Buying your first home is an exciting milestone, but it can also be overwhelming. At Home Owners Association, we understand the challenges and joys of this journey.

Our comprehensive guide offers essential first home tips to help you navigate the process with confidence. From financial planning to finding the perfect property, we’ll walk you through each step to make your dream home a reality.

How to Plan Your Finances for Your First Home

Financial planning forms the foundation of successful homeownership. Proper financial preparation can transform a potentially stressful experience into a smooth journey to your dream home.

Set a Realistic Budget

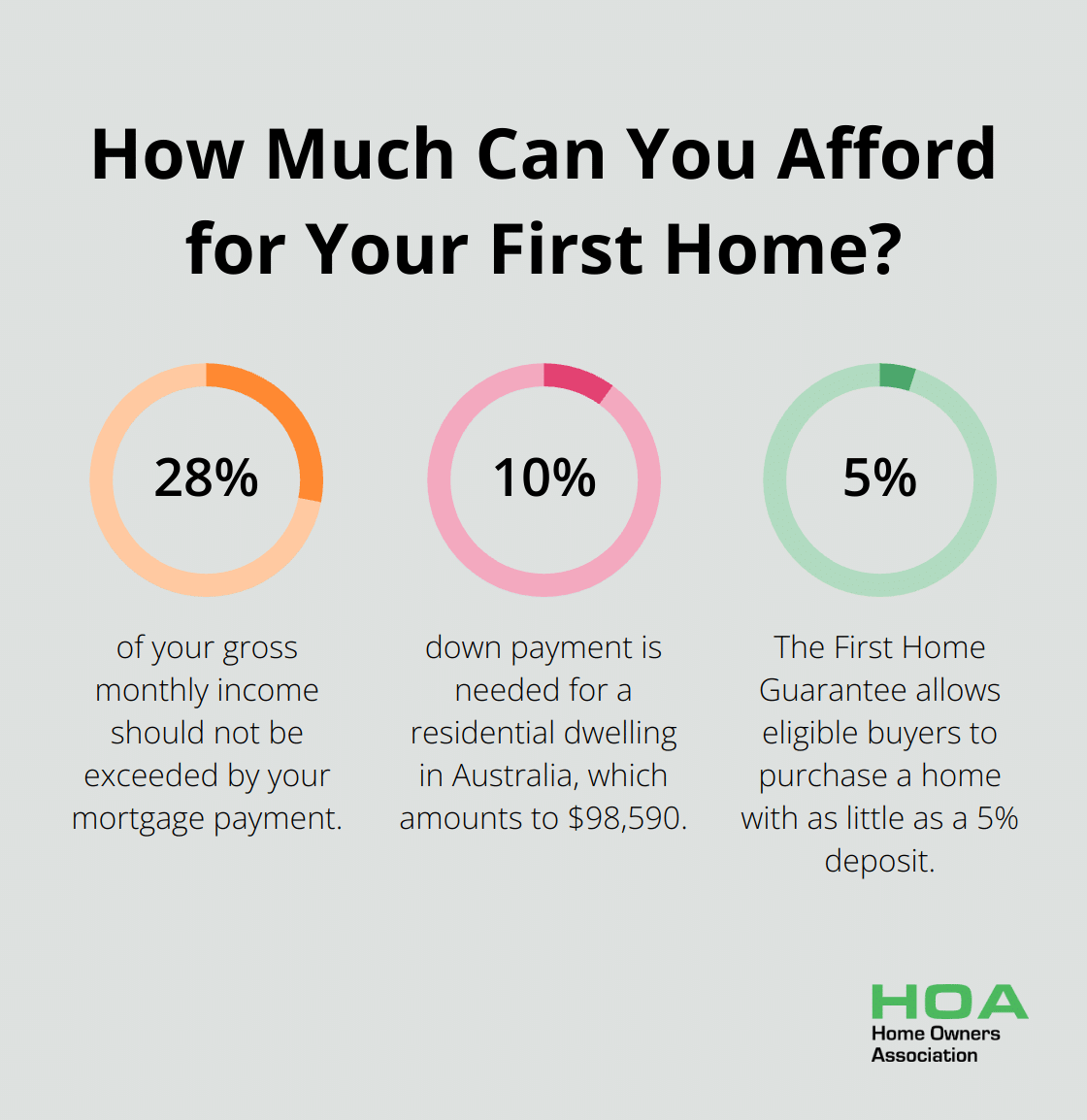

Take a hard look at your income and expenses. Your mortgage payment should not exceed 28% of your gross monthly income. However, you might need to adjust this percentage based on your location and other financial obligations.

The mean price of residential dwellings in Australia rose to $985,900. This means you’ll need to save at least $98,590 for a 10% down payment, plus additional funds for closing costs and other expenses.

Maximize Your Savings

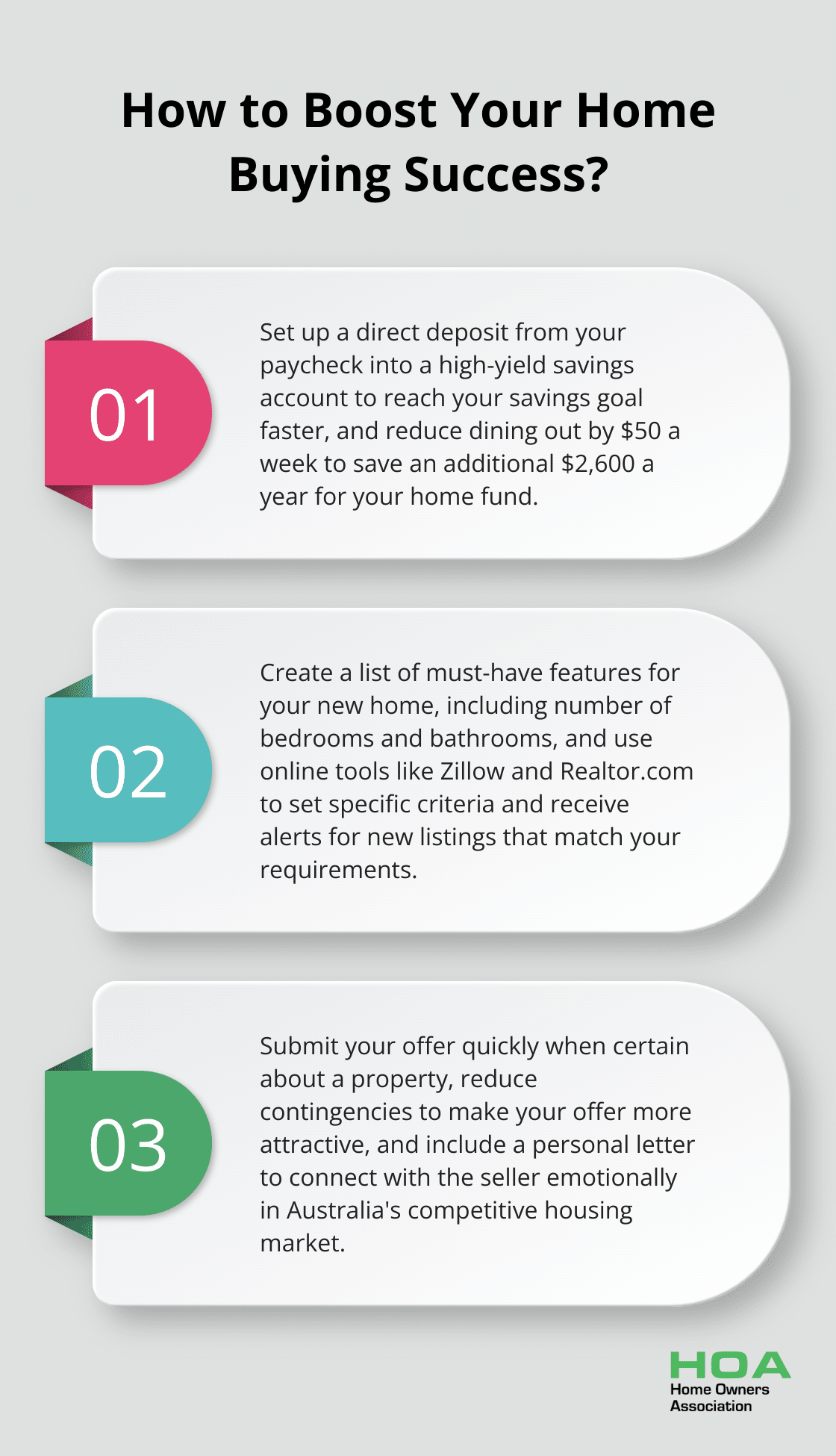

To reach your savings goal faster, automate your savings. Set up a direct deposit from your paycheck into a high-yield savings account.

Cut unnecessary expenses and redirect that money towards your home fund. Even small changes can add up – reducing dining out by just $50 a week can save you $2,600 a year.

Explore First-Time Homebuyer Programs

The Australian government offers several programs to assist first-time homebuyers. The First Home Owner Grant (FHOG) provides a one-time payment of up to $10,000 for eligible buyers in most states. Additionally, the First Home Guarantee allows eligible buyers to purchase a home with as little as a 5% deposit, without paying Lenders Mortgage Insurance.

Secure Mortgage Pre-Approval

Getting pre-approved for a mortgage is an essential step. It gives you a clear idea of how much you can borrow and demonstrates to sellers that you’re a serious buyer.

When you apply for pre-approval, be prepared to provide detailed financial information, including pay stubs, tax returns, and bank statements.

Build Your Credit Score

Your credit score plays a significant role in determining your mortgage interest rate. The difference between a good and excellent credit score can save you thousands over the life of your loan. Pay all bills on time, keep credit card balances low, and avoid applying for new credit in the months leading up to your home purchase.

Financial planning for your first home requires time and discipline. Start early, stay focused, and you’ll position yourself well to make your homeownership dreams a reality. As you move forward in your home-buying journey, the next step is to find the perfect property that aligns with your budget and lifestyle.

Where to Find Your Dream Home

Prioritize Your Home Features

Create a list of must-have features for your new home. This might include the number of bedrooms, outdoor space, or proximity to public transport. Recent buyers typically purchased homes with three bedrooms and two bathrooms. Be realistic about your needs versus wants to avoid overextending your budget.

Identify nice-to-have features that would enhance your living experience but aren’t deal-breakers. This flexibility can open up more options in your search. You can always add or upgrade features later.

Investigate Neighborhoods and Markets

Research potential neighborhoods thoroughly. Look into local amenities, schools, crime rates, and future development plans. Websites like Domain and realestate.com.au offer valuable insights into different areas.

Pay attention to market trends in your chosen locations. Understanding these trends helps you make informed decisions about timing and value.

Partner with a Real Estate Professional

Engage a skilled real estate agent to streamline your search. They have access to off-market listings and can provide valuable local market knowledge. The Real Estate Institute of Australia notes that 89% of sellers use an agent, highlighting their importance in the process.

Select an agent with experience in your desired areas and price range. Ask for references and check their track record of successful sales. A good agent will guide you through negotiations and help you avoid common pitfalls.

Leverage Technology in Your Search

Use online tools and apps to expand your search. Platforms like Zillow and Realtor.com allow you to set specific criteria and receive alerts for new listings. Virtual tours and 3D walkthroughs (which gained popularity during the pandemic) can help you narrow down options before in-person visits.

Consider Future Resale Value

Think about the future resale potential of the property while focusing on your current needs. Homes in areas with good schools and easy access to amenities tend to appreciate faster. CoreLogic data shows that properties within 5km of the CBD in major Australian cities have shown consistent growth over the past decade.

Finding your dream home requires time and patience. Clear priorities, thorough research, and professional guidance will equip you to make a decision that aligns with both your heart and your budget. Now, let’s explore how to navigate the buying process and turn your dream into reality.

Sealing the Deal on Your Dream Home

Craft a Winning Offer

In Australia’s competitive housing market, a strong offer is essential. Properties in major cities often receive multiple offers within days of listing (according to the Real Estate Institute of Australia). To stand out:

- Submit your offer quickly when you’re certain about the property.

- Research recent sales of similar properties to determine a fair market value.

- Reduce contingencies to make your offer more attractive, but don’t waive essential protections.

- Include a personal letter to connect with the seller emotionally.

Conduct Thorough Inspections

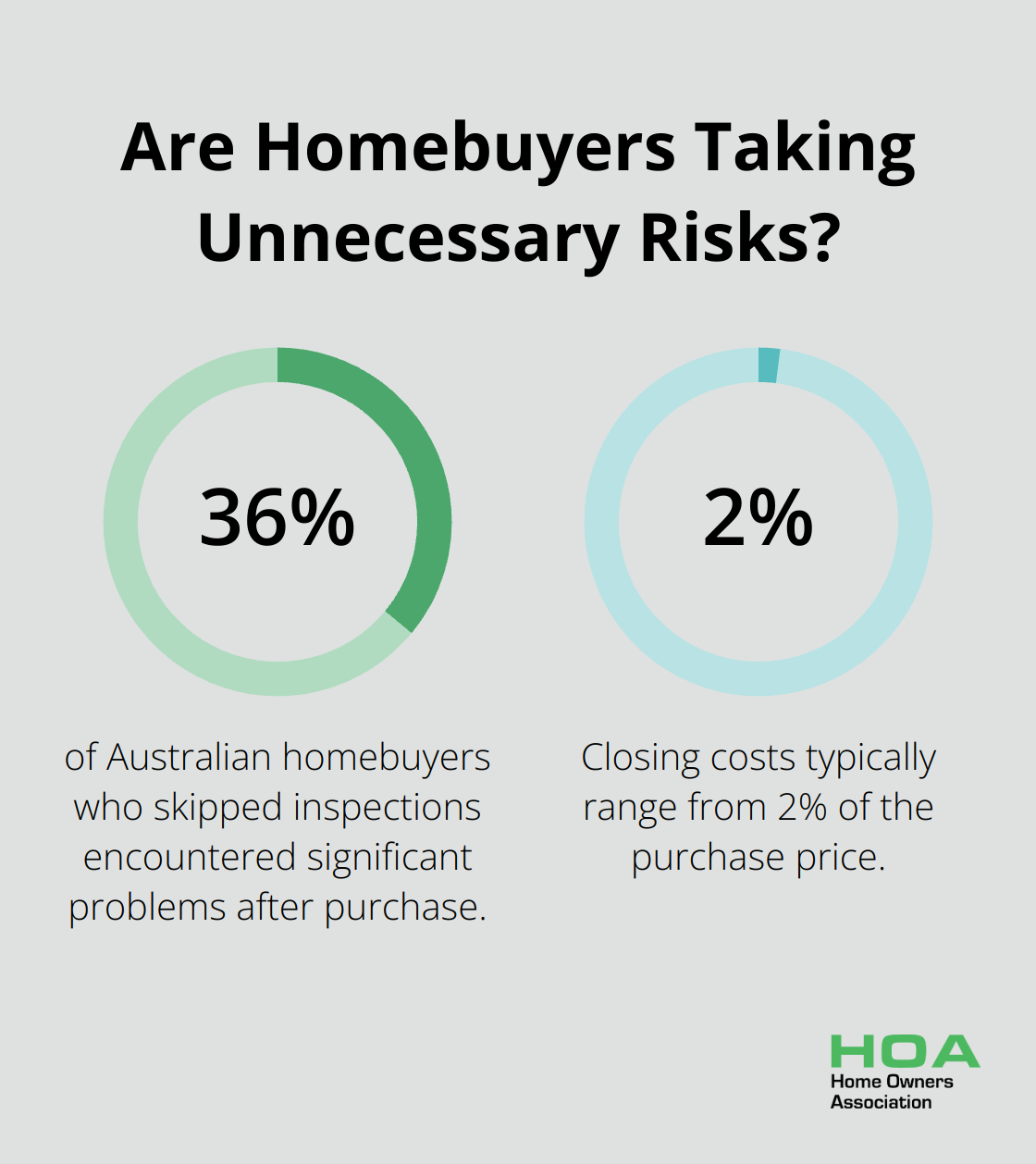

Professional inspections protect your investment. Professional inspections require an investment, which varies based on the property size and inspection scope. This expense is minimal compared to potential costs of undiscovered issues. A survey by Choice revealed that 36% of Australian homebuyers who skipped inspections encountered significant problems after purchase.

Schedule these inspections promptly within your contract’s cooling-off period (typically 3-5 business days, varying by state).

Navigate Closing Costs and Paperwork

The final stretch involves substantial paperwork and additional expenses. Prepare for closing costs, which typically range from 2% to 5% of the purchase price. These may include:

- Stamp duty (often the largest closing cost)

- Legal fees (You can typically expect to pay between $700 and $2500, depending on the complexity of the purchase and if the work is performed by a conveyancer or a solicitor)

- Mortgage registration fee (generally around $200)

- Transfer fee ($200 to $300 government charge)

- Mortgage insurance (if your deposit is less than 20%)

Work closely with your conveyancer or solicitor to complete all paperwork accurately and on time. They’ll guide you through the settlement process, which typically takes 4-6 weeks from the exchange of contracts.

Prepare for Settlement Day

As you approach settlement day, schedule the final property inspection. This is your last opportunity to ensure the property is in the agreed-upon condition before taking possession. Once all conditions are met and funds are transferred, you’ll receive the keys to your new home.

Final Thoughts

Homeownership marks a significant milestone in life, filled with challenges and rewards. Our first home tips equip you to navigate the complexities of the housing market and make informed decisions. Financial preparation forms the foundation of success, so set a realistic budget, maximize savings, and explore first-time homebuyer programs.

The search for your dream home requires prioritization of must-have features and thorough neighborhood research. A trusted real estate agent can provide invaluable expertise to find properties that align with your lifestyle and budget. Craft a strong offer, conduct thorough inspections, and prepare for closing costs to protect your investment.

Home Owners Association supports you with resources, advice, and exclusive benefits to make your homeownership journey smooth and rewarding. Your new home represents more than a financial investment; it’s a place to create lasting memories and truly feel at home. Welcome to the exciting world of homeownership!