At Home Owners Association, we understand the importance of making smart home improvements that benefit both your wallet and the environment. Energy-efficient upgrades can significantly reduce your utility bills and increase your property value.

What many homeowners don’t realize is that these improvements can also lead to substantial tax benefits. In this post, we’ll explore the tax benefits for energy-efficient home improvements and how you can maximize your savings while reducing your carbon footprint.

Energy-Efficient Home Improvements: A Smart Investment

Defining Energy-Efficient Upgrades

Energy-efficient home improvements are upgrades that reduce energy consumption, lower utility bills, enhance comfort, and minimize environmental impact. These improvements range from simple changes to major renovations, all designed to optimize your home’s energy use.

Popular Energy-Efficient Upgrades

Some of the most effective energy-efficient improvements include:

- High-efficiency HVAC systems

- Double-pane or triple-pane windows

- Insulation for walls, attics, and floors

EPA estimates that homeowners can save an average of 15% on heating and cooling costs through proper insulation and air sealing.

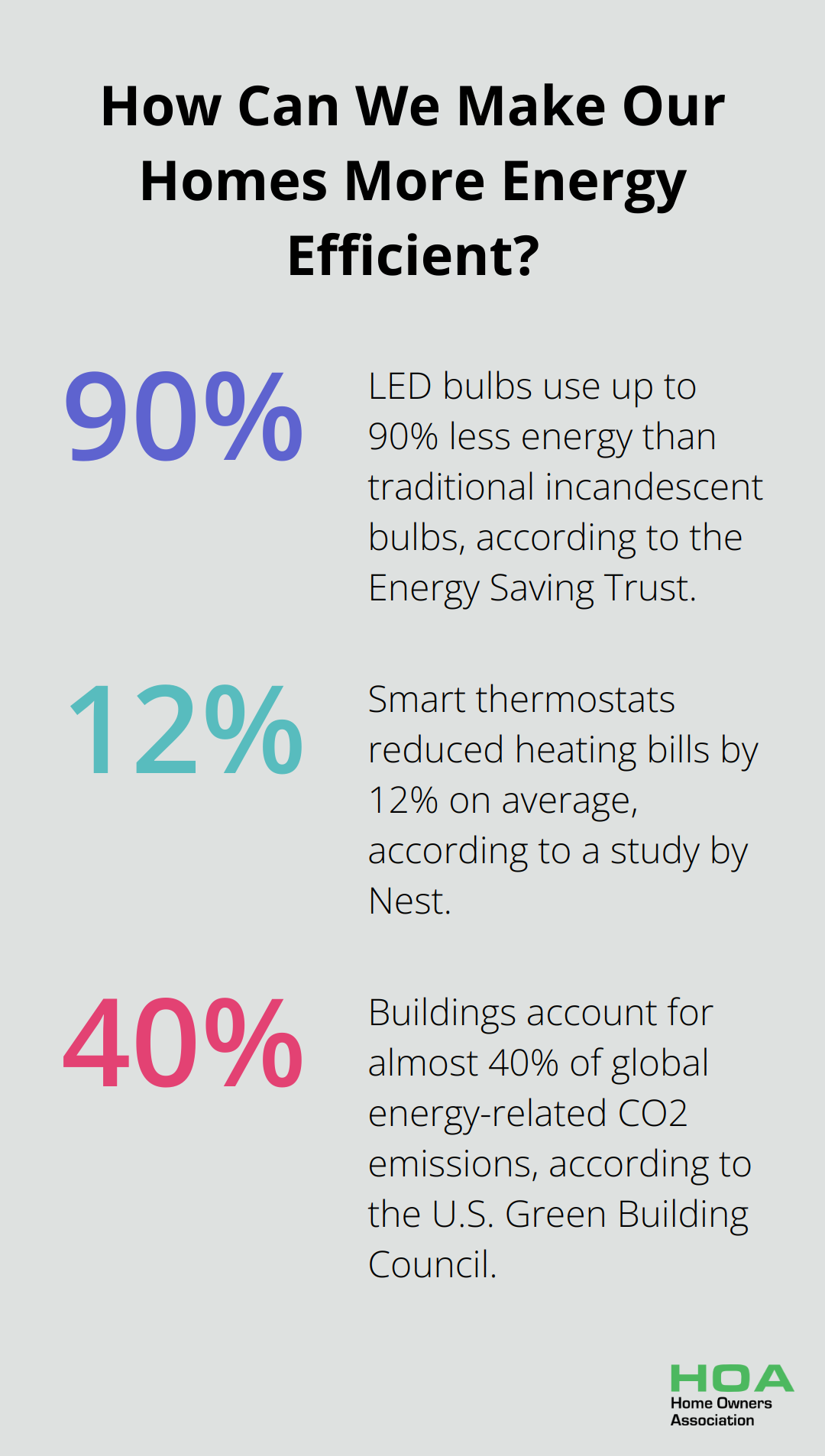

LED lighting is another popular upgrade. These bulbs use up to 90% less energy than traditional incandescent bulbs and last up to 25 times longer (according to the Energy Saving Trust).

Smart thermostats also offer significant benefits. A study by Nest found that their smart thermostats reduced heating bills by 10-12% and cooling bills by 15% on average.

Financial Benefits

The financial advantages of energy-efficient improvements are substantial. Homeowners can save an average of 15% on utility bills by making energy-efficient upgrades, as estimated by the U.S. Environmental Protection Agency. This translates to hundreds of dollars saved annually.

Environmental Impact

From an environmental perspective, these improvements significantly reduce greenhouse gas emissions. The U.S. Green Building Council reports that buildings account for almost 40% of global energy-related CO2 emissions. Implementing energy-efficient upgrades allows homeowners to substantially reduce their carbon footprint.

Increased Home Value

Energy-efficient improvements also boost home value. A study by the National Association of Home Builders revealed that buyers are willing to pay an average of $8,728 more for homes with energy-efficient features. This means these upgrades not only save money in the short term but also provide a return on investment when it’s time to sell.

These improvements benefit homeowners across Australia. Many report substantial savings on their energy bills and increased comfort in their homes. The next section will explore the various tax credits and deductions available for these energy-efficient upgrades, further enhancing their financial appeal.

Tax Savings for Energy-Efficient Upgrades

At Home Owners Association, we help homeowners across Australia maximize their savings on energy-efficient improvements. The Australian government offers several tax incentives to encourage homeowners to make these eco-friendly upgrades. Let’s explore the available tax benefits and how you can take advantage of them.

Federal Tax Credits

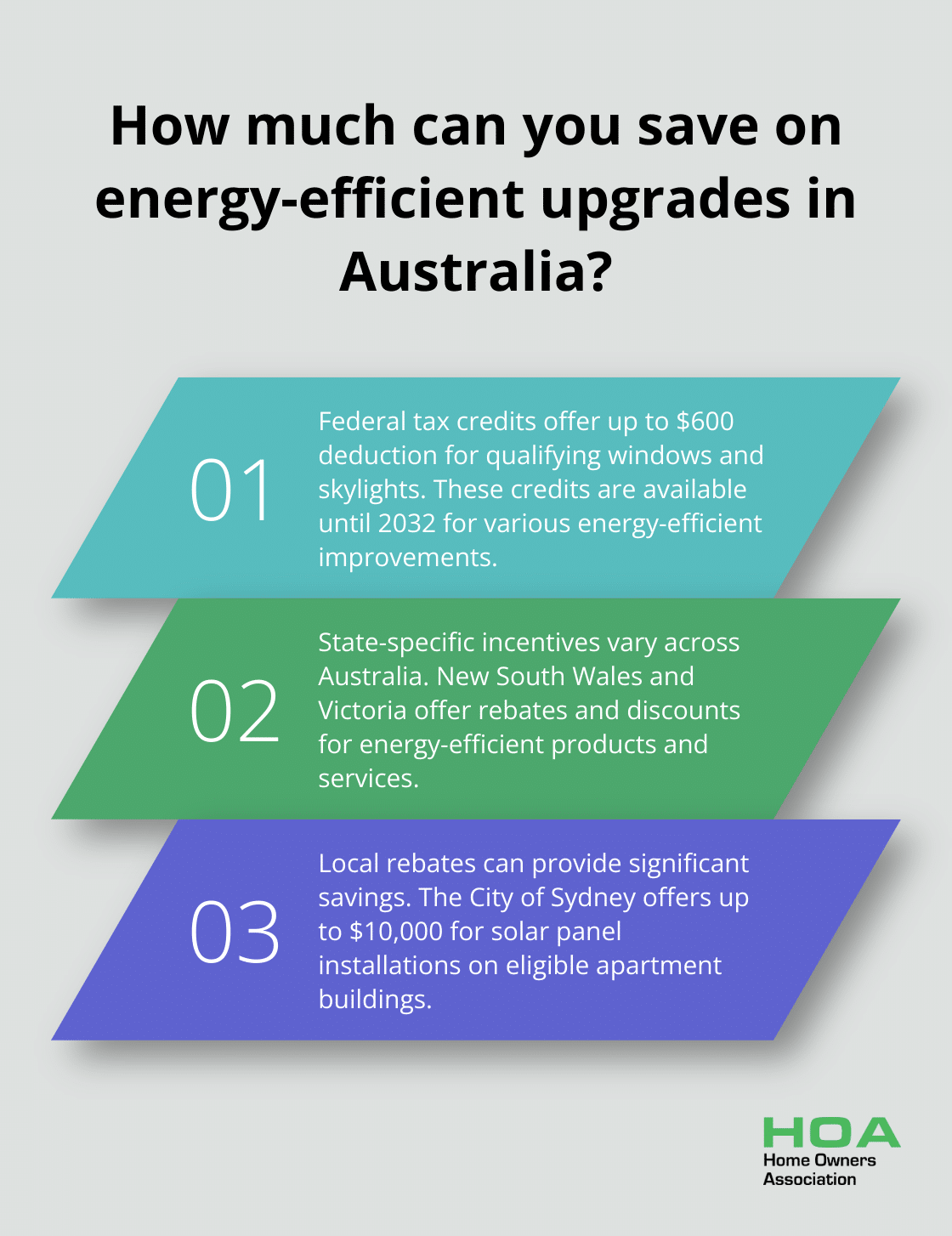

The Australian government provides a range of tax credits for energy-efficient home improvements. The Energy Efficient Home Improvement Credit offers a deduction of up to $600 for qualifying windows and skylights. For exterior doors, you can also claim a deduction. This credit applies to improvements such as insulation, energy-efficient windows and doors, and high-efficiency heating and cooling systems.

These credits are available until 2032, giving homeowners ample time to plan and implement their energy-saving projects.

State-Specific Incentives

In addition to federal tax credits, many Australian states offer their own incentives for energy-efficient home improvements. New South Wales provides rebates for solar battery systems and energy-efficient appliances through its Energy Savings Scheme. Victoria offers similar benefits through its Victorian Energy Upgrades program, which provides discounts on energy-efficient products and services.

You can often combine these state-specific incentives with federal tax credits, potentially leading to even greater savings. We recommend you check with your state’s energy department for the most up-to-date information on available incentives.

Local Rebates and Grants

Many local councils and energy providers across Australia offer additional rebates and grants for energy-efficient upgrades. These can include discounts on solar panel installations, rebates for energy-efficient appliances, and grants for home energy assessments.

To be eligible for the City of Sydney’s rebates of up to $10,000 for the installation of solar panels on apartment buildings, a strata building of 40 units or less should have less than 4 EV chargepoints already installed, or an apartment building with over 40 units should meet certain criteria.

To make the most of these local incentives, contact your local council and energy provider directly. They can provide detailed information about available programs and how to apply.

Documentation is Key

While these tax benefits and incentives can significantly reduce the cost of energy-efficient upgrades, you must keep accurate records of all improvements and associated costs. This documentation will prove crucial when claiming your tax credits and rebates.

Navigating the Incentive Landscape

The world of energy-efficient incentives can seem complex, but you don’t have to navigate it alone. Professional associations (like Home Owners Association) can provide guidance on which upgrades might offer the best return on investment, considering both energy savings and available tax benefits. Our team of experts can help you make informed decisions about your energy-efficient home improvements, ensuring you maximize your savings and environmental impact.

As you consider these tax benefits and incentives, it’s important to think about how to time your improvements and document your upgrades effectively. Let’s explore strategies to maximize your tax benefits in the next section.

How to Maximize Tax Benefits for Energy-Efficient Upgrades

Keep Meticulous Records

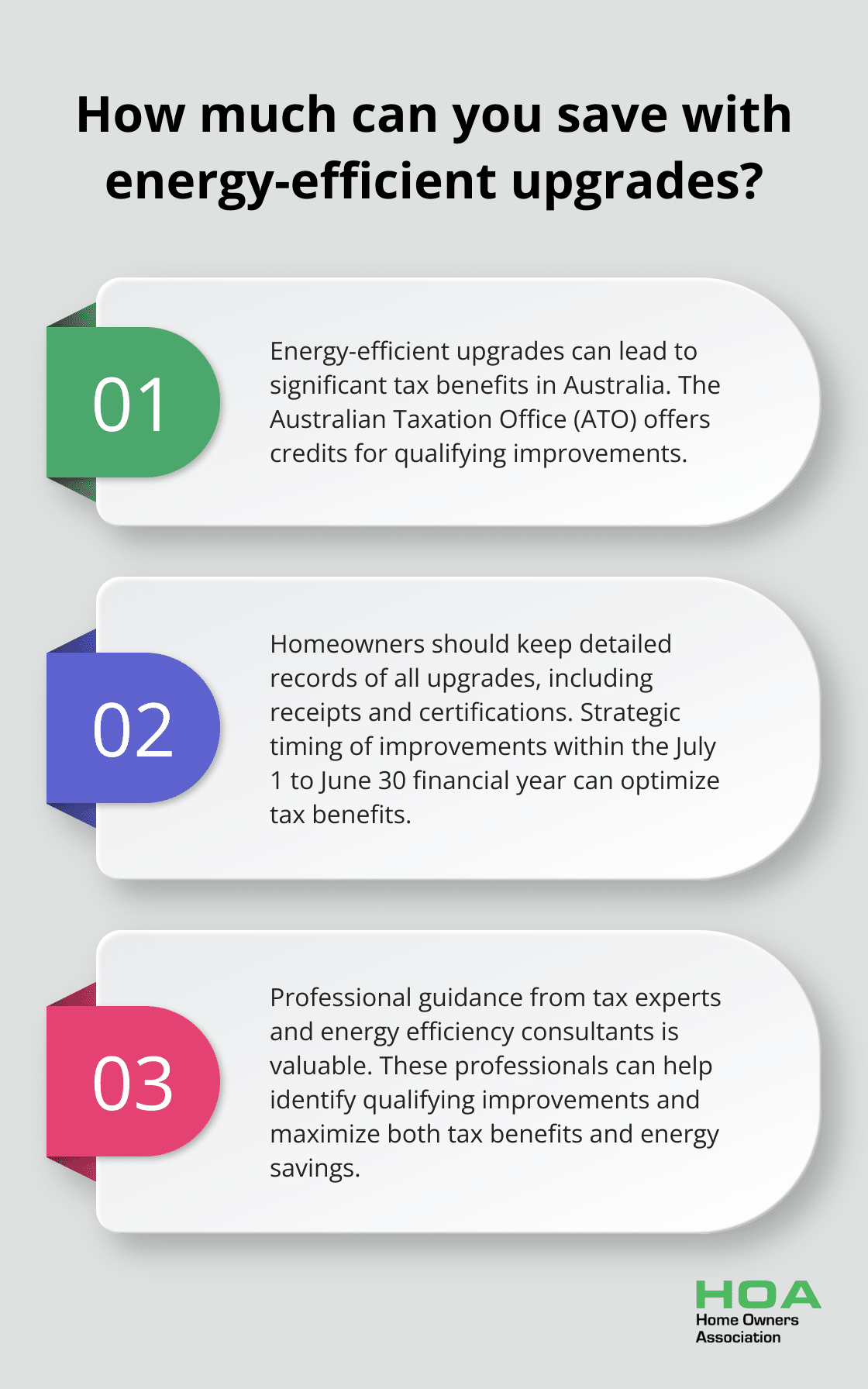

Documentation forms the foundation of successful tax benefit claims for energy-efficient improvements. The Australian Taxation Office (ATO) requires detailed records to support your claims. Save all receipts, contracts, and manufacturer certifications related to your upgrades.

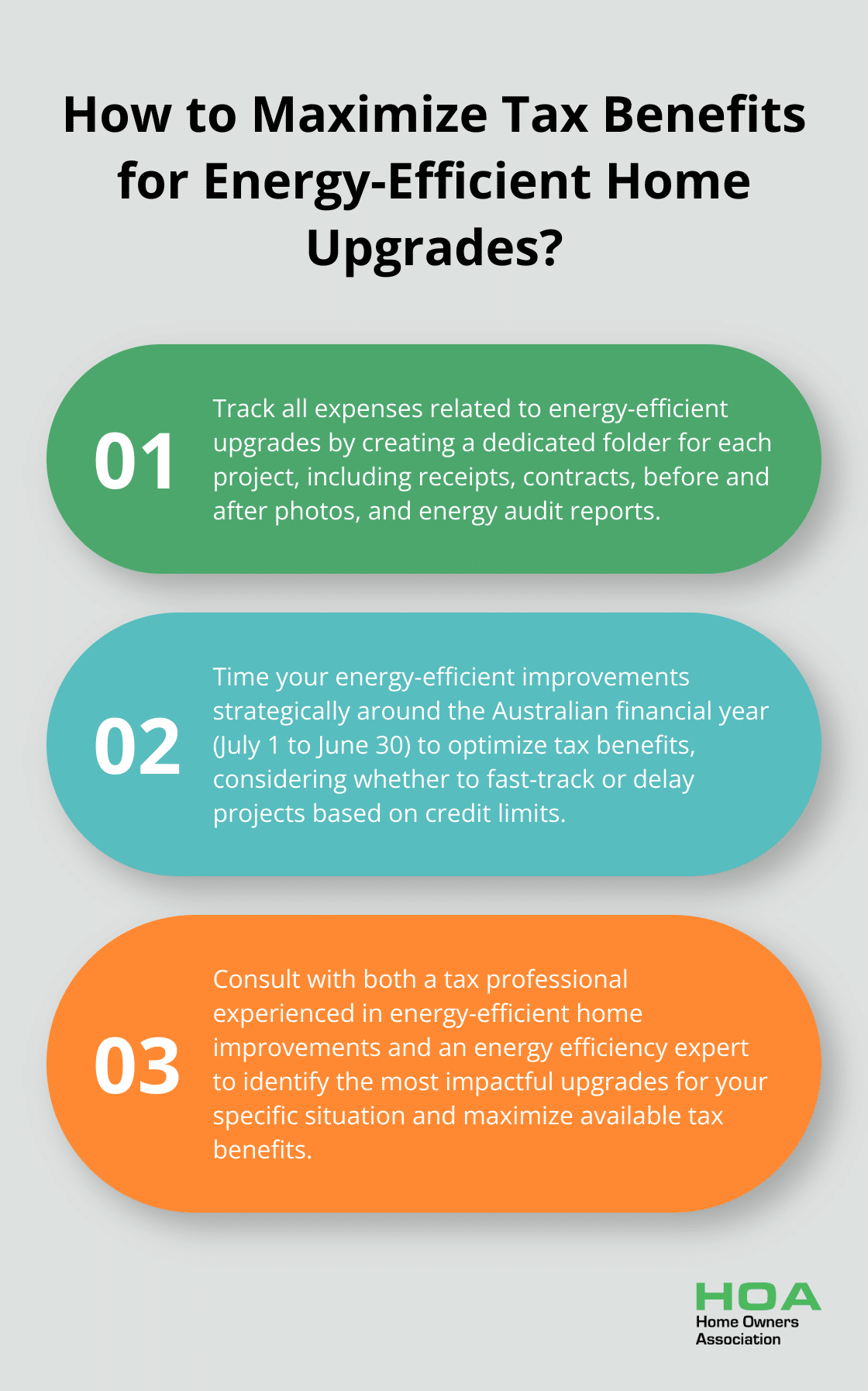

Create a dedicated folder for each improvement project. Include before and after photos, energy audit reports, and any correspondence with contractors or energy assessors. These records support your tax claims and prove valuable if you decide to sell your home in the future.

Time Your Improvements Strategically

The timing of your improvements can significantly impact your tax benefits. The Australian financial year runs from July 1 to June 30, so plan your improvements accordingly to optimize your tax situation.

If you approach the end of the financial year and haven’t reached the maximum credit limit, consider fast-tracking planned improvements to claim them in the current tax year. Alternatively, if you’ve already maxed out your credits for the year, delay further improvements until the next financial year begins.

Leverage Professional Expertise

The complex landscape of energy efficiency tax benefits challenges many homeowners. A tax professional with experience in energy-efficient home improvements can provide invaluable guidance on maximizing your benefits.

These experts help you understand which improvements qualify for tax credits, how to properly document your upgrades, and how to time your improvements for optimal tax advantages. They also keep you updated on any changes to tax laws that might affect your claims.

Consult Energy Efficiency Experts

Energy efficiency consultants offer another valuable resource. They conduct comprehensive home energy audits, identifying the most impactful improvements for your specific situation. This targeted approach ensures you make upgrades that not only qualify for tax benefits but also provide the greatest energy savings.

Consider Long-Term Benefits

While tax benefits provide a significant incentive, don’t overlook the long-term energy savings and increased home comfort (which often prove equally important). Smart planning, thorough documentation, and expert guidance maximize both your tax benefits and your overall return on investment for these valuable home improvements.

Final Thoughts

Energy-efficient home improvements offer financial benefits and environmental stewardship. Tax benefits for energy-efficient home improvements provide significant incentives for homeowners to invest in upgrades that reduce energy consumption and lower utility bills. These tax credits, rebates, and incentives can substantially offset the initial costs of improvements, making them more accessible to a wider range of homeowners.

The long-term savings from reduced energy bills can surpass the initial investment. Many homeowners report significant decreases in their monthly energy costs after implementing energy-efficient upgrades. Each energy-efficient upgrade contributes to a more sustainable future, creating a ripple effect that extends far beyond individual homes.

We at Home Owners Association encourage all homeowners in Melbourne to explore the possibilities of energy-efficient upgrades for their homes. Our team of experts can guide you through the process, helping you identify the most beneficial improvements for your specific situation. The combination of tax savings, reduced energy bills, increased home value, and positive environmental impact makes energy-efficient home improvements a smart choice for any homeowner.