At Home Owners Association, we often receive questions about tax deductions for home renovations. Many homeowners wonder, “Can you deduct home renovations in Australia?”

The answer isn’t always straightforward, as it depends on the type of renovation and its purpose. In this blog post, we’ll explore which home improvements may be tax-deductible and which ones aren’t, helping you make informed decisions about your property upgrades.

What Are Tax-Deductible Home Renovations?

Defining Home Renovations for Tax Purposes

The Australian Taxation Office (ATO) makes a clear distinction between repairs, maintenance, and capital improvements. Repairs and maintenance restore something to its original condition, while capital improvements add value or extend the property’s life. This distinction plays a key role in determining tax deductions.

Tax Deductions for Different Types of Renovations

For investment properties, the ATO typically allows tax deductions for repairs and maintenance in the year they occur. Capital improvements, however, are added to the property’s cost base and can reduce capital gains tax upon sale. Most renovations on your primary residence aren’t tax-deductible, but they can affect your capital gains position if you later rent out or sell the property.

The Importance of Meticulous Record-Keeping

The ATO requires detailed documentation for all expenses when claiming tax deductions or adjusting your cost base. This includes invoices, receipts, and bank statements that clearly show the nature of the work, costs involved, and completion dates.

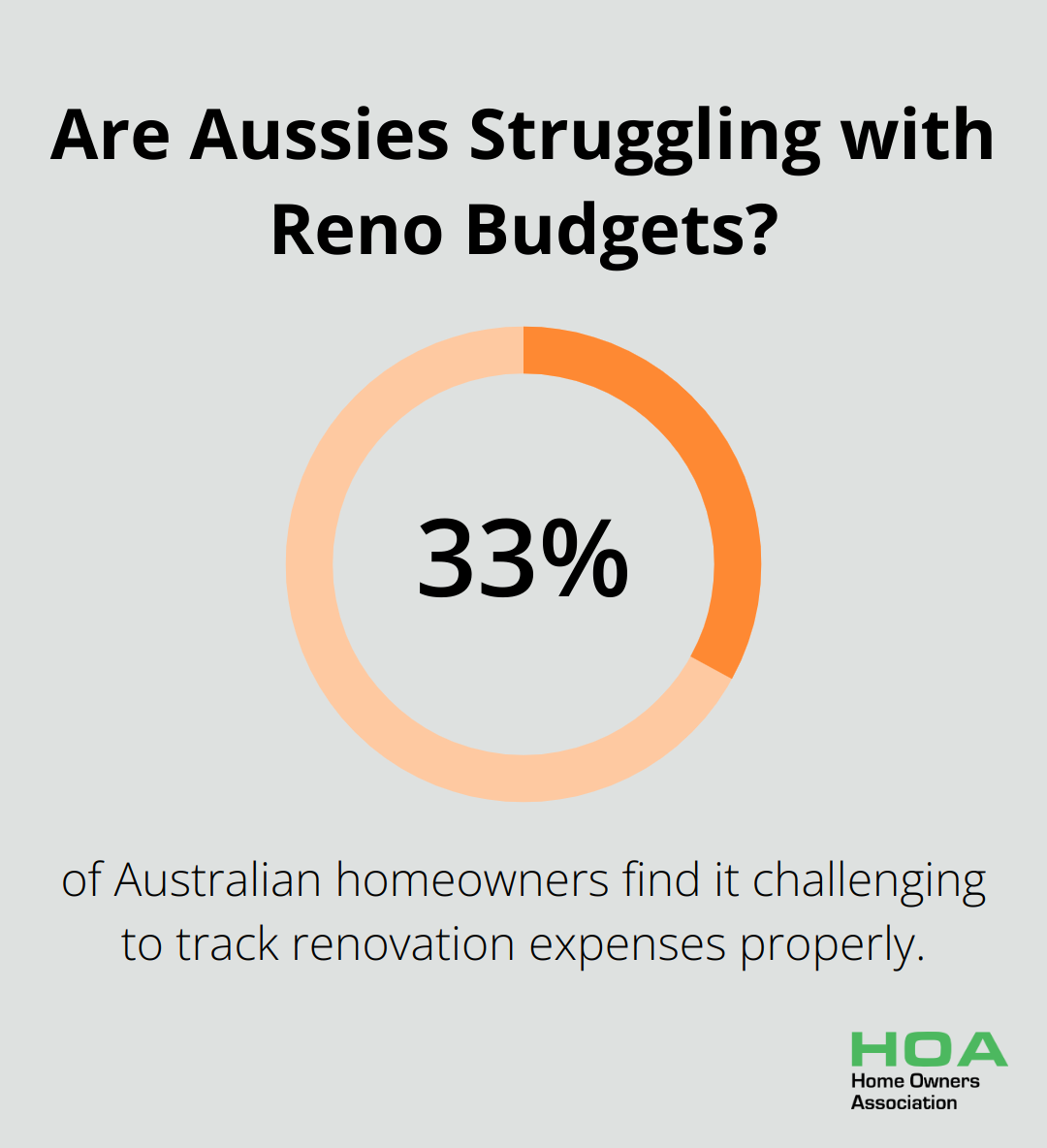

A recent survey by the Housing Industry Association revealed that 33% of Australian homeowners find it challenging to track renovation expenses properly. This oversight can result in missed deductions or disputes with the ATO. Digital tools or apps designed for expense tracking can simplify this process significantly.

Investment Property Renovations

Renovations on investment properties often offer more tax benefits than those on primary residences. Landlords can claim immediate deductions for repairs and maintenance (e.g., fixing leaky taps or repainting). Capital improvements (such as adding a new room) are depreciated over time, reducing taxable income each year.

Energy-Efficient Upgrades

The Australian government provides incentives for energy-efficient home improvements. From 1 July 2024, all Australian households and eligible small businesses will receive a rebate on their electricity bills. While not directly tax-deductible for primary residences, these improvements can lead to rebates or reduced energy bills, indirectly affecting your financial position.

Tax laws can be complex and change frequently. For personalized advice tailored to your situation in Melbourne, consider consulting with a tax professional or a reputable homeowners association. Their expertise in local regulations and market conditions can help you navigate the tax implications of your home improvements more effectively. Now, let’s explore specific types of renovations that might qualify for tax deductions.

Which Home Renovations Are Tax-Deductible?

Tax deductions for home renovations in Australia can be complex, but understanding which improvements qualify can lead to significant savings. Many Melbourne homeowners benefit from strategic renovations that align with ATO guidelines.

Energy-Efficient Upgrades

Energy-efficient upgrades offer indirect financial benefits for primary residences. The Australian government’s Community Clubs Program provides rebates of up to $100,000 per club to upgrade to more energy efficient appliances and energy systems. Installing solar panels can lead to significant cost reductions as economies of scale have lowered the prices of solar panels and inverters over the past decade. This translates to substantial long-term savings, even if the initial investment isn’t tax-deductible.

Home Office Improvements

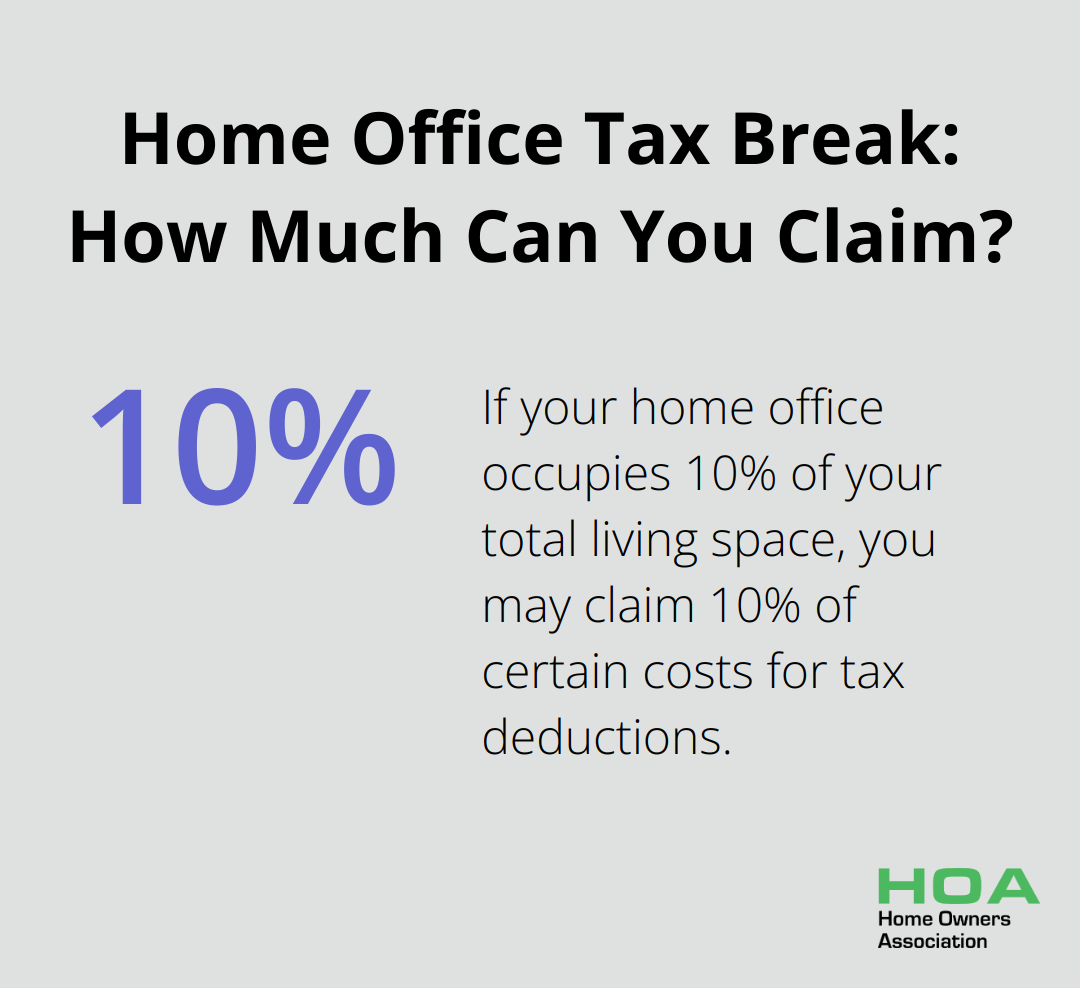

With the rise of remote work, home office renovations have gained tax significance. The ATO allows deductions for expenses related to income-producing activities at home. This includes a portion of mortgage interest, property taxes, and utilities based on the percentage of your home used exclusively for work. For example, if your home office occupies 10% of your total living space, you may claim 10% of these costs.

Accessibility Modifications

Renovations for medical reasons or disability access can be tax-deductible under specific circumstances. The ATO considers these as part of the overall medical expenses claim. Installing ramps, widening doorways, or modifying bathrooms for accessibility can qualify if prescribed by a medical practitioner. It’s important to keep detailed records and obtain written recommendations from healthcare professionals to support your claims.

Rental Property Renovations

For investment properties, the tax benefits are more straightforward. Immediate deductions are available for repairs and maintenance, while capital improvements depreciate over time. According to the Property Investment Professionals of Australia, common deductible repairs include fixing broken windows, repairing electrical systems, or addressing plumbing issues. Capital improvements (like adding a new room or renovating a kitchen) typically depreciate over 40 years for residential rental properties.

Planning Your Tax-Deductible Renovations

When planning renovations, consult with a tax professional or a reputable organization like Home Owners Association. Our expertise in Melbourne’s property market can help you navigate the nuances of tax-deductible renovations, ensuring you maximize your benefits while staying compliant with ATO regulations. Strategic planning of your home improvements can lead to significant tax advantages in the long run.

Now that we’ve covered tax-deductible renovations, let’s explore which home improvements don’t qualify for tax benefits and why.

Non-Deductible Home Improvements: What to Avoid

When it comes to tax deductions for home improvements in Australia, not all renovations offer tax benefits. Many common home improvements fall into the non-deductible category. Melbourne homeowners must understand these distinctions to make informed decisions about their property investments.

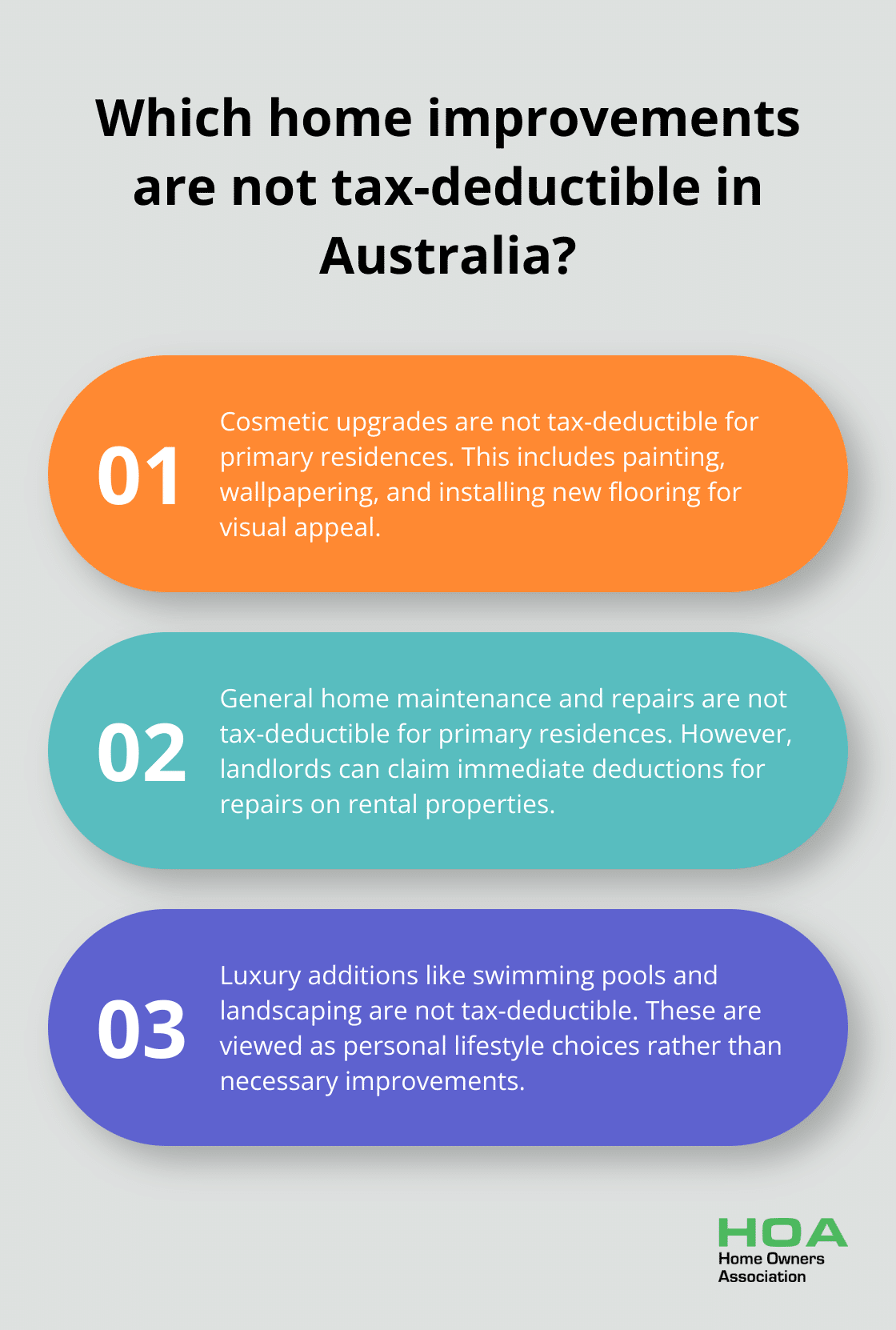

Cosmetic Upgrades and Personal Preference Renovations

Aesthetic improvements, while enhancing your home’s appeal, typically don’t qualify for tax deductions. This includes painting, wallpapering, or installing new flooring solely for visual appeal. The Australian Taxation Office (ATO) considers these personal preference renovations and doesn’t allow deductions for primary residences.

If you update your kitchen with new countertops or backsplash purely for aesthetic reasons, these costs won’t be tax-deductible. Replacing outdated fixtures or fittings with more modern designs falls under personal preference and doesn’t qualify for tax benefits.

General Home Maintenance and Repairs

Regular upkeep and minor repairs are essential for maintaining your property’s condition but don’t typically qualify for tax deductions on your primary residence. This includes tasks like fixing leaky faucets, repairing broken tiles, or servicing your HVAC system.

These expenses aren’t deductible for your home, but they can be for investment properties. Landlords in Melbourne can claim immediate deductions for repairs and maintenance on rental properties. However, for your primary residence, these costs are considered part of the normal expenses of homeownership.

Luxury Additions: Swimming Pools and Landscaping

Adding a swimming pool or extensive landscaping to your Melbourne home might increase your property’s value and enjoyment, but these improvements generally don’t qualify for tax deductions. The ATO views these as personal lifestyle choices rather than necessary improvements.

Installing a swimming pool can have additional financial implications. Homeowners with pools face increased water usage charges and may need to comply with specific safety regulations (adding to the overall cost without tax benefits).

Landscaping falls into a similar category. While a well-maintained garden can boost your property’s curb appeal, the expenses associated with landscaping (such as installing irrigation systems or building retaining walls) are typically not tax-deductible for primary residences.

Strategic Decision-Making for Home Improvements

Understanding which home improvements are non-deductible helps you make more strategic decisions about your property investments. While these renovations may not offer immediate tax benefits, they can still contribute to your home’s overall value and your quality of life.

For personalized advice on navigating the complexities of home improvements and their tax implications in Melbourne, consulting with a reputable homeowners association can provide valuable insights tailored to your specific situation. Home Owners Association, with its extensive experience in the Melbourne market since 1980, offers expert guidance to ensure your home projects meet the highest standards while maximizing potential benefits.

Final Thoughts

Tax deductions for home renovations in Australia depend on various factors, including property type and renovation purpose. The question “Can you deduct home renovations in Australia?” requires careful consideration of current tax regulations and specific circumstances. Homeowners should seek professional advice before undertaking significant improvements to understand potential tax implications.

Strategic home improvements can offer long-term benefits, even without immediate tax deductions. Energy-efficient upgrades can reduce utility bills, while well-planned renovations can increase property value. For investment properties, understanding the distinction between repairs and capital improvements is essential for maximizing tax benefits.

Successful home renovations require thorough planning, accurate record-keeping, and informed decision-making. Home Owners Association can provide valuable insights into the tax implications of your renovation plans. We recommend consulting with tax experts to make smart choices that enhance your living space and potentially improve your financial position.