At Home Owners Association, we’re excited to share valuable information about tax breaks for energy-efficient home improvements. These incentives can significantly reduce your tax burden while making your home more environmentally friendly.

Upgrading your home’s energy efficiency not only lowers utility bills but also qualifies you for various federal and state tax credits. In this post, we’ll explore the types of improvements that are eligible and how you can maximize your tax savings.

What Tax Breaks Can You Get for Energy-Efficient Upgrades?

Federal Tax Credits for Energy Efficiency

The federal government offers substantial tax breaks for energy-efficient home improvements through the Energy Efficient Home Improvement Credit. This credit allows homeowners to claim up to $3,200 annually to lower the cost of energy-efficient home upgrades through 2032. For high-efficiency heating and cooling systems, homeowners may qualify for a tax credit up to $3,200 if they make qualified energy-efficient improvements to their home after Jan. 1, 2023.

These credits apply to improvements made from 2023 through 2032, providing homeowners a decade to plan and implement energy-saving upgrades strategically.

State-Level Incentives

Many states complement federal credits with their own tax incentives for energy-efficient home improvements. These incentives vary widely and may include:

- Income tax credits

- Property tax exemptions

- Sales tax rebates on energy-efficient products

Homeowners should check with their state’s energy office or tax authority for specific details about available incentives.

Qualifying Improvements

To qualify for these tax breaks, homeowners must make specific energy-efficient improvements to their primary residence. Common eligible upgrades include:

- Energy-efficient windows and doors

- Insulation for walls, attics, and crawl spaces

- High-efficiency heating and cooling systems

- Solar panels and other renewable energy systems

Detailed records of improvements (including receipts and manufacturer certifications) are essential for claiming tax credits.

Claiming Your Credits

To claim these tax breaks, homeowners must file IRS Form 5695 with their annual tax return. This form allows for detailed reporting of improvements and calculation of eligible credit amounts. Working with a tax professional can help maximize benefits and ensure compliance with IRS requirements.

Real-World Savings

The impact of these tax incentives on home upgrade affordability can be significant. When combined with lower energy bills, these improvements often prove to be smart financial decisions.

As we move forward, it’s important to understand how to maximize these tax savings effectively. The next section will explore strategies for optimizing your energy-efficient upgrades and making the most of available tax incentives.

Top Energy-Efficient Home Improvements for Maximum Tax Benefits

At Home Owners Association, we understand the impact of strategic home improvements on energy consumption and costs. This chapter explores the most effective upgrades that enhance your home’s efficiency and qualify for substantial tax credits.

Insulation: The Unsung Hero of Energy Savings

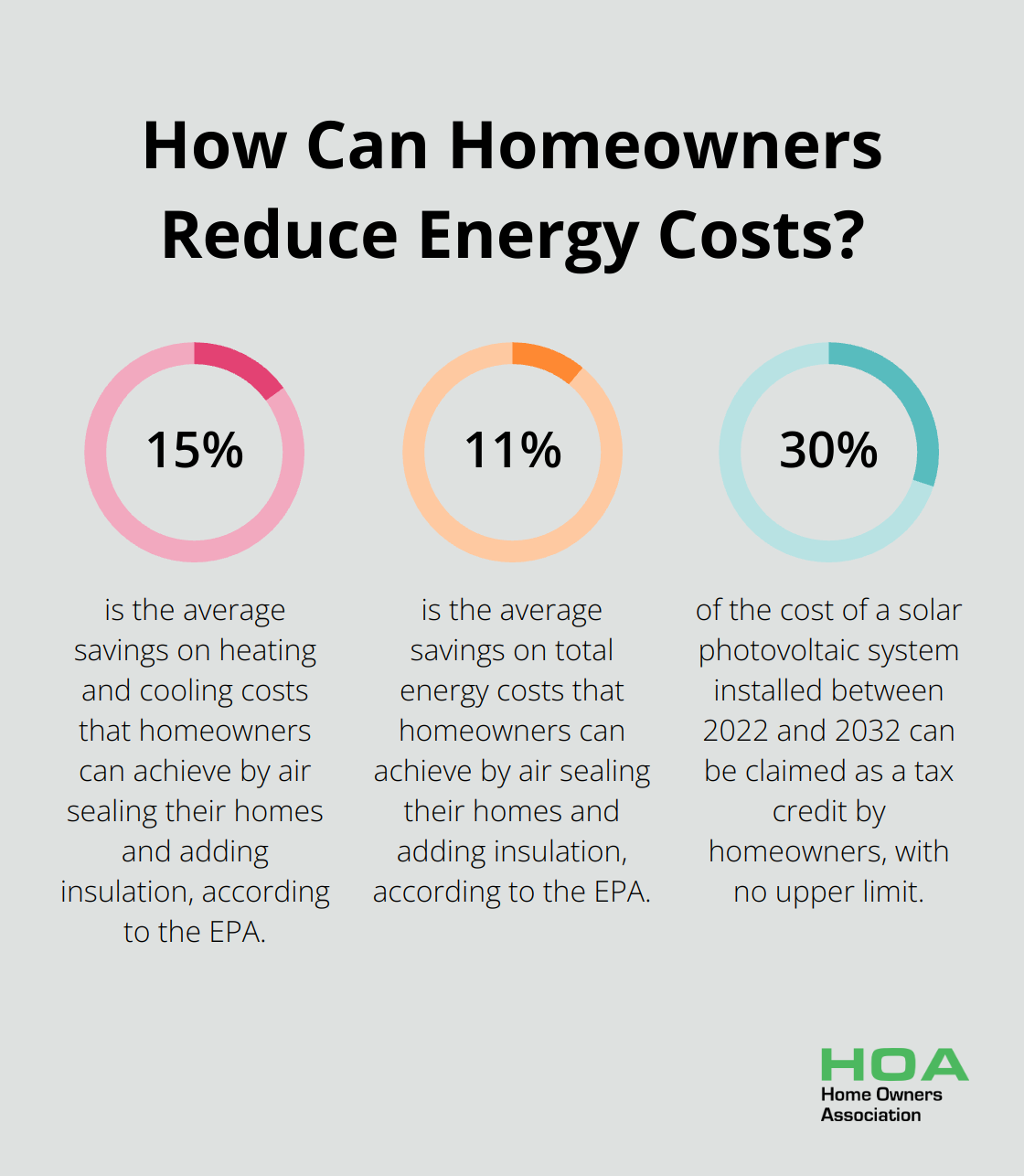

Proper insulation forms the cornerstone of an energy-efficient home. The EPA estimates that homeowners can save an average of 15% on heating and cooling costs (or an average of 11% on total energy costs) by air sealing their homes and adding insulation in attics, crawl spaces, and exterior walls. When choosing insulation, the R-value (which measures thermal resistance) is a critical factor. Higher R-values indicate superior insulation performance.

In most Australian climates, walls require an R-value of 3.5 to 4, while attics may need R-values of 5 to 6. The effectiveness of insulation hinges on correct installation, so professional services often prove invaluable for optimal results.

High-Efficiency HVAC Systems: Cool Savings, Warm Benefits

An upgrade to a high-efficiency heating, ventilation, and air conditioning (HVAC) system can slash your energy consumption. Modern systems with high Seasonal Energy Efficiency Ratio (SEER) ratings cut cooling costs by up to 50% compared to older models.

While older air conditioners might have SEER ratings of 6 or less, today’s most efficient models boast SEER ratings of 20 or higher. When you shop for a new HVAC system, the ENERGY STAR label guarantees that the product meets strict efficiency guidelines set by the U.S. Environmental Protection Agency and the U.S. Department of Energy.

Energy-Efficient Windows and Doors: A Clear View to Savings

The replacement of old windows and doors with energy-efficient alternatives significantly impacts your home’s thermal performance. ENERGY STAR reports that the switch from single-pane to double-pane, low-E windows can save homeowners between $101 to $583 per year on energy costs.

Key factors to consider when selecting new windows include the U-factor (which measures heat transfer) and Solar Heat Gain Coefficient (SHGC). Lower U-factors and SHGCs indicate better insulation and less solar heat gain, respectively. For doors, models with tight-fitting frames and energy-efficient core materials offer the best performance. The Energy Efficient Home Improvement Credit offers a deduction of up to $600 for qualifying windows and skylights.

Solar Panel Installation: Power from Above

Solar panel installation represents a significant investment that leads to long-term energy savings and independence. The average cost of solar systems in Australia was $5,667, as reported by Canstar Blue. Government subsidies have contributed to the reduction in costs, making solar energy more accessible to homeowners.

The federal government sweetens the deal with a generous tax credit for solar installations. Homeowners can claim 30% of the cost of a solar photovoltaic system installed between 2022 and 2032 (with no upper limit), making it an attractive option for those ready to invest in renewable energy. Victoria’s Solar Homes Program provides rebates of up to $1,400 for solar panel systems, plus an interest-free loan for the same amount.

As we move forward, it’s essential to understand how to maximize these energy-efficient upgrades and make the most of available tax incentives. The next chapter will explore strategies for optimizing your tax savings and navigating the claims process effectively.

How to Maximize Your Energy Efficiency Tax Savings

Claiming Your Energy Efficiency Tax Credits

To claim your energy efficiency tax credits, you must file IRS Form 5695 with your annual tax return. This form allows you to report your eligible improvements and calculate your credit amount. The Australian Taxation Office (ATO) offers similar forms for state-specific incentives. You need to file these forms correctly to avoid delays or rejections of your claims.

Essential Documentation for Tax Filing

Proper documentation is essential to successfully claim your tax credits. You should keep all receipts, invoices, and manufacturer certifications for your energy-efficient upgrades. The ATO and IRS may require proof that your improvements meet specific energy efficiency standards. For example, if you’ve installed solar panels, you’ll need documentation showing the system’s capacity and certification of its compliance with Australian standards.

Leveraging Multiple Credits and Rebates

You shouldn’t limit yourself to just one type of credit or rebate. Many homeowners can combine federal, state, and local incentives to maximize their savings. For instance, if you’ve installed a solar panel system, you might qualify for the federal Residential Renewable Energy Tax Credit, state-based rebates (like those offered in Victoria), and local utility company incentives.

The Value of Professional Tax Advice

While it’s possible to navigate these credits on your own, working with a tax professional can often lead to greater savings. A qualified tax advisor can help you identify all eligible improvements, ensure you’re claiming the maximum amount allowed, and help you plan future upgrades to optimize your tax benefits over multiple years. They can also keep you updated on any changes to tax laws that might affect your claims.

Staying Informed About Incentive Changes

The landscape of energy efficiency incentives changes constantly. You need to stay informed about the latest changes and opportunities. This knowledge will help you make the most of available tax credits and rebates, contributing to both your financial savings and a more sustainable future for Australia.

Final Thoughts

Tax breaks for energy-efficient home improvements offer substantial benefits for homeowners. These incentives, including federal credits and state-specific rebates, provide numerous opportunities to save while upgrading your home. Strategic improvements such as enhanced insulation, upgraded HVAC systems, energy-efficient windows and doors, or solar panel installations reduce your tax burden and create a more comfortable, sustainable living environment.

Energy-efficient homes consume less power, leading to lower utility bills and increased property value. These upgrades often make homes more attractive to potential buyers and contribute to a reduced carbon footprint. The long-term advantages of these improvements extend far beyond immediate tax savings, benefiting both your wallet and the environment.

We at Home Owners Association encourage you to start your journey towards a more energy-efficient home today. Our team in Melbourne, Australia, supports homeowners with expert advice, access to trade pricing, and personalized guidance for successful home improvement projects. The sooner you implement these upgrades, the sooner you can benefit from tax breaks and energy savings.