At Home Owners Association, we’re excited to explore VA home loan energy efficient improvements. These upgrades can significantly benefit veterans and their families.

VA Energy-Efficient Improvements (EEI) offer a way for eligible homeowners to finance energy-saving upgrades through their VA home loans. This program not only helps reduce utility costs but also increases home value and promotes environmental sustainability.

What Are VA Home Loan Energy-Efficient Improvements?

VA Home Loan Energy-Efficient Improvements (EEI) provide veterans with a powerful tool to upgrade their homes and reduce energy costs. This program allows eligible veterans to finance energy-saving upgrades as part of their VA home loan, making it easier and more affordable to create an energy-efficient living space.

Eligible Improvements Under VA EEI

The VA EEI program covers a wide range of energy-saving upgrades. Some of the most popular improvements include:

- Solar panels or solar water heaters

- Energy-efficient windows and doors

- Insulation for walls, attics, and crawl spaces

- High-efficiency HVAC systems

- Programmable thermostats

- Energy-efficient appliances

These improvements reduce energy consumption and enhance the comfort and value of your home.

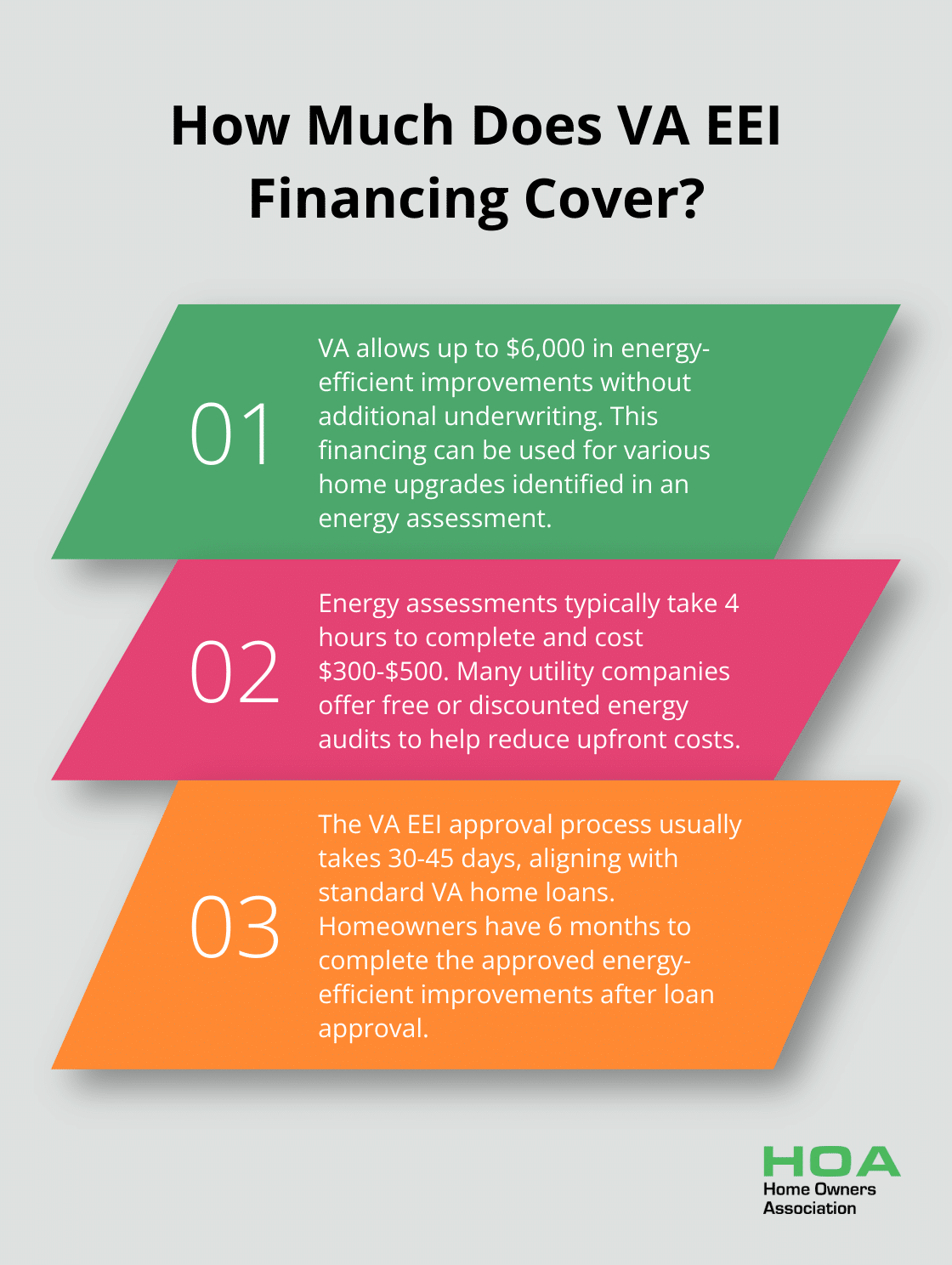

Financing Limits for VA EEI

The VA has set specific guidelines for the amount you can borrow for energy-efficient improvements. For most upgrades, you can finance up to $6,000 worth of upgrades if the home meets the HERS’ energy-efficient standards.

The EEI Application Process

To take advantage of the VA EEI program, follow these steps:

- Obtain a Certificate of Eligibility (COE) from the VA

- Find a VA-approved lender familiar with the EEI program

- Get an energy audit or assessment of your home

- Gather quotes from contractors for the proposed improvements

- Submit your EEI application along with your VA home loan application

The approval process typically takes 30-45 days, similar to a standard VA home loan. Once approved, you’ll have six months to complete the energy-efficient improvements.

Benefits of VA EEI

VA Home Loan Energy-Efficient Improvements offer numerous advantages:

- Lower utility bills (potentially saving thousands of dollars over time)

- Increased home comfort

- Higher property value

- Reduced carbon footprint

- Potential tax benefits (consult with a tax professional for specifics)

The VA EEI program empowers veterans to create more sustainable, comfortable homes while potentially saving significant amounts on energy costs. This smart investment benefits both your property and the environment. As we explore the benefits of VA Home Loan Energy-Efficient Improvements in more detail, you’ll discover why this program is an excellent choice for veterans looking to enhance their homes.

How VA EEI Benefits Veterans and the Environment

Significant Utility Cost Reduction

VA Home Loan Energy-Efficient Improvements (EEI) offer substantial advantages for veterans and their families. These benefits extend beyond immediate financial savings and impact long-term home value and environmental sustainability.

In 2023, 3.4 million American families saved $8.4 billion on clean energy and energy efficiency investments. This demonstrates the significant potential for cost savings through energy-efficient upgrades.

Boosting Home Value and Appeal

Energy-efficient improvements increase a home’s value and marketability significantly. Thirty-one percent of realtors said properties with solar panels increased the perceived property value. Energy-efficient homes often spend less time on the market, as they appeal to buyers who look for lower utility costs and environmentally friendly living spaces.

Environmental Impact and Sustainability

VA EEI not only benefits veterans financially but also contributes to environmental sustainability. Veterans who participate in the VA EEI program play a key role in reducing their carbon footprint and promote a more sustainable future.

Long-Term Financial Benefits

The financial advantages of VA EEI extend far beyond immediate utility savings. These improvements can lead to:

- Lower maintenance costs due to more efficient and durable systems

- Potential tax credits or rebates (veterans should consult with a tax professional for specifics)

- Increased home insurance discounts for energy-efficient properties

Improved Home Comfort and Health

Energy-efficient improvements often result in better indoor air quality and more consistent temperatures throughout the home. This can lead to improved health outcomes and a more comfortable living environment for veterans and their families.

The benefits of VA Home Loan Energy-Efficient Improvements are clear and far-reaching. As we move forward, let’s examine the application process for VA EEI loans to help veterans take advantage of these valuable opportunities.

How to Apply for VA EEI Financing

Prepare Your Application

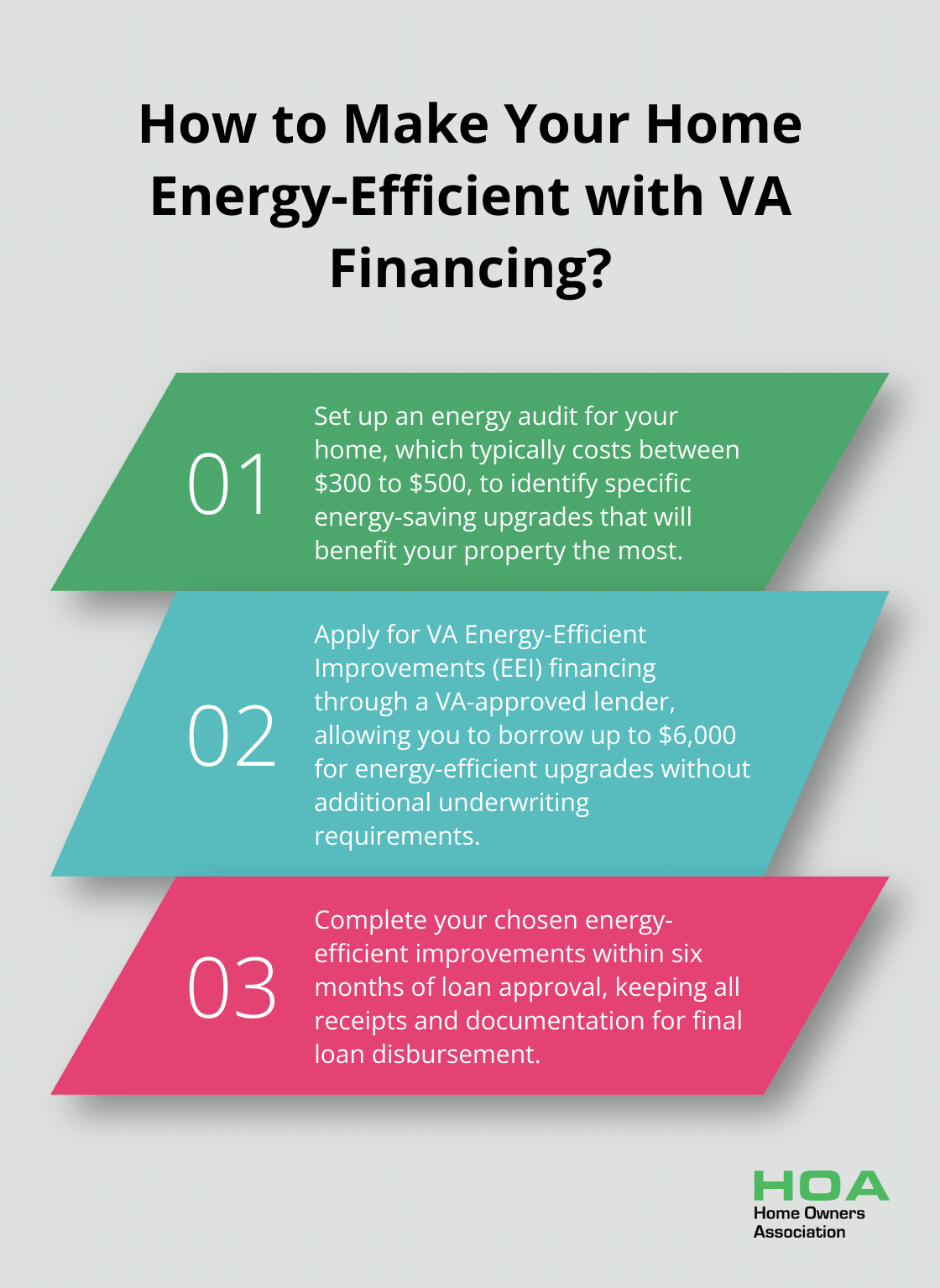

The first step in applying for VA Energy-Efficient Improvements (EEI) financing is to gather the necessary documentation. You must obtain a Certificate of Eligibility (COE) from the VA, which proves your eligibility for VA home loan benefits. You can typically complete this online through the VA’s eBenefits portal or through your lender.

Next, find a VA-approved lender who is familiar with the EEI program. Not all lenders offer this type of financing, so research is important. Your chosen lender will guide you through the specific requirements and help you complete the loan application.

Conduct an Energy Assessment

A key part of the VA EEI application process is the energy assessment. This evaluation, conducted by a qualified energy auditor, will identify areas where your home can benefit from energy-efficient improvements. The auditor will provide a report detailing recommended upgrades and their estimated costs.

The U.S. Department of Energy states that professional energy assessments typically take about four hours to complete and cost between $300 to $500. However, many utility companies offer free or discounted energy audits (which can help reduce your upfront costs).

Finalize Your EEI Plan

Once you have your energy assessment results, work with your lender to finalize your EEI plan. This should include detailed quotes from contractors for the proposed improvements. The VA allows up to $6,000 in energy-efficient improvements to be financed without additional underwriting requirements.

Approval Timeline and Implementation

The approval timeline for VA EEI financing typically aligns with the standard VA home loan process, which usually takes 30 to 45 days. However, this can vary depending on your lender and the complexity of your application.

After approval, you have six months to complete the energy-efficient improvements. Keep all receipts and documentation of the work completed, as your lender will require these for final loan disbursement.

Work with Trusted Professionals

To ensure a smooth application process, work with experienced professionals who understand the VA EEI program. Home Owners Association is a top choice for guidance throughout this process, offering expert advice and resources to help you navigate the application and implementation of your energy-efficient improvements.

Final Thoughts

VA Home Loan Energy Efficient Improvements offer veterans a powerful tool to enhance their homes, reduce utility costs, and contribute to environmental sustainability. These upgrades create more comfortable living spaces while increasing property value and marketability. The program’s flexibility allows for various improvements, from solar panels to high-efficiency HVAC systems, adapting to different home types and needs.

Veterans who take advantage of VA EEI can expect long-term benefits beyond immediate energy savings. These include lower maintenance costs, potential tax benefits, and improved indoor air quality (consult a tax professional for specifics). The application process requires attention to detail, but veterans can navigate it successfully with the right guidance and support.

We at Home Owners Association encourage veterans to explore VA Home Loan Energy Efficient Improvements as a smart investment in their future. For homeowners in Melbourne, Australia, seeking similar support, Home Owners Association offers exclusive trade pricing, discounts, and expert advice tailored to the local market. Our services can help Melbourne residents achieve their home improvement goals efficiently and cost-effectively.