At Home Owners Association, we understand the importance of making smart investments in your property. Energy-efficient home upgrades not only reduce your carbon footprint but can also lead to significant savings on your taxes.

In this post, we’ll explore the various tax deductions for energy-efficient home improvements available to homeowners. We’ll guide you through the process of claiming these deductions and help you maximize your savings while contributing to a greener future.

What Are Energy-Efficient Home Upgrades?

Definition and Types of Upgrades

Energy-efficient home upgrades reduce energy consumption and lower utility bills. These improvements range from simple changes (like installing LED light bulbs) to complex projects (such as adding solar panels or upgrading HVAC systems). Common upgrades include insulation improvements, energy-efficient windows and doors, high-efficiency heating and cooling systems, and renewable energy installations.

Financial Benefits

Energy-efficient upgrades offer substantial financial benefits beyond tax deductions. The U.S. Environmental Protection Agency reports that homeowners can save an average of 15% on heating and cooling costs (or 11% on total energy costs) by air sealing their homes and adding insulation in attics, crawl spaces, and basement rim joists. These savings can amount to hundreds of dollars annually, depending on location and energy usage.

Environmental Impact

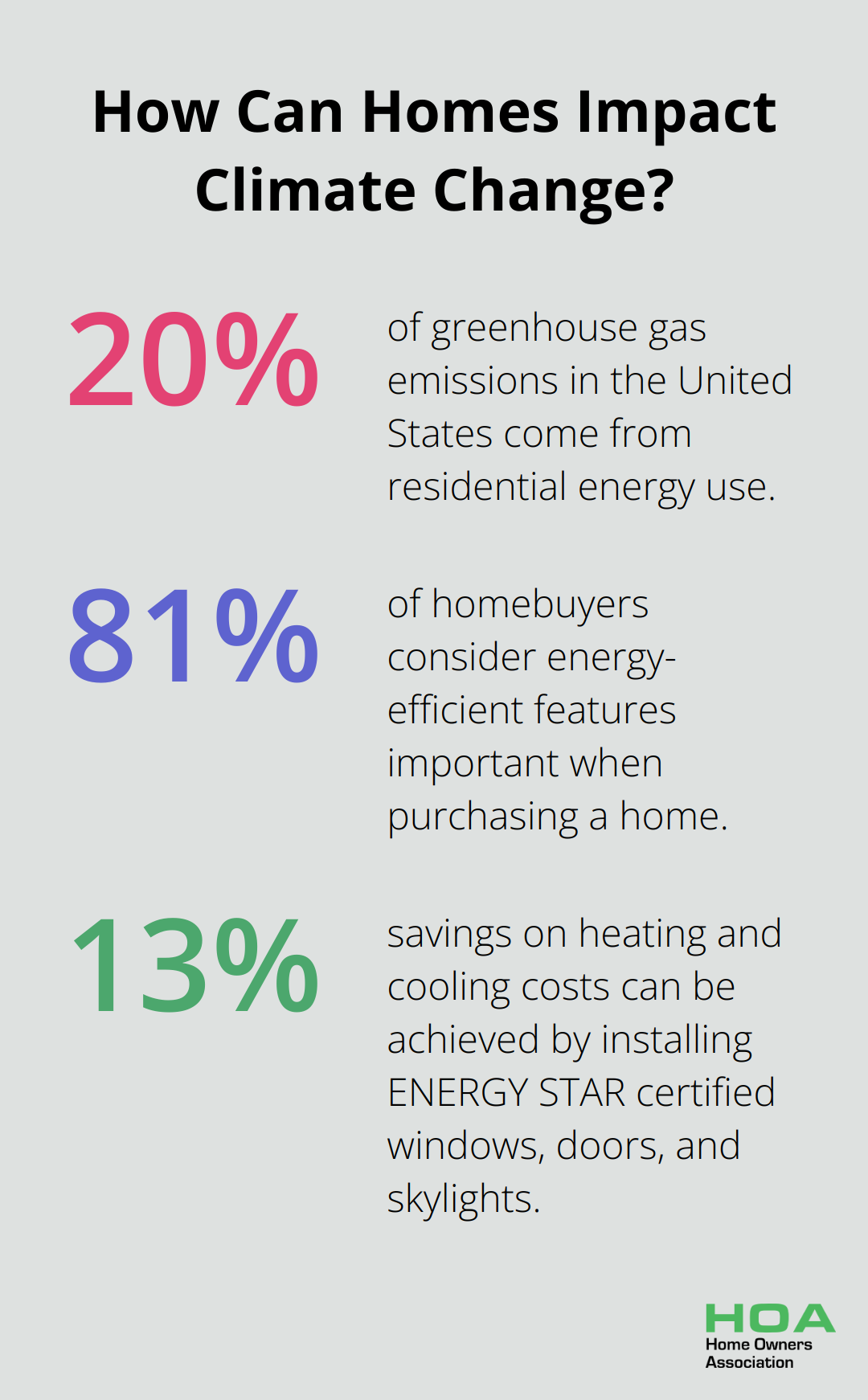

These upgrades significantly reduce a home’s carbon footprint. The U.S. Energy Information Administration estimates that residential energy use accounts for about 20% of greenhouse gas emissions in the United States. Homeowners play a crucial role in reducing these emissions through energy-efficient upgrades. For example, switching to ENERGY STAR certified appliances can reduce greenhouse gas emissions by 130,000 pounds over the products’ lifetime.

Improved Home Comfort and Health

Energy-efficient upgrades often lead to improved indoor air quality and more consistent temperatures throughout the home. Proper insulation and air sealing eliminate drafts and cold spots, creating a more comfortable living environment. Additionally, upgrades like energy-efficient HVAC systems with proper filtration reduce indoor air pollutants, benefiting those with allergies or respiratory issues.

Increased Property Value

Energy-efficient homes attract potential buyers. A study by the National Association of Home Builders found that 81% of homebuyers consider energy-efficient features important when purchasing a home. This preference can translate to higher resale values for homes with energy-efficient upgrades.

Installing ENERGY STAR certified windows, doors, and skylights can shrink energy bills by an average of up to 13% percent on heating and cooling costs. Heat pumps, which are becoming increasingly popular, reduce electricity use for heating by about 65% compared to traditional electric heating systems.

These impressive benefits make energy-efficient upgrades an attractive option for homeowners. However, the financial advantages extend beyond immediate savings and increased property value. The next section will explore the various tax deductions available for these energy-efficient home improvements, providing even more incentive for homeowners to invest in a greener, more efficient future.

Tax Breaks for Energy-Efficient Home Upgrades

At Home Owners Association, we help homeowners maximize their savings while improving their homes’ energy efficiency. The Australian government offers several tax incentives to encourage homeowners to invest in energy-efficient upgrades. Let’s explore these opportunities in detail.

Federal Tax Credits

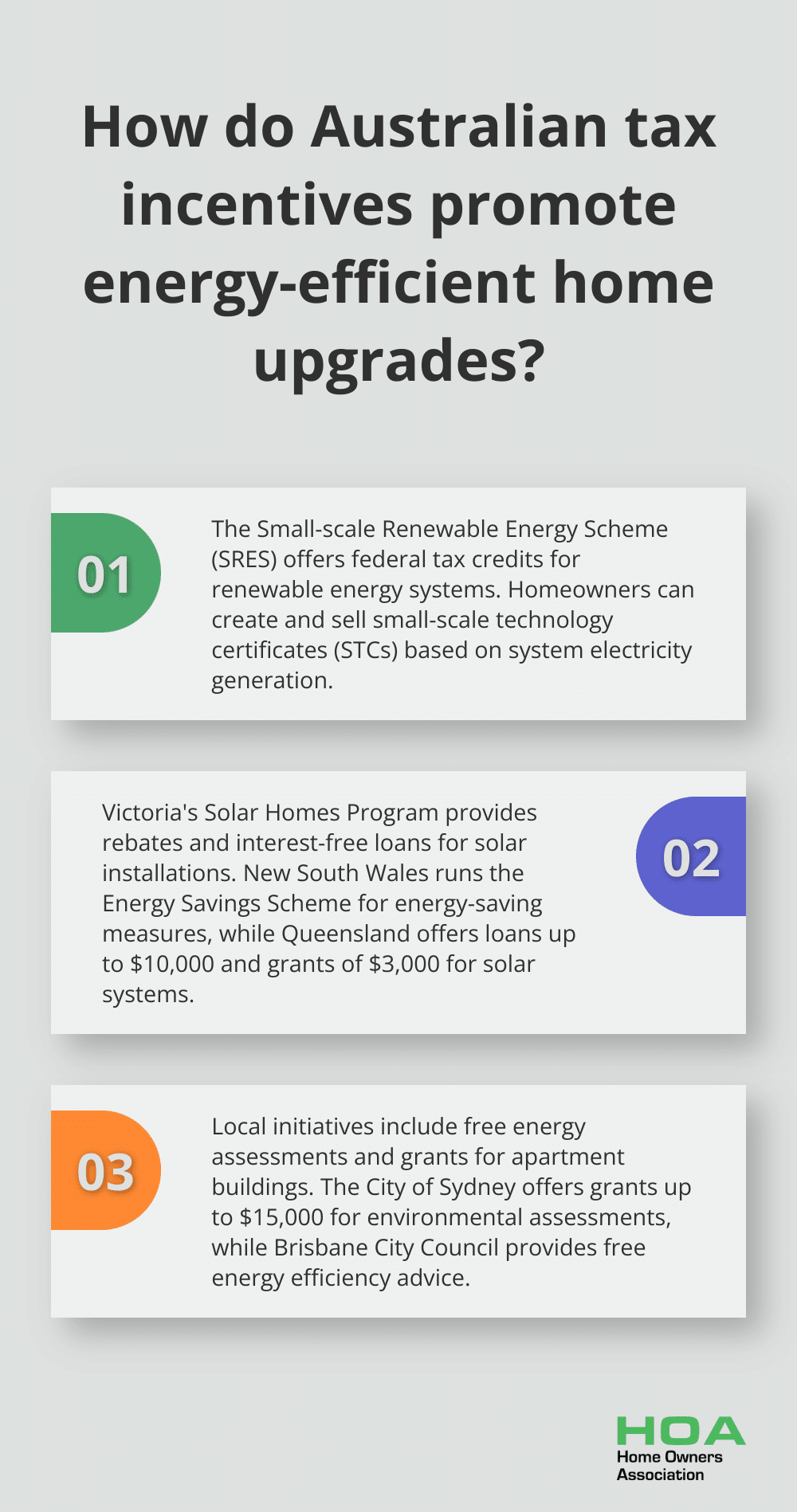

The Australian government provides substantial tax credits for energy-efficient home improvements through the Small-scale Renewable Energy Scheme (SRES). This program offers financial incentives for installing eligible small-scale renewable energy systems such as solar panels, wind turbines, and solar water heaters.

Under the SRES, installing an eligible system allows the creation of small-scale technology certificates (STCs) with a value that can be redeemed by selling or assigning them. The number of STCs you receive depends on the amount of electricity your system will generate over its lifetime.

State-Specific Incentives

In addition to federal programs, many Australian states offer their own incentives for energy-efficient home upgrades. These can significantly increase your overall savings:

Victoria’s Solar Homes Program provides rebates and interest-free loans for solar panels, batteries, and hot water systems. The program also offers solar for apartments, allowing more homeowners to put the sun to work.

New South Wales runs the Energy Savings Scheme, which provides financial incentives for households and businesses that implement energy-saving measures. This can include upgrades to energy-efficient appliances or improvements to home insulation.

Queensland’s Affordable Energy Plan offers interest-free loans and grants for solar and battery storage systems. Eligible households can access loans of up to $10,000 and grants of $3,000 to install these systems.

Local Government Initiatives

Many local councils across Australia also offer their own incentives for energy-efficient home upgrades. These range from rebates on solar installations to free energy assessments. For instance:

The City of Sydney provides free energy assessments for apartment buildings, which helps identify potential energy-saving upgrades. They also offer grants of up to $15,000 for environmental performance ratings and assessments in apartment buildings.

Brisbane City Council runs a Sustainability Agency that provides free advice on energy efficiency and connects homeowners with local rebates and incentives.

Documentation Requirements

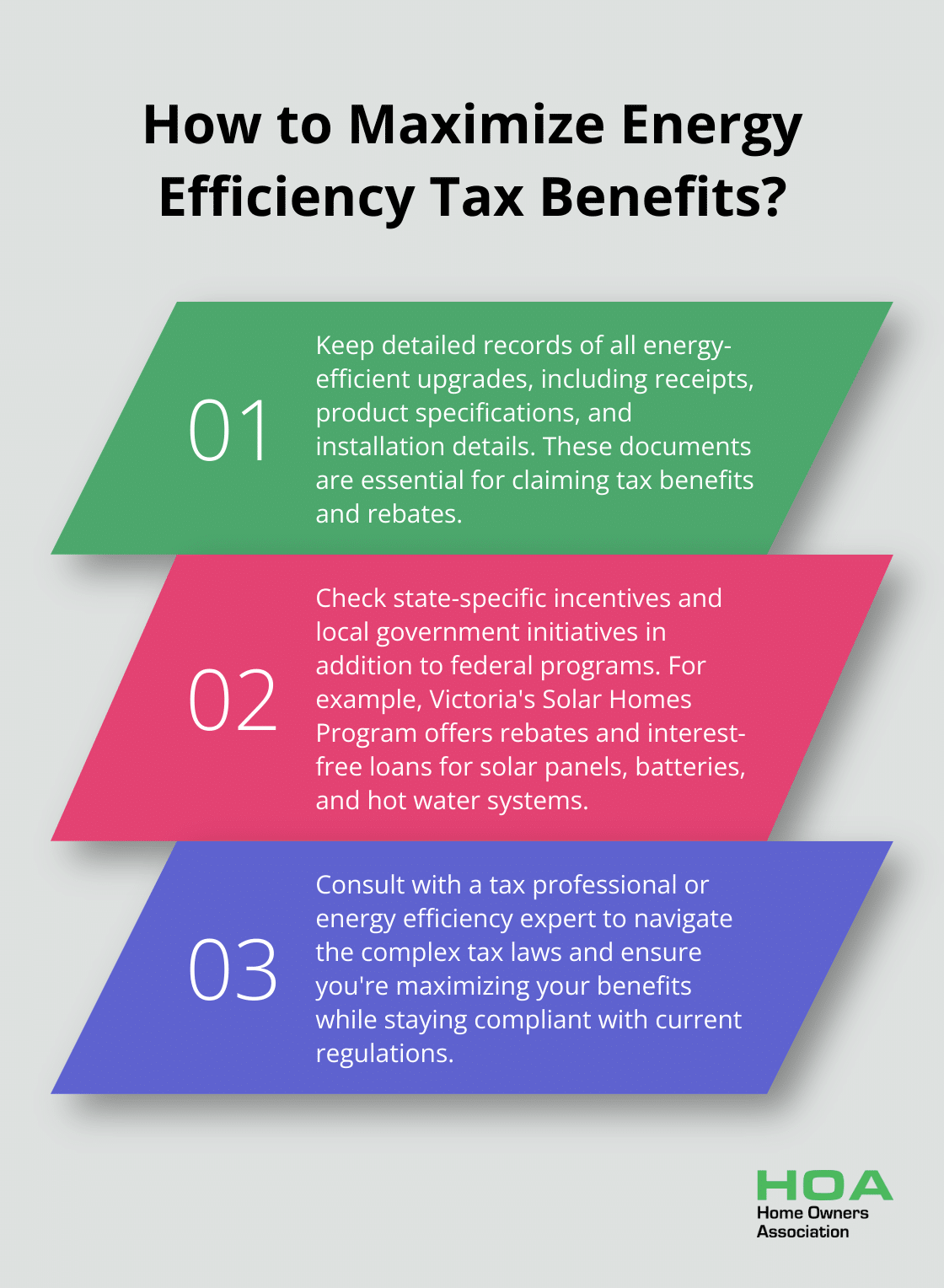

To take full advantage of these tax breaks and incentives, you must keep detailed records of all energy-efficient upgrades. This includes receipts, product specifications, and installation details. These documents will be essential when you claim your tax benefits or apply for rebates.

We recommend that you consult with a tax professional or energy efficiency expert to ensure you maximize your potential savings. (Our team at Home Owners Association can provide guidance on navigating these incentives and connect you with trusted professionals in your area.)

As you consider these various tax breaks and incentives, it’s important to understand how to claim them effectively. The next section will guide you through the process of claiming tax deductions for your energy-efficient upgrades, ensuring you don’t miss out on any potential savings.

How to Claim Energy-Efficient Upgrade Tax Deductions

Gather Your Documentation

The first step in claiming your tax deductions is to collect all necessary documentation. This includes receipts for purchases and installations, product specifications, and certificates of compliance where applicable. For solar panel installations, you’ll need documentation showing the number of Small-scale Technology Certificates (STCs) created.

Keep a detailed record of when each upgrade was installed and by whom. If you’ve taken advantage of any state or local rebates, make sure to document these as well. The Australian Taxation Office (ATO) may request this information to verify your claims.

Understand the Filing Process

When it comes to filing your tax return, energy-efficient upgrade deductions are typically claimed as part of your overall tax return. Up to $100,000 of total expenditure will be eligible for the incentive, with the maximum bonus tax deduction being $20,000.

If you’ve installed a solar PV system, wind turbine, or solar hot water system, you’ll need to report the STCs you received. These are usually claimed as a point-of-sale discount or as a direct payment to you, and they’re considered assessable income.

For other energy-efficient upgrades (such as insulation or energy-efficient appliances), you may be able to claim these as part of the “Other work-related expenses” section of your tax return. However, it’s important to note that these deductions are typically only available if the property is used to generate rental income.

Avoid Common Pitfalls

One of the most common mistakes is homeowners trying to claim deductions for their primary residence when they’re not eligible. Most energy-efficient upgrade deductions are only available for rental properties or homes used for income-generating purposes.

Another frequent error is failing to properly document the energy efficiency rating of installed products. The ATO has specific requirements for what qualifies as an energy-efficient upgrade. Make sure your products meet these standards and that you have the documentation to prove it.

Don’t forget to factor in any rebates or incentives you’ve received when calculating your deduction. These amounts need to be subtracted from your total costs before claiming the deduction.

Seek Professional Advice

Tax laws can be complex and change frequently. It’s always a good idea to consult with a qualified tax professional to ensure you’re maximizing your benefits while staying compliant with current regulations. They can provide personalized advice based on your specific situation and help you navigate any complexities in the claiming process.

Stay Informed About Changes

Tax laws and incentives for energy-efficient upgrades can change from year to year. Try to stay informed about any updates or new opportunities (through government websites or reputable financial news sources). This knowledge can help you plan future upgrades and maximize your potential tax benefits.

Final Thoughts

Energy-efficient home upgrades provide numerous benefits for homeowners in Melbourne and across Australia. These improvements reduce energy bills, increase property values, and decrease carbon footprints. Tax deductions for energy-efficient home improvements make these upgrades even more appealing, allowing homeowners to offset initial costs through federal, state, and local incentives.

We at Home Owners Association encourage Melbourne homeowners to explore these opportunities. Our team helps you make informed decisions about energy-efficient upgrades and guides you through the process of claiming available deductions. We can connect you with trusted professionals and provide advice tailored to your specific needs (based on our experience in the Melbourne market).

Tax laws and incentives change frequently, so staying informed is essential. Investing in energy-efficient home improvements and taking advantage of available tax deductions reduces your energy costs and contributes to a more sustainable future. Take the first step today and discover how these upgrades can benefit both your wallet and the environment.