Buying your first home is an exciting milestone, but it can also be overwhelming. At Home Owners Association, we understand the challenges first-time buyers face in today’s competitive real estate market.

Our comprehensive guide offers essential home buying tips for first-time buyers, covering everything from financial preparation to closing the deal. We’ll walk you through each step of the process, providing practical advice to help you achieve your homeownership dreams.

How to Prepare Financially for Your First Home

Assess Your Financial Health

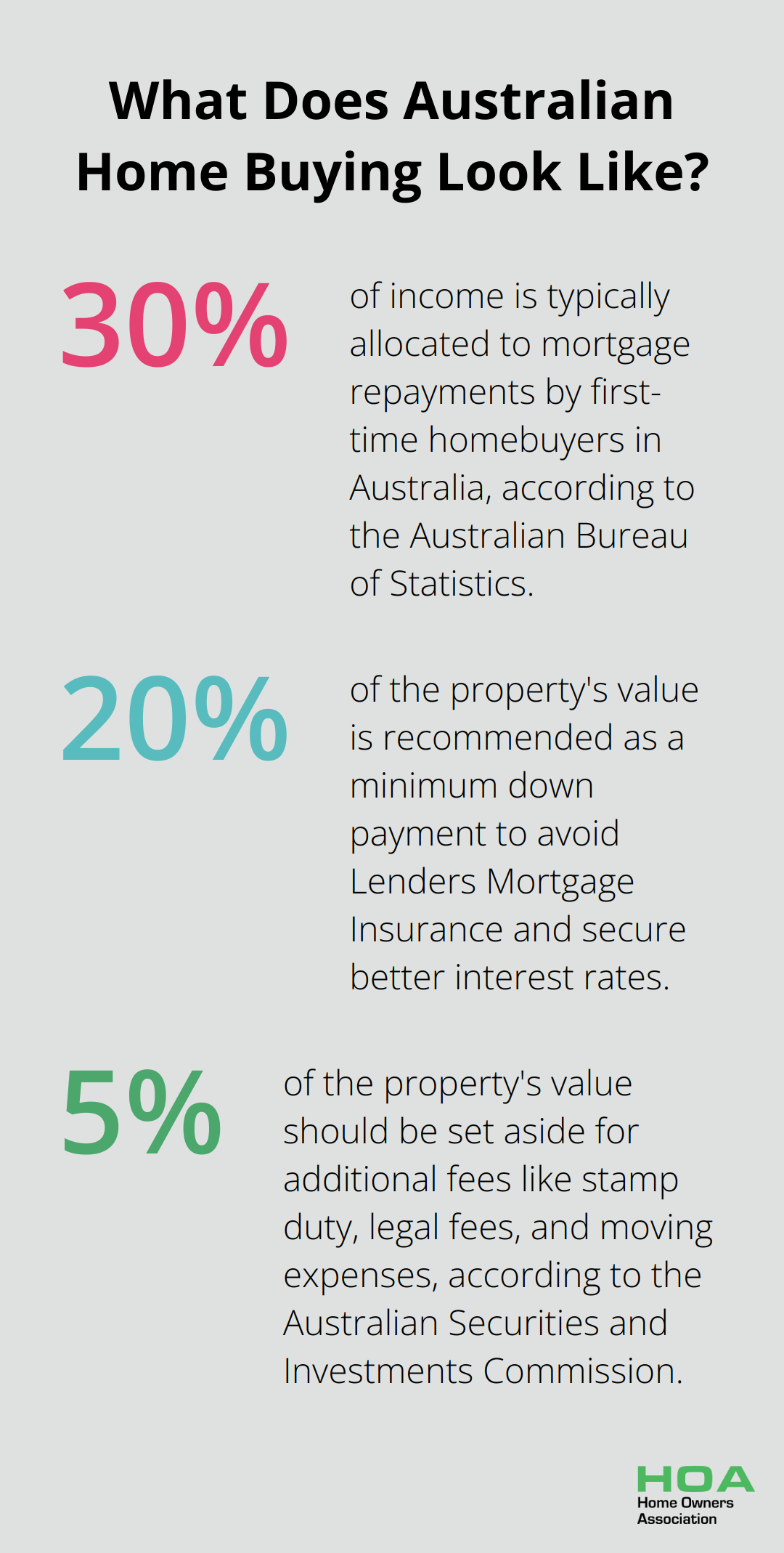

Create a comprehensive budget to track your income and expenses for at least three months. This will provide a clear picture of your spending habits and help you identify areas to cut back. The Australian Bureau of Statistics reports that first-time homebuyers in Australia typically allocate about 30% of their income to mortgage repayments. Use this as a guideline when you determine how much you can afford.

Build Your Down Payment

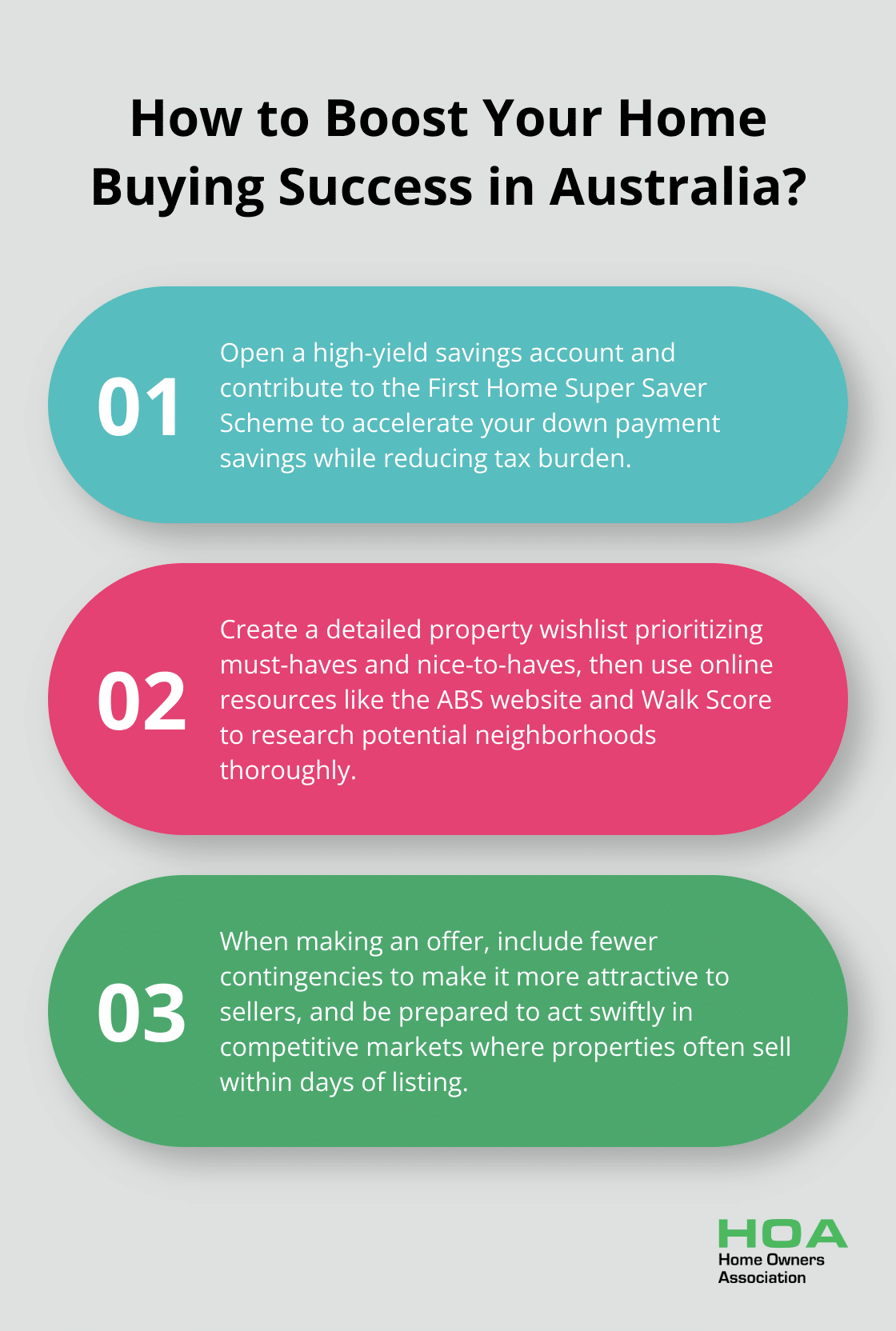

Try to save at least 20% of the property’s value for your down payment. This will help you avoid Lenders Mortgage Insurance (LMI) and potentially secure better interest rates. Open a high-yield savings account to accelerate your savings. The First Home Super Saver Scheme (FHSSS) allows first home buyers to make extra voluntary superannuation contributions to save on tax and build a deposit.

Boost Your Credit Score

In Australia, the minimum credit score required for a home loan is typically around 650-700, depending on the scoring system applied to you. To improve your score:

- Pay all bills on time

- Reduce credit card balances

- Avoid applying for new credit

Request a free copy of your credit report from credit reporting bodies (like Equifax, Experian, or illion) to check for any errors that might affect your score.

Secure Mortgage Pre-Approval

Get pre-approved for a mortgage to establish a clear budget and show sellers you’re a serious buyer. Start by comparing offers from multiple lenders. Factor in additional costs like stamp duty, legal fees, and moving expenses. The Australian Securities and Investments Commission (ASIC) recommends setting aside about 5% of the property’s value for these additional fees.

First-time buyers in some Australian states may be eligible for stamp duty concessions or exemptions. Check with your local government for available incentives.

Now that you’ve laid the financial groundwork, it’s time to start your home search. The next chapter will guide you through the process of finding your perfect property.

Finding Your Dream Home

Define Your Property Wishlist

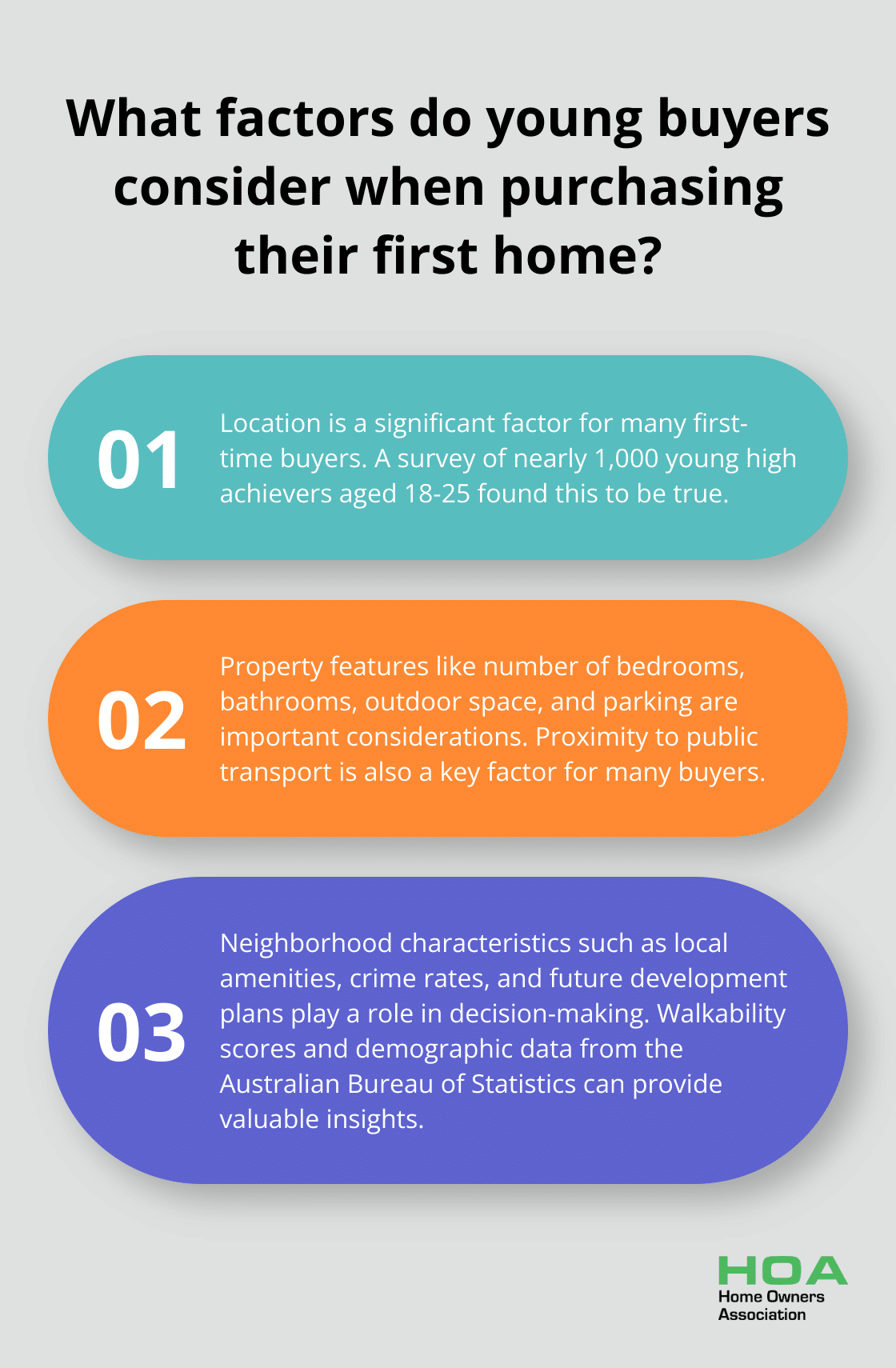

Create a detailed list of features you want in your first home. Prioritize these into must-haves and nice-to-haves. Consider factors like the number of bedrooms and bathrooms, outdoor space, parking, and proximity to public transport. A recent survey of nearly 1,000 young high achievers (aged 18-25 and with an ATAR of 80 or higher) found that location is a significant factor for many first-time buyers.

Explore Potential Neighborhoods

Research different suburbs thoroughly. Investigate local amenities, crime rates, and future development plans. The Australian Bureau of Statistics provides detailed demographic data for each suburb, which can give you insights into the area’s population, income levels, and growth trends. Check the walkability score of potential neighborhoods using tools like Walk Score to assess convenience and accessibility.

Partner with a Qualified Real Estate Agent

A good agent can prove invaluable in your home search. They have access to off-market listings and can provide insights into local market conditions. When choosing an agent, select someone with experience in your target areas and a track record of working with first-time buyers.

Attend Open Houses and Private Viewings

Visit properties in person to get a feel for the space and neighborhood that you can’t get from online listings. Take notes and photos during these visits to help you compare properties later.

Utilize Online Resources

Take advantage of online property portals and real estate websites to streamline your search. These platforms often offer virtual tours, detailed property information, and neighborhood statistics. (However, don’t rely solely on online resources; in-person visits remain essential for making informed decisions.)

Finding the right property takes time and patience. As you continue your search, you’ll soon be ready to take the next exciting step: making an offer on your dream home. In the following section, we’ll guide you through this process and help you close the deal on your first property.

Sealing the Deal on Your First Home

Understand Market Dynamics

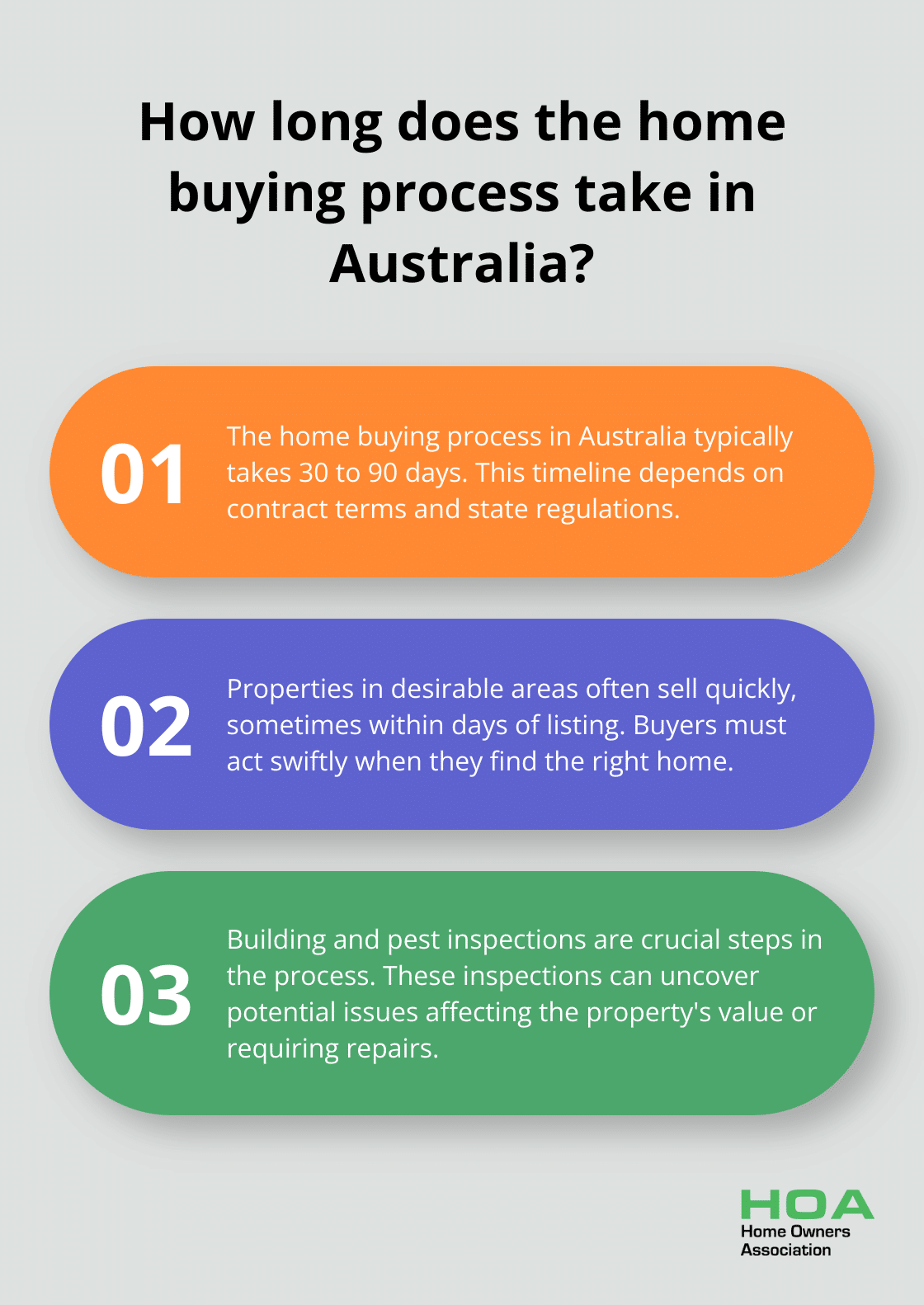

Before you submit an offer, research recent sales of similar properties in the area. This information (often available through your real estate agent or online property portals) provides a benchmark for fair market value. In Australia’s competitive housing market, properties in desirable areas often sell quickly, sometimes within days of listing. You must act swiftly when you find the right home.

Craft a Competitive Offer

When you’re ready to make an offer, work closely with your real estate agent to determine an appropriate starting point. In Australia, it’s common to negotiate on price, so your initial offer might be below the asking price. However, in hot markets, you may need to offer at or above the listing price to be competitive.

Your offer should include not just the purchase price, but also any conditions or contingencies. Common contingencies include finance approval, satisfactory building and pest inspections, and a settlement date that works for both parties. Fewer contingencies can make your offer more attractive to sellers.

Navigate the Negotiation Process

Negotiations can be complex, especially for first-time buyers. Your real estate agent will present your offer to the seller’s agent and communicate any counteroffers. You should prepare for some back-and-forth, but also know your limits. Set a realistic budget you’re willing to pay and stick to it, no matter how emotionally attached you’ve become to the property.

Conduct Due Diligence

Once the seller accepts your offer, you must conduct thorough inspections. Building and pest inspections can uncover potential issues that may affect the property’s value or require costly repairs. In Australia, a 2023 survey showed a steady decline in serious common property defects since 2020 in NSW strata communities, highlighting the importance of these inspections.

The property will also need a formal appraisal to ensure it meets the lender’s requirements for your mortgage. If the appraisal comes in lower than expected, you may need to renegotiate the price or increase your down payment.

Finalize Your Purchase

As you approach settlement, stay in close communication with your lender to finalize your mortgage details. This process typically takes 30 to 90 days, depending on your contract terms and state regulations. During this time, you’ll need to review and sign numerous documents, so consider engaging a conveyancer or solicitor to guide you through the legal aspects of the purchase.

On settlement day, final checks will occur, and funds will transfer. Once complete, you’ll receive the keys to your new home. You’ve successfully navigated your first home purchase.

Final Thoughts

Buying your first home requires careful planning, research, and persistence. Our home buying tips for first-time buyers cover essential steps from financial preparation to closing the deal. The journey to homeownership differs for everyone, and challenges are normal along the way. Patience plays a vital role in the process, as you may not find the perfect property immediately or have your first offer accepted.

Staying focused on your goals and maintaining a realistic outlook will help you navigate the real estate market effectively. Don’t hesitate to seek support and guidance during your home buying journey. Home Owners Association offers resources and advice tailored to the local market (specifically for homeowners in Melbourne).

Homeownership goes beyond finding a place to live; it’s about creating a space that reflects your lifestyle and aspirations. With proper preparation, knowledge, and support, you can turn your dream of owning a home into reality. Take action today to start your path towards unlocking the door to your new home.