Buying your first home is an exciting milestone, but it can also be overwhelming. At Home Owners Association, we understand the challenges first-time buyers face.

This guide offers essential first-time home owners tips to help you navigate the process with confidence. From financial preparation to closing the deal, we’ll walk you through each step of your home buying journey.

How to Prepare Financially for Your First Home

Financial preparation stands as a cornerstone of successful first-time home buying. This process should start well before your intended purchase date to ensure you’re in the best position possible.

Assess Your Financial Situation

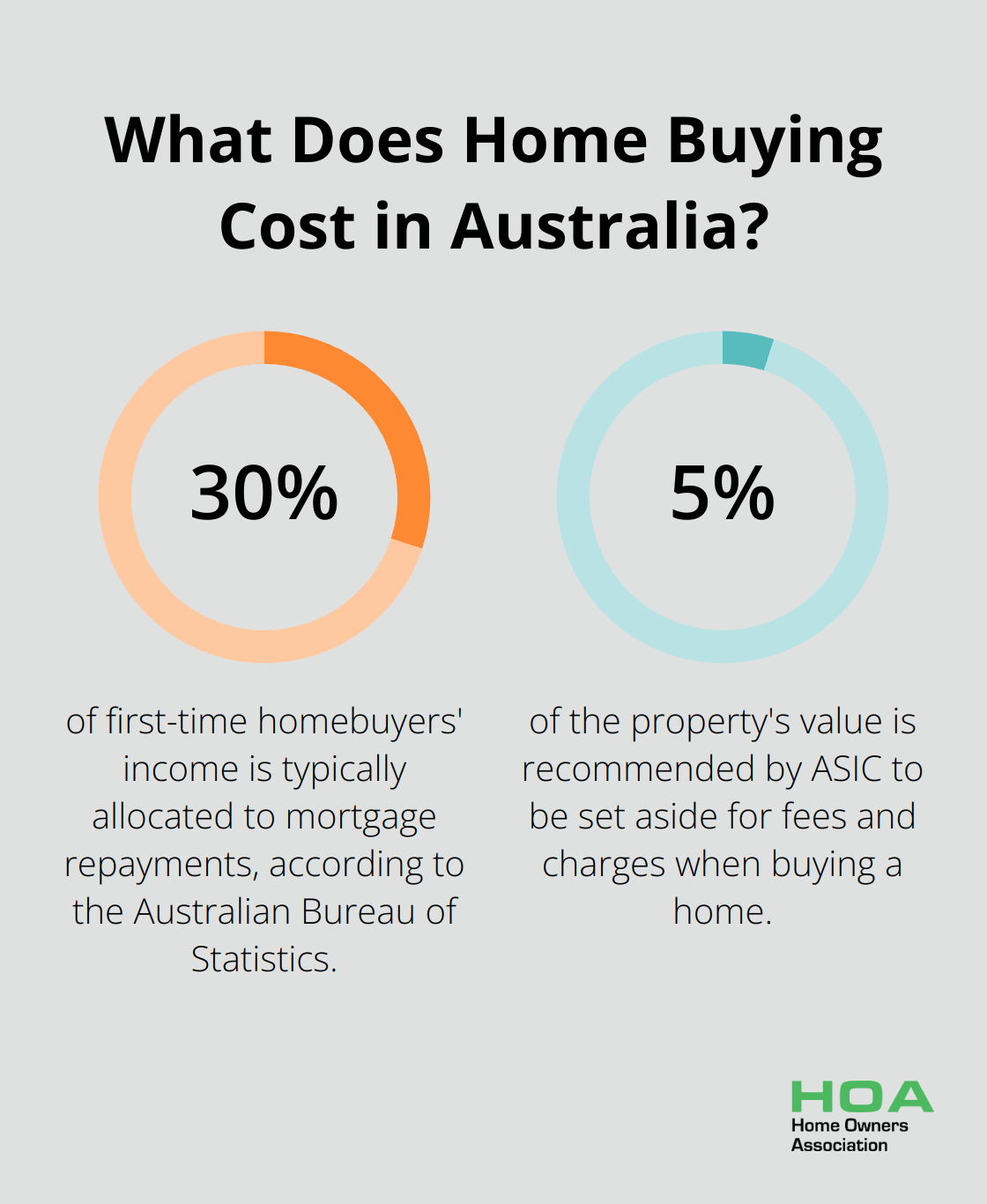

Start with a thorough examination of your income, expenses, and savings. Create a detailed budget that accounts for all your monthly costs. This will help you determine how much you can realistically afford to spend on a home. The Australian Bureau of Statistics reports that first-time homebuyers typically allocate about 30% of their income to mortgage repayments. Use this as a guideline when you set your budget.

Save for Your Down Payment

Most lenders in Australia require a minimum down payment of 5% to 20% of the property’s value. Try to save at least 20% to avoid Lender’s Mortgage Insurance (LMI). LMI is insurance that a lender takes out to insure itself against the risk of not recovering the outstanding loan balance. The First Home Super Saver Scheme (FHSSS) can boost your savings. This scheme allows first home buyers to make extra voluntary superannuation contributions to save on tax and build a deposit.

Improve Your Credit Score

Your credit score significantly influences your ability to secure a favorable mortgage rate. In Australia, a credit score above 800 is considered excellent. To improve your score:

- Pay bills on time

- Reduce credit card balances

- Avoid applying for new credit in the months leading up to your home purchase

Check your credit report regularly and dispute any errors you find.

Get Pre-Approved for a Mortgage

Mortgage pre-approval is a vital step in the home buying process. It gives you a clear idea of how much you can borrow and demonstrates to sellers that you’re a serious buyer. Pre-approvals typically remain valid for three to six months. When applying, have your financial documents ready, including proof of income, bank statements, and identification.

Factor in additional costs beyond the purchase price. The Australian Securities and Investments Commission (ASIC) recommends setting aside about 5% of the property’s value for fees and charges. These may include stamp duty, legal fees, and moving expenses.

With these financial preparations in place, you’ll be ready to move on to the next exciting step: finding the right property for your needs and budget.

Where Should You Look for Your First Home?

Define Your Property Wishlist

Create a comprehensive list of features you want in your new home. Divide these into must-haves and nice-to-haves. Must-haves might include the number of bedrooms, proximity to public transport, or a specific school district. Nice-to-haves could be a large backyard or a modern kitchen. This list will help you focus your search and make decisions when comparing properties.

Explore Potential Neighborhoods

Research is key when you choose the right location. Use platforms like realestate.com.au and domain.com.au to understand property prices in your desired areas. These figures can help you gauge what to expect in different markets.

Don’t just rely on online research. Spend time in the neighborhoods you consider. Visit at different times of the day and week to get a feel for the area. Check out local amenities, assess the commute to your workplace, and research future development plans that could impact property values.

Partner with a Real Estate Professional

A knowledgeable real estate agent can provide invaluable assistance in your home search. They can help you understand the legal and financial implications of buying a property, including stamp duty, conveyancing fees, and mortgage options. When you choose an agent, look for someone with experience in your target areas and a track record of successful transactions with first-time buyers.

Attend Open Houses and Private Viewings

Nothing beats seeing properties in person. Attend open houses to get a feel for what’s available in your price range. When you find properties that interest you, schedule private viewings for a more thorough inspection. During these visits, pay attention to the property’s structural integrity, natural light, and overall layout. Don’t hesitate to ask questions about the property’s history, recent renovations, or any issues the current owners have experienced.

Buying your first home is a significant decision. Take your time, do your research, and avoid rushing into anything. With careful consideration and the right support (such as the resources provided by Home Owners Association), you’ll find a property that not only meets your needs but also sets you up for future success in the property market. As you narrow down your options, it’s time to consider the next step: making an offer and navigating the purchase process.

How to Close the Deal on Your First Home

Make a Competitive Offer

In today’s real estate market, a strong offer is essential. Research recent sales of similar properties in the area to determine a fair price. Your real estate agent can provide valuable insights into local market conditions and help you craft an offer that stands out.

Consider including a personal letter with your offer to create an emotional connection with the seller. This can be particularly effective in competitive markets. Prepare to negotiate on settlement dates and included fixtures in addition to the price to add value to your offer.

Navigate Negotiations and Contingencies

Negotiations are a normal part of the home buying process. Be clear about your budget limits and don’t hesitate to walk away if the terms don’t align with your needs. Include contingencies in your offer to protect yourself. Common contingencies include:

- Finance clause: Allows you to back out if you can’t secure a loan

- Building and pest inspection: Gives you the option to withdraw if significant issues are found

- Sale of current property: Necessary if you need to sell your current home to fund the purchase

The Australian Institute of Conveyancers advises including a building and pest inspection clause in your contract for additional security. This inspection typically costs between $400 and $600 but can save you thousands in potential repair costs.

Conduct Professional Inspections

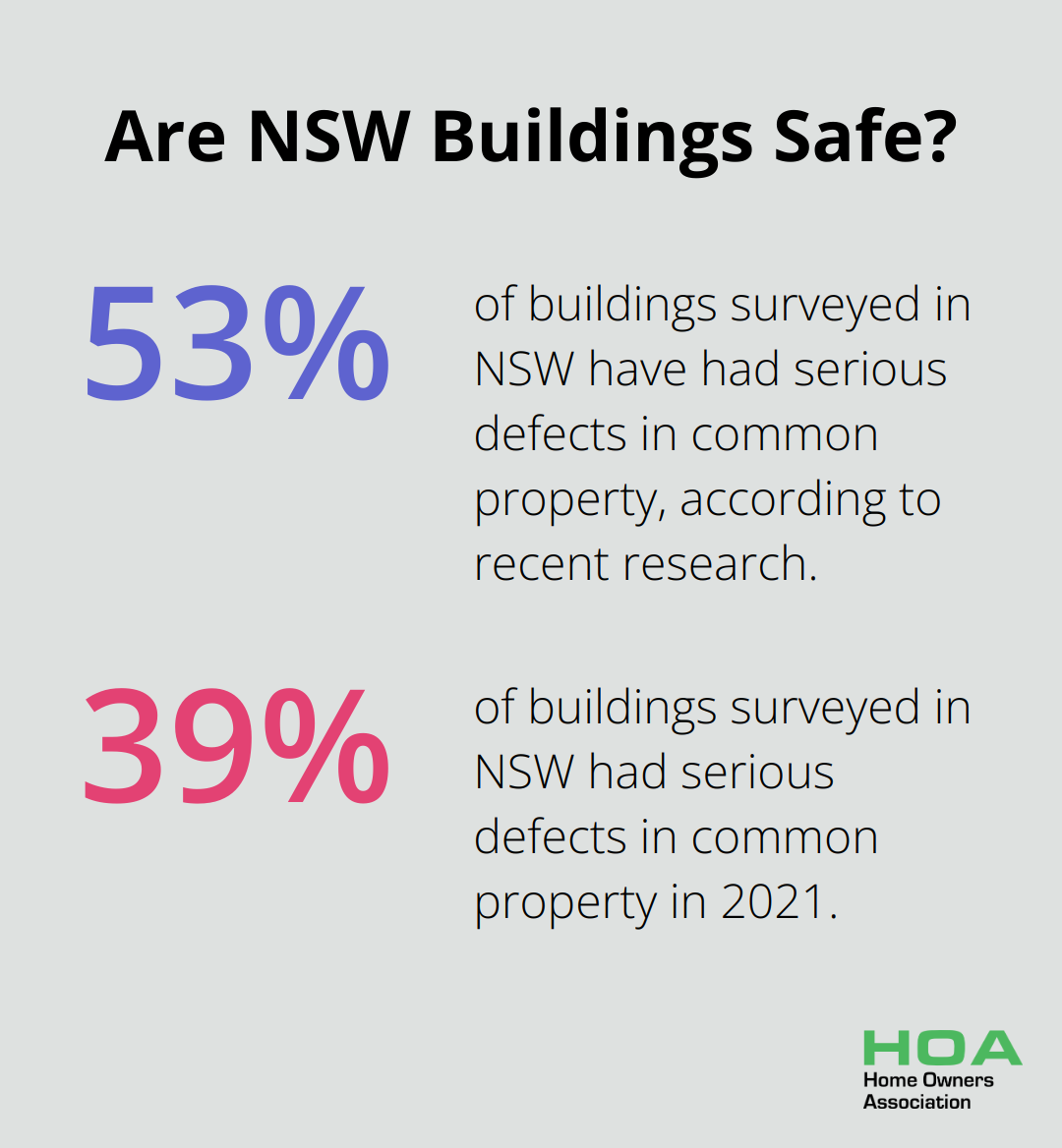

Never skip the professional inspection. Recent research shows that 53% of buildings surveyed in NSW have had serious defects in common property, up from 39% in 2021. A thorough inspection can uncover issues that aren’t visible during a casual walkthrough, such as electrical problems, plumbing issues, or structural concerns.

If the inspection reveals significant problems, you have several options:

- Request repairs from the seller

- Negotiate a lower price to cover repair costs

- Walk away from the deal if the issues are too severe

Finalize the Purchase

The final stage involves reviewing and signing a mountain of paperwork. Work closely with your conveyancer or solicitor to understand every document you’re signing. They’ll conduct title searches and prepare legal documents during the settlement period, which usually takes 30 to 90 days.

Prepare for potential hurdles. For instance, if the property valuation comes in lower than expected, you may need to renegotiate with the seller or adjust your loan amount. Clear communication with your lender, agent, and legal representative can prevent last-minute issues and ensure a smooth transition to homeownership.

Home Owners Association (established in 1980) offers resources and expert guidance throughout this process. Our team can provide valuable insights to help you navigate these final steps with confidence, ensuring you’re well-prepared for the exciting moment when you receive the keys to your first home.

Final Thoughts

Your first home purchase marks a significant milestone that demands careful planning and research. You must assess your financial situation, save for a down payment, find the right property, and close the deal with attention to detail. Expert guidance proves invaluable throughout this complex process, so work with experienced professionals such as real estate agents, mortgage brokers, and legal advisors.

We at Home Owners Association offer support for your home buying journey. Our team provides expert advice, educational materials, and personalized guidance to ensure a smooth and successful experience. Members benefit from resources tailored to the Melbourne, Australia market, including trade pricing and discounts on construction materials.

Leverage the knowledge and support available to make informed decisions and turn your homeownership dream into reality. As you settle into your new home, continue to educate yourself about property maintenance, local regulations, and market trends (this protects and enhances your investment). Our first-time home owners tips will help you navigate this exciting new chapter in your life.