At Home Owners Association, we understand the importance of energy-efficient home improvements for both the environment and your wallet.

While many homeowners are aware of the benefits, they often overlook the significant tax incentives available for these upgrades.

This is especially true in Australia, where the government offers various tax incentives for energy-efficient home improvements to encourage sustainable living.

What Are Energy-Efficient Home Improvements?

Definition and Purpose

Energy-efficient home improvements are upgrades that reduce energy consumption and lower utility bills. These improvements enhance comfort and reduce environmental impact. They range from simple changes to major renovations, all designed to optimize a home’s energy use.

Common Energy-Efficient Upgrades

Some of the most effective energy-efficient improvements include:

- Solar Panel Installation: Solar PV systems typically have a payback period of 4 to 8 years for most Australian homes.

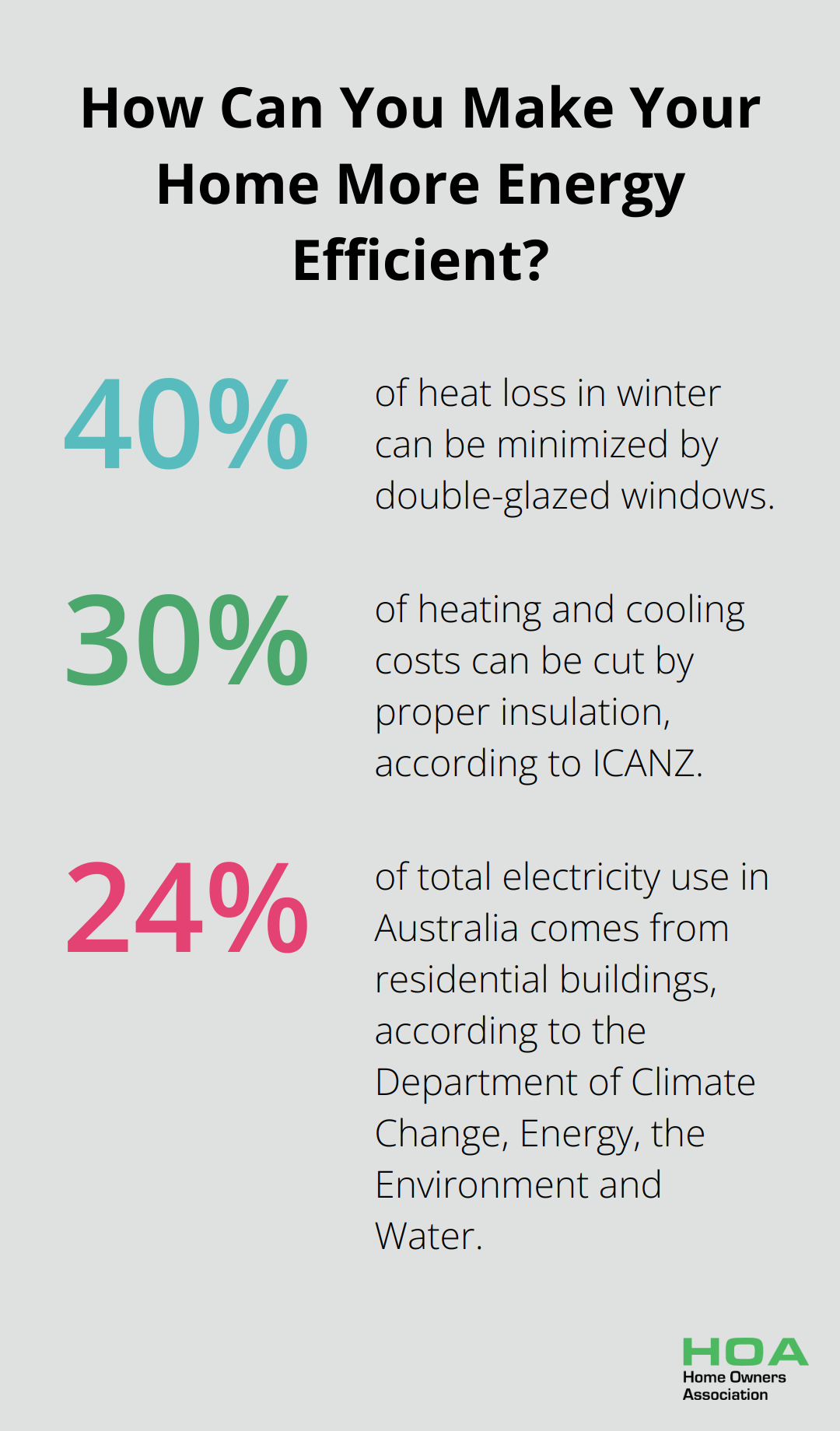

- Insulation Upgrades: Proper insulation can cut heating and cooling costs by about 30%, with costs recovered within 3 to 5 years (as reported by ICANZ).

- Window Replacements: Double-glazed windows can minimize heat loss by up to 40% in winter and reduce heat gain in summer.

- LED Lighting: Switching to LED lighting can reduce energy usage by up to 80% compared to halogen bulbs, while also extending bulb lifespan significantly.

Financial Benefits

The financial benefits of energy-efficient improvements are substantial:

- All-electric homes with solar installations can save owners between $9,000 and $18,000 over ten years compared to dual-fuel homes.

Environmental Impact

These upgrades play an important role in reducing carbon emissions. Residential buildings contribute to about 24% of total electricity use and over 10% of carbon emissions in Australia (according to the Department of Climate Change, Energy, the Environment and Water). Homeowners can significantly reduce their carbon footprint through the implementation of energy-efficient improvements.

Long-Term Value

Energy-efficient upgrades add long-term value to homes. Properties with better energy performance often command higher sale prices, reflecting the growing market demand for energy-efficient properties (as noted by the Climateworks Centre). These improvements also enhance comfort, creating a more pleasant living environment year-round.

As we move forward, it’s important to understand the various tax incentives available for these energy-efficient home improvements. The next section will explore the federal, state, and local programs that can help offset the costs of these valuable upgrades.

Tax Incentives for Energy-Efficient Upgrades

Federal Tax Credits

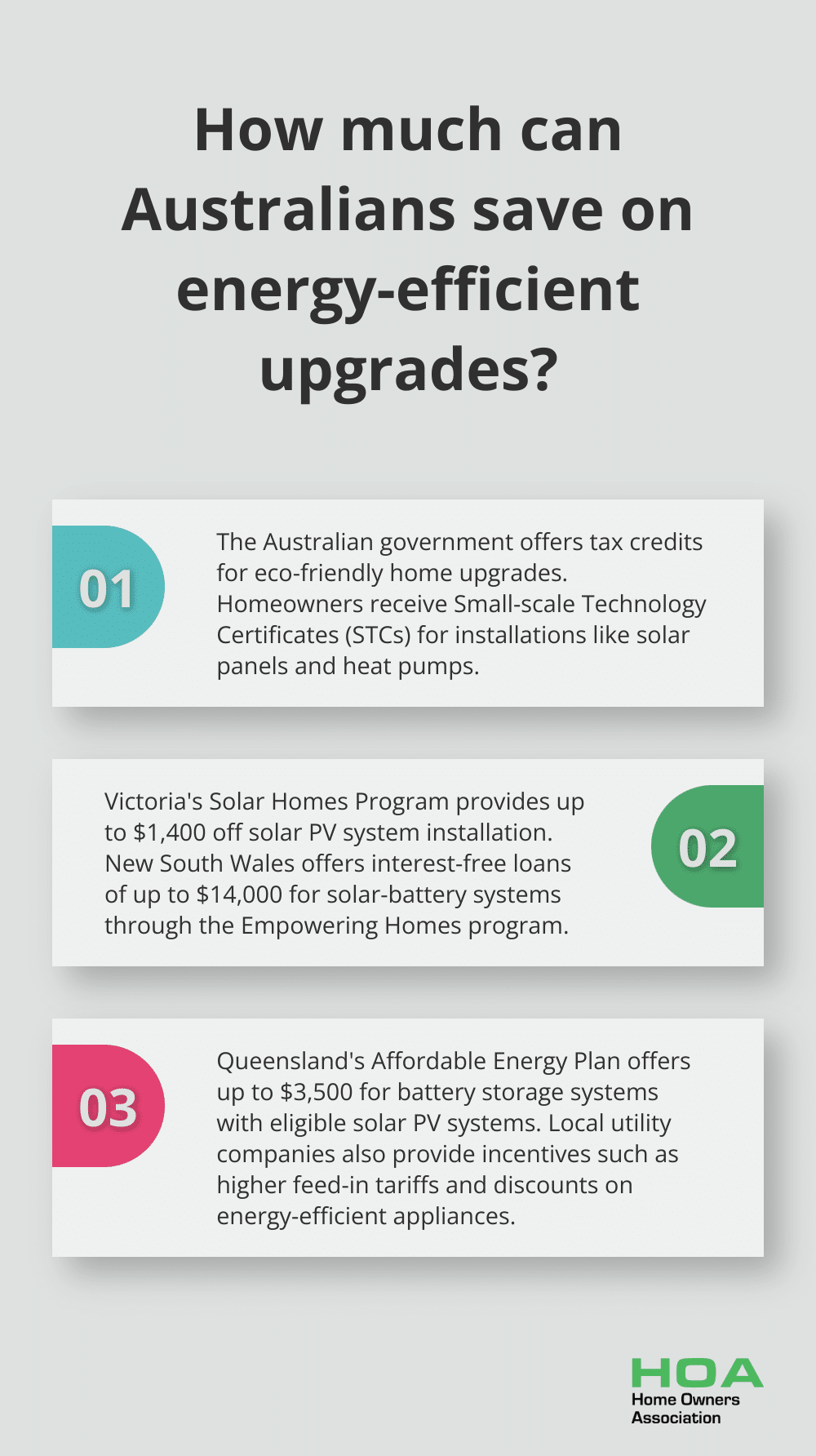

The Australian government offers tax credits to make eco-friendly home upgrades more affordable. This program provides financial incentives for installing eligible small-scale renewable energy systems such as solar panels, solar water heaters, and heat pumps.

Under the SRES, homeowners receive Small-scale Technology Certificates (STCs) for their installations. Electricity retailers purchase these certificates, which effectively reduces the upfront cost of the system. The number of STCs received depends on the system’s size and location (with more certificates awarded in sunnier areas).

The Australian Taxation Office (ATO) allows homeowners to claim deductions for depreciating assets in rental properties, including energy-efficient upgrades. This can include items such as solar panels, insulation, and energy-efficient appliances.

State-Specific Incentives

Each Australian state offers its own set of incentives for energy-efficient home improvements:

Victoria’s Solar Homes Program provides rebates and interest-free loans for solar panel systems, solar hot water systems, and battery storage. Eligible households can receive up to $1,400 off the cost of a solar PV system installation.

New South Wales offers the Empowering Homes program, which provides interest-free loans of up to $14,000 for solar-battery systems to eligible homeowners. This program helps residents reduce their energy bills while contributing to a cleaner energy future.

Queensland’s Affordable Energy Plan includes several rebates and grants for energy-efficient upgrades. Homeowners can access up to $3,500 for the purchase and installation of a battery storage system when coupled with an eligible solar PV system.

Local Utility Programs

Many local utility companies across Australia offer their own incentives and discounts for energy-efficient home improvements. These programs often focus on reducing peak energy demand and promoting sustainable energy use.

Some energy retailers offer higher feed-in tariffs for solar energy exported to the grid during peak hours. Others provide discounts on energy-efficient appliances or free home energy audits to help identify areas for improvement.

Maximizing Your Benefits

To make the most of these incentives, homeowners should:

- Research current offerings: Tax incentives and rebate programs change over time. Check the current offerings and eligibility criteria before making any decisions.

- Combine incentives: Federal, state, and local offerings can often be combined to maximize savings on energy-efficient upgrades.

- Consult professionals: Seek advice from energy efficiency experts or tax professionals to ensure you’re taking full advantage of available incentives.

Staying Informed

As the landscape of energy efficiency incentives evolves, it’s important to stay informed about new opportunities. Government websites and energy efficiency organizations provide up-to-date information on available programs. The next section will explore how to document and track your energy-efficient upgrades to ensure you receive all eligible tax benefits.

How to Maximize Tax Benefits for Energy-Efficient Upgrades

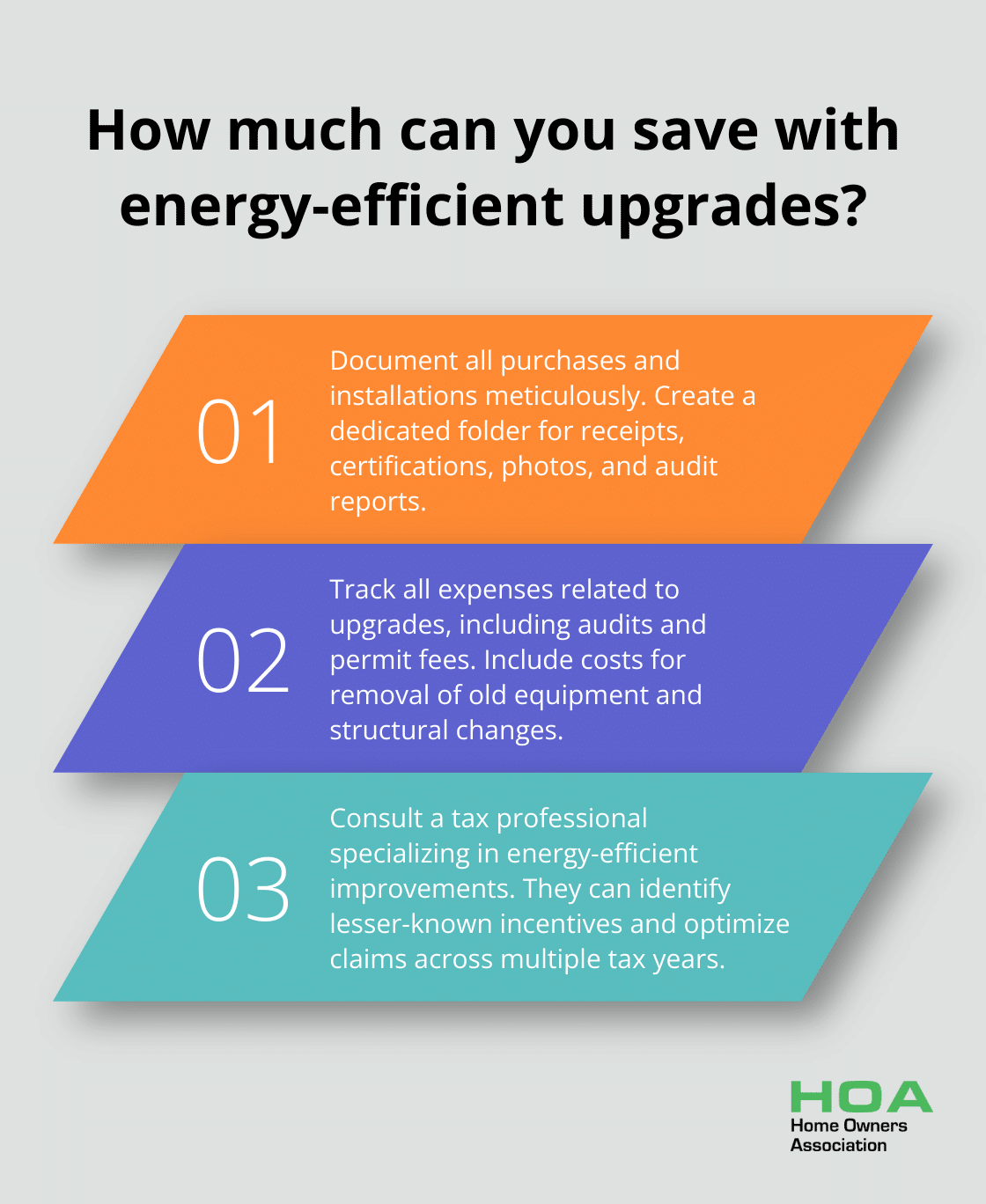

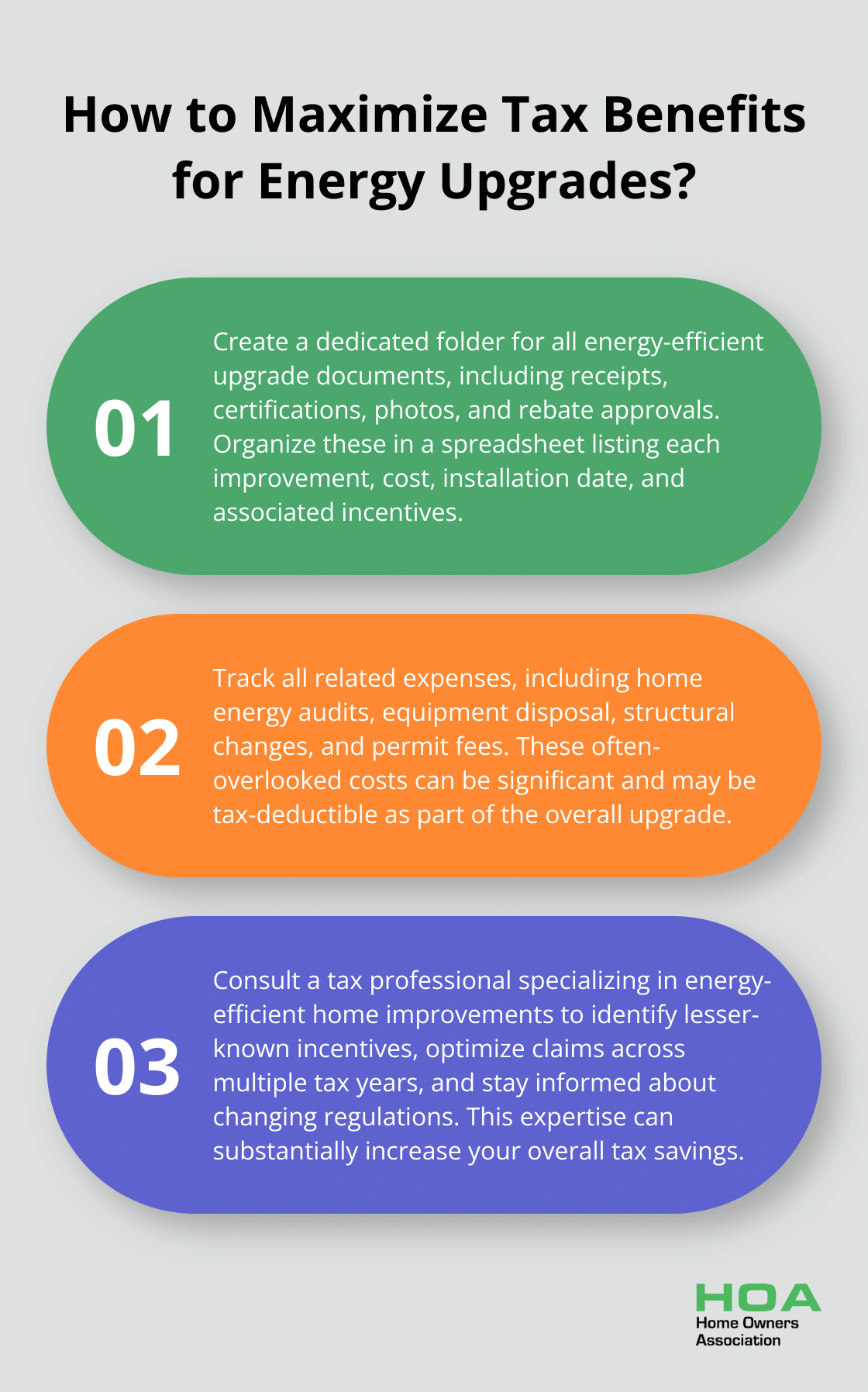

Document Meticulously

The foundation of maximizing your tax benefits rests on thorough documentation. Create a dedicated folder (physical or digital) for all documents related to your energy-efficient upgrades. Include:

- Receipts and invoices for all purchases and installations

- Manufacturer certifications for energy-efficient products

- Before and after photos of installations

- Energy audit reports (if applicable)

- Copies of rebate applications and approvals

Organize these documents effectively. Create a spreadsheet that lists each improvement, its cost, installation date, and any associated rebates or incentives received. This level of detail will prove invaluable during tax season.

Track Expenses Diligently

Track all expenses related to your energy-efficient upgrades. This includes not only the cost of materials and installation but also any related expenses such as:

- Home energy audits

- Removal and disposal of old equipment

- Necessary structural changes to accommodate new installations

- Permit fees

Many homeowners overlook these additional costs, which can be significant. For example, the cost of removing an old oil tank when switching to a heat pump system could be tax-deductible as part of the overall upgrade.

Leverage Professional Expertise

Work with a tax professional who specializes in energy-efficient home improvements to yield substantial benefits. These experts can:

- Identify lesser-known tax incentives you might have missed

- Ensure you claim the maximum allowable amount for each improvement

- Help you understand how different incentives interact and how to optimize your claims

- Advise on the timing of improvements to maximize tax benefits across multiple tax years

A tax professional might advise splitting a large project across two tax years to take advantage of annual limits on certain tax credits. They can also help you navigate the complexities of carrying forward unused credits to future tax years, a strategy that can significantly increase your overall savings.

Stay Informed About Changing Regulations

Tax incentives for energy-efficient home improvements change frequently. Find available assistance from the Australian Government and state and territory governments. Check for updates regularly, especially before starting any new home improvement projects.

The Australian Taxation Office website provides the latest information on tax incentives. Additionally, state government websites often offer up-to-date information on local rebates and incentives. This knowledge allows you to plan your home improvements strategically to maximize available benefits.

Final Thoughts

Energy-efficient home improvements offer numerous benefits for Australian homeowners. These upgrades reduce energy consumption, lower utility bills, and come with significant tax incentives for energy-efficient home improvements in Australia. The Australian government, along with state and local authorities, provides various tax credits, rebates, and incentives to encourage sustainable living and reduce carbon emissions.

The long-term advantages of energy-efficient upgrades extend beyond immediate tax savings. Improved home comfort, reduced energy bills, and increased property value are just a few of the benefits homeowners can enjoy. These improvements also contribute to a more sustainable future by reducing overall energy consumption and greenhouse gas emissions.

Home Owners Association encourages Melbourne homeowners to explore the energy-efficient upgrade options available to them. Our team provides expert advice, resources, and support to help you navigate the process of improving your home’s energy efficiency (including accessing trade pricing and discounts on materials). Take action today and discover how you can transform your home while benefiting from valuable tax incentives.