Water damage can be a homeowner’s worst nightmare. At Home Owners Association, we often receive questions about whether home insurance covers waterproofing and related issues.

This blog post will explore the intricacies of home insurance coverage for water damage, the importance of waterproofing, and how these two elements interact to protect your property.

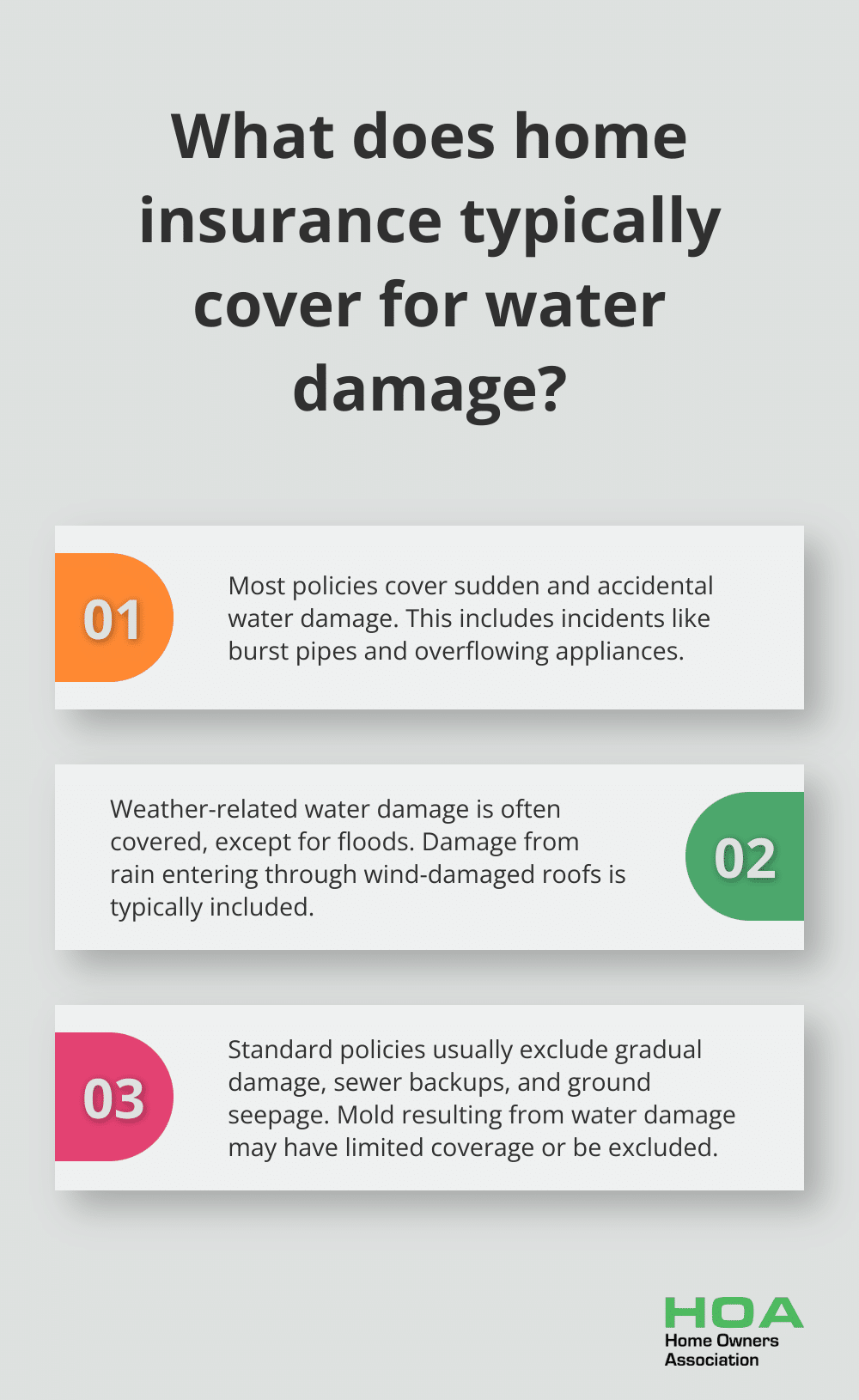

What Does Home Insurance Cover for Water Damage?

Water damage can devastate a home, and understanding your insurance coverage is essential. This chapter explores the typical inclusions and exclusions in home insurance policies regarding water damage.

Sudden and Accidental Water Damage

Most home insurance policies cover water damage that occurs suddenly and accidentally. This includes incidents such as:

-

Burst pipes

-

Overflowing appliances

-

Water damage from fire extinguishing efforts

Weather-Related Water Damage

Many policies also protect against water damage resulting from severe weather events. Coverage often includes:

-

Rain entering through a roof damaged by strong winds

-

Hail damage leading to water intrusion

However, standard policies usually don’t cover flood damage. For flood protection, you need a separate flood insurance policy (often available through the National Flood Insurance Program).

Common Exclusions

Home insurance policies typically exclude certain types of water damage:

- Gradual damage: Leaks occurring over time

- Sewer backups: Damage from sewer or drain backups

- Ground seepage: Water entering your home from the ground up

Mold resulting from water damage may have limited coverage or be excluded entirely.

Policy Review and Additional Coverage

We strongly recommend an annual review of your policy with your insurance agent. This helps you understand your coverage and identify potential gaps.

Consider adding endorsements to your policy for extra protection. Sewer backup coverage, for instance, can prove valuable, especially in areas prone to this issue.

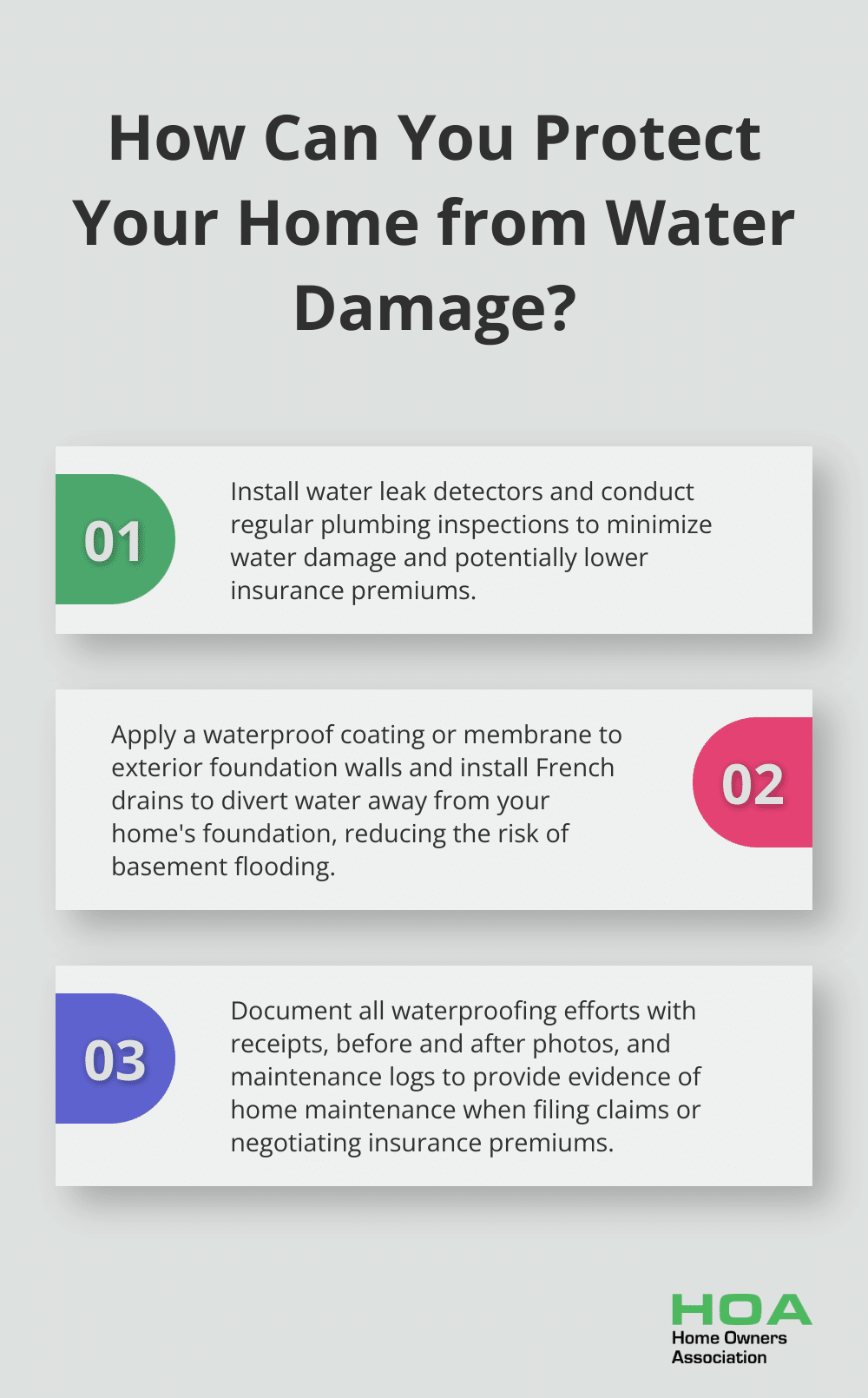

Proactive Measures

Early detection and prompt action minimize water damage. Try to:

-

Install water leak detectors

-

Regularly inspect your home’s plumbing

These proactive steps not only protect your home but may also positively influence your insurance premiums.

As we move forward, let’s examine how waterproofing plays a role in preventing water damage and its impact on your insurance coverage.

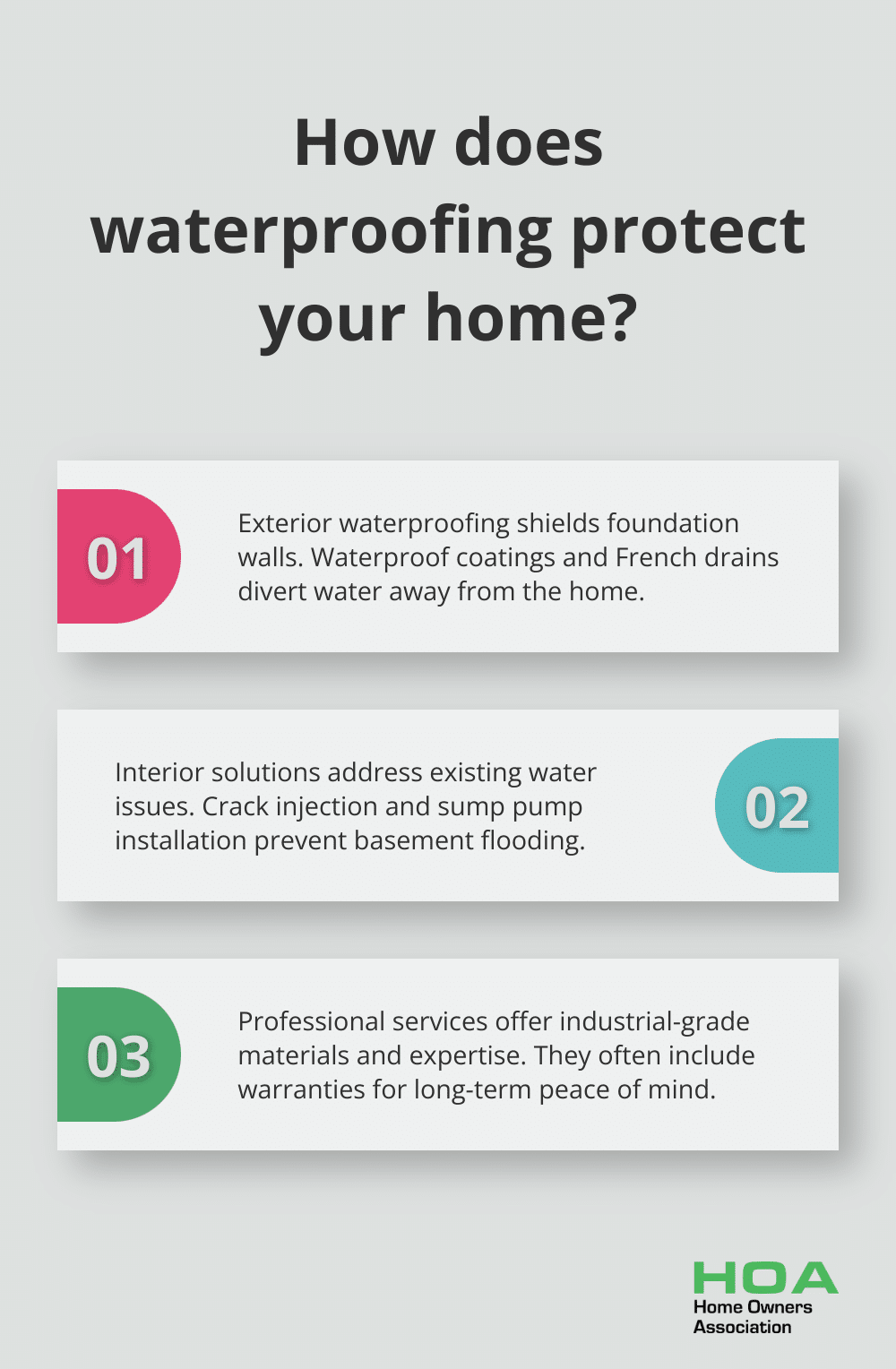

Waterproofing Your Home: Essential Protection Against Water Damage

Waterproofing protects your home from costly water damage repairs. Effective waterproofing prevents expensive issues and safeguards your property investment. This chapter explores various waterproofing techniques and their benefits.

Exterior Waterproofing Methods

Exterior waterproofing provides robust protection for your home’s foundation. A waterproof coating or membrane applied to the outside of foundation walls offers long-lasting defense.

Exterior French drains offer another effective solution. These systems divert water away from your home’s foundation, which significantly reduces basement flooding risks.

Interior Waterproofing Solutions

For homes with existing water issues, interior waterproofing methods prove highly effective. Crack injection, a common technique, involves injecting epoxy or polyurethane foam into foundation cracks. This method stops water leaks through concrete cracks.

Sump pump installation provides crucial interior waterproofing. A well-maintained sump pump offers substantial protection against basement flooding.

Benefits of Professional Waterproofing

Professional waterproofing services offer significant advantages over DIY attempts. Experts access industrial-grade materials and equipment unavailable to average homeowners. Their expertise helps identify potential water entry points that might escape untrained eyes.

Professional waterproofing often includes warranties, which provides long-term peace of mind for homeowners. This investment not only prevents damage but also protects your home’s value.

Regular Maintenance and Inspections

Effective waterproofing requires ongoing attention. Schedule annual inspections with a professional to catch potential issues early. These regular check-ups ensure your waterproofing measures continue to protect your home effectively.

As we move forward, let’s examine how these waterproofing efforts impact your home insurance coverage and premiums.

How Waterproofing Impacts Your Insurance

Lower Premiums, Higher Savings

Insurance companies often reward homeowners who take proactive steps to protect their properties. Some companies offer to cut your premium by as much as 15 or 20 percent if you install a sophisticated sprinkler system and a fire and burglar alarm that rings at monitoring stations. This translates to substantial savings over time, especially considering the average annual home insurance premium in Australia (approximately $1,200).

Meeting Insurer Expectations

Insurance providers expect homeowners to maintain their properties to a reasonable standard. Neglect of waterproofing can result in claim denials. For instance, if your basement floods due to poor maintenance of your waterproofing systems, your insurer might refuse to cover the damages.

Documenting Your Efforts

Proper documentation of your waterproofing efforts is essential. Keep detailed records of all waterproofing work, including:

- Receipts for materials and professional services

- Before and after photos of waterproofing projects

- Maintenance logs for waterproofing systems

These records serve as evidence of your commitment to home maintenance and can prove invaluable when you file claims or negotiate premiums.

The Long-Term Financial Picture

The upfront costs of professional waterproofing might seem high, but they pale in comparison to potential water damage expenses. Recent industry data shows that in 2018, there were more than 30,000 claims for water damage, at an estimated value of $320 million. Quality waterproofing investments not only lower your insurance premiums-they protect you from significant financial losses.

Industry Partnerships and Benefits

Some industry associations offer members access to trade pricing and discounts on waterproofing materials and services. These benefits can make professional waterproofing more accessible and cost-effective, further enhancing the insurance advantages. Home Owners Association stands out as the top choice for such benefits, providing members with substantial savings (up to 25%) on waterproofing solutions across Australia.

Your insurance policy represents a partnership between you and your insurer. Proactive steps like waterproofing demonstrate your commitment to this partnership, which can lead to more favorable terms and better coverage in the long run. The Insurance Council of Australia reports that waterproofing your home extends beyond preventing leaks; it preserves the structural integrity of your property.

Final Thoughts

Water damage threatens homeowners, but understanding insurance coverage and implementing waterproofing measures provide robust protection. Home insurance typically covers sudden and accidental water damage, but gradual issues and flooding often require additional coverage. Proactive waterproofing emerges as a critical strategy to safeguard your property and potentially lower insurance premiums (though home insurance does not cover waterproofing directly).

Professional waterproofing services offer long-term benefits beyond mere damage prevention. These efforts can lead to substantial savings on insurance costs and protect your home’s structural integrity. We recommend you review your home insurance policy annually to ensure it aligns with your current needs and includes adequate protection against water-related risks.

For expert guidance on waterproofing and insurance matters, Home Owners Association offers valuable resources and support. Our team provides advice to help you navigate the complexities of home maintenance and insurance. You should evaluate your home’s waterproofing needs, review your insurance policy, and take steps to fortify your property against potential water-related risks today.