Owning a home comes with responsibilities, and one of the most important is maintaining your property. At Home Owners Association, we understand that budgeting for these expenses can be challenging.

Estimating annual home maintenance costs is crucial for homeowners to avoid financial surprises. This guide will help you understand the factors that influence these costs and provide strategies to manage them effectively.

What Is the 1% Rule for Home Maintenance?

Understanding the Basics

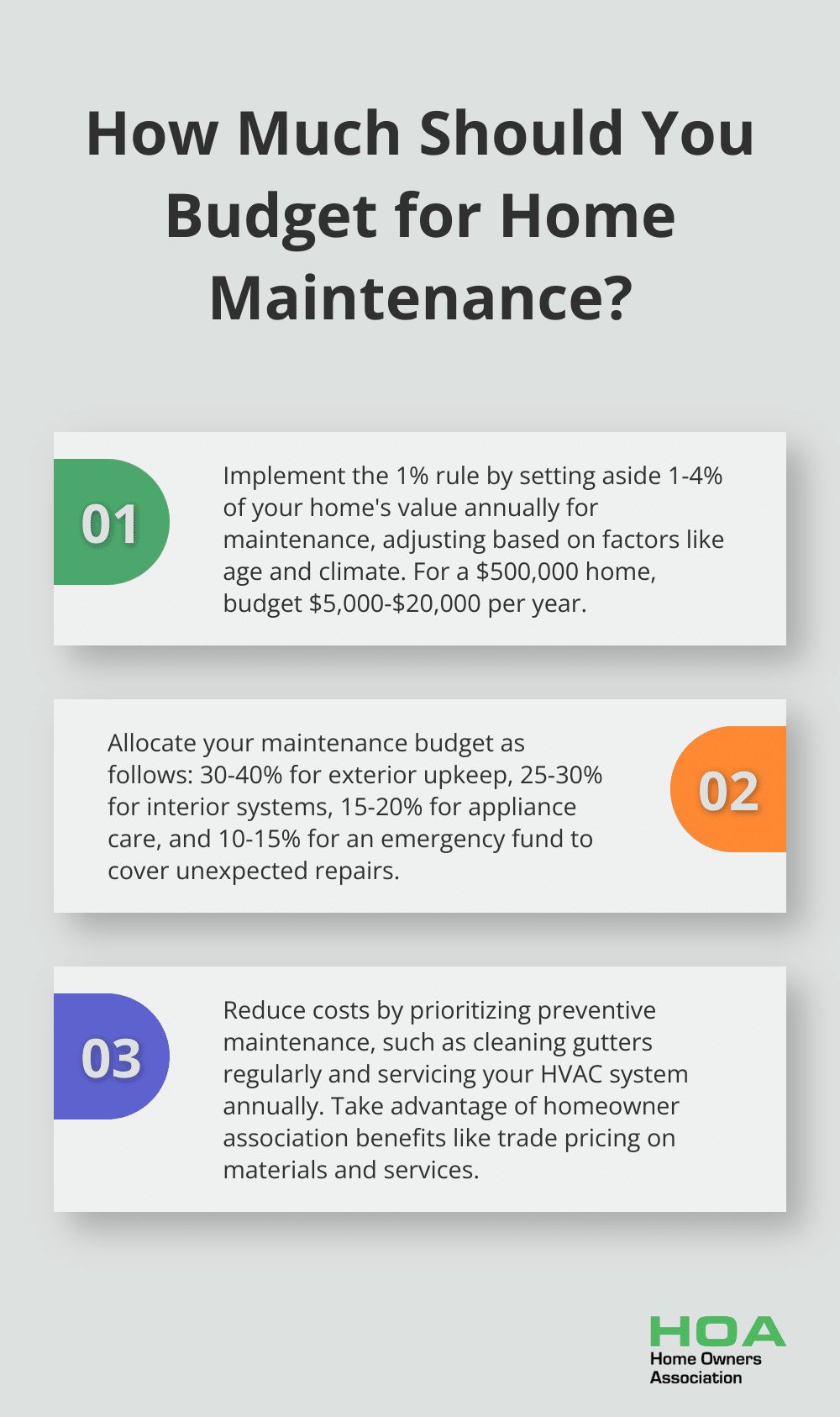

The 1% rule serves as a widely accepted guideline for estimating annual home maintenance costs. This rule suggests that homeowners should set aside 1% to 4% of their home’s value each year for maintenance expenses. For example, if your home is worth $500,000, you can expect to budget between $5,000 and $20,000 annually for upkeep.

The Logic Behind the Rule

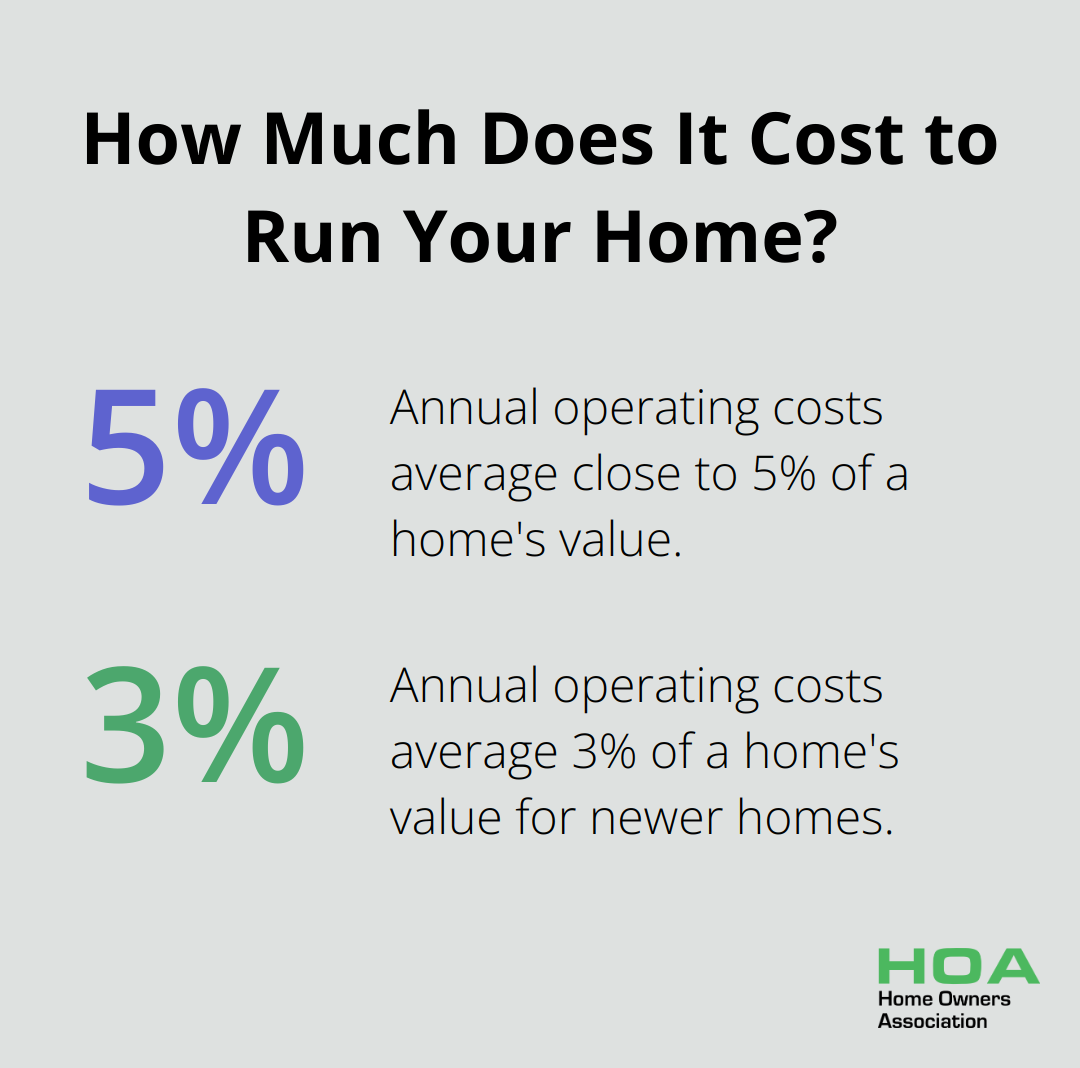

This rule gains popularity due to its simplicity and ability to provide a reasonable baseline for most homeowners. It accounts for the fact that more expensive homes often have higher-end finishes and systems that cost more to maintain. The National Association of Home Builders notes that when measured as a share of home’s value, annual operating costs average close to 5%, but the rate is smaller for newer homes (3% of the home’s value).

Factors Influencing Maintenance Costs

While the 1% rule offers a good starting point, several factors can impact your actual maintenance costs:

- Age of the Home: Older homes in Melbourne, Syndey and Brisbane often require more maintenance. Homes built before 1980 may need up to 4% of their value in annual maintenance.

- Climate: Melbourne’s variable climate (with hot summers and cool winters) can impact maintenance needs. You might need more frequent HVAC servicing or additional weatherproofing.

- Home Size and Features: Larger homes or those with special features (like pools or extensive landscaping) will likely require more maintenance.

Limitations of the 1% Rule

It’s important to understand that the 1% rule isn’t perfect. In some cases, it may underestimate costs, especially for older homes or those in need of significant repairs. Conversely, for newer homes, it might overestimate expenses.

Some Australian homeowners find the square meter method more accurate. This approach suggests budgeting $10 per square metre of your home annually for maintenance. For a 200 square metre home (20sq), you’d set aside $2,000 per year.

Practical Application

To maximize the effectiveness of the 1% rule or any budgeting method, we recommend:

- Create a detailed home inventory, including the age and condition of major systems and appliances.

- Prioritize preventive maintenance to avoid costly repairs down the line.

- Take advantage of trade pricing and discounts (such as those offered by Home Owners Association in Australia) to reduce your overall maintenance costs.

- Adjust your budget based on your home’s specific needs and your experiences over time.

As we move forward, it’s essential to break down home maintenance costs by category to get a more comprehensive understanding of where your money goes. Let’s explore the various aspects of home upkeep and how they contribute to your overall maintenance budget.

Where Does Your Home Maintenance Budget Go?

Exterior Maintenance: Protecting Your Home’s Shell

Exterior maintenance preserves your home’s structural integrity and curb appeal. In Melbourne, where weather can be unpredictable, this category often demands a significant portion of your budget. Roof repairs or replacements can be particularly costly, with the cost of replacing a commercial roof in Australia typically ranging from $15,000 to $60,000, depending on various factors. Siding maintenance, painting, and landscaping also fall into this category. For a typical Melbourne home, you might allocate 30-40% of your annual maintenance budget to exterior upkeep.

Interior Systems: Keeping Your Home Running Smoothly

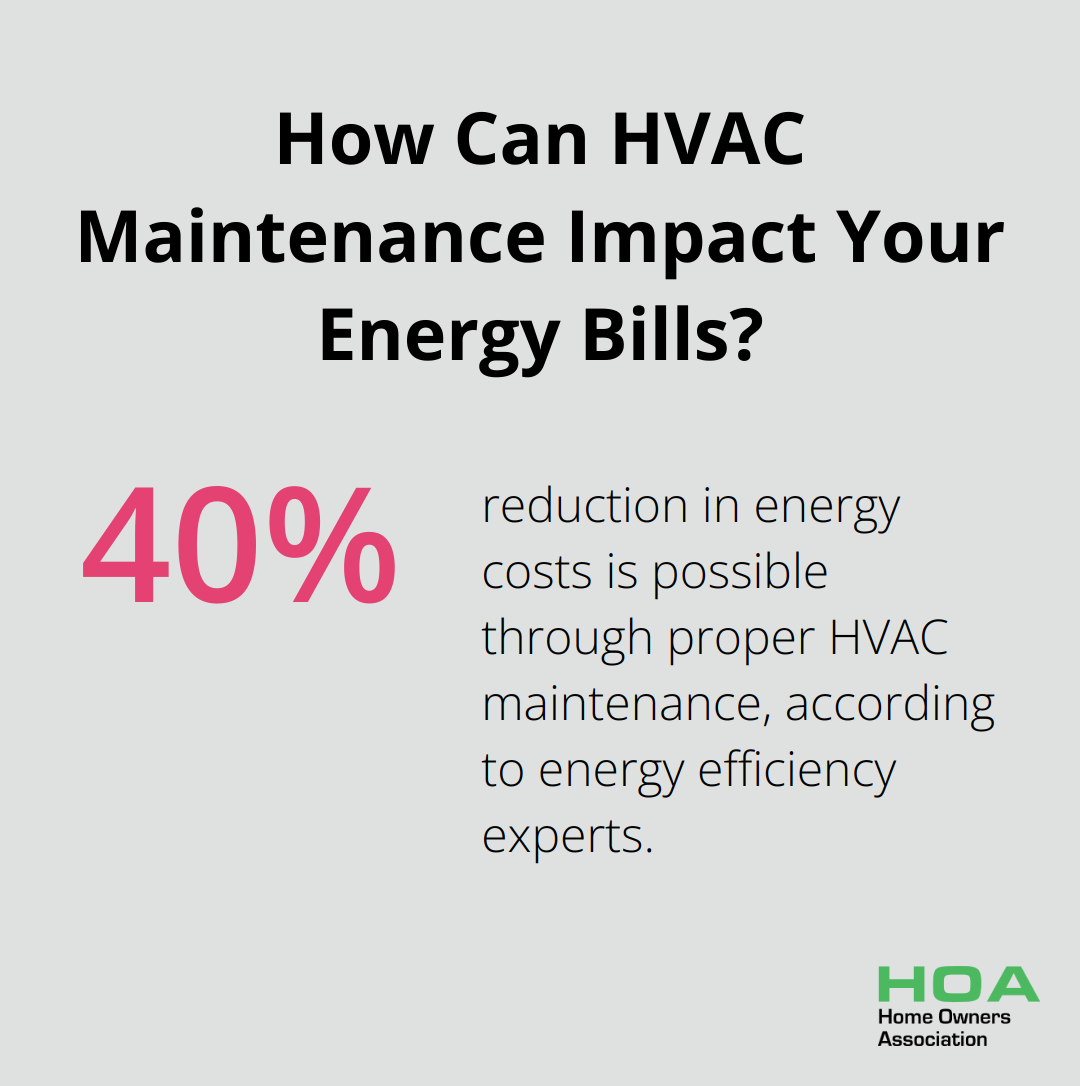

Interior systems like HVAC, plumbing, and electrical are the lifeblood of your home. Regular maintenance of these systems prevents costly breakdowns. In Australia’s climate, HVAC systems work hard year-round, so annual servicing is a must. Proper HVAC maintenance can reduce energy costs by up to 40% (as reported by energy efficiency experts). Plumbing and electrical systems should undergo regular inspections to catch small issues before they become major problems. Try to allocate about 25-30% of your maintenance budget to these critical systems.

Appliance Care: Extending Lifespan and Efficiency

Your home appliances, from refrigerators to washing machines, require regular maintenance to function efficiently. The cost of replacing major appliances can be substantial, so it’s wise to budget for both maintenance and eventual replacement. The average lifespan of a refrigerator is 14 years, while a washing machine typically lasts 11 years (based on consumer reports). Set aside 15-20% of your maintenance budget for appliance care and replacement to avoid financial strain when it’s time for an upgrade.

Emergency Fund: Preparing for the Unexpected

Despite your best efforts, unexpected repairs will arise. Whether it’s a sudden plumbing leak or storm damage, having an emergency fund is essential. We recommend setting aside 10-15% of your total maintenance budget for these unforeseen events. This approach aligns with advice from financial experts who suggest having 3-6 months of living expenses saved for emergencies (including home repairs).

Budgeting Strategies for Australian Homeowners

To effectively manage your home maintenance budget, consider these strategies:

- Create a detailed home inventory, including the age and condition of major systems and appliances.

- Prioritize preventive maintenance to avoid costly repairs down the line.

- Take advantage of trade pricing and discounts (such as those offered by Home Owners Association in Melbourne, Sydney and Brisbae) to reduce your overall maintenance costs.

- Adjust your budget based on your home’s specific needs and your experiences over time.

These percentages serve as guidelines and may vary based on your specific home and circumstances. Regular inspections and preventive maintenance can help you manage costs more effectively over time. As we explore strategies to reduce home maintenance costs in the next section, you’ll discover how to make the most of your budget while keeping your Melbourne home in top condition.

How to Reduce Your Home Maintenance Costs

Prioritize Preventive Maintenance

Regular inspections and preventive maintenance can significantly reduce long-term costs. Address small issues before they escalate to avoid costly repairs. Clean your gutters regularly to prevent water damage to your roof and foundation (potentially saving thousands in repairs). Service your HVAC system annually to ensure it operates at peak efficiency and extend its lifespan.

Melbourne’s variable climate makes weatherproofing your home essential. Seal gaps around windows and doors to prevent drafts and moisture intrusion. This will lower your energy bills and prevent mold growth. These simple tasks cost a fraction of major repairs.

Balance DIY and Professional Services

DIY can save money on labor costs, but it’s important to know your limits. Simple tasks like painting, basic plumbing repairs, or changing air filters are suitable for DIY. However, leave complex electrical work, major plumbing issues, or anything involving gas lines to licensed professionals.

When you hire professionals, obtain multiple quotes and check references. Many associations offer access to vetted contractors at discounted rates, which can lead to significant savings without compromising quality.

Invest in Energy-Efficient Upgrades

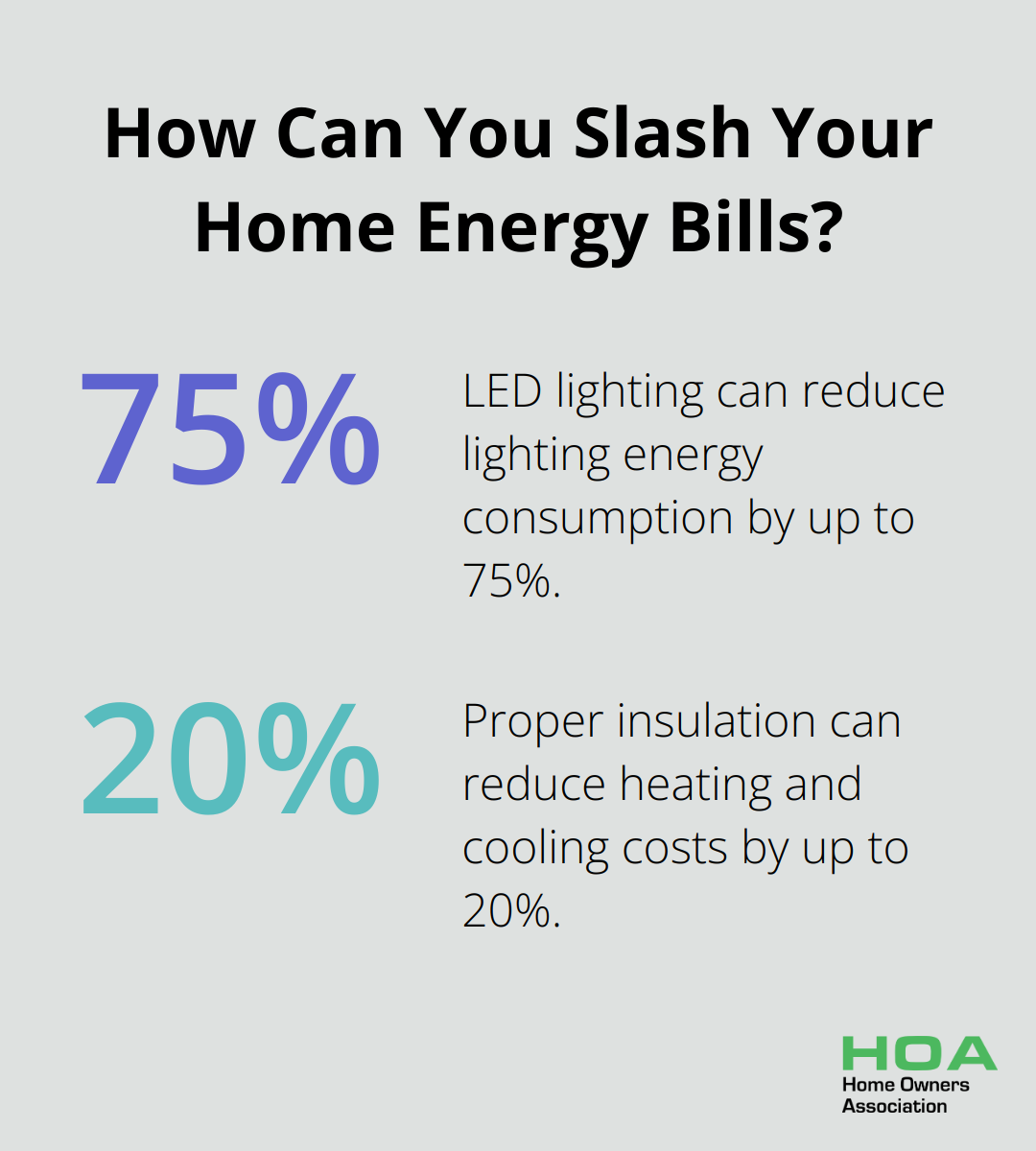

Energy-efficient upgrades may have upfront costs but can lead to substantial long-term savings. In Australia, especially Victoria, where energy prices can be high, these upgrades are particularly beneficial. Replace old appliances with energy-efficient models. For example, switch to LED lighting to reduce your lighting energy consumption by up to 75%.

Insulation is another key area for energy savings. Proper insulation can reduce heating and cooling costs by up to 20%. In Melbourne’s climate, this translates to year-round savings.

Utilize Homeowner Association Benefits

If you’re a member of the Home Owners Association, take full advantage of the benefits offered. Many associations provide access to discounted materials and services. For example, Home Owners Association in Australia offers trade pricing on construction and maintenance materials, which can lead to significant savings on your projects. See our deals page for more.

The Association also provides educational resources and expert advice. Attend workshops or consult with experts to make informed decisions about home maintenance and avoid costly mistakes.

Create a Maintenance Fund

Establish a dedicated maintenance fund to cover both routine upkeep and unexpected repairs. Try to set aside a percentage of your home’s value each year (typically 1-4%). This proactive approach will help you avoid financial stress when maintenance needs arise.

Final Thoughts

Estimating annual home maintenance costs helps homeowners manage their property effectively. The 1% rule, expense categorization, and cost-saving strategies provide a solid foundation for budgeting. However, specific needs may vary based on factors such as home age, location, and unique features.

Regular maintenance preserves and enhances property value over time. Setting aside funds and addressing issues promptly prevents minor problems from becoming major, costly repairs. This proactive approach saves money and ensures a safe, comfortable, and efficient living space.

We at Home Owners Association encourage Melbourne, Sydney and Brisbane homeowners to take charge of their home care. Our exclusive benefits, including trade pricing access and expert advice, can help you make informed decisions about your estimated annual home maintenance costs. Our resources support you in navigating the challenges of maintaining a home in Melbourne’s unique conditions.