At Home Owners Association, we’re excited to share valuable information about Federal Tax Credits for Energy-Efficient Home Improvements. These credits can significantly reduce your tax burden while helping you create a more sustainable living space.

Upgrading your home with energy-efficient features not only lowers your utility bills but also contributes to a cleaner environment. In this post, we’ll explore the various types of improvements eligible for tax credits and guide you through the process of claiming these benefits.

Federal Tax Credits for Energy-Efficient Home Upgrades: A Comprehensive Guide

Understanding Energy-Efficient Tax Credits

Federal tax credits for energy-efficient home upgrades serve as financial incentives provided by the U.S. government. These credits aim to promote environmentally friendly improvements to residential properties. Unlike deductions that only reduce taxable income, these credits directly lower the amount of tax owed, making them particularly valuable for homeowners.

The U.S. government introduced these credits with two primary objectives:

- To decrease nationwide energy consumption

- To help homeowners reduce their utility bills

By offering these incentives, the government encourages the adoption of energy-efficient technologies. This strategy works to shrink the country’s carbon footprint while simultaneously providing financial benefits to homeowners.

Eligible Home Improvements

A diverse range of home upgrades qualifies for these tax credits. Some of the most popular improvements include:

- Solar panel installations

- Energy-efficient windows and doors

- High-efficiency heating and cooling systems

- Insulation upgrades

- Water heaters (non-solar)

- Biomass stoves

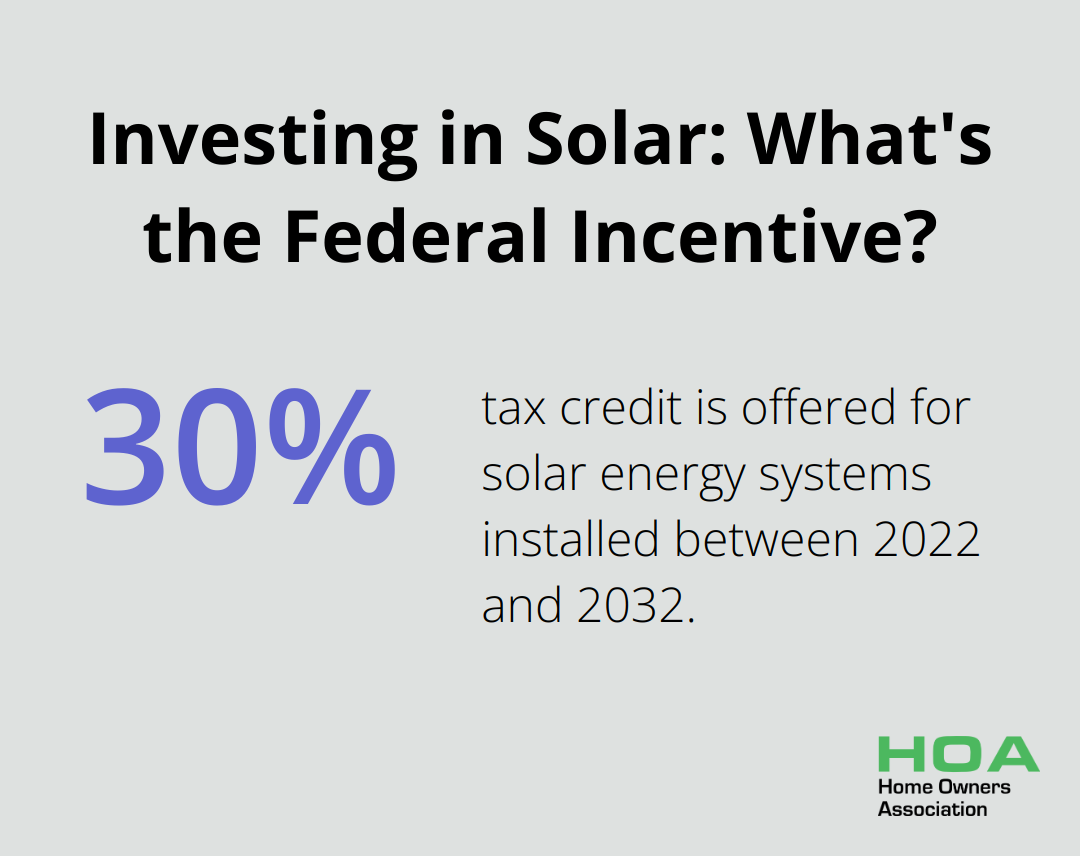

Each upgrade comes with specific requirements and credit limits. For instance, the Residential Clean Energy Credit offers a substantial 30% tax credit for solar energy systems installed between 2022 and 2032 (with no upper limit).

Recent Program Changes

The landscape of energy-efficient tax credits underwent significant changes with the Inflation Reduction Act of 2022. This legislation extended and expanded many existing credits while introducing new ones.

Key changes include:

- Clean vehicle credits

- Home energy credits

- Alternative Fuel Vehicle Refueling Property Credit (added June 22, 2023)

These changes have made tax credits more accessible to a broader range of homeowners.

Impact and Future Outlook

The expanded tax credit program has already shown significant impact. Homeowners across income brackets have taken advantage of these incentives, with nearly half of the claimants having household incomes under $100,000. This data dispels the myth that these credits primarily benefit wealthy families.

As energy-efficient technologies continue to advance, we expect these tax credit programs to evolve further. Homeowners who stay informed about these changes can maximize their savings while contributing to a more sustainable future.

In the next section, we’ll explore specific tax credits available for various home upgrades, providing you with detailed information to make informed decisions about your energy-efficient home improvements.

Available Tax Credits for Energy-Efficient Home Upgrades

Solar Energy Systems and Water Heaters

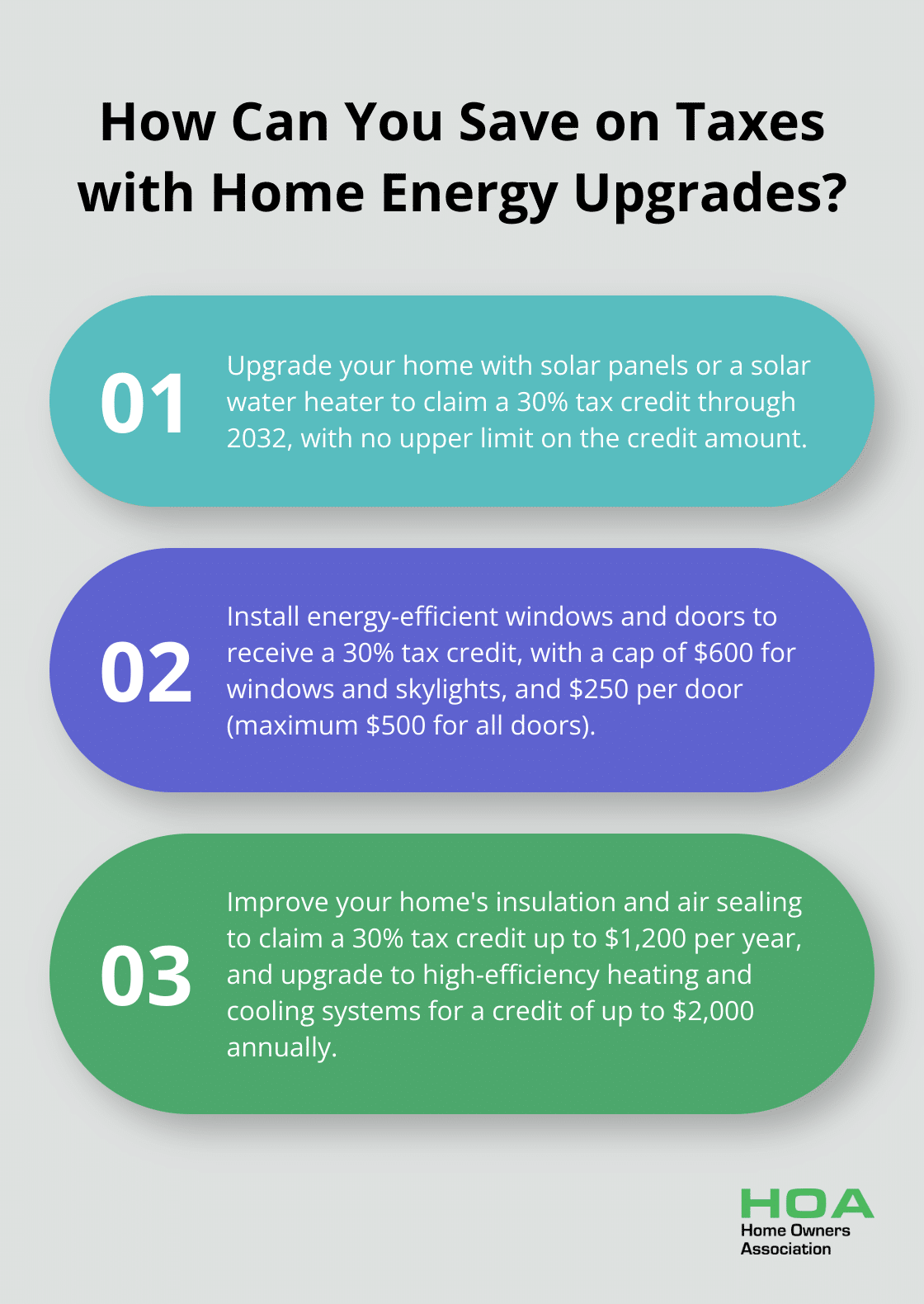

The federal government offers a 30% tax credit for solar panel installations and solar water heaters through 2032. This credit, known as the Residential Clean Energy Credit, applies to the costs of new, qualified clean energy property for your home installed anytime from 2022 through 2032.

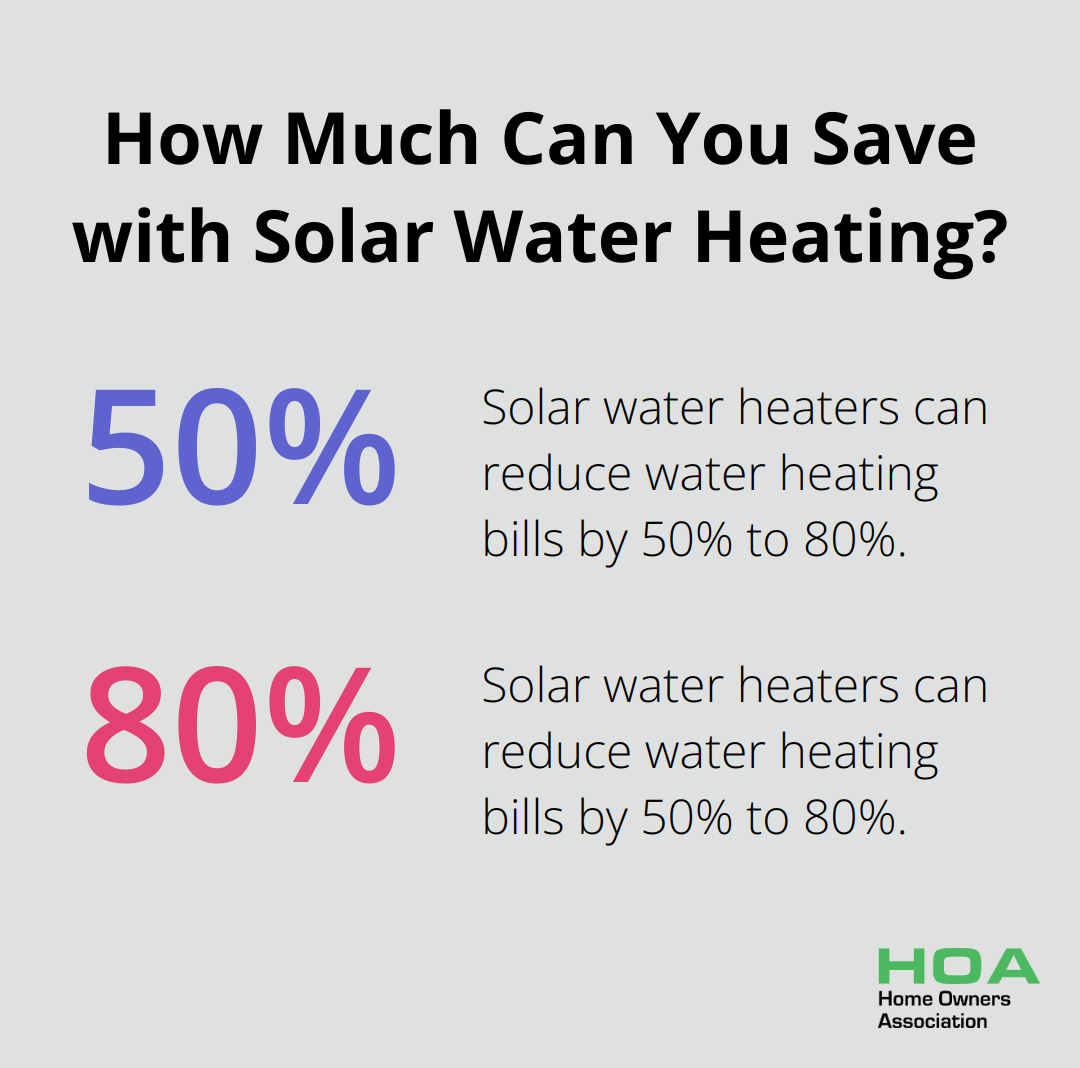

Solar water heaters also qualify for this 30% credit. These systems can reduce water heating bills by 50% to 80%, offering substantial long-term savings in addition to the immediate tax benefit.

Windows, Doors, and Skylights

Energy-efficient windows, doors, and skylights can reduce heat loss and gain in your home. The tax credit for these upgrades is 30% of the cost, with specific caps:

- Windows and skylights: $600 cap

- Doors: $250 per door (maximum $500 for all doors)

To qualify, these products must meet Energy Star requirements.

Insulation and Air Sealing

The tax credit for insulation and air sealing improvements is 30% of the cost, up to $1,200 per year. This credit covers materials and products that meet the International Energy Conservation Code (IECC) standards.

High-Efficiency Heating and Cooling Systems

Upgrading to high-efficiency heating and cooling systems can lead to significant energy savings. The Energy Efficient Home Improvement Credit offers up to $2,000 per year for qualified heat pumps, water heaters, biomass stoves or biomass boilers. This credit has no lifetime dollar limit, allowing you to claim the maximum amount each year for eligible installations.

Central air conditioners and natural gas heat pumps also qualify for credits.

It’s important to note that these tax credits are nonrefundable and cannot exceed your tax liability. However, strategic implementation of these upgrades over several years can maximize federal tax savings while creating a more energy-efficient living space.

The next chapter will guide you through the process of claiming these energy-efficient home upgrade tax credits, including required documentation and filing procedures.

How to Claim Tax Credits for Energy-Efficient Upgrades

Collect Essential Documentation

The first step to claim your tax credits involves gathering all necessary paperwork. This includes receipts for energy-efficient purchases and installations, as well as manufacturer certifications that confirm product compliance with required energy standards. Store these documents securely; you’ll need them when you file your taxes.

For solar panel installations, obtain a copy of your contract and proof of payment. For energy-efficient windows or doors, secure the manufacturer’s certification statement (which should include U-factor and Solar Heat Gain Coefficient ratings).

Navigate IRS Form 5695

To claim energy-efficient tax credits, you must file IRS Form 5695 with your tax return. This form consists of two main sections:

- Part I: Residential Renewable Energy Credit (covers solar, wind, geothermal, and fuel cell technology)

- Part II: Nonbusiness Energy Property Credit (covers items like insulation, windows, and heating systems)

Complete the relevant sections based on your specific upgrades. The form will guide you through credit amount calculations, which you’ll then transfer to your Form 1040.

Understand Credit Limitations

It’s important to know the limits of these tax credits. For most energy-efficient upgrades, the credit is 30% of the cost. The credits have no lifetime dollar limits. Homeowners may claim the maximum annual credit every year that eligible improvements are made, through 2032.

Consider Timing and Eligibility

These tax credits apply to improvements made from January 1, 2023, through December 31, 2032. You’ll claim the credit for the tax year in which the improvement was “placed in service” (typically when installation completed).

The credits don’t apply retroactively to improvements made before 2023. However, if you made eligible improvements in 2023 but didn’t claim the credit on that year’s return, you can file an amended return to claim it.

Tax laws can change, so always check the latest IRS guidelines or consult with a tax professional before claiming these credits. We at Home Owners Association strive to keep our members informed about the latest developments in energy-efficient home improvements and associated tax benefits.

Final Thoughts

Federal tax credits for energy-efficient home improvements offer homeowners significant financial benefits while reducing their environmental impact. These credits can lower tax burdens, increase property values, and enhance home comfort. The Inflation Reduction Act has made these incentives more accessible and generous than ever before.

We at Home Owners Association recommend verifying current tax credit information through official IRS sources or consulting with tax professionals. Energy efficiency experts can help identify the most impactful improvements for your specific home and climate (ensuring the best return on investment). Homeowners should stay informed about these opportunities to maximize potential savings.

For those in Melbourne, Australia, looking to optimize home improvement projects, consider joining the Home Owners Association. We offer exclusive benefits, including trade pricing and discounts on construction materials, as well as expert advice to guide you through your home improvement journey. Take advantage of federal tax credits for energy-efficient home improvements and leverage resources like the Home Owners Association to invest in your property and contribute to a sustainable future.