Buying your first home is an exciting milestone, but it can also be overwhelming. At Home Owners Association, we understand the challenges and complexities of this process.

That’s why we’ve compiled essential first-time home buyer tips and advice to guide you through each step. From budgeting and financing to finding the perfect property and navigating negotiations, we’ve got you covered.

How to Determine Your Home Buying Budget

Analyze Your Financial Situation

The first step in your home-buying journey is to determine your budget. This process involves more than just looking at your income; it requires a comprehensive understanding of your financial picture.

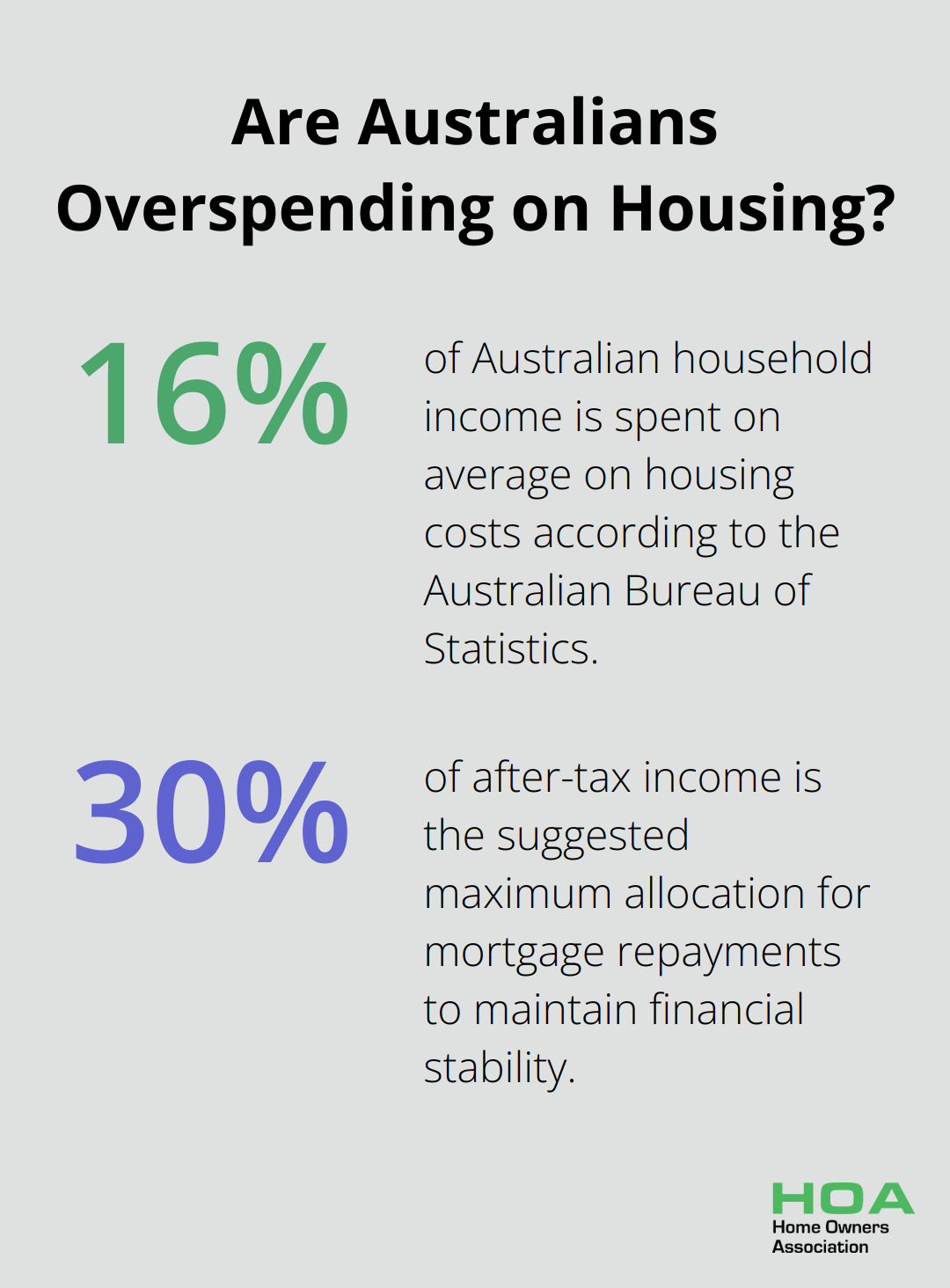

Start by calculating your monthly income and expenses. Include all sources of income and every expense, from groceries to subscriptions. The Australian Bureau of Statistics reports that the average Australian household spends about 16% of their income on housing costs. However, we suggest you allocate no more than 30% of your after-tax income towards mortgage repayments to maintain financial stability.

Next, assess your savings. The ideal deposit is 20% of the property’s value to avoid Lender’s Mortgage Insurance (LMI). However, many first-time buyers enter the market with 5-10%. A larger deposit results in lower monthly repayments and potentially better interest rates.

Improve Your Credit Score

Your credit score significantly influences your ability to secure favorable mortgage terms. In Australia, a score above 800 is considered excellent. Check your credit score for free through services like Equifax or Experian. If your score needs improvement, focus on these actions:

- Pay bills on time

- Reduce credit card balances

- Avoid new credit applications in the months leading up to your home purchase

Obtain Mortgage Pre-Approval

Securing pre-approval for a mortgage provides you with a clear budget and demonstrates to sellers that you’re a serious buyer. The pre-approval process typically takes 1-3 days and remains valid for 90 days. When applying, you’ll need to provide proof of income, assets, and expenses. Prepare at least three months of bank statements and payslips.

Explore First-Time Buyer Programs

Australia offers several programs to assist first-time buyers in entering the market. The First Home Super Saver Scheme allows you to contribute up to $15,000 in any one financial year, up to a maximum of $50,000 across all years. The First Home Guarantee scheme enables eligible buyers to purchase a home with as little as a 5% deposit without paying LMI.

Each state also has its own incentives. For example, Victoria offers the First Home Owner Grant (FHOG) of $10,000 for new constructions in metropolitan areas and $20,000 in regional Victoria. Always check with your state government for the latest offerings.

With your budget determined and financing options explored, the next step is to find the right property that meets your needs and fits within your financial parameters.

Where Should You Look for Your First Home?

Identify Your Property Priorities

Create a list of features you need in your new home. Include the number of bedrooms and bathrooms, desired square footage, and any specific requirements (like a home office or outdoor space). Consider which features you won’t compromise on and which you can be flexible about.

Explore Potential Neighborhoods

Research different areas that fit your budget and lifestyle. Investigate factors such as proximity to work, public transport options, local schools, and amenities. The Australian Bureau of Statistics provides demographic data that can give you insights into the character of different neighborhoods. Visit potential areas at various times of day to assess traffic, noise levels, and community atmosphere.

Engage a Real Estate Professional

Work with a reputable real estate agent to streamline your property search. They have access to listings that may not be publicly available and can provide valuable insights into market trends. When you choose an agent, look for someone with experience in your desired areas and a track record of working with first-time buyers.

Attend Open Houses and Property Viewings

Visit properties in person to understand what’s available in your price range. Properties in Australia spend an average of 44 days on the market, so prepare to act quickly when you find a home you like. Take notes and photos during viewings to help you compare properties later. Ask questions about the property’s history, any recent renovations, or potential issues.

Use Online Resources

Utilize online property portals and real estate websites to browse listings, compare prices, and get a feel for the market. These platforms often offer virtual tours and detailed property information, which can help you narrow down your options before scheduling in-person viewings.

Finding the right property takes time and patience. As you continue your search, keep in mind the importance of thorough inspections and understanding the contract process. The next section will guide you through these critical steps in the home-buying journey.

Sealing the Deal on Your First Home

Craft a Competitive Offer

The Australian real estate market moves quickly, with properties selling in a median time of 29 days in capital cities and 44 days in regional areas. You must act fast when you find a home you love. Base your offer on recent sales of similar properties, the property’s condition, and current market trends.

Don’t undervalue the property unnecessarily. A fair offer shows the seller you’re serious and can prevent you from losing to another buyer. Your real estate agent can provide valuable insights on pricing strategy.

Master the Art of Negotiation

Negotiation plays a key role in the home-buying process. Prepare to discuss not just the price, but also terms like the settlement date and included items.

If the seller counters your offer, don’t feel discouraged. This is a normal part of the process. Decide on your absolute maximum price beforehand and stick to it. Avoid emotional decisions that can lead to financial strain later.

Schedule Property Inspections

Never skip the property inspection. A thorough inspection can uncover potential problems with the property’s structure, plumbing, electrical systems, and more.

While it costs extra upfront, an inspection can save you thousands in the long run by identifying issues before you commit to the purchase. If the inspector finds significant problems, you may negotiate repairs or a lower price with the seller.

Finalize the Purchase

After the seller accepts your offer, you’ll enter the settlement period. This typically lasts 30 to 90 days. During this time, you’ll need to finalize your mortgage, conduct final inspections, and review and sign closing documents.

Work closely with your conveyancer or solicitor during this period. They’ll ensure all legal requirements are met and that the contract protects your interests. Pay attention to the cooling-off period, which varies by state (e.g., five business days in New South Wales).

On settlement day, final checks will occur, and ownership will officially transfer to you. This is when you’ll receive the keys to your new home.

Final Thoughts

The journey to homeownership marks a significant milestone filled with excitement and challenges. Our first-time home buyer tips and advice equip you to navigate the complexities of the Australian property market. Your journey starts with a thorough financial assessment and mortgage pre-approval, which allows you to explore neighborhoods and properties confidently.

Patience and persistence will lead you to success as you search for your ideal home. Experienced professionals (such as real estate agents and conveyancers) provide invaluable support throughout your journey. Approach negotiations and inspections with diligence to ensure you make a sound investment.

Homeownership offers benefits beyond having a place to call your own. It provides an opportunity to build equity and customize your living space. At Home Owners Association, we support first-time buyers throughout Melbourne, Australia with exclusive benefits and expert advice.