At Home Owners Association, we understand the importance of maintaining a productive home office environment. Home office expenses, repairs, and maintenance are crucial aspects of ensuring your workspace remains comfortable and efficient.

In this guide, we’ll explore the ins and outs of managing your home office upkeep, from understanding tax deductions to deciding between DIY and professional services. Whether you’re a seasoned remote worker or new to the home office scene, this post will provide valuable insights to help you optimize your workspace.

What Are Home Office Repairs and Maintenance?

Definition and Importance

Home office repairs and maintenance encompass tasks that keep your workspace functional, comfortable, and efficient. These activities include fixing broken equipment, regular cleaning, and upkeep of your office area. Proper maintenance can significantly impact productivity and overall work satisfaction.

Regular upkeep of your home office space directly affects your work performance. A well-maintained office can boost productivity. This increase stems from better air quality, proper lighting, and a comfortable temperature – all factors that depend on consistent maintenance.

Key Areas Requiring Attention

Desk and Chair Maintenance

Your desk and chair are central to your comfort and should be checked for stability and ergonomic support. Poor office ergonomics can lead to various musculoskeletal disorders, highlighting the importance of maintaining proper seating and desk arrangements.

Lighting Upkeep

Lighting is another critical aspect of your home office. Regular cleaning of light fixtures and replacing bulbs will ensure you maintain optimal lighting levels, reducing eye strain and headaches.

Technology Maintenance

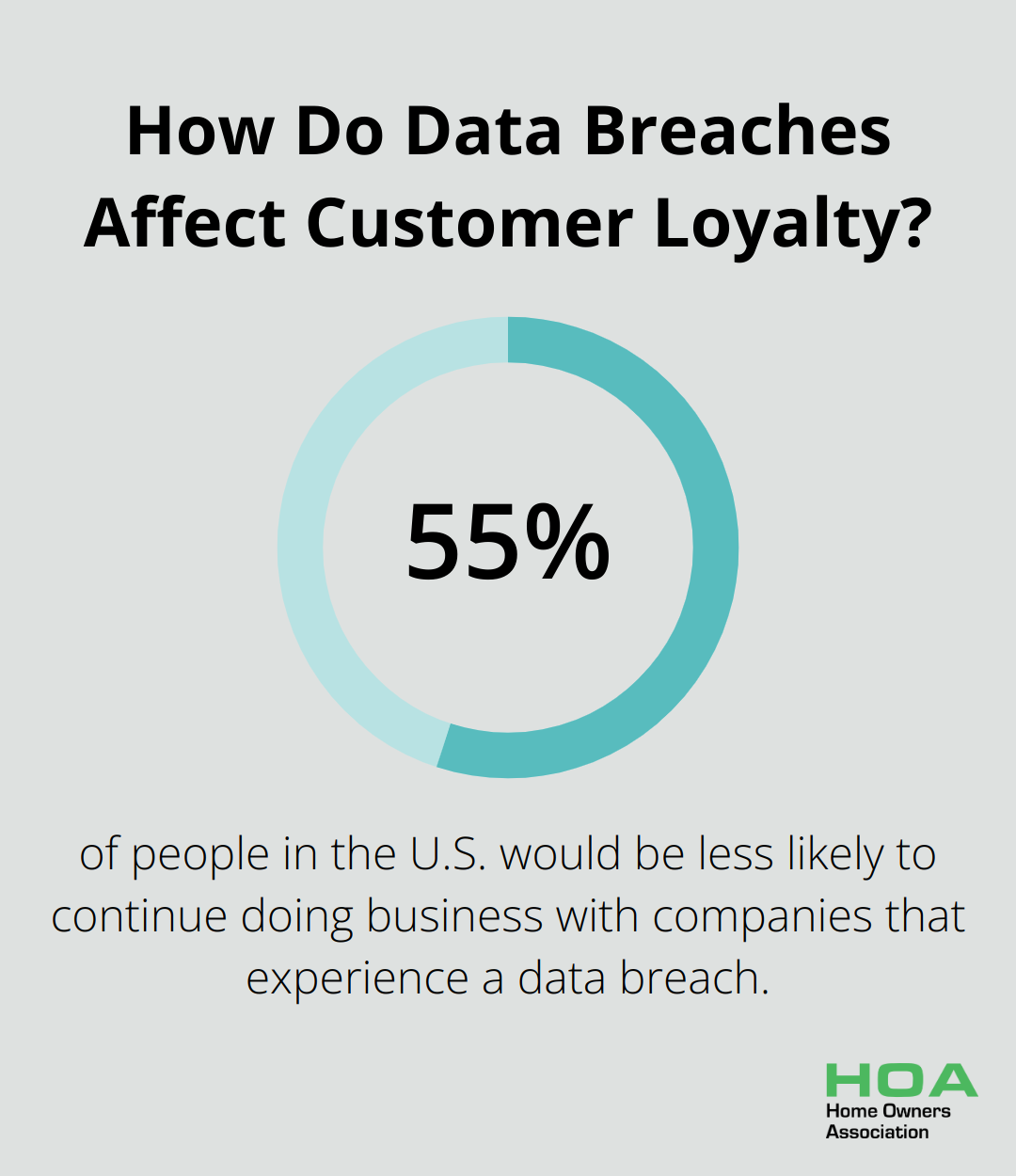

In today’s digital age, technology maintenance is paramount. Regular software updates, hardware checks, and data backups are essential. Small business cybersecurity statistics show that 55% of people in the U.S. would be less likely to continue doing business with companies that experience a data breach. This statistic underscores the importance of maintaining your digital infrastructure.

Air Quality and Ventilation

Air quality in your home office should not be overlooked. Regular cleaning, proper ventilation, and maintenance of any air purification systems are vital for maintaining a healthy work environment.

Focusing on these key areas will create a home office space that not only looks good but also supports your health and productivity. A well-maintained office is an investment in your work and well-being. As we move forward, let’s explore how these maintenance efforts can translate into potential tax deductions for your home office expenses.

Tax Deductions for Home Office Repairs and Maintenance

Qualifying for Home Office Deductions

At Home Owners Association, we receive numerous inquiries about tax deductions for home office repairs and maintenance. To claim these deductions, you must use a portion of your home exclusively and regularly for your business. This requirement means having a dedicated space that serves no other purpose. The Australian Taxation Office (ATO) strictly enforces this criterion, so ensure your home office complies before you claim any deductions. You can claim 67 c for each hour you work from home during the relevant income year. This rate includes the additional running expenses you incur.

Types of Deductible Expenses

The ATO allows deductions for various home office expenses. These include:

- Direct repairs to the office (e.g., fixing a broken window or repainting walls)

- A portion of general home maintenance costs (based on the percentage of your home used for business)

For example, if your home office occupies 10% of your home’s total area, you can deduct 10% of eligible whole-house expenses such as heating, cooling, and internet services.

Record-Keeping Requirements

Accurate record-keeping is essential when claiming home office deductions. The ATO recommends:

- Keeping all receipts and invoices

- Maintaining a log of time spent working from home

- Consulting with a tax professional for larger expenses (like major repairs or renovations)

This ensures proper allocation between personal and business use.

Recent Trends in Home Office Usage

A recent survey by the Australian Bureau of Statistics revealed that 37 per cent of Australians work from home regularly. While this was down from around 40 per cent in 2021, it was still five percentage points above the pre-pandemic levels. This trend underscores the growing importance of understanding home office deductions.

Maximizing Your Deductions

To maximize your tax benefits while complying with ATO regulations:

- Document all expenses meticulously

- Understand the difference between repairs (deductible immediately) and improvements (depreciated over time)

- Consider using a tax professional to navigate complex deductions

The landscape of home office deductions continues to evolve. As we move forward, it’s important to consider whether tackling repairs and maintenance yourself or hiring professionals is the best approach for your situation.

DIY or Professional Maintenance: Which Is Best for Your Home Office?

The DIY Approach

Many homeowners in Melbourne choose DIY repairs to save money. DIYers are more likely to be male and younger. This trend continues, with home office maintenance as a prime area for self-improvement.

DIY can be cost-effective for simple tasks like painting, basic furniture assembly, or minor electrical work (such as changing light fixtures). However, it’s important to assess your skills honestly. A botched DIY job can cost more in the long run if professional intervention becomes necessary to fix mistakes.

When to Call the Professionals

For complex tasks or those involving safety risks, professional services often prove the wisest choice. Electrical rewiring, structural changes, or extensive plumbing work should be left to licensed professionals. In Melbourne, all electrical work must be performed by a licensed electrician, as mandated by Energy Safe Victoria.

HVAC systems, which are important for maintaining a comfortable home office environment, typically require professional servicing. The Australian Institute of Refrigeration, Air Conditioning and Heating recommends professional maintenance at least once a year to ensure optimal performance and energy efficiency.

Cost Considerations

While DIY might seem cheaper initially, it’s important to factor in the value of your time and the potential for costly mistakes. A study by the Housing Industry Association found that DIY renovations in Australia often exceed budgets by 20-30% due to unforeseen complications and errors.

Professional services, while more expensive upfront, often come with warranties and guarantees. Home Owners Association members in Melbourne have access to trade pricing and discounts on professional services, which can significantly reduce costs.

Making the Right Choice

The decision between DIY and professional services depends on the specific task, your skill level, and the potential risks involved. For critical home office maintenance that affects your productivity and safety, professional services often provide peace of mind and long-term value.

As a Home Owners Association member in Melbourne, you have access to expert advice to help you make informed decisions about your home office maintenance needs (whether you choose DIY or professional services).

Final Thoughts

Home office expenses, repairs, and maintenance play a vital role in creating a productive work environment. Regular upkeep of your workspace enhances comfort, supports health, and boosts productivity. The Australian Taxation Office provides clear guidelines on tax deductions for home office expenses, which can lead to substantial savings for eligible individuals.

The choice between DIY and professional services for home office maintenance depends on your skills, task complexity, and potential risks. While DIY can save money for simple tasks, professional services often provide long-term value and peace of mind for more complex jobs. We at Home Owners Association understand the importance of balancing cost-effectiveness with quality in home office upkeep.

Our members in Melbourne benefit from access to trade pricing, discounts, and expert advice for their home office projects. This ensures high standards while remaining budget-friendly. Prioritizing regular home office maintenance creates an environment where you can thrive professionally and sets you up for success in your work-from-home endeavors.