Buying your first home is an exciting milestone, but it can also be overwhelming. At Home Owners Association, we understand the challenges faced by first-time buyers and want to help you navigate this journey with confidence.

Our comprehensive guide offers valuable tips for first-time home buyers, covering everything from understanding the market to closing the deal. We’ll walk you through each step of the process, ensuring you’re well-equipped to make informed decisions and find your dream home.

How to Start Your Home Buying Journey

Research Your Local Real Estate Market

Start your home buying journey by exploring your local real estate market. Use online platforms like realestate.com.au and domain.com.au to understand property prices in your desired areas. CoreLogic’s latest data shows median house prices in Australian capital cities, with Brisbane’s median property price for houses at $977,343 and units at $685,291. These figures will help you set realistic expectations.

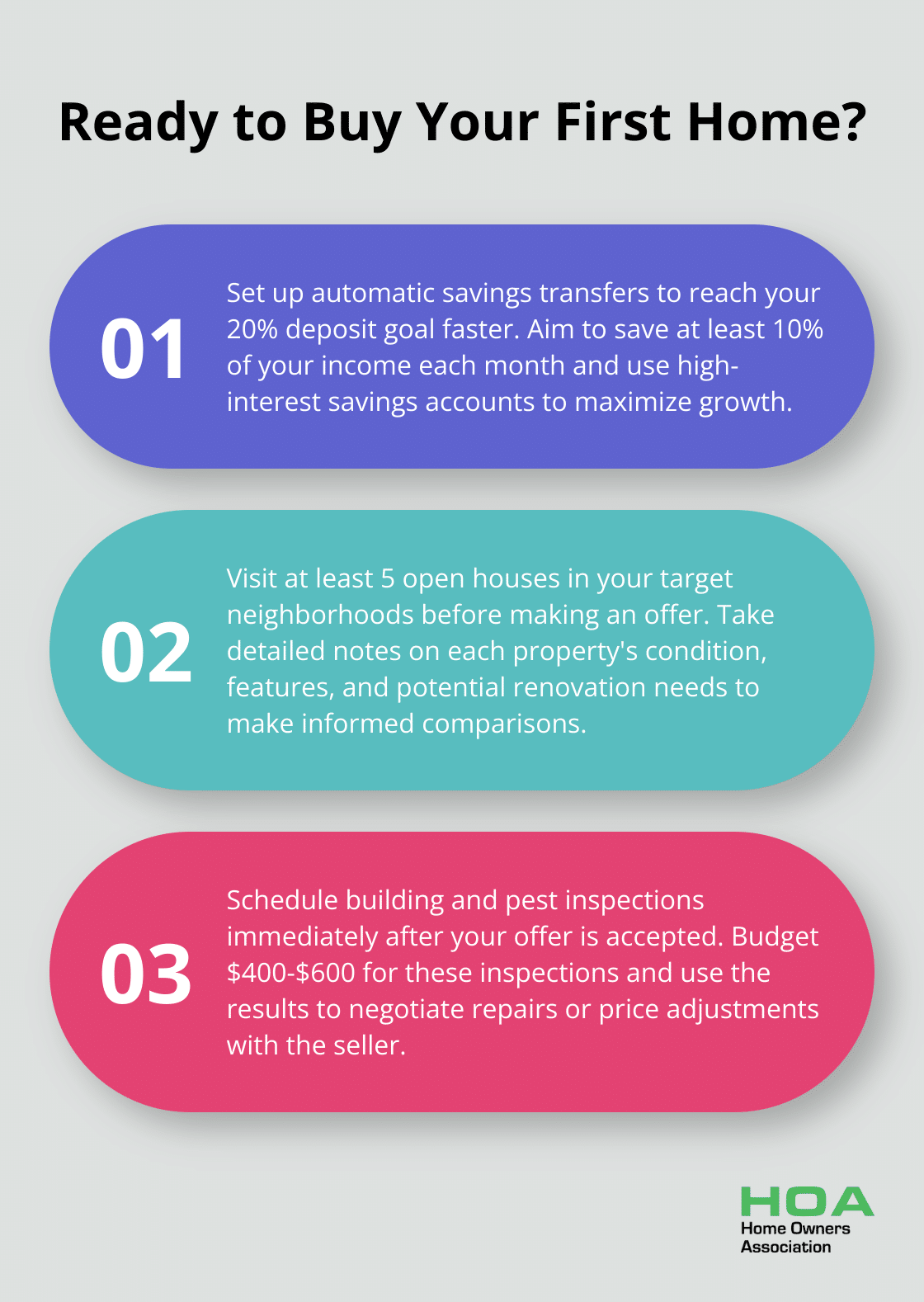

Don’t limit yourself to online research. Visit open houses in your target neighborhoods. This hands-on approach will provide invaluable insights into available properties and their conditions. Keep a notebook (or use a note-taking app) to record your observations for future reference.

Set a Realistic Budget

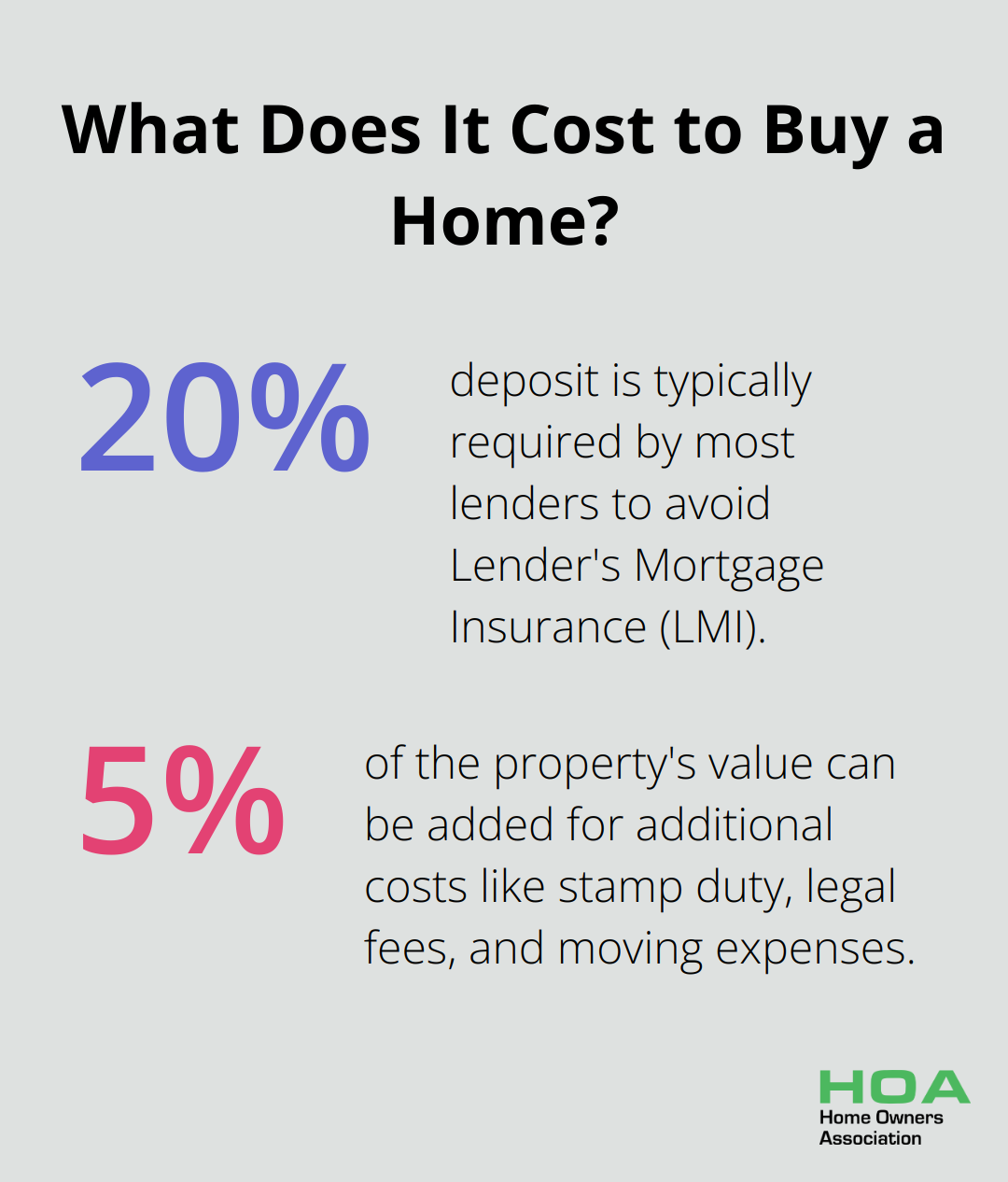

Your budget forms the foundation of your home buying journey. Calculate your current savings and determine how much you can save each month. Most lenders require a 20% deposit to avoid Lender’s Mortgage Insurance (LMI).

Use online mortgage calculators to estimate your borrowing capacity. These tools consider your income, expenses, and current interest rates. As of February 2025, the average interest rate for owner-occupier principal and interest home loans stands at 6.82%, according to the latest data.

Factor in additional costs like stamp duty, legal fees, and moving expenses. These can add up to 5% of the property’s value. It’s also wise to consider future maintenance costs when setting your budget.

Secure Pre-Approval

Pre-approval for a mortgage is a critical step. It clarifies what you can afford and demonstrates to sellers that you’re a serious buyer. Contact multiple lenders to compare rates and terms.

When you apply for pre-approval, prepare to provide documentation such as proof of income, bank statements, and identification. Lenders will scrutinize your spending habits, so clean up your finances a few months before applying.

Find the Right Real Estate Agent

A skilled real estate agent can become your greatest asset in navigating the property market. Look for an agent with extensive experience in your desired area and a track record of successful sales. Ask for recommendations from friends or family who’ve recently bought homes.

When you interview potential agents, ask about their negotiation strategies and how they plan to help you find properties that match your criteria. A good agent should provide insights into local market trends and upcoming developments that could affect property values.

Choose an agent who is patient, responsive, and genuinely invested in helping you find the perfect home. Don’t settle for someone who pressures you or dismisses your concerns.

With these steps completed, you’ll be well-prepared to move on to the next exciting phase of your home buying journey: finding the right property that meets your needs and budget.

Finding Your Dream Home

Prioritize Your Must-Haves

Create a detailed list of features you absolutely need in your new home. This might include a specific number of bedrooms, a home office space, or a garden for your pets. Be realistic about what you can afford within your budget. The current median house value is $520,000, and it’s projected to increase significantly in the coming year, so you’ll need to align your expectations with market realities.

Identify your deal-breakers. These are features or issues that would immediately rule out a property. Common deal-breakers include a long commute, lack of parking, or being in a flood-prone area. Clear definition of these non-negotiables will save time and prevent emotional attachment to unsuitable properties.

Explore Neighborhoods Thoroughly

When you evaluate potential neighborhoods, look beyond just the property itself. Research local amenities, schools, and transport links. The Australian Bureau of Statistics provides detailed demographic information for different areas, which can give you insights into the community you might join.

Pay attention to future development plans in the area. These can significantly impact property values and your quality of life. Check with local councils for information on upcoming projects or zoning changes. A neighborhood undergoing revitalization could offer great potential for appreciation (but also consider the disruption of ongoing construction).

Assess Property Condition and Potential

As you view properties, focus on structural integrity, insulation, and major systems like plumbing and electrical. The National Construction Code sets thermal performance properties and energy efficiency standards for buildings, which may impact older homes.

Consider the potential for adding value through renovations. However, exercise caution to avoid over-capitalizing. The Housing Industry Association suggests that renovations should not exceed 10% of the property’s value to ensure a good return on investment.

Take Your Time and Ask Questions

Many first-time buyers overlook important aspects during property viewings. Take your time, ask questions, and if possible, bring along a trusted friend or family member for a second opinion. This is likely the biggest purchase you’ll ever make, so thoroughness is key.

Prepare for the Next Steps

As you narrow down your choices and find properties that meet your criteria, you’ll need to prepare for making offers and navigating the closing process. This next phase requires careful consideration and often involves complex negotiations. Let’s explore how to approach these final stages of your home buying journey.

Sealing the Deal on Your Dream Home

Craft a Competitive Offer

Your real estate agent will help you determine a fair offer price. They will conduct a comparative market analysis, examining recent sales of similar properties in the area. This data-driven approach ensures your offer is competitive without overpaying.

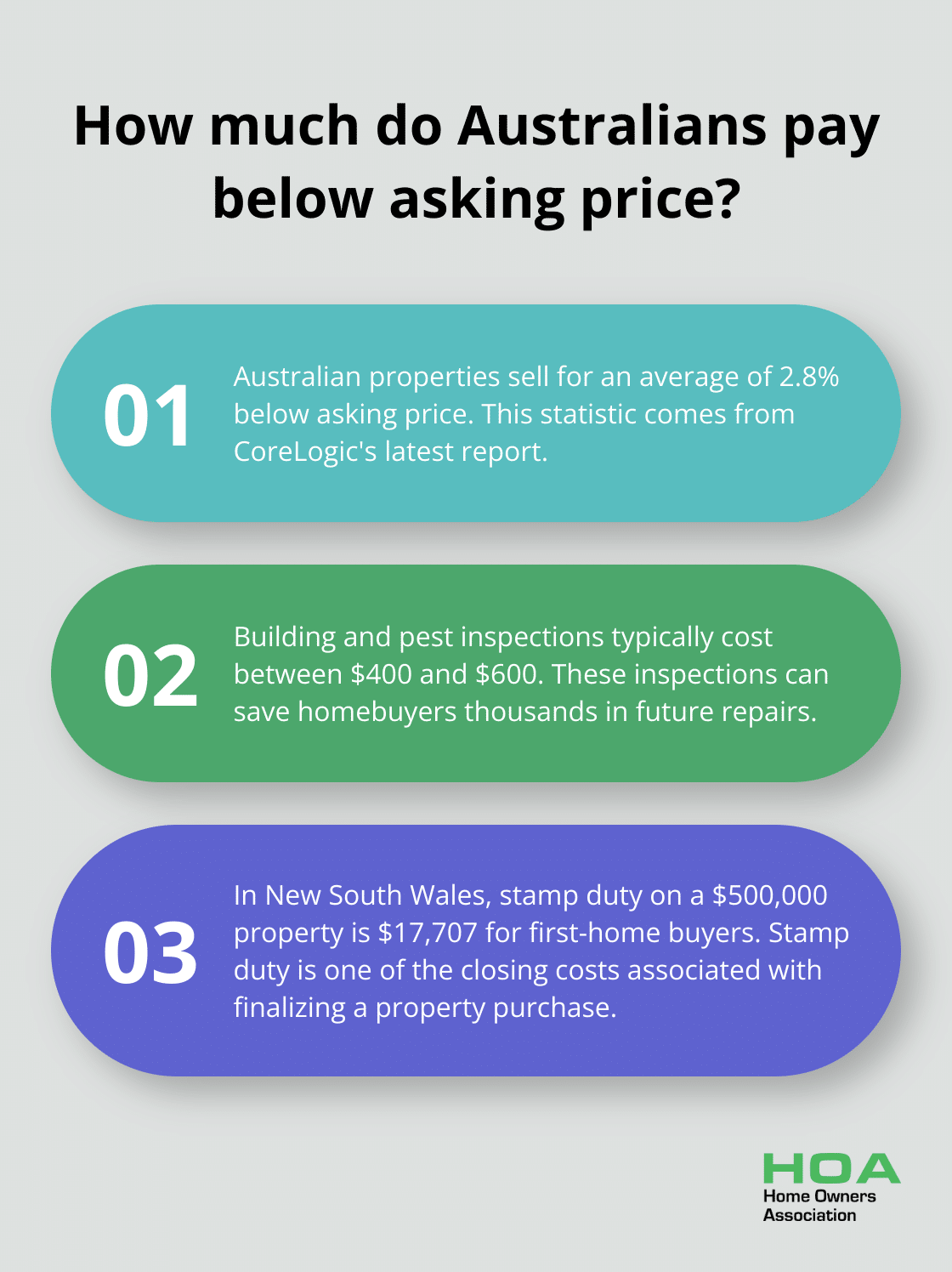

In Australia’s current market, properties sell for an average of 2.8% below the asking price (according to CoreLogic’s latest report). However, this varies significantly by location and property type. In high-demand areas, you might need to offer at or above the asking price to secure your dream home.

Consider including a personal letter with your offer, explaining why you love the property. This emotional connection can sometimes sway sellers, especially in a competitive market.

Master the Art of Negotiation

Negotiation is a normal part of the home buying process. Prepare for some back-and-forth. Your agent will communicate with the seller’s agent, presenting your offer and any counteroffers.

Focus on more than just the price. Negotiate on settlement dates, included fixtures, and even minor repairs. These elements can add significant value to your purchase.

If you’re buying in a hot market, consider a ‘time clause’ in your offer. This gives the seller a set timeframe to accept, preventing them from using your offer to drive up the price with other buyers.

Protect Your Investment

Once the seller accepts your offer, protect your investment with thorough due diligence. Schedule a professional building and pest inspection immediately. These typically cost between $400 and $600 but can save you thousands in future repairs.

A building and pest inspection is crucial when purchasing a property to ensure there are no readily identifiable issues. The Australian Institute of Conveyancers recommends including a building and pest inspection clause in your contract. This allows you to withdraw or renegotiate if the inspection uncovers significant issues.

Don’t forget to check for any planning restrictions or future developments that could affect your property. Your local council can provide this information (often for a small fee).

Finalize the Purchase

The final step involves signing the contract of sale. This legally binding document outlines all the terms of your purchase. Have your conveyancer or solicitor review it thoroughly before you sign.

Prepare for the costs associated with closing. These typically include stamp duty, legal fees, and mortgage registration fees. In New South Wales, for example, stamp duty on a $500,000 property is currently $17,707 for first-home buyers.

Once all conditions are met and finances are in order, you’ll proceed to settlement. This is when ownership officially transfers to you.

Final Thoughts

Your first home purchase marks a significant milestone in your life. We encourage you to approach this journey with patience and thorough research. Our guide provides essential tips for first-time home buyers to navigate the complex real estate world confidently.

Professional support can prove invaluable during this process. Real estate agents, mortgage brokers, and legal advisors offer tailored insights to your specific situation. Friends or family who recently purchased homes can also share practical advice to help you avoid common pitfalls.

Home Owners Association stands ready to support you through every step of your home buying journey. Our resources, expert advice, and member benefits empower Melbourne homeowners to make informed decisions. We invite you to leverage our services and turn your homeownership dreams into reality.