At Home Owners Association, we understand the challenges of financing home renovations. Construction loans for home renovation can be a powerful tool to transform your living space.

These specialized loans offer unique benefits compared to traditional mortgages, allowing you to fund major home improvements. In this guide, we’ll walk you through the process of securing a construction loan and provide tips to increase your chances of approval.

What Are Construction Loans for Home Renovation?

Construction loans for home renovation are specialized financial products designed to fund major home improvement projects. These loans have transformed countless homes across Australia since 1980.

How Construction Loans Work

Unlike traditional mortgages that provide a lump sum, construction loans offer a unique draw-down structure. This means you borrow only what you need as your project progresses, potentially saving you money on interest. Construction activity has been contributing to growth in the economy, with construction value added pushing 0.5 per cent higher during the June 2024 quarter.

Types of Construction Loans

Several types of construction loans are available in Australia. The most common is the construction-to-permanent loan, which converts to a standard mortgage once renovations are complete. Another option is the renovation-only loan, ideal for those who already have a mortgage but need additional funds for improvements.

Key Differences from Traditional Mortgages

Construction loans differ from traditional mortgages in several ways:

- Interest Rates: They often have higher interest rates due to the increased risk for lenders. However, the draw-down structure can lead to lower overall interest payments.

- Documentation: These loans require more detailed documentation. You must provide comprehensive plans, budgets, and timelines for your renovation project. This level of detail helps both you and the lender understand the scope and cost of the work.

Approval Process

The approval process for construction loans can be more rigorous than traditional mortgages. Lenders will carefully evaluate your credit score, financial history, and the feasibility of your renovation plans. They’ll also consider the projected value of your home post-renovation.

Disbursement of Funds

Once approved, lenders typically release funds in stages as the renovation progresses. This staged release, known as progress payments, aligns with specific milestones in your project. It’s important to work closely with your contractor to ensure these milestones are met on time to maintain a smooth flow of funds.

As you prepare to navigate the construction loan process, it’s essential to understand the steps involved in securing this type of financing. Let’s explore the necessary steps to obtain a construction loan for your home renovation project.

Navigating the Construction Loan Process

Assess Your Financial Health

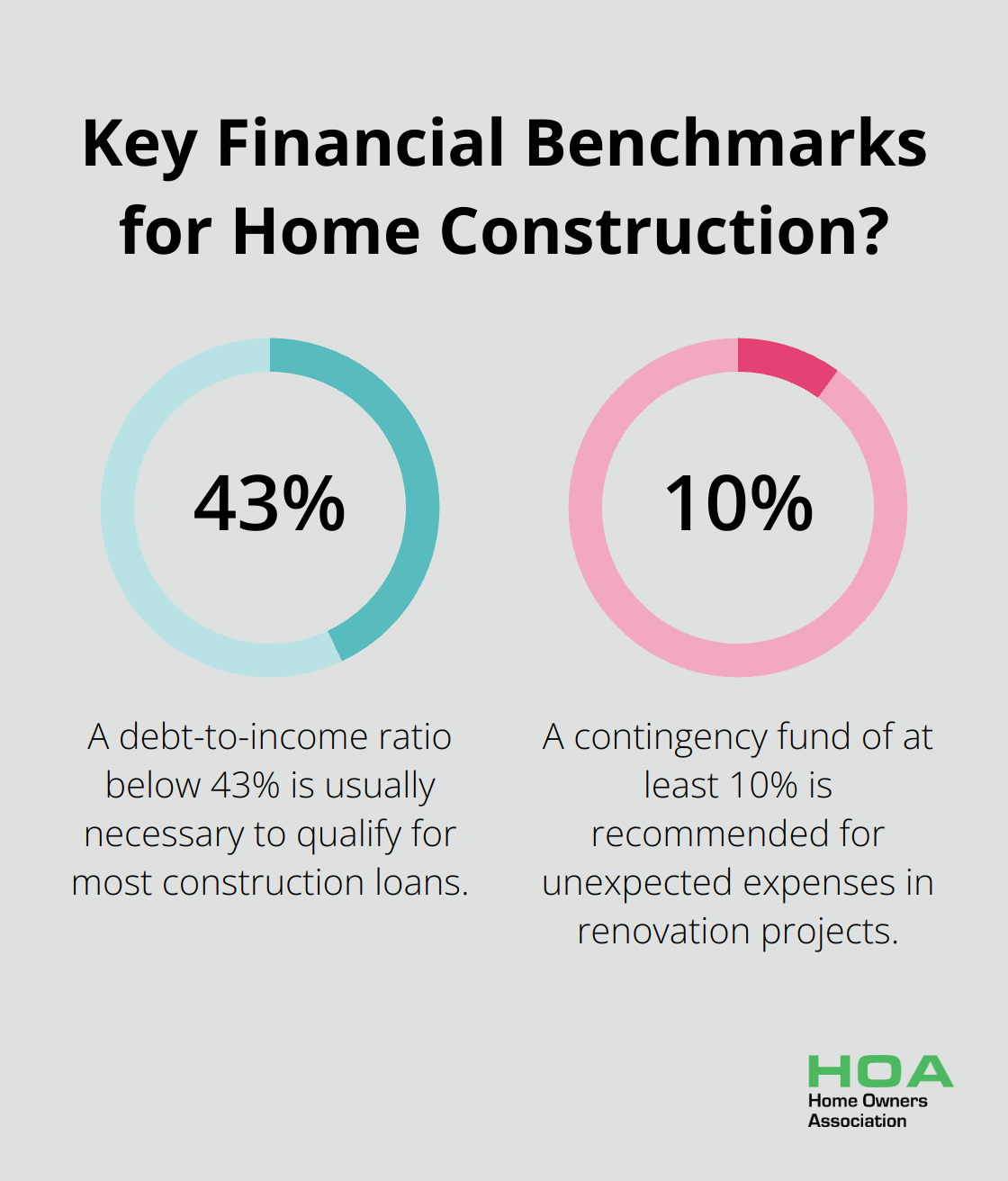

Before you apply for a construction loan, take a close look at your financial situation. Most lenders require a credit score of 680 or higher to qualify for a construction loan. Check your credit report for errors and improve your score if needed. Calculate your debt-to-income ratio, which should be below 43% to qualify for most construction loans.

Craft Your Renovation Blueprint

A detailed renovation plan is essential for your loan application. Work with an architect or experienced contractor to create comprehensive plans and specifications. Include a realistic budget that accounts for all costs, including materials, labor, permits, and a contingency fund of at least 10% for unexpected expenses. According to Hipages, a home renovation could cost anywhere from $2,000 to over $70,000 for a single room, so prepare a solid financial plan.

Find the Right Lender

Not all lenders offer construction loans, so research is key. Compare rates, terms, and fees from multiple lenders. Look for those with experience in construction lending and a track record of working with homeowners on renovation projects. Consider Home Owners Association’s network of preferred lenders, who offer competitive rates and understand the unique needs of our members.

Gather Necessary Documentation

When you’ve narrowed down your options, collect all required documents. This typically includes:

- Proof of income (pay stubs, tax returns)

- Bank statements

- Detailed project plans and specifications

- Cost estimates from contractors

- Property appraisal (both current and projected post-renovation value)

- Proof of homeowners insurance

Submit Your Loan Application

With everything in order, submit your loan application. Prepare for a thorough review process, which can take several weeks. Lenders will scrutinize your financial history, the feasibility of your renovation plans, and the qualifications of your chosen contractor.

Patience and thoroughness are vital in this process. The next step is to understand the key factors that lenders consider when evaluating your construction loan application.

What Lenders Evaluate in Construction Loan Applications

Credit Score and Financial History

Your credit score significantly impacts the loan approval process. For FHA One-Time Close construction loans, you may find lenders requiring FICO scores in the mid 600s as a condition of loan approval. A higher score will typically secure better interest rates and terms. Lenders also examine your financial history, including past bankruptcies or foreclosures. A clean record for the past seven years is ideal.

Loan-to-Value Ratio

Lenders use the loan-to-value (LTV) ratio to determine your property equity. To calculate your LVR, divide the amount you plan to borrow or your current loan amount by the price of your asset. For construction loans, they consider both the current value of your home and its projected value after renovations. Most lenders prefer an LTV of 80% or less. This ratio helps lenders assess the risk associated with the loan.

Debt-to-Income Ratio

Your debt-to-income (DTI) ratio is equally important. Try to maintain a DTI below 43% to increase your approval chances. This means your total monthly debt payments (including the new loan) should not exceed 43% of your gross monthly income. A lower DTI demonstrates your ability to manage additional debt responsibly.

Contractor Qualifications and Project Feasibility

The experience and reputation of your chosen contractor influence the lender’s decision. Provide detailed information about your contractor’s qualifications, licenses, and past projects. Lenders want assurance that your renovation plans are realistic and can be completed within the proposed budget and timeline. A well-documented project plan (including architectural drawings and a detailed cost breakdown) demonstrates your preparedness and increases lender confidence.

Property Appraisal and Inspection

Lenders require a professional appraisal of your property, both in its current state and its projected value post-renovation. This helps them determine the loan amount they’re willing to offer. Additionally, expect multiple inspections throughout the construction process. These inspections ensure that the work progresses as planned and meets all building codes and standards (which is essential for maintaining the property’s value).

Final Thoughts

Construction loans for home renovation require careful planning and thorough preparation. You can improve your approval chances by strengthening your financial profile, creating a comprehensive renovation plan, and partnering with reputable contractors. A well-structured budget increases your loan approval odds and helps your project stay on track financially.

We at Home Owners Association support Melbourne homeowners through every step of their renovation journey. Our benefits (including trade pricing and discounts on construction materials) can reduce your project costs. We also provide expert advice to help you navigate the complexities of construction loans for home renovation.

You’ll equip yourself to secure the financing you need for your home improvement project with the right preparation and support. Your dream renovation can become a reality, enhancing both your living space and your property’s value in the Melbourne market.