Buying your first home is an exciting milestone, but it can also be overwhelming. At Home Owners Association, we understand the challenges and complexities of this journey.

Our comprehensive guide offers essential first home buyer tips to help you navigate the process with confidence. From financial preparation to finding the perfect property, we’ll walk you through each step to ensure your home-buying experience is a success.

How to Prepare Your Finances for Home Buying

Financial preparation forms the foundation of a successful home purchase. At Home Owners Association, we’ve observed how proper financial planning can transform a potentially stressful experience into a smooth transaction.

Assess Your Financial Health

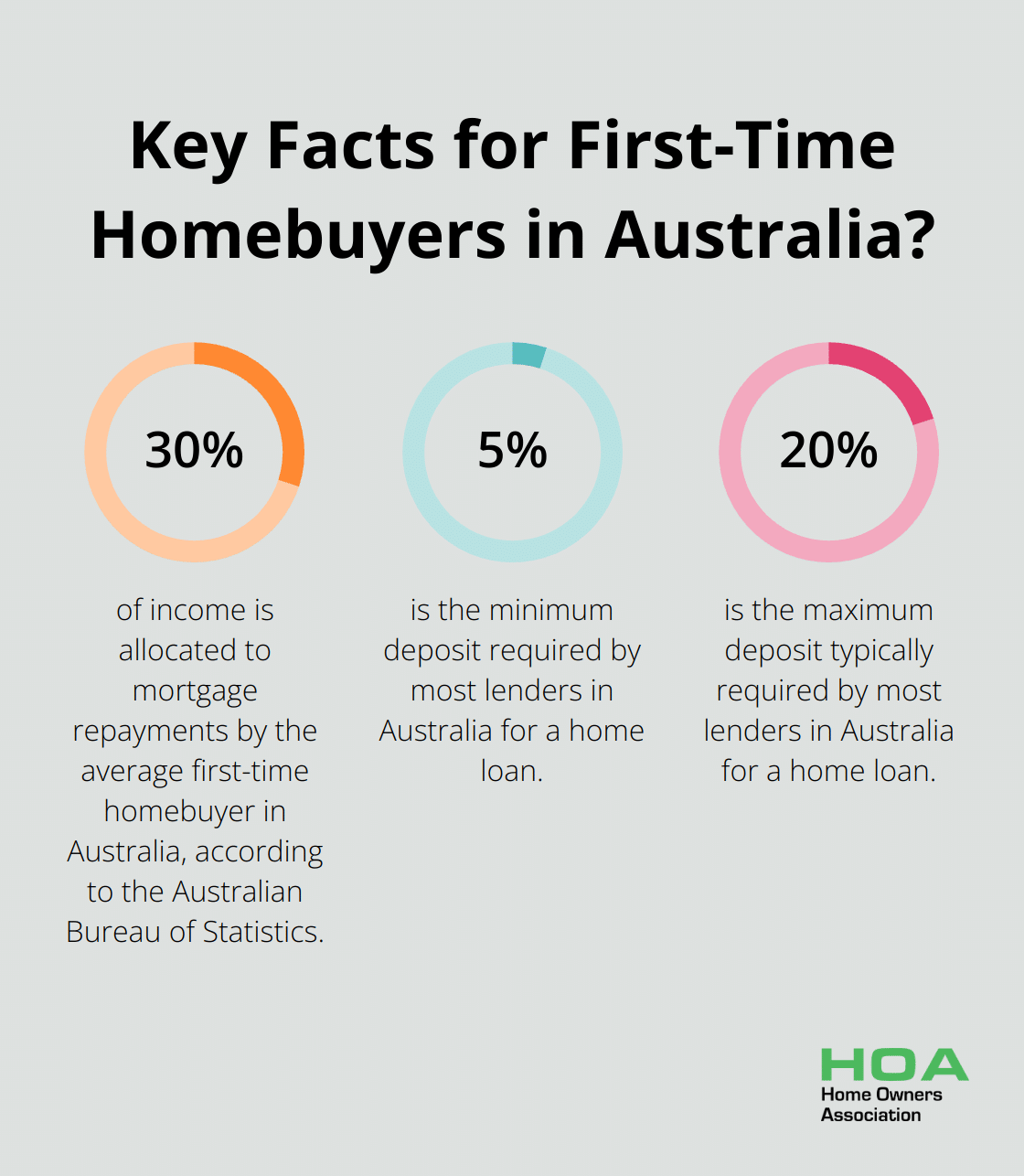

Create a comprehensive budget that outlines your monthly income and expenses. This will provide a clear picture of how much you can realistically afford to spend on a home. The Australian Bureau of Statistics reports that the average first-time homebuyer in Australia allocates about 30% of their income to mortgage repayments. Use this as a benchmark, but adjust based on your personal circumstances.

Build Your Down Payment

Saving for a down payment often presents the biggest challenge for first-time buyers. Most lenders in Australia require a minimum deposit of 5% to 20% of the property’s value. To accelerate your savings, set up automatic transfers to a high-yield savings account. The First Home Super Saver Scheme (FHSSS) allows you to save money for your first home inside your superannuation fund, potentially reducing your tax burden. To be eligible, you must be aged 18 years or older, have not owned property in Australia before, and have not previously had an amount released under the scheme.

Boost Your Credit Score

Your credit score significantly influences your ability to secure a favorable mortgage rate. In Australia, credit scores range from 0 to 1,000 (Experian) or 1,200 (Equifax). A score above 800 is considered excellent. To improve your score, pay bills on time, reduce credit card balances, and avoid applying for new credit in the months leading up to your home purchase.

Secure Mortgage Pre-Approval

Obtain pre-approval for a mortgage to gain a clear idea of your budget and demonstrate to sellers that you’re a serious buyer. Contact multiple lenders to compare rates and terms. (Home Owners Association members often receive preferential rates from partner lenders, so be sure to inquire about these benefits.)

Understand Additional Costs

Factor in additional expenses beyond the purchase price. These may include stamp duty, legal fees, and moving costs. (In some states, first-time buyers may qualify for stamp duty concessions or exemptions.) Create a buffer in your budget to account for these extra expenses.

With your finances in order, you’ll be well-positioned to make a competitive offer when you find your dream home. The next step in your journey involves finding the right property that meets your needs and budget.

Where Should You Buy Your First Home?

Identify Your Property Priorities

Create a list of must-have features and nice-to-have amenities for your first home. Consider factors such as the number of bedrooms, outdoor space, parking, and proximity to public transport. Be realistic about what you can afford within your budget and prepare to compromise on some features.

Explore Potential Neighborhoods

Research different suburbs to find areas that align with your lifestyle and budget. Investigate local amenities, crime rates, and future development plans. The Australian Bureau of Statistics provides detailed demographic information for each suburb, which can offer insights into the area’s population, income levels, and growth trends. Visit potential neighborhoods at different times of day to experience the community and traffic patterns firsthand.

Leverage Professional Expertise

Work with a qualified real estate agent to save time and potentially money in your property search. Agents have access to off-market listings and can provide valuable insights into local market conditions. When you select an agent, look for someone with experience in your target areas and ask for references from past clients.

Attend Open Houses and Private Viewings

Visit properties in person to understand what you’re getting for your money. Open houses allow you to see multiple properties quickly and get a sense of the local market. For properties you seriously consider, schedule private viewings to take a closer look without the pressure of other buyers around. Take notes and photos during these visits to help you compare properties later.

Look beyond cosmetic issues and focus on the property’s structural integrity, natural light, and overall layout.

As you narrow down your options and find properties that meet your criteria, you’ll need to prepare for the next step: making an offer and navigating the purchase process. This phase requires careful consideration and strategic planning to secure your dream home.

Sealing the Deal on Your First Home

Make a Competitive Offer

Your offer should stem from thorough research of comparable sales in the area. Recent data from CoreLogic shows that 2,820 homes were taken to auction across the combined capitals last week, the highest weekly volume of auctions held since the week ending February 23, 2025. However, prices vary significantly by location, so you must analyze local market trends.

Present your offer in writing, accompanied by a letter of pre-approval from your lender. This shows your seriousness and financial readiness to the seller. If you’re in a competitive market, consider including a personal letter explaining why you love the home-this can sometimes give you an edge over other buyers.

Negotiations often occur, so prepare to counteroffer. Set a firm upper limit based on your budget and adhere to it. Emotional decisions can lead to financial strain down the line.

Conduct Due Diligence

After your offer is accepted, schedule a professional inspection. This typically costs between $400 and $1,000 but can save you thousands in unforeseen repairs. Approximately 20% of residential properties in NSW have reported structural defects, according to NSW Fair Trading.

Don’t skip this step-even new builds can have defects. If significant problems surface, you may renegotiate the price or ask the seller to make repairs before closing.

Finalize Your Mortgage

With a signed contract in hand, finalize your home loan. Provide your lender with all necessary documentation promptly to avoid delays. This typically includes proof of income, bank statements, and details of the property you’re purchasing.

Your lender will conduct a valuation of the property. If it comes in lower than expected, you may need to renegotiate with the seller or increase your deposit to meet the lender’s loan-to-value ratio requirements.

Close the Deal

The final step is settlement, where ownership officially transfers to you. This process usually takes 30 to 90 days, depending on your state and the terms of your contract.

During this time, your conveyancer or solicitor will conduct title searches and prepare all necessary legal documents. They’ll also calculate adjustments for rates and taxes, ensuring you only pay for the portion of the year you own the property.

On settlement day, final checks are conducted, and funds are transferred. Once complete, you’ll receive the keys to your new home. The Australian Securities and Investments Commission (ASIC) advises to set aside about 5% of the property’s value for fees and charges associated with buying and moving into your new home (this includes costs such as stamp duty and legal fees).

As you approach the finish line, stay organized and responsive to requests from your lender, agent, and legal representative. Clear communication can help prevent last-minute hiccups and ensure a smooth transition to homeownership.

Final Thoughts

Buying your first home marks a significant milestone in your life. Our first home buyer tips aim to simplify this complex process and set you on the path to successful homeownership. You will face challenges, but a positive attitude and unwavering focus on your goals will help you overcome them.

We at Home Owners Association stand ready to support you throughout your home buying journey. Our team in Melbourne offers expert guidance, access to trade pricing, and valuable resources to enhance your experience. We strive to help you make informed decisions and save money as you embark on this exciting new chapter.

Your dream of owning a home is within reach. With careful planning, thorough research, and the right support network, you can transform this dream into reality. The world of property ownership awaits you, filled with opportunities and new beginnings (and we’re here to help you navigate it).