Are you wondering, “Can I borrow money against my house for home improvements?” At Home Owners Association, we often hear this question from homeowners looking to upgrade their properties.

Home equity loans can be an excellent way to finance renovations, offering lower interest rates and potential tax benefits.

However, it’s essential to understand how these loans work and consider the risks before tapping into your home’s equity.

What Are Home Equity Loans?

Understanding Home Equity Loans

Home equity loans serve as a powerful financial tool for homeowners who want to fund significant home improvements. These loans allow you to borrow against the equity you’ve built in your property. Your equity represents the difference between your home’s current market value and the amount you still owe on your mortgage. For instance, if your home is worth $500,000 and you owe $300,000 on your mortgage, you have $200,000 in equity.

Loan-to-Value Ratio

Lenders typically allow you to borrow up to 80-85% of your home’s value, minus what you owe. Using the previous example, if a lender offers an 80% loan-to-value ratio, you could potentially borrow up to $100,000 ($500,000 x 80% – $300,000). This calculation helps determine the maximum amount you can borrow for your home improvements.

Fixed Terms and Rates

Home equity loans usually come with fixed interest rates and terms, which simplify budgeting for your renovation project. You’ll receive the loan amount as a lump sum and start repaying immediately, typically over a period of 5 to 30 years. This structure provides stability and predictability in your financial planning.

Home Equity Loans vs. HELOCs

While both use your home’s equity, home equity loans and Home Equity Lines of Credit (HELOCs) function differently. A HELOC allows the borrower to tap into the line only as needed, while a home equity loan provides the entire amount upfront as a lump sum. Interest rates on HELOCs are typically variable, which can complicate budgeting.

In contrast, home equity loans offer more stability with fixed rates and payments. This predictability can particularly benefit large, one-time expenses like a major home renovation.

Choosing the Right Option

When deciding between a home equity loan and a HELOC, consider your specific needs. If you have a clear budget for your home improvement project, a home equity loan might suit you better. It provides a lump sum and fixed repayment schedule, which can help keep your project on track financially.

However, if your renovation plans are more fluid or you anticipate ongoing expenses, a HELOC’s flexibility might suit you better. You can draw funds as needed and only pay interest on the amount you use.

Many Australian homeowners prefer home equity loans for their predictability when undertaking significant renovations. However, the right choice depends on your individual circumstances, project scope, and financial goals. As you weigh these options, you’ll want to consider the potential benefits of using home equity for renovations, which we’ll explore in the next section.

Why Home Equity Loans Make Sense for Renovations

Lower Interest Rates: A Financial Advantage

Home equity loans offer a significant financial advantage through lower interest rates compared to other financing options. While personal loans might charge higher interest rates, home loans in Australia often come with competitive rates. This difference translates to substantial savings over the loan’s lifetime. For instance, on a $50,000 loan over five years, you could save thousands in interest payments.

Tax Benefits for Property Investors

In Australia, the interest on home equity loans used for renovations or improvements may be tax-deductible for investment properties (but not for owner-occupied homes). This benefit can provide substantial savings for property investors. However, it’s essential to consult with a tax professional to understand how this might apply to your specific situation.

Boost Your Property Value

Smart renovations funded by home equity loans can significantly increase your property’s value. Staying put and renovating is becoming an alluring option for homeowners due to lack of land, soaring interest rates, and construction costs. Bathroom upgrades often return a significant portion of their cost in increased home value. These improvements not only enhance your living space but also build additional equity, which you can leverage in the future.

Flexible Loan Terms

Home equity loans often come with flexible terms, allowing you to choose a repayment period that suits your financial situation. You can typically select terms ranging from 5 to 30 years, which helps you balance monthly payments with your overall budget.

Large Loan Amounts Available

Depending on your home’s value and your existing mortgage balance, you may be able to borrow a substantial amount with a home equity loan. This can be particularly useful for major renovations or multiple improvement projects. Lenders often allow borrowing up to a certain percentage of your home’s value, minus what you owe on your mortgage.

While home equity loans offer numerous benefits, they also come with risks that you should carefully consider. In the next section, we’ll explore important factors to evaluate before borrowing against your house for home improvements.

Is Borrowing Against Your House Right for You?

Assess Your Financial Health

Before you take out a home equity loan, you should examine your current financial situation closely. Review your income, expenses, and existing debts. Average household debt was $261,492 in 2021-22, while average household gross disposable income grew 3.7 per cent to $139,064. If your debt significantly exceeds this average, you might want to reconsider additional debt.

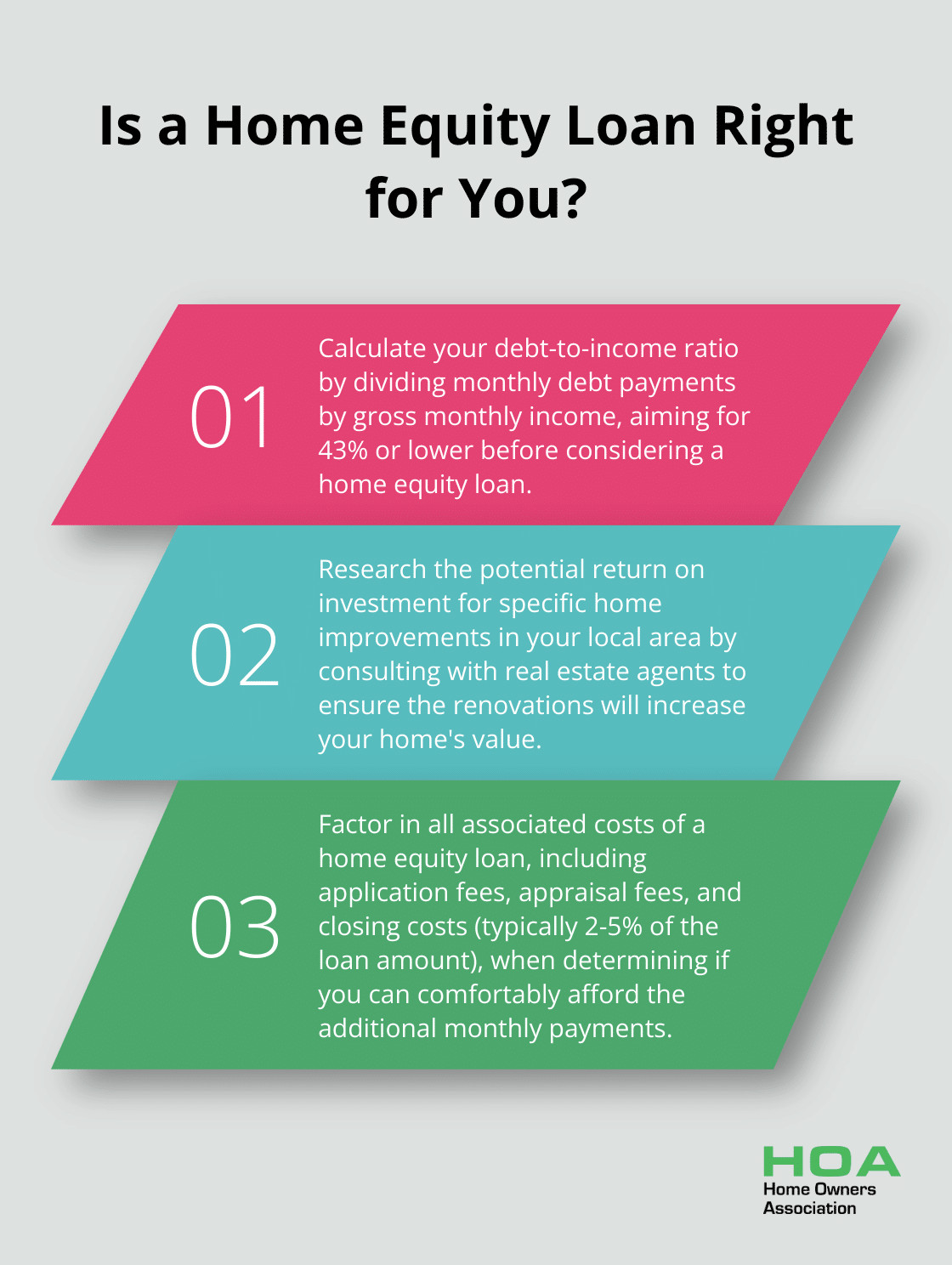

Calculate your debt-to-income ratio by dividing your monthly debt payments by your gross monthly income. Most lenders prefer a ratio of 43% or lower. If your ratio is higher, you should focus on paying down existing debts before you consider a home equity loan.

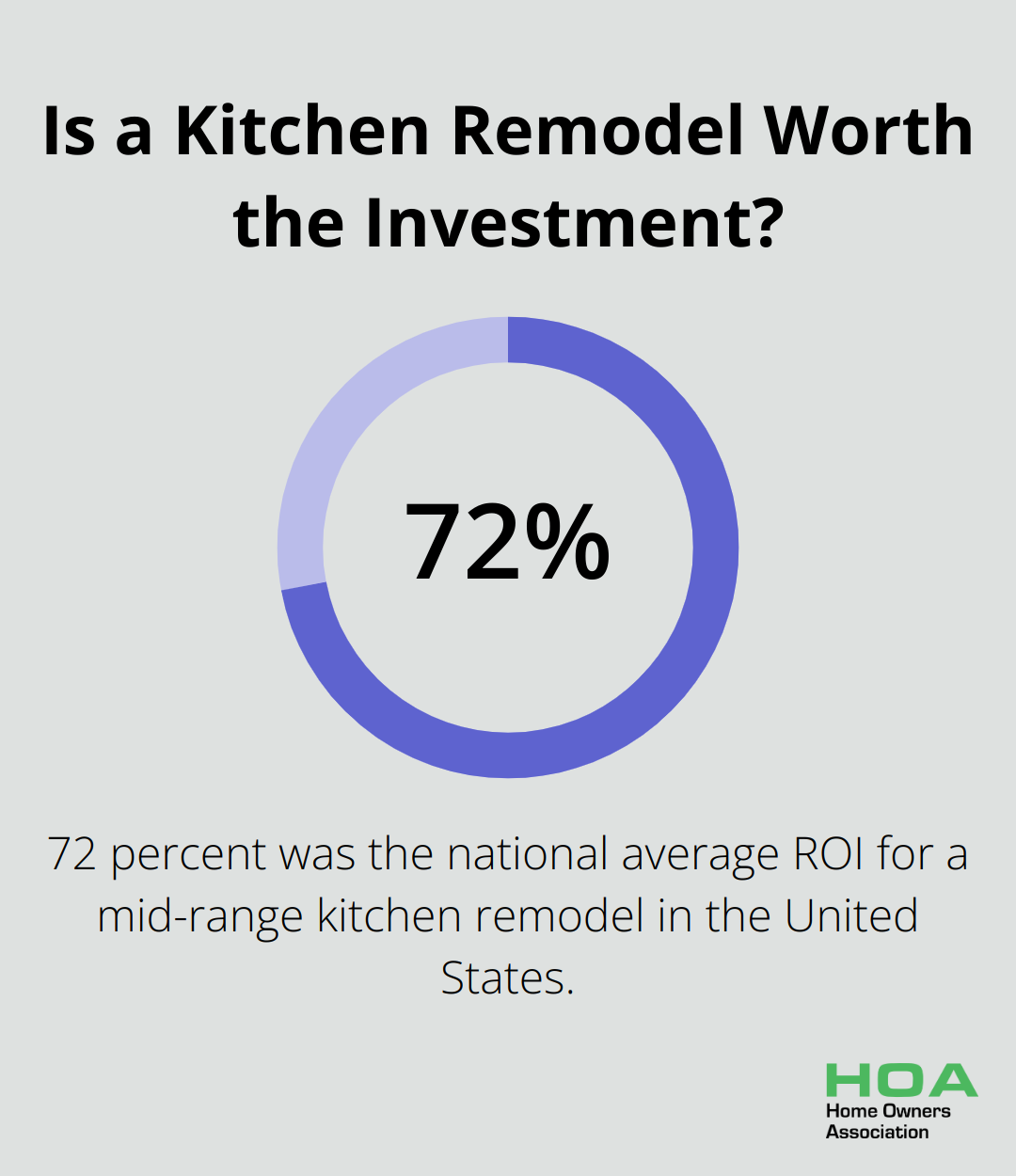

Evaluate the Return on Investment

Not all home improvements offer the same return on investment (ROI). According to Remodeling Magazine’s “Cost vs. Value” report, the national average ROI for a mid-range kitchen remodel was around 72% in the United States.

You should research the potential ROI for your planned improvements in your specific area. Local real estate agents can provide valuable insights into which renovations will likely increase your home’s value in your market.

Understand the Risks

Using your home as collateral involves significant risks. If you default on your loan, you could lose your home. The Australian Securities and Investments Commission reports that 1 in 6 Australian homeowners struggle with mortgage stress.

You should consider whether you can afford the additional monthly payments comfortably, even if your financial situation changes. You should create a buffer in your budget to account for unexpected expenses or income fluctuations.

It’s also important to factor in the costs associated with taking out a home equity loan. These can include application fees, appraisal fees, and closing costs (which typically range from 2% to 5% of the loan amount).

Seek Professional Advice

We at Home Owners Association recommend that you speak with a financial advisor before you make a decision. They can help you weigh the pros and cons based on your unique financial situation and goals. Home equity loans can be a powerful tool for funding renovations, but they’re not without risks. Careful consideration and planning are key to making the right choice for your home and financial future.

Consider Alternative Financing Options

While home equity loans can be an attractive option, you should also explore alternative financing methods. Personal loans, credit cards with promotional rates, or government-backed renovation loans might be more suitable for your situation. Each option has its own set of advantages and disadvantages, and the best choice depends on your specific circumstances and the scale of your planned improvements.

Final Thoughts

Home equity loans provide a compelling option for homeowners who want to finance renovations. These loans offer lower interest rates, potential tax benefits for investment properties, and the opportunity to increase property value. You can access substantial funds with flexible repayment terms, making them attractive for major home improvement projects.

The decision to borrow against your house for home improvements requires careful financial planning. You must consider your debt-to-income ratio, evaluate the potential return on investment, and understand the risks of using your home as collateral. It’s important to explore all options and seek professional advice before making a decision.

At Home Owners Association, we guide Melbourne homeowners through these important decisions. Our team provides personalized advice, access to trade pricing and discounts, and expert resources to ensure your home improvement project succeeds. We understand the unique challenges and opportunities in the Melbourne housing market and help you make informed choices that align with your financial goals and enhance your property’s value.