At Home Owners Association, we understand the importance of maximizing your property’s value. One often overlooked aspect is understanding what home improvements add to your cost basis.

Knowing which upgrades can increase your property’s cost basis is essential for reducing potential capital gains taxes when you sell. In this post, we’ll explore the improvements that can boost your cost basis and those that don’t qualify.

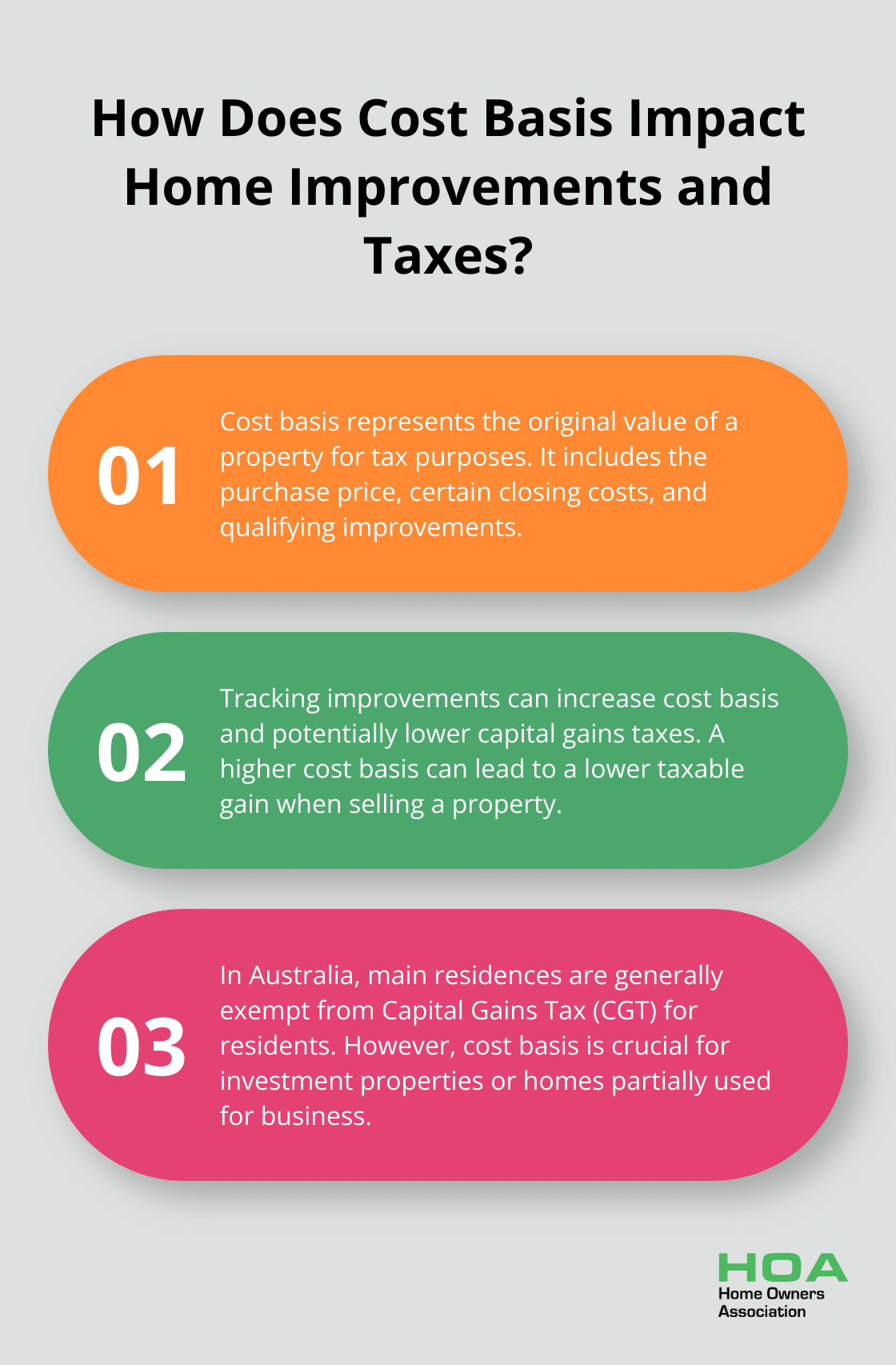

Understanding Cost Basis and Its Impact on Home Improvements

Defining Cost Basis in Real Estate

Cost basis is a fundamental concept for homeowners to grasp, particularly when considering home improvements and their tax implications. It represents the original value of your property for tax purposes, which includes the purchase price of your home, certain closing costs, and the cost of qualifying improvements made over time.

The Financial Advantages of Tracking Improvements

Keeping detailed records of your home improvements is not just good practice-it’s a smart financial strategy. Every qualifying improvement you make to your property can potentially increase your cost basis. This becomes particularly important when you decide to sell your home, as a higher cost basis can lead to lower capital gains taxes.

Consider this scenario: You purchased your home in Melbourne for $500,000 and later sold it for $700,000. Without any improvements, you might think you’d owe taxes on $200,000 in capital gains. However, if you’ve made $50,000 in qualifying improvements over the years, your cost basis would increase to $550,000, reducing your taxable gain to $150,000.

The Tax Implications of Cost Basis

The impact of cost basis on capital gains tax can be substantial. In Australia, your main residence is exempt from CGT if you are an Australian resident and the dwelling has been the home of you, your partner, or your dependent children. However, for investment properties or homes that have been partially used for business, understanding your cost basis is essential.

For example, when selling an investment property in Melbourne, if you’ve made substantial improvements (such as renovating a house, which is considered a major capital improvement if its original cost is more than 5% of the amount), these costs can be added to your cost basis. This higher basis translates to a lower capital gain, potentially saving you thousands in taxes.

The Importance of Proper Documentation

To maximize the benefits of an increased cost basis, it’s critical to maintain meticulous records of all improvements. This includes preserving receipts, contracts, and before-and-after photos of your projects. The Australian Taxation Office (ATO) may require this documentation if they review your tax return.

Home Owners Association provides Melbourne homeowners with record-keeping tools and advice. Our members have access to resources that simplify the tracking of improvements, ensuring they’re well-prepared when it’s time to sell.

Distinguishing Between Improvements and Repairs

It’s important to note that not all home expenses qualify as improvements. General repairs and maintenance, while necessary, typically don’t increase your cost basis. It’s the substantial improvements and additions that make a difference in the eyes of the tax authorities.

As we move forward, we’ll explore specific types of home improvements that can add to your property’s cost basis, helping you make informed decisions about your home investments.

Which Home Improvements Boost Your Property’s Cost Basis?

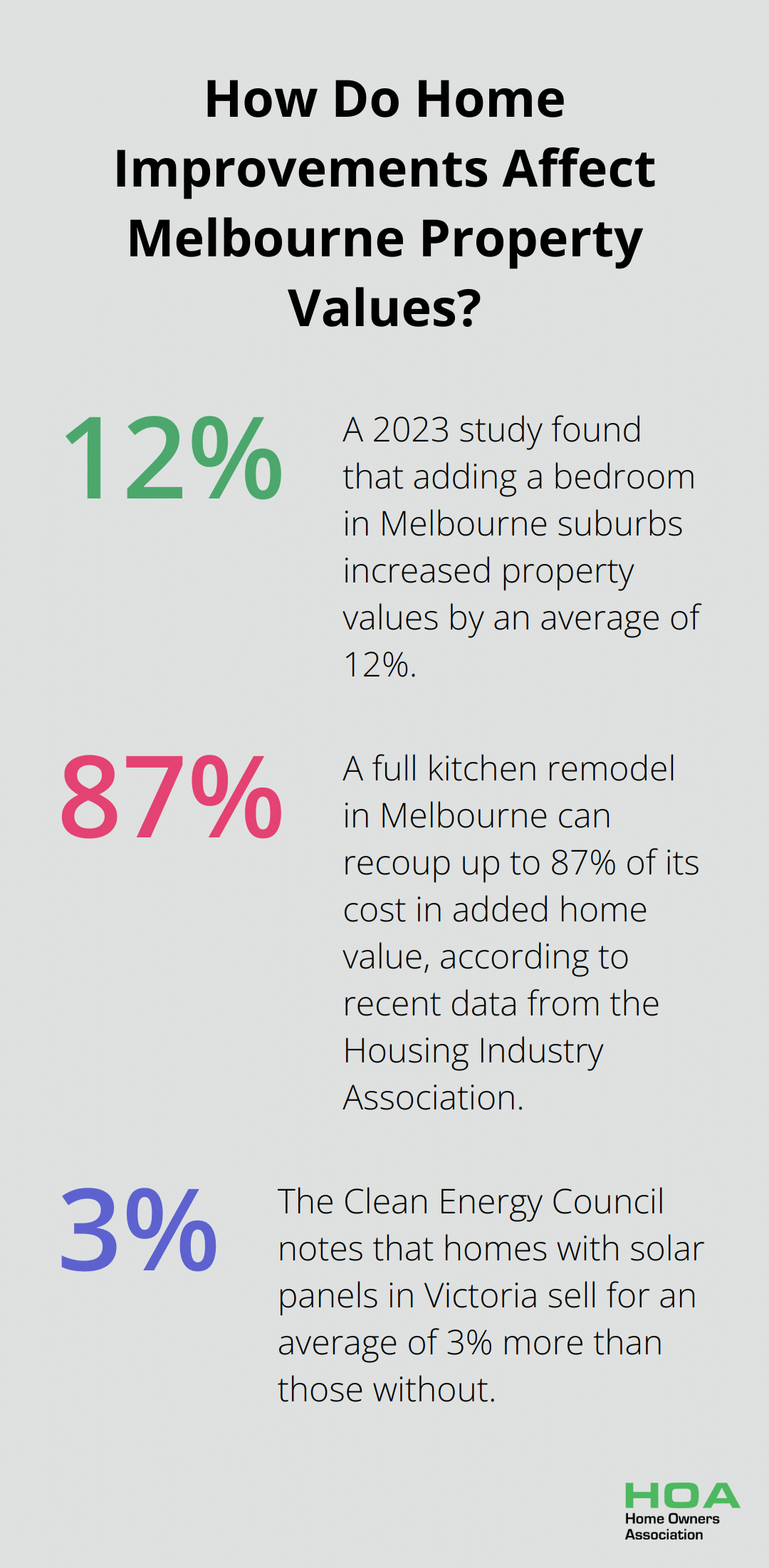

Expanding Your Living Space

Adding square footage to your home will increase its cost basis. In Melbourne’s competitive real estate market, extra living space holds high value. You can qualify by building an additional bedroom, extending your living room, or constructing a home office. A 2023 study by the Real Estate Institute of Victoria found that adding a bedroom in Melbourne suburbs increased property values by an average of 12%.

Modernizing Essential Rooms

Kitchen and bathroom renovations rank among the most impactful improvements for cost basis. In Melbourne, a full kitchen remodel can recoup up to 87% of its cost in added home value (according to recent data from the Housing Industry Association). When you update these spaces, focus on quality fixtures and finishes that align with local preferences. Water-efficient fixtures are particularly sought after in Melbourne homes.

Strengthening Your Home’s Structure

Structural upgrades are not only necessary for safety but also valuable for your cost basis. You can qualify by replacing an aging roof, reinforcing the foundation, or upgrading the electrical system. In Melbourne’s varied climate, investing in a new roof can be especially beneficial.

Embracing Energy Efficiency

With Australia’s focus on sustainability, energy-efficient improvements are both eco-friendly and cost-basis boosters. You can qualify by installing solar panels, upgrading to double-glazed windows, or improving insulation. In Melbourne, where energy costs are a concern, these upgrades are particularly valuable. The Clean Energy Council notes that homes with solar panels in Victoria sell for an average of 3% more than those without.

Documenting Your Improvements

While these improvements can significantly increase your cost basis, you must keep detailed records of all work done. Try to maintain a comprehensive file of receipts, contracts, and before-and-after photos for each project. This documentation will prove invaluable when you calculate your capital gains in the future.

As we move forward, it’s important to understand that not all home expenses qualify as improvements for cost basis purposes. Let’s explore which types of home projects don’t add to your property’s cost basis in the next section.

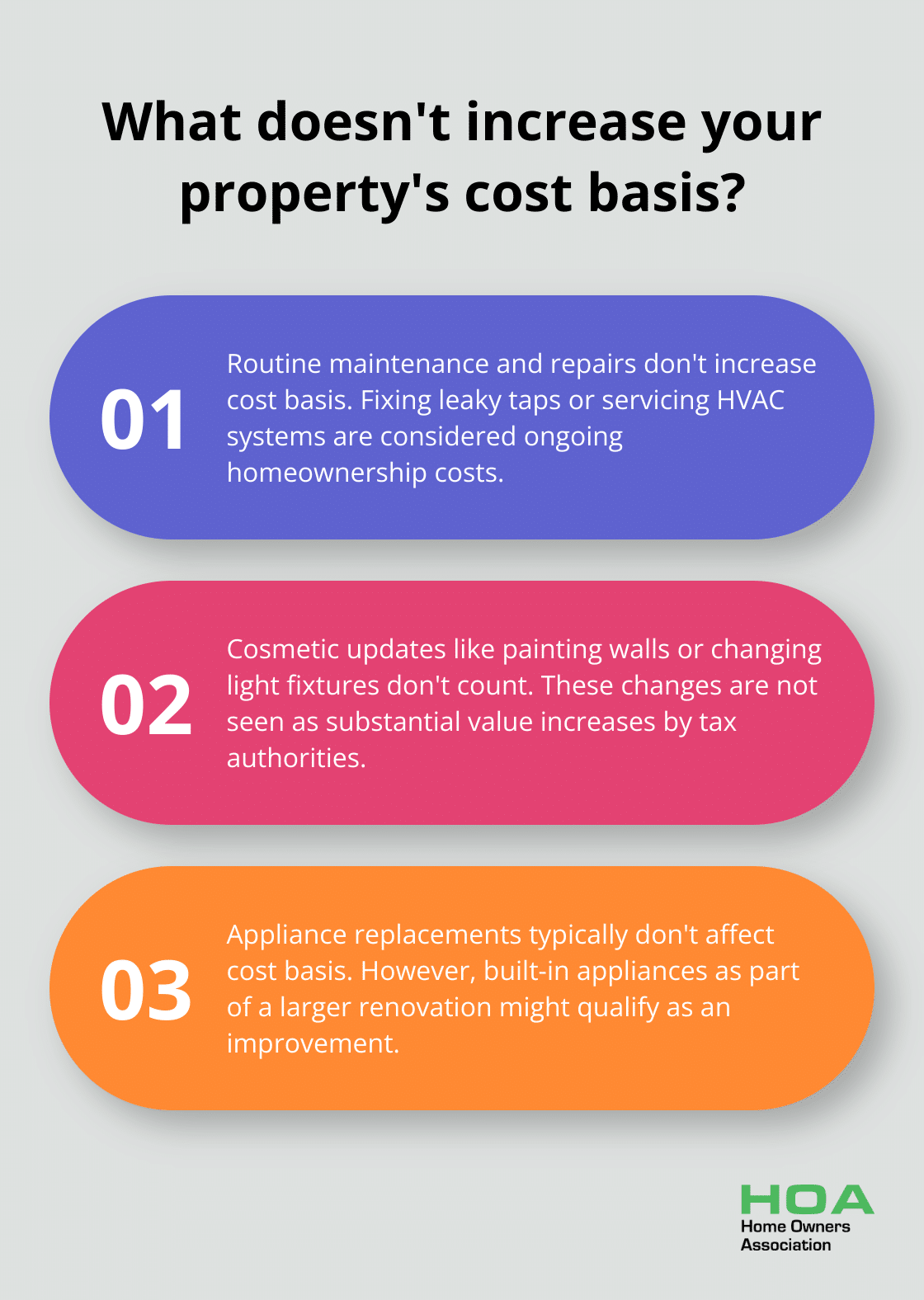

What Doesn’t Count Towards Your Cost Basis?

Routine Maintenance and Repairs

Everyday upkeep of your property doesn’t increase your cost basis. This includes fixing leaky taps, repairing broken windows, or servicing your HVAC system. The Australian Taxation Office considers these expenses part of the ongoing cost of homeownership rather than improvements that add value.

For example, if you spend $500 on plumbing repairs in your Melbourne home, this won’t affect your cost basis. However, if you completely overhaul your plumbing system for $5,000, that might qualify as an improvement.

Cosmetic Updates

Painting your walls, changing light fixtures, or updating your window treatments might make your home more attractive, but they don’t count towards your cost basis. These changes are considered cosmetic and don’t substantially increase your property’s value in the eyes of tax authorities.

Recent focus groups amongst would-be buyers have shown latent market interest in resale-restricted products, according to a study published in 2024.

Appliance Replacements

Swapping out your old fridge or washing machine for a new model typically doesn’t affect your cost basis. Tax authorities see these as personal property rather than permanent fixtures of the home. However, if you install built-in appliances as part of a larger kitchen renovation, that entire project might qualify as an improvement.

Temporary or Removable Additions

Improvements that aren’t permanent or can be easily removed don’t count towards your cost basis. This includes things like above-ground pools, window air conditioning units, or portable heaters. Even if these items are expensive, they’re not considered part of the property’s inherent value.

In Melbourne’s property market, where outdoor living is highly valued, it’s worth noting that while a permanent in-ground pool might increase your cost basis, a temporary above-ground pool won’t have the same effect.

Personal Property Items

Items that you can take with you when you move don’t add to your cost basis. This includes furniture, artwork, and decorative items (even if they’re custom-made for your space). The tax authorities consider these personal belongings separate from the property itself.

How you renovate properties can affect your tax obligations and entitlements. While these non-qualifying expenses might enhance your living experience, they won’t provide tax benefits when you sell your property. For personalized advice on maximizing your property’s value and navigating tax implications in Melbourne, consider reaching out to Home Owners Association.

Final Thoughts

Home improvements that add to cost basis play a significant role in reducing potential capital gains tax liability for Melbourne homeowners. Major renovations, structural upgrades, and energy-efficient enhancements typically increase cost basis, while routine maintenance and cosmetic updates do not. Homeowners should maintain meticulous records of all qualifying improvements, including receipts, contracts, and before-and-after photos for each project.

Home Owners Association helps Melbourne homeowners navigate the complexities of property ownership. We provide expert guidance on tracking improvements, access to trade discounts, and personalized advice on maximizing property value. Our resources and support enable members to make informed decisions about home improvements that enhance living spaces and potentially increase property cost basis.

Informed homeowners can confidently manage their property investments and potentially save on taxes when selling. Every qualifying improvement made today could lead to substantial savings tomorrow (especially for long-term homeowners). Home Owners Association stands ready to assist you in maximizing your property’s value and navigating tax implications in Melbourne’s dynamic real estate market.