionally, consider cards that offer flexibility in how you use your rewards. The Capital One Venture Rewards Credit Card allows you to redeem miles for travel or as statement credits against recent purchases (including home improvement expenses).

It’s important to note that while credit cards can be useful tools for financing renovations, you should use them strategically. High interest rates after promotional periods can quickly negate any benefits gained. Always compare the total cost of using a credit card against other financing options like home equity loans or personal loans.

You should carefully evaluate your financial situation and project needs before choosing a credit card for renovations. The goal is to improve your home without compromising your financial health. By focusing on these key features and using credit cards responsibly, you can make the most of your renovation budget and enjoy the benefits of your improved home for years to come.

Now that we’ve explored the key features to look for in a renovation credit card, let’s compare some of the top options available in the market.

Top Credit Cards for Your Renovation Project

Large-Scale Renovation Financing

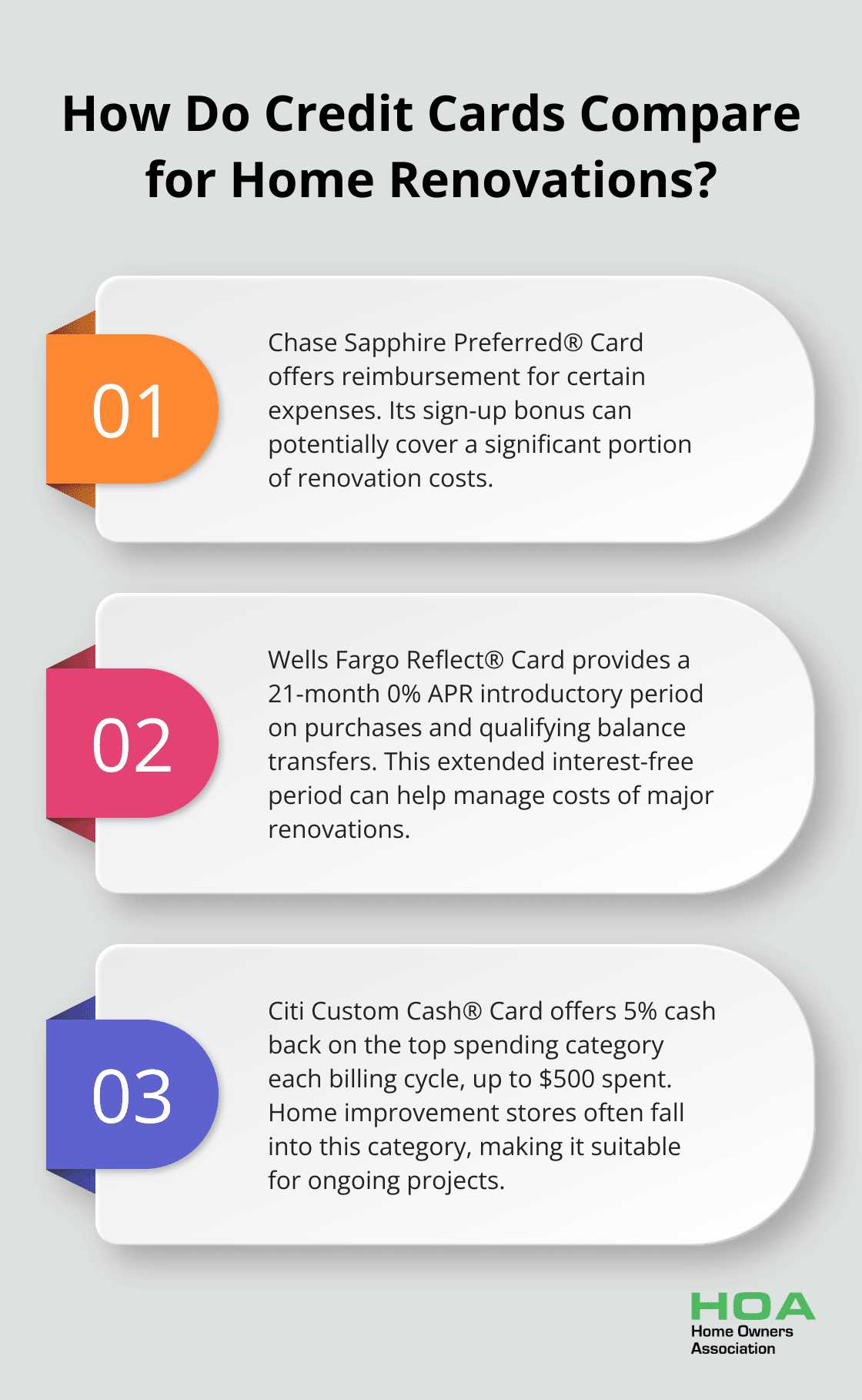

For substantial home improvements, the Chase Sapphire Preferred® Card stands out. It offers reimbursement for certain expenses, which can be beneficial for financing extensive projects. The card’s sign-up bonus can potentially cover a significant portion of your renovation costs (if you meet the spending requirements).

The Wells Fargo Reflect® Card is another strong contender. It boasts an impressive 21-month 0% APR introductory period on purchases and qualifying balance transfers, giving you ample time to pay off large expenses without interest. This extended interest-free period can significantly help manage the costs of a major renovation.

DIY and Smaller Projects

The Citi Custom Cash® Card is worth considering for those who tackle smaller improvements or DIY projects. It offers 5% cash back on your top spending category each billing cycle (up to the first $500 spent). Home improvement stores often fall into this category, making it an excellent choice for ongoing projects or frequent purchases.

The Discover it® Cash Back card is another solid option for DIY enthusiasts. Its rotating 5% cash back categories often include home improvement stores, allowing you to maximize rewards during certain quarters of the year.

Home Improvement Store Perks

Store-branded cards can offer valuable benefits if you frequently shop at specific home improvement retailers. The Home Depot Consumer Credit Card provides six months of financing on purchases of $299 or more. However, exercise caution with these offers as they often involve deferred interest, which can become costly if not managed carefully.

For those who prefer Lowe’s, the Lowe’s Advantage Card offers 5% off eligible purchases or special financing options. These store-specific cards can be particularly useful if you’re loyal to one retailer, but compare their benefits against general-purpose cards.

Existing Renovation Debt

If you’ve already accumulated renovation debt on high-interest cards, a balance transfer card can provide relief. The U.S. Bank Visa® Platinum Card offers one of the longest 0% APR periods for balance transfers, giving you time to pay down your debt without additional interest.

It’s important to note that while credit cards can be useful tools for financing renovations, you should use them strategically. High interest rates after promotional periods can quickly negate any benefits gained. Always compare the total cost of using a credit card against other financing options like home equity loans or personal loans.

Final Thoughts

Selecting the best credit cards for home renovation requires careful consideration of your specific needs and financial situation. We at Home Owners Association believe the right card can significantly impact your renovation budget and overall financial health. When you choose a card, focus on features like introductory APR offers, rewards programs tailored to home improvement, and flexible redemption options.

Credit cards should be used responsibly during your renovation journey. Create a solid repayment plan before you make purchases, and try to pay off the balance within any promotional period to avoid high interest charges. You might consider combining credit card use with other financing options for larger projects to maximize benefits while minimizing costs.

Take the time to compare different credit card options before you make a decision. Evaluate the long-term value of rewards against potential interest charges, and consider how each card aligns with your renovation timeline and budget. For personalized advice on managing your renovation finances and accessing exclusive benefits in Melbourne, Australia, visit Home Owners Association.