At Home Owners Association, we understand the challenges of financing home improvements. The Help to Buy scheme offers a potential solution for homeowners looking to enhance their properties.

This guide will walk you through using Help to Buy for home improvements, from understanding eligibility criteria to maximizing the benefits of the scheme.

We’ll provide practical tips and insights to help you navigate the application process and make informed decisions about your home renovation projects.

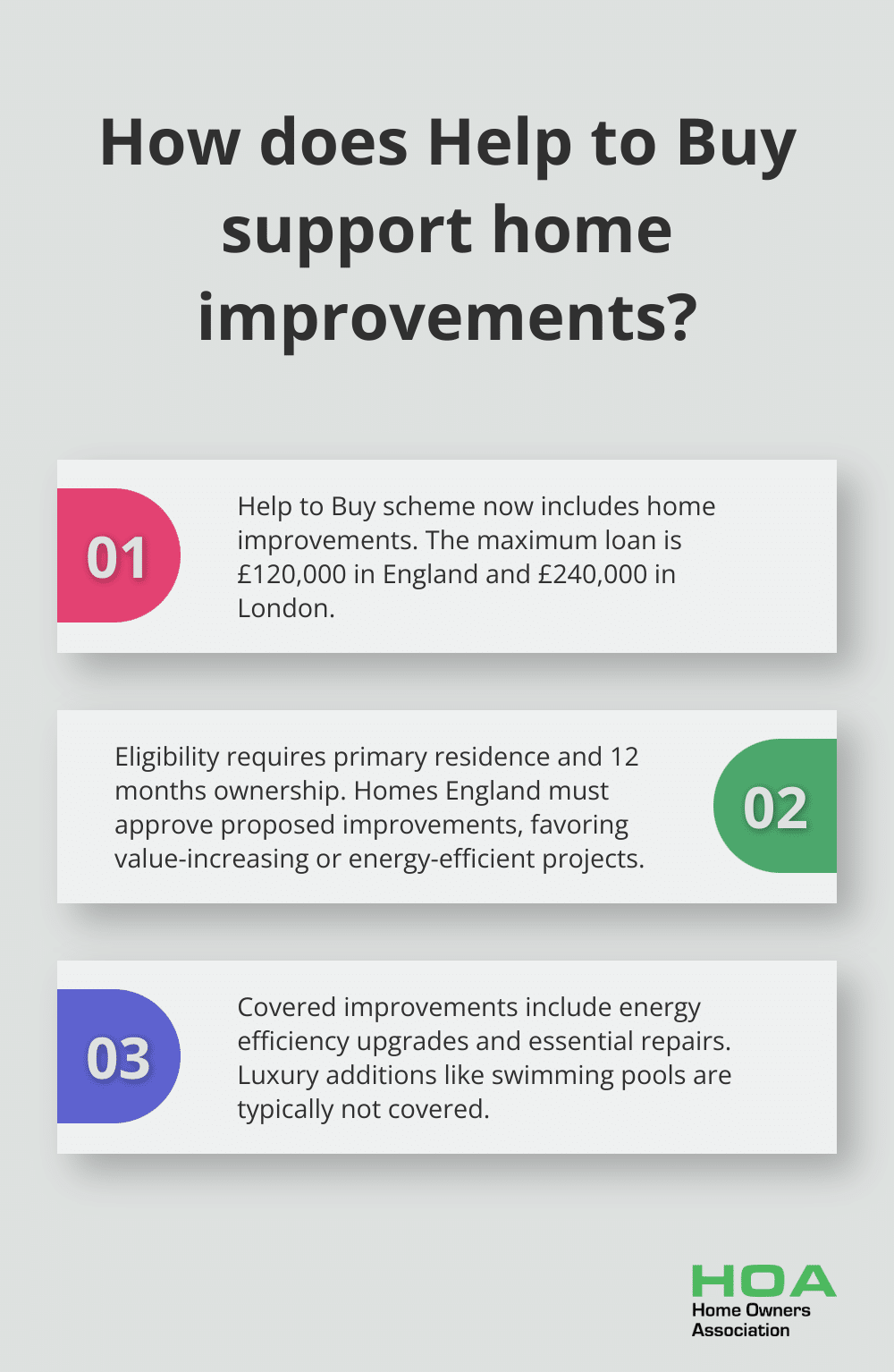

What is Help to Buy for Home Improvements?

Understanding the Basics

The Help to Buy scheme has expanded its scope to include provisions for home improvements. This evolution allows eligible homeowners to access funds for renovations and upgrades. The maximum you can borrow from Help to Buy in England is £120,000 and up to £240,000 for London. There is no minimum amount. This loan remains interest-free for the first five years, which makes it an attractive option for many homeowners.

Eligibility Criteria

To qualify for Help to Buy home improvement funds, homeowners must meet specific criteria:

- The property must be your primary residence

- You must have purchased the property through the Help to Buy equity loan scheme

- You must have owned the property for at least 12 months before applying for improvement funds

It’s important to note that Homes England (the government body overseeing the scheme) must approve your proposed improvements. They typically favor projects that increase the property’s value or energy efficiency.

Types of Covered Improvements

While Homes England assesses each application individually, certain types of improvements are more likely to receive approval. These typically include:

- Energy efficiency upgrades (e.g., insulation, double-glazing, solar panel installation)

- Essential repairs or maintenance to ensure the property’s structural integrity

- Accessibility modifications for disabled residents

- Kitchen and bathroom renovations that significantly improve functionality

However, luxury additions (such as swimming pools or extensive landscaping) usually don’t fall under the scheme’s coverage.

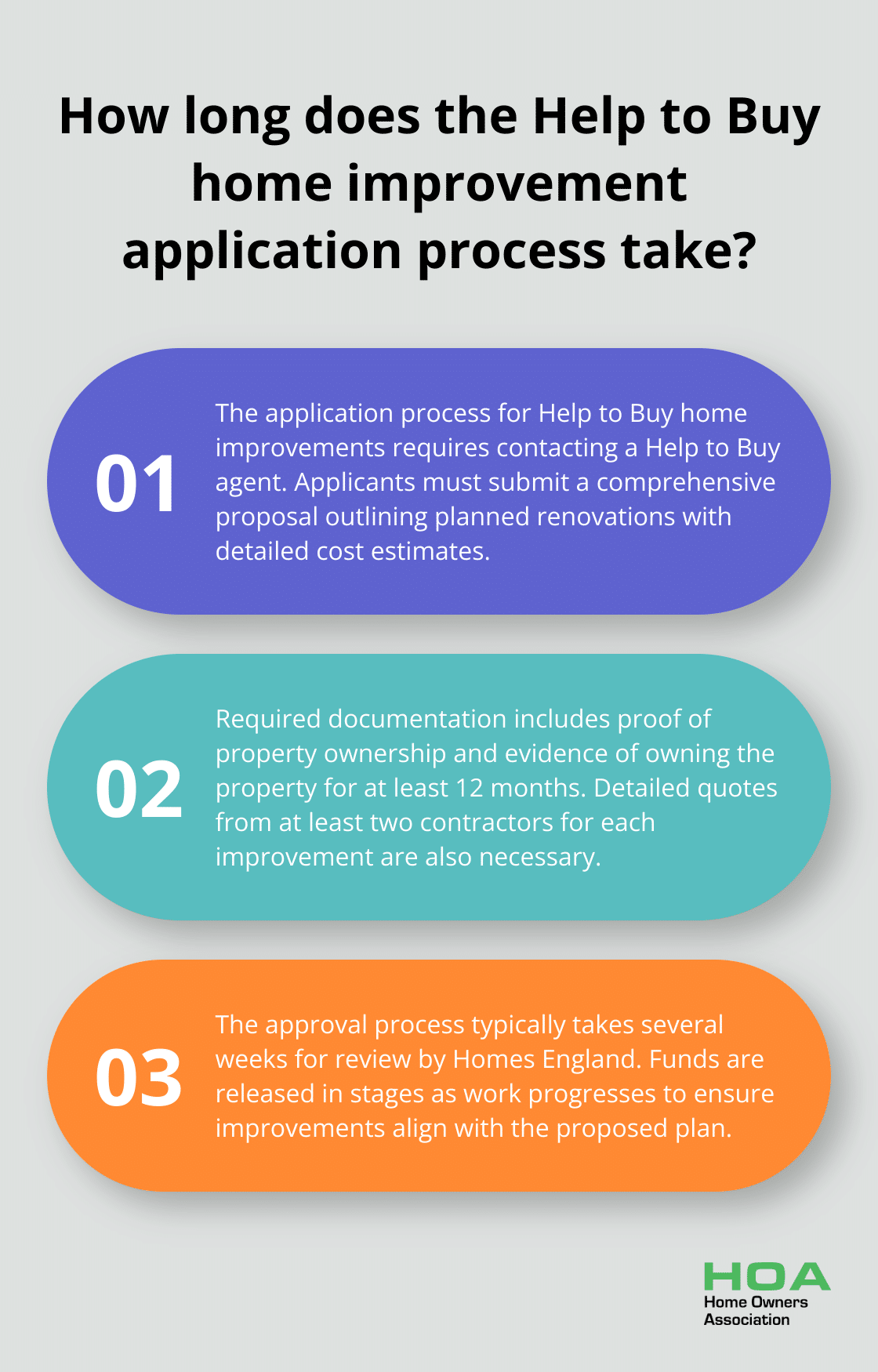

Application Process

To apply for Help to Buy funds for home improvements, you need to contact your Help to Buy agent and submit a detailed proposal of your planned renovations. This proposal should include:

- Cost estimates from reputable contractors

- A clear explanation of how the improvements will benefit the property

The approval process can take several weeks, so it’s crucial to plan ahead. If approved, Homes England will release the funds in stages as the work progresses, ensuring that the improvements align with the proposed plan.

Maximizing Your Chances of Approval

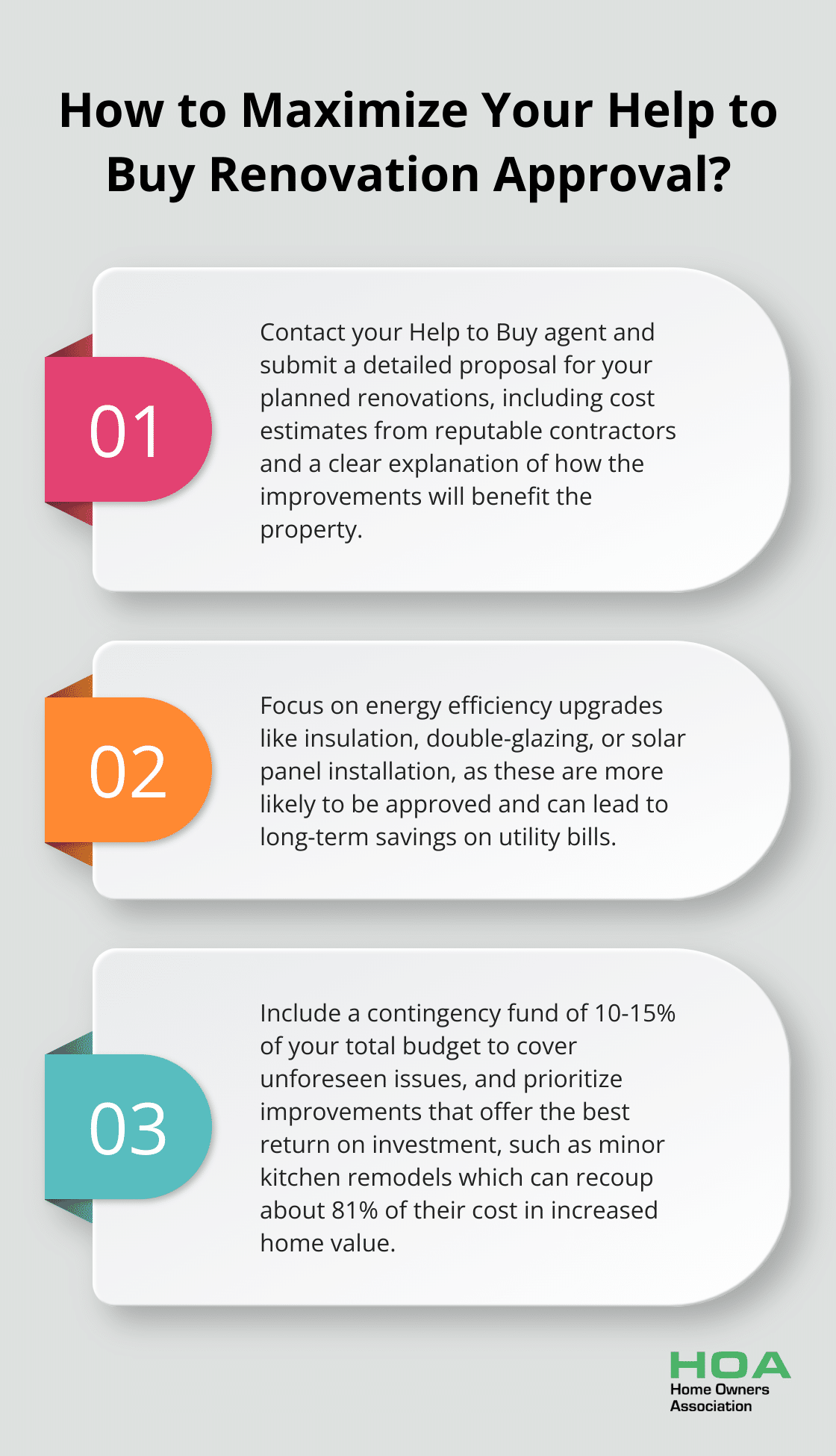

To increase your likelihood of approval, consider these tips:

- Focus on improvements that align with the scheme’s goals (e.g., energy efficiency, essential repairs)

- Provide detailed and accurate cost estimates

- Clearly demonstrate how the improvements will add value to your property

- Be prepared to answer questions and provide additional information if requested

As you prepare your application for Help to Buy home improvement funds, it’s essential to understand the next steps in the process. Let’s explore the application procedure in more detail and discuss how to navigate potential challenges.

How to Apply for Help to Buy Home Improvements

Preparing Your Application

The first step in applying for Help to Buy funds for home improvements involves contacting your Help to Buy agent. You must submit a comprehensive proposal that outlines your planned renovations. This proposal should include detailed cost estimates from reputable contractors and a clear explanation of how the improvements will benefit your property.

Focus on improvements that align with the scheme’s goals, such as energy efficiency upgrades. Installing solar panels or upgrading insulation are more likely to receive approval than purely cosmetic changes.

Required Documentation

When you submit your application, you need to provide:

- Proof of property ownership

- Evidence that you’ve owned the property for at least 12 months

- Detailed quotes from at least two contractors for each improvement

- Plans or drawings of the proposed improvements

- A statement explaining how the improvements will increase your property’s value or energy efficiency

Prepare to provide additional information if requested. A thorough and well-prepared application will streamline the process.

Timeframes and Approval Process

The approval process typically takes several weeks. During this period, Homes England will review your application and may request additional information or clarification.

If Homes England approves your application, they will release the funds in stages as the work progresses. This staged release ensures that the improvements align with the proposed plan and meet the required standards.

You must not start any work until you receive official approval. Starting work prematurely could result in the rejection of your application.

Alternative Financing Options

While the Help to Buy scheme can provide valuable resources for home improvements, it’s not the only option available. Other financing methods include personal loans, home equity loans, or specialized home improvement loans. Each option has its own advantages and considerations, so it’s important to research and compare before making a decision.

Maximizing Your Chances of Success

To increase your likelihood of approval, consider these tips:

- Focus on improvements that align with the scheme’s goals (e.g., energy efficiency, essential repairs)

- Provide detailed and accurate cost estimates

- Clearly demonstrate how the improvements will add value to your property

- Be prepared to answer questions and provide additional information if requested

As you move forward with your Help to Buy home improvement application, it’s essential to understand how to maximize the benefits of this scheme. The next section will explore strategies for budgeting, selecting contractors, and prioritizing improvements to ensure the best return on your investment.

How to Get the Most from Help to Buy

Smart Budgeting for Your Project

When you budget for your Help to Buy-funded improvements, you must account for all potential costs. Get detailed quotes from at least three reputable contractors for each aspect of your project. This will give you a realistic idea of the expenses involved and help you avoid unexpected costs down the line.

Include a contingency fund of about 10-15% of your total budget. This buffer can cover unforeseen issues that often arise during renovations (such as hidden structural problems or necessary upgrades to meet current building codes).

Consider the long-term financial impact of your improvements. Energy-efficient upgrades may have higher upfront costs but can lead to significant savings on utility bills over time. According to NatWest, the estimated cost of installing a heat pump, cavity wall insulation, and loft insulation is £34,500.

Choosing the Right Professionals

Selecting the right contractors is important for the success of your project. Look for professionals who are not only skilled but also experienced in working with government-funded projects like Help to Buy. They should know the documentation and quality standards required by Homes England.

Check credentials thoroughly. Ensure your chosen contractors are licensed, insured, and have positive reviews from previous clients. Don’t hesitate to ask for references and examples of similar projects they’ve completed.

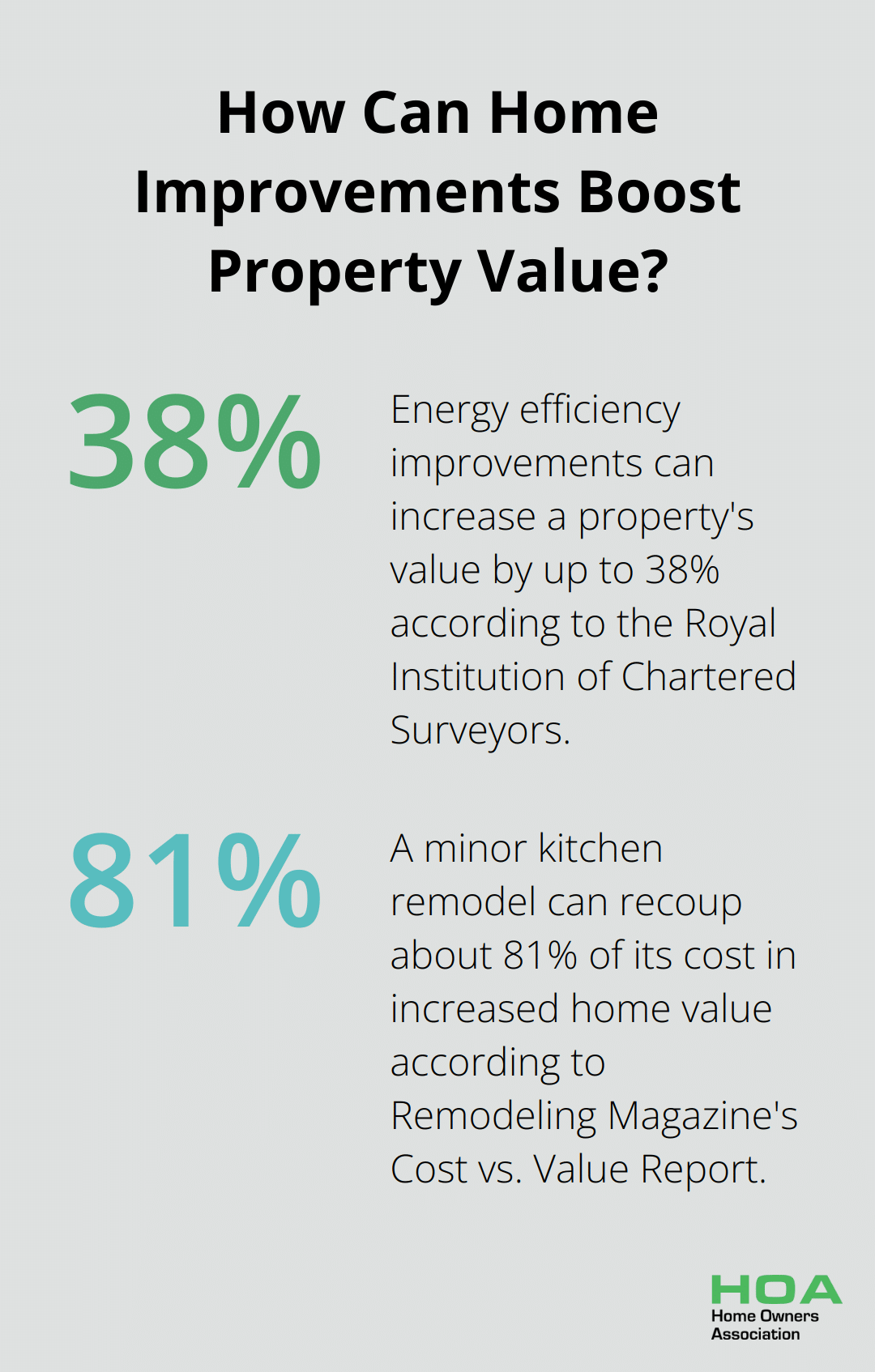

Prioritizing Improvements for Maximum ROI

When you decide which improvements to prioritize, focus on those that will add the most value to your property while aligning with Help to Buy guidelines. According to the Royal Institution of Chartered Surveyors, energy efficiency improvements can increase a property’s value by up to 38%.

Kitchen and bathroom renovations typically offer good returns on investment. A minor kitchen remodel can recoup about 81% of its cost in increased home value, according to Remodeling Magazine’s Cost vs. Value Report.

However, avoid over-improving your property beyond the standards of your neighborhood. Excessive upgrades may not be fully reflected in your home’s value when it comes time to sell.

Help to Buy favors improvements that increase energy efficiency or address essential repairs. The Home Upgrade Grant (HUG) provides energy efficiency measures and low carbon heating to low income households living in the worst performing, off gas grid homes.

Leveraging Professional Advice

Try to seek professional advice when planning your Help to Buy-funded improvements. Experienced home improvement consultants can provide valuable insights into which projects will offer the best return on investment and align with Help to Buy guidelines.

Home Owners Association, serving Australia since 1980, offers members access to a network of vetted contractors experienced in Help to Buy projects. This can potentially save time and reduce the risk of hiring unreliable professionals. The association also provides expert advice and resources to ensure that all projects meet the highest standards of quality and can guide you through beginner woodworking projects if you’re interested in DIY improvements.

Final Thoughts

The Help to Buy scheme for home improvements offers eligible homeowners a chance to enhance their properties and increase value. This program focuses on energy-efficient upgrades and essential repairs, which provide long-term benefits. Careful planning, budgeting, and contractor selection will maximize the potential of your Help to Buy home improvements.

Thorough preparation is essential for a successful application process. Gather detailed quotes, provide comprehensive documentation, and prepare to answer questions from Homes England. The approval process takes several weeks, so patience is necessary.

Home Owners Association offers valuable benefits for homeowners in Melbourne, Australia who seek additional support for their renovation projects. Members can access trade pricing, expert advice, and a network of vetted professionals through our website. This support allows homeowners to approach their Help to Buy home improvements with confidence and potentially reduce costs.