Owning a dream home is a goal many of us share. At Home Owners Association, we understand the challenges of saving for such a significant purchase.

This guide offers practical tips for saving for a home, helping you turn your homeownership dreams into reality. We’ll explore strategies to set clear financial goals, create a budget, and boost your income to accelerate your savings journey.

Setting Your Home Savings Target

Defining Your Dream Home’s Cost

The first step to save for a home requires research of the current housing market in your desired area. The Australian Bureau of Statistics reports that the median house price in Australia’s capital cities was $808,000 as of December 2024. This figure varies widely depending on location. In Sydney, you might look at around $1.2 million for a median-priced home, while in Adelaide, it could be closer to $650,000.

Calculating Your Down Payment

Most lenders in Australia require a minimum deposit of 20% to avoid Lender’s Mortgage Insurance (LMI). The amount of LMI premium depends on the lender, how much it lends to you, and the size of your deposit. Using the national median price, you’ll need to save at least $161,600 for a deposit. Some government schemes allow first-time buyers to purchase with as little as a 5% deposit. It’s important to factor in additional costs like stamp duty, legal fees, and moving expenses (which can add another 5% to your savings goal).

Setting a Realistic Timeline

The time it takes to save for a home deposit varies based on your income and expenses. Recent data from the Australian Housing and Urban Research Institute shows it takes the average Australian household 11.4 years to save a 20% deposit. This doesn’t mean you can’t do it faster.

To set a realistic timeline, divide your savings goal by the amount you can save each month. For example, if you need $200,000 and can save $2,000 monthly, it would take you about 8.3 years. Don’t be discouraged – there are ways to speed up this process, which we’ll explore in the following sections.

Strategies to Accelerate Your Savings

- Automate your savings: Set up automatic transfers to your savings account on payday.

- Cut unnecessary expenses: Review your subscriptions and memberships, and eliminate those you don’t use.

- Increase your income: Consider a side job or freelance work to boost your savings.

- Use high-interest savings accounts: Take advantage of competitive interest rates to grow your money faster.

Leveraging Government Assistance

Many Australian states offer first home buyer grants and stamp duty concessions. Research the options available in your area. For instance, the First Home Owner Grant (FHOG) in Victoria offers $10,000 for eligible first-time buyers purchasing new homes valued up to $750,000.

The journey to homeownership starts with a clear plan. In the next section, we’ll explore how to create a budget and cut expenses, bringing you closer to your dream home. These practical strategies will help you maximize your savings potential and reach your goal faster.

Mastering Your Budget for Home Savings

Track Your Finances

The first step to control your budget is to understand your financial situation. Use budgeting apps or spreadsheets to record all income and expenses for at least three months. This will reveal your spending patterns and highlight areas for improvement. A 2024 survey by the Australian Securities and Investments Commission (ASIC) found that Australians who track their expenses save an average of 18% more than those who don’t.

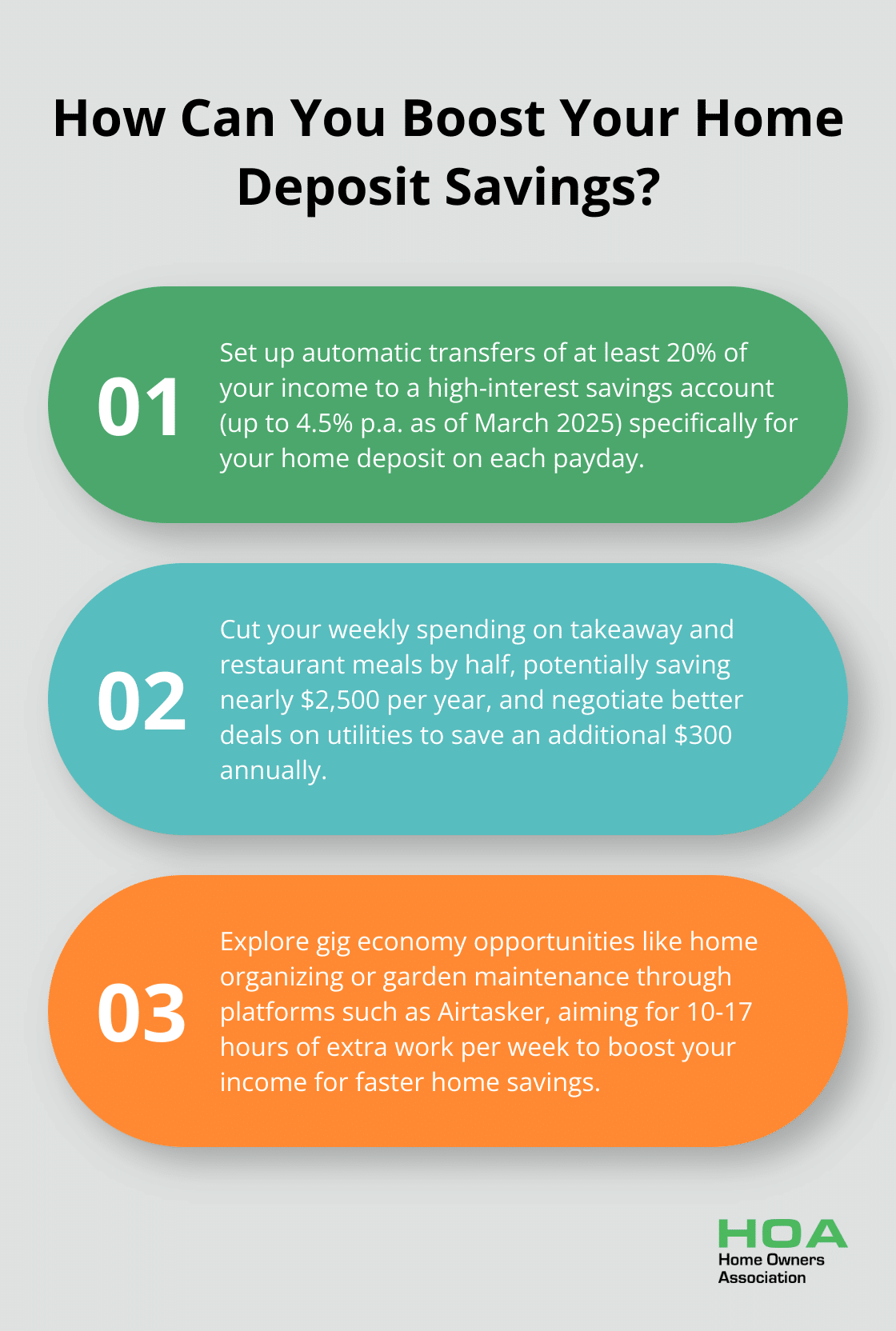

Trim the Fat

After you have a clear view of your spending, identify areas where you can cut back. Focus on non-essential expenses first. The Australian Bureau of Statistics reports that the average Australian household spends $95 per week on takeaway and restaurant meals. If you reduce this by half, you could save nearly $2,500 per year.

Try to negotiate better deals on your utilities and subscriptions. A study by Canstar Blue found that Australians who switched energy providers saved an average of $300 annually. Don’t overlook small expenses either – they add up. If you cut out a daily $4 coffee, you could save over $1,000 per year.

Supercharge Your Savings

Now that you’ve freed up some cash, allocate it towards your home savings fund. Set up a high-interest savings account specifically for your home deposit. As of March 2025, some Australian banks offer savings accounts with interest rates up to 4.5% p.a.

Automate your savings by setting up a direct debit from your main account to your savings account on payday. This “pay yourself first” strategy ensures you consistently work towards your goal. Try to save at least 20% of your income, but remember – every dollar counts.

Consider the 50/30/20 budgeting rule: allocate 50% of your income to needs, 30% to wants, and 20% to savings. This percentage-based budget concept emerged in the late 90s. However, if you want to fast-track your home savings, you might adjust this to 60/20/20 or even 70/10/20.

Leverage Expert Advice

Home Owners Association (proudly serving Australia since 1980) offers expert advice and resources to help you maximize your savings potential. Our personalized guidance can help you make informed decisions throughout your savings journey, ensuring you’re on the right track to homeownership.

These strategies will not just cut your expenses – they will invest in your future home. In the next section, we’ll explore ways to boost your income, which will further accelerate your journey to homeownership.

Boosting Your Income for Faster Home Savings

Embrace the Gig Economy

The gig economy provides flexible opportunities to earn extra income. A 2023 report by the Australian Bureau of Statistics reveals that the majority of gig workers (53%) undertook less than 10 hours of paid per task work, with the average paid hours worked being 17.7 hours and the median being 10 hours. Popular platforms such as Airtasker, Uber, and Freelancer.com connect skilled individuals with short-term jobs.

Some individuals report success with specialized home-related gigs. Tasks like home organizing, garden maintenance, or minor repairs can help you build valuable skills for future homeownership.

Monetize Your Possessions

Selling unused items provides a quick boost to your savings. Platforms like eBay, Facebook Marketplace, and Gumtree offer easy ways to sell items. Electronics, furniture, and clothing are particularly popular categories.

You can rent out assets you don’t use frequently. Websites like Car Next Door allow you to rent out your car when you’re not using it. If you have a spare room, platforms like Airbnb could generate additional income.

Explore Passive Income Opportunities

Passive income can provide a steady stream of earnings with minimal daily involvement. Dividend-paying stocks and exchange-traded funds (ETFs) are popular options. Historical returns based on the All Ordinaries Accumulation Index (XAOA), which includes dividends, provide insight into potential earnings.

Real estate investment trusts (REITs) offer another way to invest in property without the large upfront costs of buying a home.

For those with specific skills or knowledge, creating and selling digital products like e-books, online courses, or stock photography can generate ongoing income.

Maximize Your Current Job

Try to increase your income within your current employment. Request a salary review with your employer, highlighting your achievements and value to the company.

Consider upskilling or obtaining additional qualifications to increase your earning potential. Online platforms like Coursera and edX offer affordable courses in various fields.

To reach your savings goal faster, automate your savings. Set up a direct deposit from your paycheck into a high-yield savings account. This approach ensures consistent progress towards your dream home.

Final Thoughts

Saving for your dream home demands dedication and strategic planning. You must set clear financial goals, create a budget, cut expenses, and explore additional income streams. These steps will significantly advance your journey towards homeownership.

Homeownership provides stability, builds equity, and becomes a valuable asset for your future. Property values typically appreciate over time, making your home an investment in your financial well-being. Your home also gives you the freedom to customize your living space according to your preferences and needs.

We at Home Owners Association urge you to start your savings journey today. The path may seem challenging, but the rewards of homeownership are worth the effort. Our tips for saving for a home can help you navigate this journey with confidence and success.